Search Market Research Report

Litigation Funding Investment Market Size, Share Global Analysis Report, 2020 – 2026

Litigation Funding Investment Market By Application (Class Action Lawsuit Funding, Insolvency Litigation Funding, International Arbitration, Commercial Litigation Funding, Intellectual Property Litigation Funding, Patent Litigation Funding, Consumer Disputes, Labor Lawsuit Funding, and Others), and By End User (Businesses, Individuals, and Law Firms and Attorneys): Global Industry Perspective, Comprehensive Analysis, and Forecast 2020 – 2026

Industry Insights

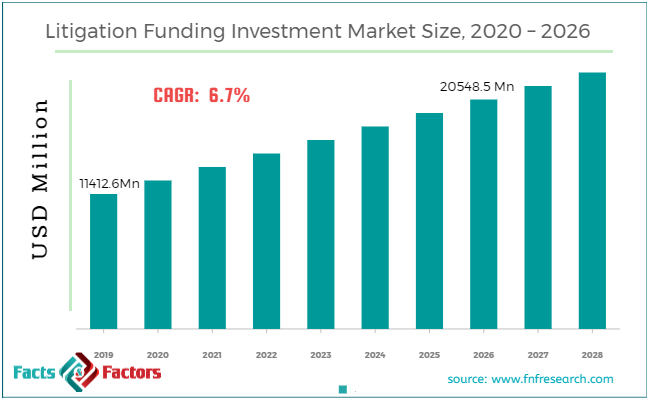

[190+ Pages Report] According to the report published by Facts and Factors, the global litigation funding investment market size was valued around USD 11412 million in 2019 and is estimated to surpass to around USD 20548 million by 2026 with a compound annual growth rate (CAGR) of approximately 6.7% between 2020 and 2026. The report analyzes the global litigation funding investment market drivers, restraints, and the effect they have on the demands during the projectiont period. In addition, the report analyzes emerging opportunities in the litigation funding investment market.

Synopsis

Synopsis

In recent years, litigation funding investment has turned into a productive, fast-growing, and attractive asset class. Commonly, Litigation funding investment is also referred to as legal financing and third-party litigation funding (TPLF). This type of funding is a financing arrangement wherein the entire legal costs and expenses of a particular party are funded by a third party that is not connected to the dispute in any manner. Generally, such work is carried out in exchange for a financial gain from the share of any favorable reward or settlement. The funded cases are generally settled at a popular and trustworthy forum with a convincing title value and high prospects of success. From the global perspective, the regions such as the US, UK, and Australia have shown tremendous growth potential over the forecast period in this market.

Growth Dynamics

Growth Dynamics

The litigation funding investment market is expected to progress due to the surging funding even in the minor lawful suits. In case of intellectual property disputes, class-action lawsuits, labor lawsuits, international arbitration, consumer disputes, and a commercial lawsuit, this type of litigation funding is being practiced. Moreover, the ICC had stated that the leading countries with parties exemplified 210 cases in the US, 110 in Spain, 117 in Brazil, 139 cases in France, and 95 in Germany. The surveys have shown the consumer products to have had the big shares of patent litigation cases with 14% for practicing entities and 2% for non-practicing entities. It is thus clear that such small numbers also slowly persuade the demand for litigation funding investment market.

With the decreasing risk, relying on third-party subsidizing instead of self-financing lawful discussions expresses the rapid accounting advantages to various organizations and law offices. Furthermore, there are possibilities that the developments may increase the working costs and in turn, reduce profits. However, debate subsidizing is known to help lessen the cost, and in certain cases, be considered as income, thereby filliping the monetary goal for an organization or law office.

Segmentation Analysis

Segmentation Analysis

Global Litigation Funding Investment market is categorized subject to the end-user, application, and region. The end-user segment is fragmented into Businesses, Individuals, and Law Firms and Attorneys. The application segment is segregated into Commercial Litigation Funding, Class Action Lawsuit Funding, International Arbitration, Labor Lawsuit Funding, Insolvency Litigation Funding, Consumer Disputes, Patent Litigation Funding, Intellectual Property Litigation Funding, and Others. It has been observed that the individual litigation funding is showcasing a warm embrace during the forecast period. Even though the individual noncommercial disagreements are challenging to let go of the advanced data analysis and artificial intelligence have helped consider every case based on their evidence. Additionally, there is an increase in the startups associated with individual litigation funding and it is the reason there might be lucrative growth as proficiency in justice delivery mechanism will improve and there will be more awareness about it.

Regional Analysis

Regional Analysis

Regional analysis has helped classify the market into Europe, North America, Latin America, Asia Pacific, and the Middle East and Africa. North America region holds the largest share in the litigation funding investment market. In the US, the recent demand for case law in favor of viable dispute funding helped enhance its popularity by applicants as an alternate fee solution that assists to liquefy financial barriers to the courts. Such developments provide extra mileage to the growth of litigation funding investments.

Australia is found to have a strong third-party funding market compared to the rest of the new or growing regions. Also, the surging developments and changing landscape in this region are likely to help the Asia-Pacific region expand its litigation funding investment market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 11412 Million |

Projected Market Size in 2026 |

USD 20548 Million |

Growth Rate |

CAGR 6.7% |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Augusta Ventures Limited, Apex Litigation Finance, Burford Capital LLC, IMF Bentham, Deminor, Harbour Litigation Funding Limited, Legalist Inc., Balance Legal Capital LLP, Longford Capital Management LP, Pravati Capital, Nivalion, Woodsford Litigation Funding Ltd, Omni Bridgeway, FORIS AG, Validity Finance LLC, Therium Group Holdings Limited and Others |

Key Segment |

By Type, By Organization Size, By Application and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the leading players in the global market include

Some of the leading players in the global market include

- Augusta Ventures Limited

- Apex Litigation Finance

- Burford Capital LLC

- IMF Bentham

- Deminor

- Harbour Litigation Funding Limited

- Legalist Inc.

- Balance Legal Capital LLP

- Longford Capital Management LP

- Pravati Capital

- Nivalion

- Woodsford Litigation Funding Ltd

- Omni Bridgeway

- FORIS AG

- Validity Finance LLC

- Therium Group Holdings Limited

This report segments the Litigation Funding Investment market as follows:

By Type Segment Analysis

By Type Segment Analysis

- Commercial Litigation

- International Arbitration

- Bankruptcy Claim

By Organization Size Segment Analysis

By Organization Size Segment Analysis

- Small & Medium Enterprises

- Large Enterprises

By Application Segment Analysis

By Application Segment Analysis

- Banking, Financial Services, and Insurance

- Travel & Hospitality

- Manufacturing, Healthcare

- IT & Telecommunication

- Media & Entertainment

By Regional Segmentation

By Regional Segmentation

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- The Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Mexico

- The Middle East and Africa

Industry Major Market Players

- Augusta Ventures Limited

- Apex Litigation Finance

- Burford Capital LLC

- IMF Bentham

- Deminor

- Harbour Litigation Funding Limited

- Legalist Inc.

- Balance Legal Capital LLP

- Longford Capital Management LP

- Pravati Capital

- Nivalion

- Woodsford Litigation Funding Ltd

- Omni Bridgeway

- FORIS AG

- Validity Finance LLC

- Therium Group Holdings Limited

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors