Search Market Research Report

Online On-Demand Laundry Service Market Size, Share Global Analysis Report, 2025 – 2034

Online On-Demand Laundry Service Market Size, Share, Growth Analysis Report By Service (Laundry Care, Dry Clean, Duvet Clean), By Application (Residential, Commercial), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

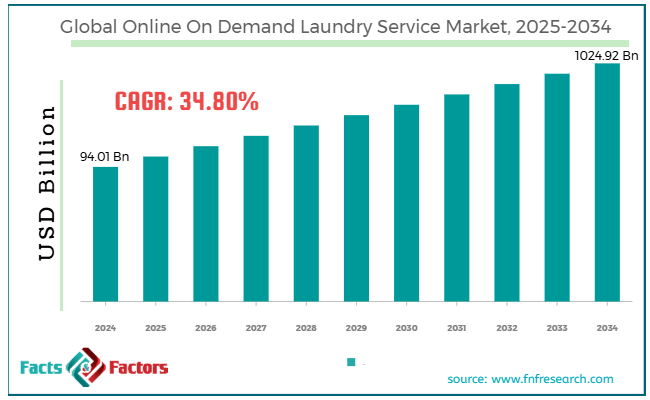

[214+ Pages Report] According to Facts & Factors, the global online on-demand laundry service market size was worth around USD 94.01 billion in 2024 and is predicted to grow to around USD 1024.92 billion by 2034, with a compound annual growth rate (CAGR) of roughly 34.80% between 2025 and 2034.

Online On-demand Laundry Service Market: Overview

Online On-demand Laundry Service Market: Overview

Online on-demand laundry services refer to mobile applications and digital platforms that enable users to plan, schedule, and track laundry pickup, cleaning, and delivery at their convenience. These facilities cater to working and busy individuals who seek hygienic and time-saving laundry solutions, offering dry cleaning, washing, and ironing services. The key drivers of the online on-demand laundry service market include busy lifestyles, growing urbanization, increasing internet and smartphone penetration, and rising demand for professional garment care.

Urban populations are growing rapidly, with an increasing number of individuals moving to small apartments that often lack laundry services. Hectic lives and dual-income households leave less time for extra home chores. This drives the demand for outsourced services, including pickup and delivery services.

Additionally, the increasing affordability of mobile internet and smartphones is enabling consumers tfo book such services through mobile applications. Over 5 billion consumers worldwide have access to the internet through mobile devices. This move is vital for scaling online laundry services.

Moreover, business attire, designer wear, and laundry fabrics need expert cleaning solutions. Users are increasingly opting for professional services over home washing to extend the life of their garments. Specialized care like dry-cleaning (eco-friendly) is gaining prominence.

However, the global market faces barriers due to high operational costs, regulatory challenges, and customer retention. Managing labor, logistics, machinery costs, and water can significantly impact profit margins. Without scale, staying profitable may be challenging for the providers. Repetitive discounts to attract a larger audience may also strain the laundry company's finances.

With many players offering equivalent services, users may easily switch, thereby hindering demand for these services. Retaining customers without offering continuous discounts or promotions remains a primary challenge. A lack of brand loyalty notably restricts growth potential.

Yet, the global online on-demand laundry service industry will progress at a remarkable rate over the coming years, owing to the integration with IoT and smart devices, the increasing offering of niche segments, and the growing prominence of green technology.

Future laundry services may incorporate smart home systems, such as Google Home or Alexa. Voice-enabled bookings, real-time updates, and laundry-ready alerts can improve the user experience, thereby positioning companies as premium and tech-forward.

Moreover, expanding into adjacent services, such as bag restoration, shoe polishing, or curtain cleaning, may offer significant market potential. These premium services appeal to high-income consumers and differentiate themselves from others.

Furthermore, there is a strong potential for eco-friendly machines, transport, and packaging. Carbon-neutral qualifications attract sustainability-conscious users. Government incentives also back green transitions.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global online on-demand laundry service market is estimated to grow annually at a CAGR of around 34.80% over the forecast period (2025-2034)

- In terms of revenue, the global online on-demand laundry service market size was valued at around USD 94.01 billion in 2024 and is projected to reach USD 1024.92 billion by 2034.

- The online on-demand laundry service market is projected to grow significantly due to the rising penetration of the internet and smartphones, increasing consumer spending power, and busy user schedules.

- Based on service, the laundry care segment is expected to lead the market, while the dry clean segment is expected to grow considerably.

- Based on application, the residential is the dominant segment, while the commercial segment is projected to witness substantial revenue growth over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Online On-demand Laundry Service Market: Growth Drivers

Online On-demand Laundry Service Market: Growth Drivers

- The increasing prominence of hygienic and eco-friendly laundry solutions propel the market growth

With the growing priority of sustainability, users are vastly preferring eco-friendly services that use water-efficient and biodegradable detergent processes. According to the McKinsey Report 2024, nearly 43% of users choose services that demonstrate sustainable methods, including in-home facilities such as laundry.

This is pressurizing online laundry platforms to capitalize on green technology, such as ozone-based cleaning, water recycling systems, and energy-efficient machines, thereby fueling the global online on-demand laundry service market.

For example, the UAE's Love2Laundry and the UK's Laundrapp have launched green laundry alternatives that reduce water usage by 30% with every wash cycle.

- Rising demand from millennials and working professionals fuels the market growth

Gen Z and millennials, who are heavily reliant on online services, form a dominant consumer base for online laundry applications. A 2024 survey by Accenture revealed that 61% of millennials worldwide are members of at least one home service application, with laundry among the top three services used daily. Their preference for membership is propelling the revenue models in the online on-demand laundry service industry.

The rise of hybrid models and remote work following the pandemic has shifted priorities. Users are increasingly preferring leisure and productive activities over spending a lot of time on laundry, thereby generating more demand for outsourced facilities. Millennials are also willing to pay the price for express laundry and eco-friendly options.

Online On-demand Laundry Service Market: Restraints

Online On-demand Laundry Service Market: Restraints

- Delivery failures and logistical complexities negatively impact market progress

Providing well-timed pickup and delivery remains a key challenge for online service providers. Several platforms face challenges related to traffic congestion, route optimization, customer no-shows, and weather delays, all of which complicate operational intricacies.

According to a 2023 logistics report by McKinsey, last-mile delivery costs account for up to 53% of total logistics costs in service-oriented startups.

Order mix-ups and late deliveries can adversely impact consumer satisfaction, leading to lower retention rates. In densely populated cities like Lagos, Mumbai, or Jakarta, arranging accurate pickups often fails due to traffic delays and infrastructure problems. These intricacies result in repeated trips and additional fuel costs, ultimately draining resources.

Online On-demand Laundry Service Market: Opportunities

Online On-demand Laundry Service Market: Opportunities

- Growth in value-added service and subscription models remarkably impacts market growth

Users are actively subscribing to bi-weekly, weekly, or monthly laundry plans for convenience, which offers an opportunity to create a predictable recurring profit. A 2024 report states that in-home subscriptions are experiencing 28% annual growth, with housekeeping and laundry services leading the way.

Zipjet and Laundrapp have launched services like express delivery, ironing, fabric care packages, and shoe cleaning. These premium offerings are gaining prominence, primarily among middle- and high-income consumers. These new launches present a key opportunity for the online on-demand laundry service industry to grow.

Online On-demand Laundry Service Market: Challenges

Online On-demand Laundry Service Market: Challenges

- Low funding and investor lassitude in service startups limit the growth of the market

While the gig economy initially attracted significant venture capital, investors are now actively cautious of service-based startups with slow break-even schedules and rising operational costs. Most prominent laundry startups have either downsized or shut down because of funding crunches. Most VCs now opt for B2B or SaaS technology, which offers recurring revenue and high margins, resulting in service-based startups planning to safeguard their Series B and beyond funding rounds.

This funding constraint impacts growth programs, including automation updates, fleet expansion, and entry into new areas. Without the necessary capital, marketing, maintaining competitiveness, and modernization become highly challenging in a fast-paced, changing scenario.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 94.01 Billion |

Projected Market Size in 2034 |

USD 1024.92 Billion |

CAGR Growth Rate |

34.80% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Laundrapp, Rinse, Cleanly, Washmen, Laundryheap, FlyCleaners, Tide Cleaners, DRYV, DhobiLite, PickMyLaundry, Press Cleaners, Mulberrys Garment Care, Wassup Laundry, Hello Laundry, LaundryMate, and others. |

Key Segment |

By Service, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Online On-demand Laundry Service Market: Segmentation

Online On-demand Laundry Service Market: Segmentation

The global online on-demand laundry service market is segmented based on service, application, and region.

Based on service, the global online on-demand laundry service industry is divided into laundry care, dry clean, and duvet clean. The laundry care segment has gained significant prominence over the past year and is expected to continue dominating the market in the coming years. The segment comprises regular washing, folding, and drying of daily-use garments and clothes. The segment caters to the daily-use household needs and is usually preferred by working professionals, students, and families. Its surging repetitive usage and affordability increase its popularity in both developing and developed regions.

Based on application, the global online on-demand laundry service market is segmented into residential and commercial. The residential segment led the global market in the previous year and is expected to continue growing substantially in the coming years. This growth is backed by the rising demand from individual consumers, students, working professionals, and families—weekly and daily laundries, along with the convenience of mobile app booking, fueling notable adoption. The growth in dual-income households and urbanization boosts this segmental dominance.

Online On-demand Laundry Service Market: Regional Analysis

Online On-demand Laundry Service Market: Regional Analysis

- North America to witness significant growth over the forecast period

North America is anticipated to hold a leading position in the global online on-demand laundry service market due to high smartphone and internet penetration, growing urbanization, a busy lifestyle, and a sophisticated e-commerce network. North America boasts the highest internet penetration rate globally, with over 92% of its population using the internet.

Smartphone ownership surpasses 85% in Canada and the United States, allowing broader access to smartphone-based laundry applications. This digital accessibility creates strong backing for the region's progressing online service budget. Nearly 83% of residents live in urban areas, where restricted home laundry space and long working hours increase dependency on external services.

In cities like Los Angeles, Toronto, and New York, on-demand laundry services are becoming increasingly essential for students and working professionals who value their time and convenience.

Additionally, North America is regarded as an early adopter of app-based platforms and digital services. Its sophisticated logistics, customer service, and payment getaway infrastructure aid unified laundry service experiences.

Europe holds a second-leading share in the online on-demand laundry service industry due to high urbanization, rising eco-consciousness among consumers, and government support for digital startups and clean technology. Europe has a dense urban population, with 75% of residents living in cities, where space limitations and busy lifestyles often necessitate the use of outsourced laundry services. The growth in dual-income households in nations such as France, the United Kingdom, and Germany supports the heavy use of convenient services like online laundry platforms.

European users are highly conscious of sustainability. Several online on-demand laundry providers promote their eco-friendly practices, like energy-efficient machinery and biodegradable detergents. Economies like the Netherlands and Sweden are leaders in adopting green services, driving industry appeal, and influencing consumer choices.

Additionally, European governments actively support gig-economy businesses and clean-tech initiatives through funding, digital transformation projects, and grants. The European Union's programs to decrease carbon footprints and support digital startups offer a promising network for tech-based and sustainable laundry services to advance.

Online On-demand Laundry Service Market: Competitive Analysis

Online On-demand Laundry Service Market: Competitive Analysis

The key operating players in the global online on-demand laundry service market include:

- Laundrapp

- Rinse

- Cleanly

- Washmen

- Laundryheap

- FlyCleaners

- Tide Cleaners

- DRYV

- DhobiLite

- PickMyLaundry

- Press Cleaners

- Mulberrys Garment Care

- Wassup Laundry

- Hello Laundry

- LaundryMate

Online On-demand Laundry Service Market: Key Market Trends

Online On-demand Laundry Service Market: Key Market Trends

- Membership-based laundry plans:

Several providers are moving towards monthly subscription packages from pay-per-use models. These offer consumers fixed pricing, loyalty rewards, and prioritized scheduling. This trend enhances consumer retention and yields expected recurring profits for businesses.

- Growth into value-added services:

Companies are diversifying beyond mere laundry to offer bag restoration, curtain care, shoe cleaning, and stain treatment. These less-frequent yet high-margin services help distinguish companies and appeal to premium users seeking specialized garment care.

The global online on-demand laundry service market is segmented as follows:

By Service

By Service

- Laundry Care

- Dry Clean

- Duvet Clean

By Application

By Application

- Residential

- Commercial

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Laundrapp

- Rinse

- Cleanly

- Washmen

- Laundryheap

- FlyCleaners

- Tide Cleaners

- DRYV

- DhobiLite

- PickMyLaundry

- Press Cleaners

- Mulberrys Garment Care

- Wassup Laundry

- Hello Laundry

- LaundryMate

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors