Search Market Research Report

Treasury Software Market Size, Share Global Analysis Report, 2022 – 2028

Treasury Software Market Size, Share, Growth Analysis Report By Deployment Mode (On-Premise, Cloud-Based), By Organization Size (Large Enterprises, Small & Medium-Sized Enterprises), By Vertical (Banking, Financial Services, & Insurance (BFSI), Healthcare, Manufacturing, Consumer Goods, Chemicals, Metals, & Energy), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

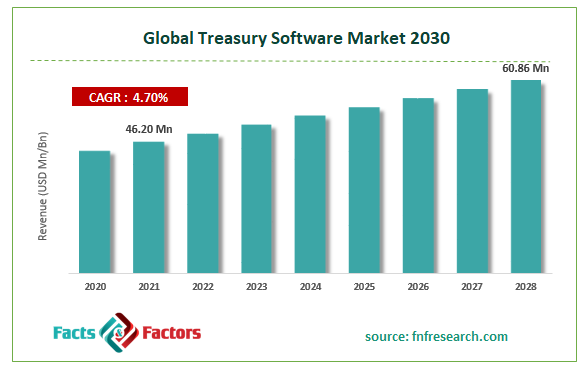

[238+ Pages Report] According to Facts and Factors, the global treasury software market size was worth around USD 46.20 million in 2021 and is estimated to grow to about USD 60.86 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.70% over the forecast period. The report analyzes the treasury software market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the treasury software market.

Market Overview

Market Overview

Financial risk management standards and procedures are meant to be appropriately maintained by cash or treasury management software. It includes the management of the business's assets with the main objectives of controlling the firm's liquidity and lowering the risk to the business's operations, finances, and reputation. It also includes payouts, financial activities, and concentration. The greatest businesses use treasury software to manage bonds, financial derivatives, currencies, and financial risk. Both internal and external service providers may administrate the program. The program reduces exposure and streamlines cash management processes by eliminating cybercrime and ensuring regulatory compliance.

In other words, it has to do with creating rules that ensure a company maintains its financial stability. Over the projection period, it is anticipated that the widespread usage of automation systems will impact the expansion of the global treasury software market. The market is anticipated to increase due to the increasing acceptability of treasury software among end users like the government, banks, and businesses.

COVID-19 Impact:

COVID-19 Impact:

Following the abrupt pandemic breakout, many factories and specialized units only operate partially. A select few have even temporarily closed their units and ceased output. This is the cause of the material shortage that the technology sector is experiencing, which is being made worse by shipment delays. Most nations have implemented a state of lockdown and have forbidden social gatherings to stop the pandemic. Additionally, travel was prohibited, which resulted in the events being canceled. The abrupt cancellation of events in the software development services sector forced IT behemoths to postpone events worldwide.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global treasury software market value is expected to grow at a CAGR of 4.70% over the forecast period.

- In terms of revenue, the global treasury software market size was valued at around USD 46.20 million in 2021 and is projected to reach USD 60.86 million by 2028.

- Throughout the projection period, it is anticipated that the widespread usage of automation systems will impact the expansion of the treasury software market.

- By organization size, the large enterprise segment dominated the market in 2021.

- By vertical, the banking, financial services, & insurance (BFSI) segment dominated in 2021.

- North America dominated the treasury software market in 2021.

Drivers

Drivers

- Large-scale acceptance of automated systems drives the market growth

The growing popularity of automated solutions is expected to drive the growth of the global treasury software market throughout the forecast period. Furthermore, treasury software has proven beneficial to people with limited resources. Additionally, the software can link the BFSI to other businesses such as government, healthcare, energy, and retail. Furthermore, blockchain technology has the potential to remove treasury tasks such as payment transactions, fiscal settlement activities, reconciliation, and audits.

Restraints

Restraints

- Threats of a data breach may hinder the market growth

During the forecast period, data breaches brought on by computer viruses, worms, and phishing are anticipated to be major obstacles to the growth of treasury software, while a lack of knowledge about the advantages of treasury software in emerging nations may hinder the market's expansion.

Opportunity

Opportunity

- Rapid advancements in treasury software present market growth opportunities

The global treasury software market is anticipated to experience strong growth due to the rapid development of treasury management software, including cloud-based deployment and managed services, as well as technological advancements in artificial intelligence (AI), blockchain, analytics, and cloud computing.

