Search Market Research Report

Smart Factory Market Size, Share Global Analysis Report, 2023 – 2030

Smart Factory Market Size, Share, Growth Analysis Report By Components (Hardware, Software, Services, And Others), By End Users (Process And Discrete Industries), By Industry Verticals (Healthcare, Pharmaceuticals, Energy & Utilities, Food & Beverage, Electronics, Aerospace & Defense, Automotive, And Others), By Connectivity Outlook (Wired And Wireless Connectivity), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

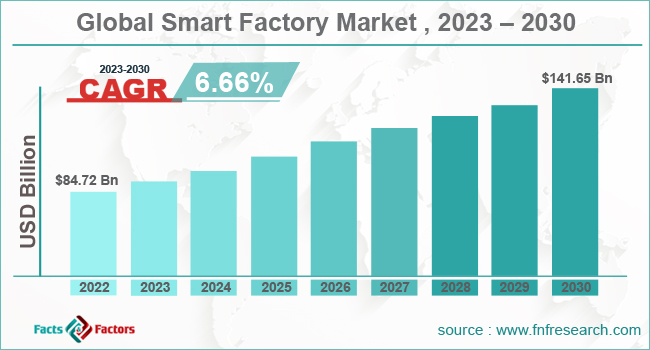

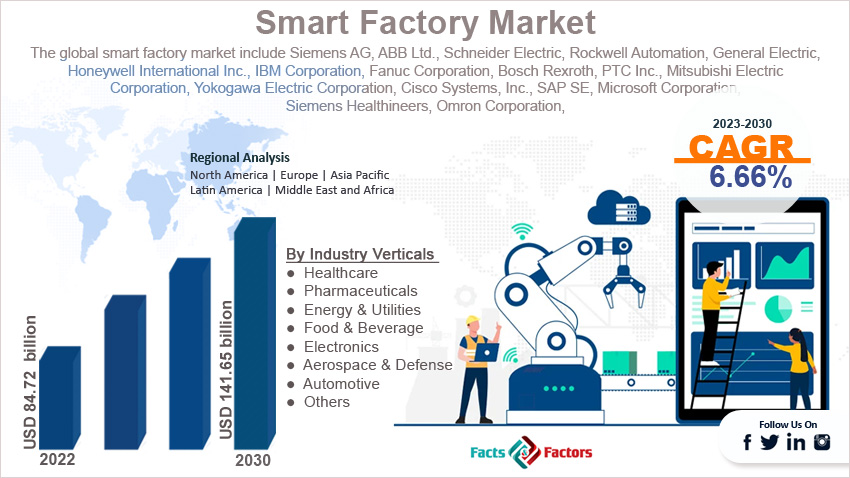

[220+ Pages Report] According to Facts and Factors, the global smart factory market size was valued at USD 84.72 billion in 2022 and is predicted to surpass USD 141.65 billion by the end of 2023. The smart factory industry is expected to grow by a CAGR of 6.66%.

Market Overview

Market Overview

A smart factory is referred to as Industry 4.0 or the factory of the future. It is a manufacturing facility that utilizes the power of automation, data analytics, and other advanced technologies to optimize production processes. Smart factories will improve the flexibility and efficiency of the industry. The concept is expected to transform traditional manufacturing into more technologically advanced, data-driven, and connected systems.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global smart factory market size is estimated to grow annually at a CAGR of around 6.66% over the forecast period (2023-2030).

- In terms of revenue, the global smart factory market size was valued at around USD 84.72 billion in 2022 and is projected to reach USD 141.65 billion by 2030.

- Increasing adoption of Industry 4.0 is driving the growth of the global smart factory market.

- Based on the components, the software segment is growing at a high rate and is projected to dominate the global market.

- Based on the end users, the discrete manufacturing industries segment is projected to swipe the largest market share.

- Based on the industry verticals, the automotive industry segment accounts for the largest share of the global market.

- Based on the connectivity outlook, the wireless connectivity segment is likely to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Increasing adoption of Industry 4.0 is likely to drive the growth of the global market.

Adoption of Industry 4.0 principles is significantly focusing on data exchange, automation, and digitalization in the manufacturing sector, which is likely to be a major driver for the growth of the global smart factory market. Moreover, companies are looking forward to improving and modernizing their working operations, which is further expected to contribute heavily towards market growth.

For instance, ABB Robotics came up with IRB 1010 in October 2022. It is the smallest industrial robot. This is expected to help electronics manufacturers enhance the production of devices like health trackers, earphones, sensors, watches, etc.

Restraints

Restraints

- High initial investment is likely to hamper the growth of the global market.

The upfront cost of setting up the smart factory technology is quite high. Execution of smart factory technology includes advanced infrastructures, software, and various hardware, which is substantial. Therefore, small and medium-cap companies find it challenging to adopt the smart factory technology.

Opportunities

Opportunities

- Rapid prototyping and innovation are expected to offer growth opportunities in the global market.

Smart factories are helping in iterative design and rapid prototyping. Therefore widening the scope of the global smart factory market by facilitating innovations of new products. Moreover, the collaboration between machines and humans, like cobots, is further increasing work safety and productivity, thereby offering new opportunities in the market.

For instance, Emerson integrated renewable energy capabilities and extensive power expertise into OvationTM Green Portfolio to help power generation companies align with the customer’s requirements transitioning to green energy generation.

Challenges

Challenges

- Data privacy and cyber security concerns are a big challenge in the global market.

Handling large volumes of data integrated by smart factories is increasing concerns regarding data privacy and compliance with regulations like GDPR. Additionally, as smart factories are becoming more connected, they are becoming highly vulnerable to cyber security threats. Therefore, such a landscape is likely to slow down the growth of the smart factory industry in the coming years.

Segmentation Analysis

Segmentation Analysis

The global smart factory market can be segmented into components, end users, industry verticals, connectivity outlook, and region.

By component, the market can be segmented into hardware, software, services, and others. The hardware segment can further be bifurcated into industrial 3D printing, machine systems, industrial robots, sensors, and others. The software can further be bifurcated into ERP, SCADA, distribution control system, product life cycle management, human-machine interface, and others.

The service segment can further be bifurcated into support & maintenance, consulting, and integration & deployment. The software segment is projected to swipe the largest market share in the forthcoming years.

Industries globally are stepping towards full automation, and software has emerged as the backbone of the industry. Sophisticated software is required to operate and execute instructions on robots, drones, and other machines that work without human interruption. However, it also reduces the chance of error, which is expected to foster developments in the segment. Software components are crucial in a smart factory as they enable the control, automation, and data analysis functions.

By end-user segment, the market can be segmented into process and discrete industries. The discrete industry segment is likely to dominate the global smart factory industry. The discrete manufacturing industries are experiencing several challenges, like a surplus of unorganized data, a lack of tech resources, and workplace interruptions. The discrete manufacturing sector is making efforts to overcome these obstacles with the use of the smart factory framework.

However, it includes better mobility, enterprise-wide visibility, cloud-based manufacturing execution, integrated production, and out-of-the-box analytics. This offers manufacturers from discrete industries to have real-time interaction between the system, assets, and people. Therefore, it helps them to control the system through cognitive computing and machine learning.

By industry vertical, the market can be segmented into healthcare, pharmaceuticals, energy & utilities, food & beverage, electronics, aerospace & defense, automotive, and others. The automotive industry segment is likely to have a major influence on the smart factory industry. The automotive industry is extensively employing industrial robots and automation systems for various tasks like material handling, assembly, painting, welding, and several others, which is likely to propel the growth of the segment during the anticipated period.

Also, advanced technologies like machine learning, computer vision, and artificial intelligence are further helping the automotive sector with quality control parameters. Sensors and cameras are used to inspect different parts for defects and ensure consistent quality. Therefore, such a landscape is further increasing the demand for the smart factory in the sector.

By connectivity outlook, the market can be segmented into wired and wireless connectivity. The wireless connectivity segment accounts for the largest share of the global smart factory market and is likely to grow with a high CAGR during the predicted period.

Wireless connectivity plays a crucial role in the smart factory ecosystem and Industry 4.0. Wireless connectivity has significantly increased the flexibility in manufacturing operations and enhanced the communication between devices & systems, and offers real-time data collection.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 84.72 Billion |

Projected Market Size in 2030 |

USD 141.65 Billion |

CAGR Growth Rate |

6.66% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Siemens AG, ABB Ltd., Schneider Electric, Rockwell Automation, General Electric, Honeywell International Inc., IBM Corporation, Fanuc Corporation, Bosch Rexroth, PTC Inc., Mitsubishi Electric Corporation, Yokogawa Electric Corporation, Cisco Systems Inc., SAP SE, Microsoft Corporation, Siemens Healthineers, Omron Corporation, PTC Inc., KUKA AG, Hexagon AB., and Others. |

Key Segment |

By Components, By End Users, By Industry Verticals, By Connectivity Outlook, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market during the forecast period.

North America is expected to experience a high growth rate in the global smart factory market during the forecast period. The emergence of industry 4.0 technology, digital transformation, and automation is likely to drive the growth of the regional market.

Also, the region is home to many growing industries like pharmaceuticals, food processing, electronics, aerospace, and automotive, which are actively adopting smart factory technology to enhance manufacturing processes. Therefore, the market is expected to see positive developments in the coming years.

The increasing advancements in technology like big data analytics, robotics, artificial intelligence, and the Internet of Things are further expected to contribute heavily towards the growth of the regional market.

Asia Pacific is also a dynamic player in the smart factory industry, and the region is likely to embrace smart factory technology to grow significantly in the coming years. The region is known for its diverse manufacturing landscape, ranging from consumer goods to semiconductors and electronics to automobiles.

The region is at the forefront of adopting smart factory technology, and therefore, it is expected to swipe the highest market revenue during the anticipated period. For instance, P-lab, short for Audi’s Production Lab, was identified as a leading technology for serial production in Gaimersheim in July 2022. The approval for this technology has significantly widened the growth opportunity for the smart factory industry.

Competitive Analysis

Competitive Analysis

The key leaders in the global smart factory market include:

- Siemens AG

- ABB Ltd.

- Schneider Electric

- Rockwell Automation

- General Electric

- Honeywell International Inc.

- IBM Corporation

- Fanuc Corporation

- Bosch Rexroth

- PTC Inc.

- Mitsubishi Electric Corporation

- Yokogawa Electric Corporation

- Cisco Systems Inc.

- SAP SE

- Microsoft Corporation

- Siemens Healthineers

- Omron Corporation

- PTC Inc.

- KUKA AG

- Hexagon AB.

For instance, Shell PLC chose Yokogawa Electric Corporation in September 2022 as the main automation contractor in its business. The latter company is providing help in the construction of its Holland Hydrogen plant in Rotterdam.

The global smart factory market is segmented as follows:

By Components Segment Analysis

By Components Segment Analysis

- Hardware

- Software

- Services

- Others

By End Users Segment Analysis

By End Users Segment Analysis

- Process

- Discrete Industries

By Industry Verticals Segment Analysis

By Industry Verticals Segment Analysis

- Healthcare

- Pharmaceuticals

- Energy & Utilities

- Food & Beverage

- Electronics

- Aerospace & Defense

- Automotive

- Others

By Connectivity Outlook Segment Analysis

By Connectivity Outlook Segment Analysis

- Wired

- Wireless Connectivity

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Siemens AG

- ABB Ltd.

- Schneider Electric

- Rockwell Automation

- General Electric

- Honeywell International Inc.

- IBM Corporation

- Fanuc Corporation

- Bosch Rexroth

- PTC Inc.

- Mitsubishi Electric Corporation

- Yokogawa Electric Corporation

- Cisco Systems Inc.

- SAP SE

- Microsoft Corporation

- Siemens Healthineers

- Omron Corporation

- PTC Inc.

- KUKA AG

- Hexagon AB.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors