Search Market Research Report

Wood Coatings Resins Market Size, Share Global Analysis Report, 2022 – 2028

Wood Coatings Resins Market Size, Share, Growth Analysis Report By Resin Type (Polyurethane, Acrylic, Epoxy, Alkyd, Nitrocellulose, Polyester, Others), By Technology (Solvent-borne, High solids, Radiation cure, Waterborne, Powder), By Application (Furniture, Cabinets, Doors & windows, Flooring, Decoration, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

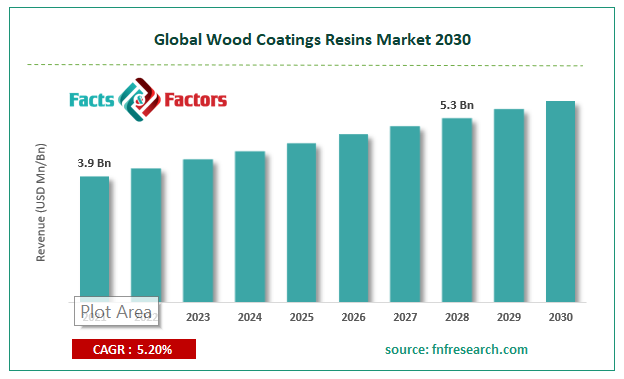

[200+ Pages Report] According to Facts and Factors, the global wood coatings resins market size was worth USD 3.9 billion in 2021 and is estimated to grow to USD 5.3 billion by 2028, with a compound annual growth rate (CAGR) of approximately 5.20% over the forecast period. The report analyzes the wood coatings resins market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the wood coatings resins market.

Market Overview

Market Overview

Wood coating resins are natural substances that give the wood more tensile strength and endurance while enhancing its visual appeal. The need for wood coating resins has recently been fueled by the development of environmentally friendly wood coating resins. Almost any sort of woodwork in a home, including doors, windows, cabinets, floors, ornaments, and other furniture, may be coated with these coating resins. The demand for wood coatings is anticipated to grow more in the next years due to the resin's qualities that prevent the wood from deteriorating and boost its durability. Wood Polymer compounds, known as coating resins, are essential in manufacturing coatings and paints. These ground-breaking materials are only used to provide corrosion, hardness, weather, and stain resistance and act as protective coatings for various items. Coating resins are applied to the surface of an object to offer hardness, corrosion resistance, weather resistance, and stain resistance.

Resins offer coatings short drying times, gloss maintenance, and superior weathering. When the resin and hardener are combined, a chemical process causes the components to cross-link as the mixture dries. Several methods are used to make coating resins. The formulation may be solvent- or water-based. Wood and furniture in a home, such as cabinets, doors, windows, and floors, are often coated with wood coating resins. During the forecast period, the demand for ecologically friendly wood coatings is anticipated to increase, along with using wood coating resins based on polyurethane. However, it is anticipated that the price of water-based wood coating resins, the rise in the usage of particle boards, and the use of various metal products in furniture production would restrain the market's expansion.

Covid-19 Impact:

Covid-19 Impact:

Companies rapidly increasing their capacity to meet the short-term COVID-induced demand must exercise caution when interpreting these rare demand patterns. From 2021 to 2025, the wood coating resins market industry will see post-pandemic changes in social, economic, trade, and political situations with anticipated changes in environmental legislation. During COVID-19, the wood coating resins market revealed conflicting findings for several applications and regions. The study examines the pandemic's segment-by-segment effects and presents various case studies illustrating the wood coating resins market's potential possibilities through 2028.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global wood coatings resins market value is expected to grow at a CAGR of 5.20 % over the forecast period.

- In terms of revenue, the global wood coatings resins market size was valued at around USD 3.9 million in 2021 and is projected to reach USD 5.3 million by 2028.

- The demand for eco-friendly coating systems and rising demand from the construction and automotive industries are the main factors propelling the market's growth. Other important factors include increased infrastructure spending, increased use of liquid and bio-based epoxy resin, technological advancements in powder coating, and rising consumer spending power.

- By resin type, the acrylic category dominated the market in 2021.

- By technology, the powder category dominated the market in 2021.

- Asia-Pacific dominated the global wood coatings resins market in 2021.

Growth Drivers

Growth Drivers

- Increasing use of liquid and bio-based epoxy resin drives the market growth

In electrodeposition (ED) and industrial coatings, notably in the transportation, industrial maintenance, and maritime industries, a variety of epoxy resins are frequently used. Powder coatings typically use epoxy resins as well. Liquid epoxy resin is increasingly used to create formulations with high and ultra-high solid contents. To create 100% solid epoxy compositions for use as concrete surfaces, tank linings, and other similar applications, liquid epoxy resin is employed. To improve functionality and features, phenoxy and novolac resins are routinely used.

Restraints

Restraints

- Variable raw material costs and declining petrochemical stockpiles may hinder the market growth

The potential of the global coating resins market has not yet been fully realized. People's preferences for furniture made of wood are predicted to change, which is expected to limit development rates in the market for wood coating resins as well. In addition, declining demand from mature application sectors, including railroad goods and utility poles, is anticipated to restrain market expansion for wood coating resins.

Segmentation Analysis

Segmentation Analysis

The global wood coatings resins market is segregated based on resin type, technology, application, and region.

Based on resin type, the market is segmented into polyurethane, acrylic, epoxy, alkyd, nitrocellulose, polyester, and others. In the market for coating resins, acrylic resin dominated in 2021. Acrylic is the most widely used form of resin due to its usage in architectural coatings, floor finishes, and automotive coatings. Among resin types, polyurethane is the second most popular. The greatest end-use market for powdered polyurethane is the appliance sector, where it is used in range cabinets, dryer drums, and freezers. Polyurethane's high cost is offset by its excellent performance characteristics, capacity to cure at lower baking temperatures, and low volatile organic compound (VOC) content.

Based on technology, the market is segmented into solvent-borne, high-solids, radiation cure, waterborne, and powder. The coating resins market for powder coatings is anticipated to develop fastest during the forecast period. The powder coating technique uses dry resin powders to cover substrates with thermoplastic or thermoset films. The powder coating technique uses dry resin powders to cover surfaces with thermoplastic or thermoset films. The coating is produced by heating and melting a layer of powder sprayed on the substrate via a fluidized bed tank or powder spray cannon. The automobile, appliance finishing, outdoor furniture manufacturing, and construction and building sectors employ powder coatings extensively. The demand for zero- or non-VOC coatings is largely driven by the proliferation of strict environmental regulations.

Based on application, the market is segmented into furniture, cabinets, doors & windows, flooring, decoration, and others. Due to the increasing need for product innovation and R&D in wood coatings and resin, which motivates manufacturing companies to search for organic and inorganic methods, the furniture category accounted for the highest part of the global market size in 2021. The most crucial characteristics needed for wood coating resins in the furniture industry include great resistance to dirt, abrasion, and water. Furthermore, strong chemical resistance against nail polish remover, shoe polish, and other chemicals is critical for wood coatings. As a result, the demand for wood coating resins is strongly correlated with the development in demand for both traditional and modern furniture.

Recent Development:

Recent Development:

- February 2021: Arkema's novel formulation, ENCOR 2793 functionalized pure acrylic binder, is intended for use in multiple substrate primers and rehabilitation paints. Both emissions of formaldehyde and alkylphenol ethoxylates are absent. On many different surfaces, including wood, concrete, porcelain, plastics, and many others, ENCOR 2793 pure acrylic has a great adhesion profile. It is easy to put into words. As a result, various applications are made possible, such as multi-substrate primers, wall paints, wood lacquers, stain and tannin blocking primers, and two-coat repair paints.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 3.9 Billion |

Projected Market Size in 2028 |

USD 5.3 Billion |

CAGR Growth Rate |

6.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Arkema S.A., Nuplex Industries Limited, Koninklijke DSM N.V., Allnex S.à.r.l., Synthopol Chemie Dr. rer. pol. Koch GmbH & Co. KG, Dynea AS, Polynt Spa, Sirca Spa, IVM Group, Helios Group, and Others |

Key Segment |

By Resin Type, Technology, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia Pacific to dominate the global wood coating resins market in the near future

The Asia-Pacific area is expanding quickly due to solid economic development and improved infrastructure. To meet the rising demand for wood finishing resins, Asia Pacific is evolved as a global center in 2021. The market's growth is attributed to rising living standards and infrastructure expenditure. Asia-Pacific is well known for being a significant producer and consumer of coated resins. Numerous economies in various stages of development may be found across Asia-Pacific.

The area's wealth is partly attributable to its quick economic expansion and huge investments in industries like automotive, consumer goods & appliances, building & construction, and furniture. The leading producers of coating resins are increasing their production capacity globally, but mainly in China and India. The benefits of relocating production include lower manufacturing costs, easier access to competent personnel at reasonable rates, and the potential to serve a burgeoning regional market better.

Competitive Landscape

Competitive Landscape

- Arkema S.A.

- Nuplex Industries Limited

- Koninklijke DSM N.V.

- Allnex S.à.r.l.

- Synthopol Chemie Dr. rer. pol. Koch GmbH & Co. KG

- Dynea AS

- Polynt Spa

- Sirca Spa

- IVM Group

- Helios Group

Global Wood Coatings Resins Market is segmented as follows:

By Resin Type

By Resin Type

- Polyurethane

- Acrylic

- Epoxy

- Alkyd

- Nitrocellulose

- Polyester

- Others

By Technology

By Technology

- Solvent-borne

- High solids

- Radiation cure

- Waterborne

- Powder

By Application

By Application

- Furniture

- Cabinets

- Doors & windows

- Flooring

- Decoration

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Arkema S.A.

- Nuplex Industries Limited

- Koninklijke DSM N.V.

- Allnex S.à.r.l.

- Synthopol Chemie Dr. rer. pol. Koch GmbH & Co. KG

- Dynea AS

- Polynt Spa

- Sirca Spa

- IVM Group

- Helios Group

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors