Search Market Research Report

Mental Health Software Market Size, Share Global Analysis Report, 2024 – 2032

Mental Health Software Market Size, Share, Growth Analysis Report By Component (Software [Integrated Software & Standalone Software] and Services), By Delivery Model (Subscription and Ownership), By Application (Clinical [EHR for Behavioral Health, Therapy Management Software, Telehealth Platforms For Mental Health] and Administrative), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

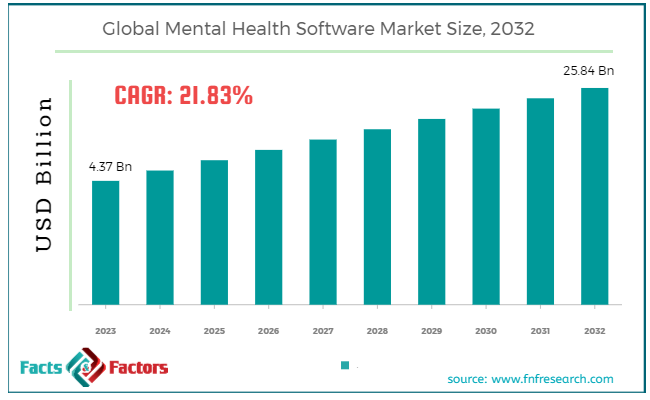

[229+ Pages Report] According to Facts & Factors, the global mental health software market size in terms of revenue was valued at around USD 4.37 billion in 2023 and is expected to reach a value of USD 25.84 billion by 2032, growing at a CAGR of roughly 21.83% from 2024 to 2032. The global mental health software market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Mental health software is a specialized tool designed to assist mental health professionals in managing and supporting their clients' mental health needs. It serves various purposes, including the collection and analysis of patient data, facilitation of treatment planning, and management of appointments and billing. The software can range from applications that help in diagnosing mental health conditions to those that provide platforms for therapy sessions, including telepsychiatry. Additionally, mental health software often includes features for electronic health records (EHR), client communication, and potentially, the delivery of therapeutic interventions directly through the software.

The objective is to enhance the efficiency of mental health services by streamlining administrative tasks and improving the accuracy of patient care through data analysis and management. As mental health awareness grows and technology advances, such software plays a critical role in modernizing and improving the accessibility and quality of mental health care services.

Key Highlights

Key Highlights

- The mental health software market has registered a CAGR of 21.83% during the forecast period.

- In terms of revenue, the global mental health software market was estimated at roughly USD 4.37 billion in 2023 and is predicted to attain a value of USD 25.84 billion by 2032.

- The growth of the mental health software market is being propelled by mental health issues like depression and anxiety are becoming increasingly common around the world. This creates a greater demand for accessible and affordable mental health services.

- On the basis of Component, the software segment dominates the market due to its comprehensive functionalities for both clinical and administrative aspects of mental healthcare.

- Based on Application, the clinical application segment is expected to have a high CAGR due to the increasing demand for technology-driven tools to enhance patient care and treatment outcomes.

- By region, North America leads the mental health software market due to high healthcare IT adoption, significant mental health investments, and prominent market participants.

To know more about this report | Request Free Sample Copy Growth Drivers:

- Rising Mental Health Issues: The prevalence of mental health conditions like depression and anxiety is increasing globally. This fuels demand for software that supports diagnosis, treatment, and management.

- Telehealth Boom: The COVID-19 pandemic accelerated the adoption of telehealth, making mental health services more accessible through software solutions.

- Focus on Early Intervention: Early identification and intervention for mental health issues are crucial. Mental health software can aid in screening, prevention, and early treatment plans.

- Provider Shortage: There's a global shortage of mental health professionals. Software can streamline workflows, improve efficiency, and potentially extend the reach of providers.

- Government Initiatives: Many governments are promoting mental health awareness and supporting the use of technology in healthcare. This includes funding and encouraging the adoption of mental health software.

Restraints:

Restraints:

- Data Privacy Concerns: Mental health data is sensitive, and ensuring its security and privacy is a major concern. Stringent regulations and robust data security measures are required.

- Stigma Around Mental Health: In some cultures, seeking mental health help carries a stigma. This can hinder user adoption of mental health software.

- Reimbursement Challenges: Reimbursement policies for mental health services delivered through software might not be well-established in all regions.

- Limited Integration: Interoperability with existing electronic health records (EHR) systems can be challenging, creating data silos and hindering information flow.

- Affordability: The cost of mental health software for both providers and individuals can be a barrier to wider adoption.

Opportunities:

Opportunities:

- AI-powered Solutions: Integrating artificial intelligence (AI) can personalize treatment plans, enhance diagnostics, and offer 24/7 support through chatbots.

- Gamification & Self-Help Tools: Engaging self-help tools and gamified features can make mental health resources more accessible and user-friendly.

- Workplace Wellness Programs: Employers are increasingly offering mental health support for their workforce. This creates a market for software solutions tailored to employee needs.

- Emerging Markets: The mental health software market has significant growth potential in developing countries with rising healthcare demands.

- Focus on Preventative Care: Software can be used for mental health education, stress management techniques, and early intervention strategies.

Challenges:

Challenges:

- Standardization and Regulations: Standardization of features and functionalities across mental health software is needed. Additionally, clear regulations regarding data privacy and security are crucial.

- Ethical Considerations: The use of AI in mental health software raises ethical concerns around bias and potential manipulation. Careful development and oversight are necessary.

- Digital Divide: Unequal access to technology can limit access to mental health software, particularly in underserved communities.

- Tech Literacy Among Users: User interfaces need to be user-friendly and cater to users with varying levels of technical literacy.

- Integration with Traditional Therapies: Mental health software should complement, not replace, traditional in-person therapy and medication.

Mental Health Software Market: Segmentation Insights

Mental Health Software Market: Segmentation Insights

The global mental health software market is segmented based on component, delivery model, application, and region.

By Component Insights

By Component Insights

Based on Component, the global mental health software market is bifurcated into software and services. Software segment holds the major market share around 80.45% due to its diverse functionalities. This segment includes all software solutions used for managing mental health services. It encompasses Electronic Health Records (EHR) for behavioral health, therapy apps, self-help tools, telehealth platforms, and practice management software. The high growth is driven by factors like rising adoption of electronic solutions, increasing demand for remote therapy options, and growing need for streamlining administrative tasks in mental health practices. Services segment includes services related to implementation, training, and support for mental health software solutions. While still important, the growth might be slower compared to software as healthcare providers become more comfortable with technology adoption.

By Delivery Model Insights

By Delivery Model Insights

On the basis of Delivery Model, the global mental health software market is categorized into subscription and ownership. Subscription segment offers software access through a subscription model, typically with a monthly or annual fee. This allows for flexible pricing and easier budgeting for mental health professionals, especially smaller practices. The convenience and affordability are driving high growth in this segment. Ownership segment involves a one-time purchase of the software license. While offering potential cost savings in the long run, upfront investment can be a barrier for some practices.

By Application Insights

By Application Insights

Based on Application, the global mental health software market is categorized into clinical and administrative. Clinical segment encompasses software solutions used for managing clinical aspects of mental healthcare. It includes tools for appointment scheduling, documentation, billing, coding, treatment planning, and progress tracking. The rising demand for efficient clinical workflow and improved patient care is fueling growth. Administrative segment focuses on software solutions for managing administrative tasks in mental health practices. It includes tools for appointment scheduling, patient intake forms, claims management, and practice financials. While important, growth might be slower compared to clinical applications as these tasks may be partially addressed by integrated clinical software.

Recent Developments

Recent Developments

- Epic Systems Corporation (March 2022): Introduced a new shared environment software service. This offering makes Epic's electronic health records (EHR) accessible to smaller physician groups, potentially improving access to mental health services for patients.

- Valant (December 2022): Launched a new tool for their cloud-based EHR system specifically designed for behavioral health practices. This tool focuses on prospective patient management, aiming to efficiently match patients with the most suitable mental health provider within a practice. This could lead to a better patient experience, faster intake processes, and increased satisfaction for both patients and clinicians.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 4.37 Billion |

Projected Market Size in 2032 |

USD 25.84 Billion |

CAGR Growth Rate |

21.83% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

The Echo Group, Qualifacts, Nextgen Healthcare, Netsmart, Mindlinc, Meditab Software, Credible Behavioral Health, Core Solutions, Compulink, Cerner, AdvancedMD, Advanced Data Systems, and Others. |

Key Segment |

By Component, By Delivery Model, By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Mental Health Software Market: Regional Insights

Mental Health Software Market: Regional Insights

The mental health software market is experiencing dynamic growth across various regions, each with its unique drivers and opportunities. Here's a brief regional analysis:

- North America: North America is leading the mental health software market, with the United States being a major contributor. This dominance is attributed to high healthcare IT adoption rates, substantial investments in mental health initiatives, and a strong presence of key market players. The region's advanced healthcare infrastructure and increasing awareness about mental health are significant growth drivers. North America's market is characterized by a robust CAGR, driven by technological advancements and the growing prevalence of mental health disorders.

- Europe: Europe holds the second-largest share in the mental health software market. The growth is fueled by the rising prevalence of behavioral health issues, government initiatives promoting mental health awareness, and the rapid adoption of healthcare IT solutions. Countries like Germany and the UK are leading in the region, thanks to their advanced healthcare systems and emphasis on mental health care. The integration of digital health solutions, including mental health software, is increasingly supported by both public and private sectors, contributing to market growth in the region.

- Asia-Pacific: The Asia-Pacific region is projected to grow at the fastest CAGR during the forecast period. Factors contributing to this rapid growth include increasing awareness of mental health issues, rising healthcare IT adoption, and governmental initiatives towards improving mental healthcare infrastructure. Countries like China and India are pivotal in driving the market expansion in the region. The vast population base, increasing internet penetration, and improving healthcare systems present significant opportunities for market players looking to expand in the Asia-Pacific region.

- Rest of the World: While the Rest of the World segment includes Latin America, the Middle East, and Africa, these regions exhibit slower growth compared to North America, Europe, and Asia-Pacific. However, increasing awareness of mental health and gradual adoption of healthcare IT solutions provide growth opportunities. Limited healthcare infrastructure and lower healthcare IT adoption rates are challenges that need to be addressed to tap into the potential of these markets.

Mental Health Software Market: Competitive Landscape

Mental Health Software Market: Competitive Landscape

Some of the main competitors dominating the global mental health software market include;

- The Echo Group

- Qualifacts

- Nextgen Healthcare

- Netsmart

- Mindlinc

- Meditab Software

- Credible Behavioral Health

- Core Solutions

- Compulink

- Cerner

- AdvancedMD

- Advanced Data Systems

The global mental health software market is segmented as follows:

By Component

By Component

- Software

- Integrated Software

- Standalone Software

- Services

By Delivery Model

By Delivery Model

- Subscription

- Ownership

By Application

By Application

- Clinical

- EHR for Behavioral Health

- Therapy Management Software

- Telehealth Platforms for Mental Health

- Administrative

- Document Management

- Patient Scheduling

- Workforce Management

- Case Management

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- The Echo Group

- Qualifacts

- Nextgen Healthcare

- Netsmart

- Mindlinc

- Meditab Software

- Credible Behavioral Health

- Core Solutions

- Compulink

- Cerner

- AdvancedMD

- Advanced Data Systems

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors