Search Market Research Report

Naphtha Market Size, Share Global Analysis Report, 2022 – 2028

Naphtha Market Size, Share, Growth Analysis Report By Type (Light Naphtha and Heavy Naphtha), By Application (Chemicals, Energy & Fuel and Others), By Process (Gasoline Blending, Naphtha Reforming, Steam Cracking and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

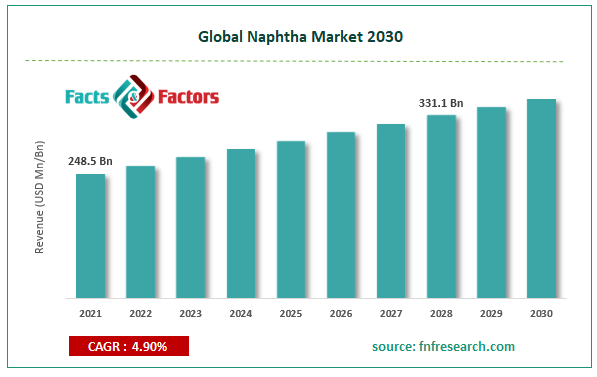

[227+ Pages Report] According to Facts and Factors, the global naphtha market size was worth USD 248.5 billion in 2021 and is estimated to grow to USD 331.1 billion by 2028, with a compound annual growth rate (CAGR) of approximately 4.90% over the forecast period. The report analyzes the naphtha market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the naphtha market.

Market Overview

Market Overview

A naphtha is a form of raw petrol or gasoline derived from raw materials and crude oil for use in the chemical industry. Naphtha is derived from crude oil and has a boiling temperature ranging from 30 °C to 200 °C. It may contain a significant number of aromatic chemicals. Naphtha is a highly flexible hydrocarbon chemical that is flammable, colorless, and highly volatile. It is made by distilling organic materials such as wood, coal tar, petroleum, and shale. Depending on its source or composition, naphtha is known by several names, such as petroleum spirits, coal tar naphtha, shellite, wood naphtha, and white gas. Major oil businesses in the naphtha market have announced the launch of clean fuel and aromatics projects as part of their environmental responsibility. They are adding naphtha splitter columns to their capabilities. These columns aid in segregating light and heavy naphtha from hydro-treated naphtha.

Naphtha is frequently used due to its vast range of applications. Some of them are gasoline manufacturing, shoe polishing, fluid cleaning, and functioning as fuel in portable stoves. The market thrives because of its various characteristics and usages, which allow it to meet the needs of a larger audience distributed around the globe. Furthermore, naphtha-derived components are used to make a variety of polymers, industrial chemicals, and synthetic fiber precursors. The increased use of these end-products worldwide has helped to create an attractive global market for naphtha.

COVID-19 Impact:

COVID-19 Impact:

The naphtha market's functions and requirements are dispersed across multiple industry verticals. However, the pandemic has hampered production and manufacturing facilities. The global market has been stagnant under restrictions such as permanent and temporary lockdowns and functional restraints. In addition, there is a lack of investment to supply the demand for raw materials utilized in manufacturing. Furthermore, labor scarcity is causing a shortage of workers to meet global market demand, resulting in a disrupted supply chain mechanism. As the lockdown limitations are relaxed, the market is regaining demand, which will aid in mitigating the market's losses.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global naphtha market value is to grow at a CAGR of 4.90% over the forecast period.

- In terms of revenue, the global naphtha market size was valued at around USD 248.5 billion in 2021 and is projected to reach USD 331.1 billion by 2028.

- Naphtha is frequently used due to its vast range of applications. Some of them are gasoline manufacturing, shoe polishing, fluid cleaning, and functioning as fuel in portable stoves. The market thrives because of its various characteristics and usages, which allow it to meet the needs of a larger audience distributed around the globe.

- By type, the light naphtha category dominated the market in 2021.

- By application, the chemicals category dominated the market in 2021.

- The Asia Pacific dominated the global naphtha market in 2021.

Growth Drivers

Growth Drivers

- Rising demand for olefin-rich naphtha to drive market growth

Olefin-rich naphtha is a naphtha derivative primarily utilized as a feedstock in producing low-cost high-octane diesel. Naphtha consumption has increased in industrialized and emerging economies due to increased demand for cost-effective gasoline due to rising populations and fast urbanization. In addition, petroleum naphtha is commonly used as a solvent. It can be found in a variety of cleaning chemicals. It is also used to dilute varnishes, paints, and asphalt. Naphtha is also used in the dry-cleaning industry. This increases the need for naphtha and is predicted to drive the expansion of the naphtha market.

Restraints

Restraints

- Fluctuating crude oil prices hinder the market growth

The variation and unpredictability in the cost of obtaining crude oil pose a significant barrier to the growth of the naphtha market. Natural gas liquid demand, as well as a shift in trends away from naphtha and toward low-cost alternatives such as LPG, is projected to hinder naphtha market progress throughout the forecast period.

Opportunity

Opportunity

- Increased consumer trade activity due to the development of electricity and transportation presents market opportunities

The development of the electricity and transportation industries in many countries due to increased consumer trade activity is expected to drive naphtha demand. Technological advancements have resulted in improved distillation procedures and the creation of new furnace materials. The chemical industry's expansion is increasing naphtha consumption. Furthermore, the rise of emerging new markets and strategic alliances will act as market drivers, increasing the usable chances for the market's growth rate.

Segmentation Analysis

Segmentation Analysis

The global naphtha market has been segmented into type, application, and process.

Based on type, light and heavy naphtha are segments of the global naphtha market. In 2021, the light naphtha category dominated the market over the forecast period. Light naphtha is often utilized in petrochemical steam crackers, whereas heavy naphtha improves fuel efficiency in refinery catalytic reformers.

Based on application, the market is classified into chemicals, energy and fuel, and others. In 2021, the chemicals category, which included toluene, petrochemicals, xylenes, and benzene, led the global naphtha market, accounting for more than 60% of the global market. The category is expected to maintain its advantage over the next few years. Naphtha is principally employed in producing olefins via steam cracking, aromatics via reforming, and as a feedstock for high-octane gasoline.

On the basis of Process, the global naphtha market is segmented into gasoline blending, naphtha reforming, steam cracking, and others. In 2021, the steam cracking category dominated the market over the forecast period. The primary applications of naphtha are in steam cracking to produce olefins, reforming to produce aromatics, and as a feedstock for high-octane gasoline. Rising demand for aromatics and olefins from the food and beverage industries and the chemical industry is likely to boost the market in the coming years.

Recent Developments

Recent Developments

- July 2019: PDV LLC, a Venezuelan oil and gas corporation, has announced intentions to build minor pipelines to compensate for import naphtha shortages, which have hampered heavy crude output and exports.

- In 2019: the Saudi Arabian Oil Company (Saudi Aramco) launched the Ras Tanura refinery clean fuels and aromatics project, worth USD 2.6 billion, to increase the plant's environmental friendliness.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 248.5 Billion |

Projected Market Size in 2028 |

USD 331.1 Billion |

CAGR Growth Rate |

4.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Chevron Corporation, SABIC, BP PLC, Reliance Industries Limited, Shell Chemicals, Exxon Mobil Corporation, China Petrochemical Corporation, Indian Oil Corporation Ltd, Novatek., and Others |

Key Segment |

By Type, Application, Process, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- The Asia Pacific dominated the naphtha market in 2021

Asia Pacific region dominated the global naphtha market in 2021. Demand for naphtha has been steadily increasing in nations such as India, China, and Japan, owing to expansion in various end-user sectors such as fertilizers, petrochemicals, and paints & coatings, among others. Numerous chemical factories are planned for development in China during the next five years, increasing the demand for naphtha. Due to technological advancements such as improved distillation techniques and chemical development, the Asia-Pacific region dominates the naphtha market. Furthermore, furnace materials' widespread and advanced users will play a significant role in aiding global naphtha market growth.

Competitive Landscape

Competitive Landscape

Key players within the global Naphtha market include

- Chevron Corporation

- SABIC

- BP PLC

- Reliance Industries Limited

- Shell Chemicals

- Exxon Mobil Corporation

- China Petrochemical Corporation

- Indian Oil Corporation Ltd

- Novatek

Global Naphtha Market is segmented as follows:

By Type

By Type

- Light Naphtha

- Heavy Naphtha

By Application

By Application

- Chemicals

- Energy And Fuel

- Others

By Process

By Process

- Gasoline Blending

- Naphtha Reforming

- Steam Cracking

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Chevron Corporation

- SABIC

- BP PLC

- Reliance Industries Limited

- Shell Chemicals

- Exxon Mobil Corporation

- China Petrochemical Corporation

- Indian Oil Corporation Ltd

- Novatek

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors