Search Market Research Report

London Insurance Business Process Outsourcing Market Size, Share Global Analysis Report, 2018 - 2027

London Insurance Business Process Outsourcing Market By Deployment Types (On-Premise and Cloud-Based), By Types of Outsourcing (Call Center Services, Data Mining Services, Finance & Accounting Services, Underwriting Services, Data Processing Services, and Outsourcing Services), By Project Types (Life & Annuity Policy Services, Property & Casualty Policy Services/Claim Services, and Pension Services), and By Organization Size (Large Enterprises and Small & Medium Enterprises): Industry Perspective, Comprehensive Analysis, and Forecast 2018 - 2027

Industry Insights

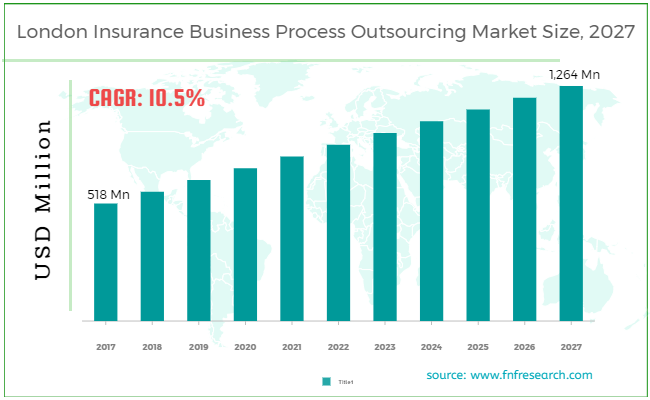

[167+ Pages Report] According to the report published by Facts and Factors, the london insurance business process outsourcing market size was valued at around USD 518 million in 2017 and is expected to grow to around USD 1,264 million by 2027 with a compound annual growth rate (CAGR) of roughly 10.5% between 2017 and 2027. The report analyzes the london insurance business process outsourcing market drivers, challenges, and the impact they have on the demands during the forecast period. In addition, the report explores emerging opportunities in the london insurance business process outsourcing market.

The report covers the forecast and analysis of the London Insurance Business Process Outsourcing market. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2027 based on revenue (USD Million). The study includes drivers and restraints of the London Insurance Business Process Outsourcing market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the London Insurance Business Process Outsourcing market.

In order to give the users of this report a comprehensive view of the London Insurance Business Process Outsourcing market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new services, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

The study provides a decisive view of the London Insurance Business Process Outsourcing market by segmenting the market based on deployment types, types of outsourcing, project types, organization size, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2019 to 2027.

The expansion of the market during the period from 2019 to 2027 is subject to the business process outsourcing providing cost-efficacy and flexibility. In addition to this, the hiring of the workforce from outside or another country can prove to be cost-effective for the firm as the organization has to pay fewer wages to the overseas staff as compared to the regional staff. This will further account remarkably towards the surge of the London insurance business process outsourcing industry during the forecast timeline. Nonetheless, the thinner work limits and strict implementation of laws will obstruct the expansion of the market over the forecast period. Apart from this, data security can pose a huge challenge to business expansion. However, the evolution of the knowledge process outsourcing sector has assisted in the fulfillment of the new business demands & offering special roles like equity research, web development, market research, and web design. This, in turn, will create lucrative growth avenues for the market during the forecast timeline.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2017 |

USD 518 Million |

Projected Market Size in 2027 |

USD 1,264 Million |

Growth Rate |

CAGR 10.5 % |

Base Year |

2017 |

Forecast Years |

2018-2027 |

Key Market Players |

Accenture plc, Capita plc, Cognizant, EXL, Genpact, HCL Technologies Limited, Infosys, Insuserve-1, Sutherland Global Services Inc, WNS (Holdings) Ltd, Wipro Limited and Others |

Key Segment |

By Deployment, By Types of Outsourcing, By Project Types, By Organization Size and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Based on the deployment types, the insurance business process outsourcing market in London is sectored into On-Premise and Cloud-Based. On the basis of types of outsourcing, the industry is segmented into Call Center Services, Data Mining Services, Finance & Accounting Services, Underwriting Services, Data Processing Services, and Outsourcing Services. In terms of project types, the London insurance business process outsourcing market is classified into Life & Annuity Policy Services, Property & Casualty Policy Services/Claim Services, and Pension Services. On the basis of organization size, the industry is divided into Large Enterprises and Small & Medium Enterprises.

Some of the leading players in the global market include

Some of the leading players in the global market include

- Accenture plc,

- Capita plc,

- Cognizant,

- EXL,

- Genpact,

- HCL Technologies Limited,

- Infosys,

- Insuserve-1,

- Sutherland Global Services Inc.,

- WNS (Holdings) Ltd.,

- Wipro Limited.

This report segments the London Insurance Business Process Outsourcing market as follows:

By Deployment Segment Analysis

By Deployment Segment Analysis

- On-Premise

- Cloud-Based

By Types of Outsourcing Segment Analysis

By Types of Outsourcing Segment Analysis

- Call Center Services

- Data Mining Services

- Finance & Accounting Services

- Underwriting Services

- Data Processing Services

- Outsourcing Services

By Project Types Segment Analysis

By Project Types Segment Analysis

- Life & Annuity Policy Services

- Property & Casualty Policy Services/Claim Services

- Pension Services

By Organization Size Segment Analysis

By Organization Size Segment Analysis

- Large Enterprises

- Small & Medium Enterprises

Industry Major Market Players

- Accenture plc,

- Capita plc,

- Cognizant,

- EXL,

- Genpact,

- HCL Technologies Limited,

- Infosys,

- Insuserve-1,

- Sutherland Global Services Inc.,

- WNS (Holdings) Ltd.,

- Wipro Limited.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors