Search Market Research Report

Transparent Display Market Size, Share Global Analysis Report, 2022 – 2028

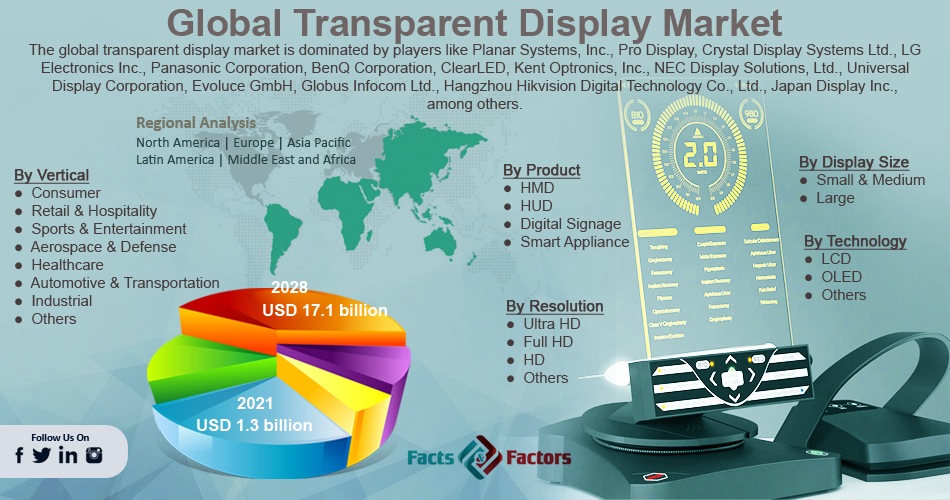

Transparent Display Market Size, Share, Growth Analysis Report By Technology (LCD, OLED, and Others), By Display Size (Small & Medium, and Large), By Resolution (Ultra HD, Full HD, HD, and Others), By Product (HMD, HUD, Digital Signage, and Smart Appliance), By Vertical (Consumer, Retail & Hospitality, Sports & Entertainment, Aerospace & Defense, Healthcare, Automotive & Transportation, Industrial, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

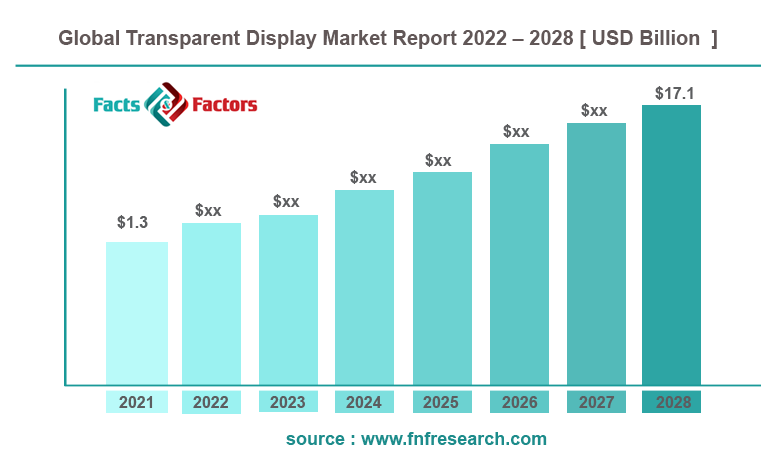

[221+ Pages Report] According to Facts and Factors, the global transparent display market size was worth around USD 1.3 billion in 2021 and is predicted to grow to around USD 17.1 billion by 2028 with a compound annual growth rate (CAGR) of roughly 44.5% between 2022 and 2028. The report analyzes the global transparent display market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Transparent Display market.

Market Overview

Market Overview

Transparent displays, unlike other types of displays, may display graphical information on a transparent screen. These see-through displays transmit ambient light from real-world objects behind a display screen, such as LCD or OLED. Transparent displays are the next generation of display technology that has transformed the display industry and offers excellent advertising and aesthetic effects. In addition, as compared to traditional display systems, these displays feature high transparency, a fast reaction time, and a high contrast ratio. Furthermore, transparent screens are believed to use less electricity.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global transparent display market is estimated to grow annually at a CAGR of around 44.5% over the forecast period (2022-2028).

- In terms of revenue, the global Transparent Display market size was valued at around USD 1.3 billion in 2021 and is projected to reach USD 17.1 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on technology, the OLED segment is expected to hold the largest market share during the forecast period.

- Based on the display size, the small & medium segments accounted for the largest revenue share in 2021.

- Based on vertical, the healthcare segment is expected to grow at the highest CAGR during the forecast period.

- Based on region, the Asia Pacific is projected to hold the largest market share during the forecast period.

Covid-19 Impact

Covid-19 Impact

The worldwide supply chain disruption caused by the shutdown caused a sharp decline in transparent display output in 2020. The activities of makers of transparent displays, as well as those of their suppliers and distributors, were impacted by COVID-19. The short-term growth of the transparent display industry is anticipated to be significantly impacted by the failure of export shipments and the poor domestic semiconductor demand compared to pre-COVID-19 levels. A lockdown has been imposed in numerous significant economies as a result of the current COVID-19 epidemic. Supply networks have been messed up, which has affected the business of electronic goods. Additionally, the closure of industrial facilities is losing many economies a significant amount of money. The overall situation has therefore limited the market for transparent displays in 2020.

Growth Drivers

Growth Drivers

- Technological advancements coupled with innovative product launch to drive the market

Transparent displays, which use technology to show or convey information, are anticipated to alter the way that displays are used. Many businesses are spending a lot of money on research and development for transparent display technologies. For instance, Samsung plans to introduce a phone with a transparent display and a revolutionary triple-foldable tablet in 2021. Similar to this, Crystal Display Systems plans to release a curved transparent liquid crystal display in 2021 for shop displays that truly offer them a distinctive advantage over other displays. Intelligent glasses that can recall where consumers last saw their keys, phones, and other items were created by Japanese scientists. Additionally, the development of smartphone-compatible virtual reality technology supports the expansion of this sector. Furthermore, increasing awareness and adoption of advanced technologies are the factors that drive the global transparent display market.

The growing use of transparent displays for HMD and HUD products to flourish the market

The growing use of transparent displays for HMD and HUD products to flourish the market

The need for transparent displays is rising as more industries, including automotive, aerospace & military, sports & entertainment, and healthcare, adopt transparent displays in HMDs and HUDs. Customers are influenced by the transparent display's creative, attention-grabbing impact on them and their viewing habits. OLED has become a crucial display technology for smart wearables, such as smart glass and AR/VR head-mounted displays (HMDs). With a significant market share in 2018, OLED displays are anticipated to have rapid expansion across all segments. In the upcoming years, it is anticipated that the market for transparent displays would expand considerably due to the growing use of HMDs in a variety of applications, including medical, automotive, consumer, entertainment, and educational ones. In the coming five years, the need for display panels for smart glass, HUDs, and HMDs will increase due to the rise of the transparent display industry.

Restraints

Restraints

- The high cost associated with transparent displays might be hampering the market growth

Although it is predicted that the market for transparent displays would expand significantly, the high initial costs associated with this technology's R&D are expected to restrain market expansion. New functionality and the competitive display technology market will drive up the price of developing items utilizing this technology. On the other hand, the majority of the technologies needed for the transparent display that faces the outside are still in the development phase. The global transparent display market size would be hampered during the projected period by costly initial expenditures and a long development cycle.

Opportunities

Opportunities

- Increasing adoption of transparent display for digital signage products

Digital signage solutions for many different industries, including retail, hospitality, smart appliances, and automotive, frequently employ transparent displays. A remarkable new advancement in digital signage and display technology is the use of transparent OLED panels to transmit dynamic or interactive content. Although the backdrop may still be seen through by viewers, they can still see what is being displayed on the screen. Designers may use this display method to add digital material to real-world items that are positioned behind the transparent screen, such as images, text, and videos. Digital signage uses transparent displays because they are glass windows combined with touchscreens and alternative light sources that do not interfere with the display and enable light to travel through in both directions. Unlike most LCD panels, which include backlit elements that illuminate the pixels on the screen and make them visible to viewers, this one lacks such features. Because they use just around 10% of the electricity of a conventional LCD panel, transparent screens are becoming more and more popular.

Segmentation Analysis

Segmentation Analysis

The global transparent display market is segmented based on technology, display size, resolution, product, vertical, and region

Based on the technology, the global market is bifurcated into LCD, OLED, and others. The OLED segment is expected to hold the largest market share during the forecast period. OLED possesses a simpler structure than LCD, and both its picture quality and form factor are better. OLED is more flexible and thinner, and it performs better. Contrary to LCD's artificial modifications, the color gamut is inherently wide. Additionally, the contrast ratio and image response speed are also superb. OLED quickly gained popularity as the technology to replace LCDs because of these characteristics. As a result, the transparent display market is anticipated to benefit greatly from OLED display technology during the projected period.

Based on the display size, the global transparent display market is segmented into small & medium and large. The small & medium segment accounted for the largest revenue share in 2021 and is expected to show its dominance during the forecast period. They have become a crucial part of many devices, including head-mounted display (HMD) systems and heads-up display (HUD) systems, because of their small size, low power consumption, and great brightness. The growing use of AR HMDs in industrial, military, defense, aerospace, and medical applications as well as their connection between virtual items and reality is driving the expansion of the transparent display industry. Therefore, there is potential for a transparent display to expand at a rapid rate in the future due to the growing use of the transparent display for different small and medium-sized goods, such as HMDs and HUDs.

Based on vertical, the market is segmented into consumer, retail & hospitality, sports & entertainment, aerospace & defense, healthcare, automotive & transportation, industrial, and others. The healthcare segment is projected to grow at the highest CAGR during the forecast period. Transparent displays are becoming more widely used in settings like surgery and patient checkups because of rising technical breakthroughs in the healthcare sector. During crucial procedures, transparent screens are used to support surgeons. Additionally, the healthcare sector is expanding significantly year over year, and several businesses and research institutions are creating these displays for a variety of uses. A surgical navigation system with a transparent display was created by the Industrial Technology Research Institute (ITRI) in 2021 to lower the danger of surgery. To address the demands of preoperative communication and intraoperative navigation, this system offers high-precision direct view type virtual-real fusion picture information. Future applications for this include smart surgery and medical education. Thus, these factors influence segment growth during the forecast period.

Recent Developments:

Recent Developments:

- In May 2022, A transparent 55-inch OLED display module with exceptional image visibility has been commercialized, according to an announcement by Panasonic Corporation. A transparent self-illuminating OLED display panel is used in the new product, which has a thickness of less than 1 cm and provides high transparency while producing images with vibrant color.

- In September 2021, LG Display collaborated with Kakao Mobility, a Korean taxi-hailing company, to develop a smart car park in Seoul using transparent OLED screens. The 55-inch transparent OLED Display panels, according to the company, would be installed at the six entrances to the parking lot from the shopping mall. These will be installed over the existing glass walls to create effects and illusions without taking up space or distracting customers.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1.3 Billion |

Projected Market Size in 2028 |

USD 17.1 Billion |

CAGR Growth Rate |

44.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Planar Systems Inc., Pro Display, Crystal Display Systems Ltd., LG Electronics Inc., Panasonic Corporation, BenQ Corporation, ClearLED, Kent Optronics Inc., NEC Display Solutions Ltd., Universal Display Corporation, Evoluce GmbH, Globus Infocom Ltd., Hangzhou Hikvision Digital Technology Co. Ltd., Japan Display Inc., and others. |

Key Segment |

By Technology, Display Size, Resolution, Product, Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- The Asia Pacific is expected to hold the largest market share during the forecast period

The Asia Pacific is expected to hold the largest global transparent display market share during the forecast period. The market is expanding as a result of the rise in demand for transparent displays among different end users, including those in the automotive, electronic, healthcare, and other sectors. Moreover, A significant factor in the market's expansion is the strong demand for transparent display panels in South Korea, China, and Japan. Because of the availability of display panel manufacturers, the transparent display industry has plenty of options to embrace the newest technology-based display devices. 2019 saw the completion of LG Electronics Inc.'s new transparent OLED screen manufacturing facility in China. By 60,000 units per month, this would significantly enhance the manufacturing of clear OLED displays with display sizes of 55 inches and above. Thus, the aforementioned factors support the market growth of the region.

Competitive Analysis

Competitive Analysis

- Planar Systems Inc.

- Pro Display

- Crystal Display Systems Ltd.

- LG Electronics Inc.

- Panasonic Corporation

- BenQ Corporation

- Clear LED

- Kent Optronics Inc.

- NEC Display Solutions Ltd.

- Universal Display Corporation

- Evoluce GmbH

- Globus Infocom Ltd.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Japan Display Inc.

The global transparent display market is segmented as follows:

By Technology

By Technology

- LCD

- OLED

- Others

By Display Size

By Display Size

- Small & Medium

- Large

By Resolution

By Resolution

- Ultra HD

- Full HD

- HD

- Others

By Product

By Product

- HMD

- HUD

- Digital Signage

- Smart Appliance

By Vertical

By Vertical

- Consumer

- Retail & Hospitality

- Sports & Entertainment

- Aerospace & Defense

- Healthcare

- Automotive & Transportation

- Industrial

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Planar Systems Inc.

- Pro Display

- Crystal Display Systems Ltd.

- LG Electronics Inc.

- Panasonic Corporation

- BenQ Corporation

- Clear LED

- Kent Optronics Inc.

- NEC Display Solutions Ltd.

- Universal Display Corporation

- Evoluce GmbH

- Globus Infocom Ltd.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Japan Display Inc.

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors