03-May-2023 | Facts and Factors

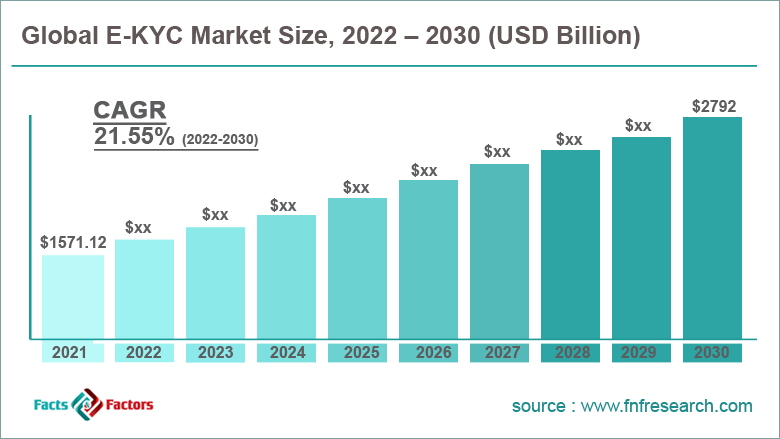

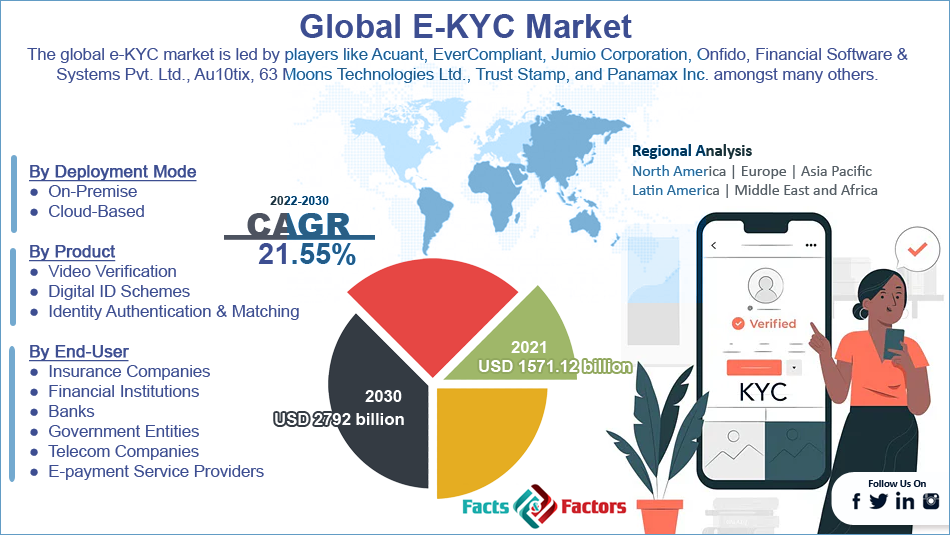

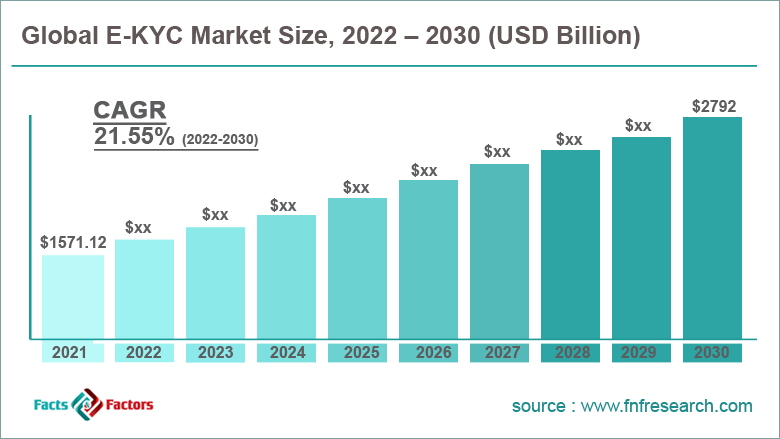

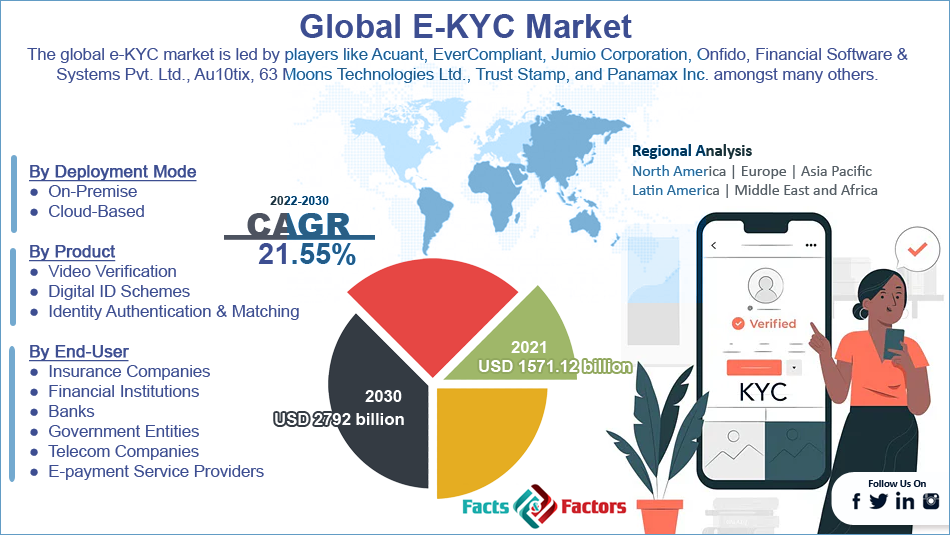

According to Facts and Factors, the global e-KYC market size was worth around USD 1571.12 billion in 2021 and is predicted to grow to around USD 2792 billion by 2030 with a compound annual growth rate (CAGR) of roughly 21.55% between 2023 and 2030.

Know your customer (KYC) is a significant part of the modern commercial world and it is highly beneficial in tackling fraud cases related to financial aspects. It is the customer identification method employed by various agencies that deal in trades related to money. KYC is a mandatory process that has to be a part of the initial stages of customer-business interaction. It is one of the few processes that are not only recommended by national anti-money laundering agencies but also regulated by them. E-KYC is the process of knowing customers using digital systems or technologies like applications, websites, or online links.

Browse the full “E-KYC Market Size, Share, Growth Analysis Report By Deployment Mode (On-Premise and Cloud-Based), By Product (Video Verification, Digital ID Schemes, and Identity Authentication & Matching), By End-User (Insurance Companies, Financial Institutions, Banks, Government Entities, Telecom Companies, and E-payment Service Providers), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030" report at https://www.fnfresearch.com/e-kyc-market

Different companies employ various means of e-KYC. For instance, some use voice-recognition methods while some may use face-recognition software. E-KYC has been gaining popularity amongst the younger population as they continue to leverage the offerings of the modern world.

The global e-KYC market is projected to grow owing to the several benefits associated with the use of digital technology both for the customers and the business entity using e-KYC methods. There is a minimum requirement of human resources as e-KYC can be initiated without the need for an intermediate. This leads to a reduction of work burden on employees as they can use their valuable time for other critical tasks. E-KYC is beneficial to customers because generally electronic devices can be swift and quick, hassle-free, provide instant verification, and offer higher accessibility ease while also ensuring faster or easier compliance with essential regulatory requirements.

The global market growth is expected to be further propelled by the growing number of people opting for electronic funds transfer for various activities including online shopping, automatic equated monthly installment (EMI) deductions, or money transfers for any other personal reasons. Rising investments in technological advancements with the use of cloud technology, linked devices, and artificial intelligence are expected to act as major growth factors.

E-KYC is highly prone to technical glitches, especially on days when several members are trying to access the website or business application at the same time. Since e-KYC is a digital system it is extremely prone to technical failures due to issues like malware infiltrations, server disruption, poor internet connectivity, and other reasons for which some may be more serious than others. Many countries lack the necessary technical infrastructure required to run e-KYC on a large scale which acts as a growth inhibitor.

The growing importance of paperless activities may provide market growth whereas the lack of awareness could act as a major challenge

Segmental Overview

The global e-KYC market is segmented based on deployment mode, product, end-user, and region

Based on product, the global market is divided into video verification, digital ID schemes, and identity authentication & matching. The global market was dominated by the identity authentication & matching system in 2021 as most of the units incorporating e-KYC make use of verifying customer identification using national documents that are interlinked to other official accounts. For instance, Aadhaar e-KYC is the most preferred way of identity proof across India. As of September 2022, more than 22.84 crore Aadhaar e-KYC was carried out in India. Digital ID schemes are another popular means of customer KYC.

Based on end-user, the global market is segmented into insurance, companies, financial institutions, banks, government entities, telecom companies, and e-payment service providers. Banks are the largest consumers of e-KYC followed by telecom companies and e-payment service providers. e-KYC is one of the mandated processes for any institute that works with financial dealings, especially banks. Billions of bank accounts are created every year across the world and every new account is linked with KYC either digitally or non-digitally. As of March 2017, India had more than 157 crore bank accounts.

Regional Overview

North America is anticipated to lead the global e-KYC market mainly propelled by the advanced digital and technical infrastructure present in the countries of the US and Canada allowing them to roll out e-KYC measures which are further encouraged by the high acceptance rate among the consumers. Growth in Europe can be expected to be the result of growing initiatives by the national safety and financial regulatory bodies. European companies use e-KYC systems that not only provide an enhanced experience to local customers but go beyond regional boundaries. The rising investments in the banking and financial sectors of Asia-Pacific are expected to help the region register a high growth rate. China’s banking Tier 1 capital now stands at USD 3.38 trillion.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1571.12 Billion |

Projected Market Size in 2030 |

USD 2792 Billion |

CAGR Growth Rate |

21.55% CAGR |

Base Year |

2021 |

Forecast Years |

2023-2030 |

Key Market Players |

Acuant, EverCompliant, Jumio Corporation, Onfido, Financial Software & Systems Pvt. Ltd., Au10tix, 63 Moons Technologies Ltd., Trust Stamp, Panamax Inc., and others. |

Key Segment |

By Deployment Mode, Product, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Landscape

The global e-KYC market is led by players like Acuant, EverCompliant, Jumio Corporation, Onfido, Financial Software & Systems Pvt. Ltd., Au10tix, 63 Moons Technologies Ltd., Trust Stamp, and Panamax Inc. amongst many others.

Recent Developments:

- In November 2019, the Securities and Exchange Board of India (Sebi) announced the revival of Aadhaar-based, India’s national identity verification document, e-KYC for transactions in mutual funds. In the notification sent confirming the revival the agency did not mention any upper monetary limit as opposed to the investment limit of INR 50,000 in the previous version

- In January 2022, the Reserve Bank of India allowed the use of video-based authentication for e-KYC systems as an alternative method. These verifications will have to be Aadhaar-based and can be done either offline or online

The global e-KYC market is segmented as follows:

By Deployment Mode

By Product

- Video Verification

- Digital ID Schemes

- Identity Authentication & Matching

By End-User

- Insurance Companies

- Financial Institutions

- Banks

- Government Entities

- Telecom Companies

- E-payment Service Providers

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1 (347) 690-0211

Email: [email protected]

Web: https://www.fnfresearch.com