Segmentation Analysis

Segmentation Analysis

The global treasury software market is segmented based on deployment mode, organization size, vertical, and region.

Based on deployment mode, the market is segmented into on-premise and cloud-based. The cloud-based segment dominated the market in 2021. Treasury software now has more adaptability to meet end-user needs and is more cost-effective due to the development of treasury software leveraging cloud technology. Additionally, the treasury software market is expected to see attractive opportunities due to the increased innovation in the cloud computing sector. Over the forecast year, all of these variables will significantly support the segment's growth. Innovations in treasury software systems due to ongoing research and development in the cloud computing space have further fueled the segmental expansion.

Based on organization size, the market is segmented into large enterprises and small & medium-sized enterprises. The large enterprise segment dominated the market in 2021 as cost-effective treasury software technology and service portfolios are provided by small and medium-sized enterprises (SMEs) for the developers to use on their projects. Large-scale organizations' and firms' solid foundations and market share in established and developing economies are major contributors to the market's expansion.

Based on vertical, the market is segmented into banking, financial services, & insurance (BFSI), healthcare, manufacturing, consumer goods & chemicals, metals, and energy. The banking, financial services, & insurance (BFSI) segment dominated the market in 2021. The segment's expansion is attributable to the expanding need for treasury software in the banking, financial services, and insurance industries.

Recent Developments

Recent Developments

- July 2021: New line of risk management tools powered by artificial intelligence (AI) was introduced by FIS. To help capital market firms manage regulatory compliance and risk more effectively by leveraging the power of their organizational data, FIS has previously unveiled a new set of tools developed in partnership with C3 AI.

- November 2020: To seek assistance with liquidity optimization, risk management, and expansion, Nordic challenger bank Lunar chose FIS' cloud-based solution for treasury and risk management. Lunar chose FIS's private cloud-based Ambit Quantum to simplify regulatory compliance and hedge accounting. To connect its treasury and payment operations to banking partners through SWIFT and other industry exchanges and networks, Lunar uses the FIS SWIFT Service Bureau.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 46.20 Million |

Projected Market Size in 2028 |

USD 60.86 Million |

CAGR Growth Rate |

4.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Calypso, CRISK Software ApS, Escali Financial Systems AS, Exidio ltd. (Trezone), HCL Technologies Limited, Infor, ION (Reval), Kyriba, Mitigram, MORS Software, SAP SE, SimCorp A/S, Treasury Systems, ZenTreasury Ltd, and Others |

Key Segment |

By Deployment Mode, Organization Size, Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the treasury software market in 2021

In 2021, North America dominated the global treasury market because the region had a sophisticated technology infrastructure. Due to the widespread use of advanced technology and significant regional players, the United States dominates North America. Additionally, the industry is booming. Its dominance results from the region's increasing acceptance of advanced technology and the introduction of new items. Additionally, it is anticipated that the growing number of local-level competitors would accelerate market expansion in this area. The expanding technology sector aided the rise of North America's treasury and risk management markets.

Competitive Landscape

Competitive Landscape

- Calypso

- CRISK Software ApS

- Escali Financial Systems AS

- Exidio ltd. (Trezone)

- HCL Technologies Limited

- Infor

- ION (Reval)

- Kyriba

- Mitigram

- MORS Software

- SAP SE

- SimCorp A/S

- Treasury Systems

- ZenTreasury Ltd.

The Global Treasury Software Market is segmented as follows:

By Deployment Mode

By Deployment Mode

- On-Premise

- Cloud-Based

By Organization Size

By Organization Size

- Large Enterprises

- Small & Medium-Sized Enterprises

By Vertical

By Vertical

- Banking, Financial Services, & Insurance (BFSI)

- Healthcare

- Manufacturing

- Consumer Goods

- Chemicals, Metals, & Energy

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Calypso

- CRISK Software ApS

- Escali Financial Systems AS

- Exidio ltd. (Trezone)

- HCL Technologies Limited

- Infor

- ION (Reval)

- Kyriba

- Mitigram

- MORS Software

- SAP SE

- SimCorp A/S

- Treasury Systems

- ZenTreasury Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors