Search Market Research Report

Refurbished Smartphone Market Size, Share Global Analysis Report, 2025 - 2034

Refurbished Smartphone Market Size, Share, Growth Analysis Report By Smartphone Type (Luxury Smartphones, Mid-Range Smartphones, Budget Smartphones), By Condition (Like New, Good, Fair), By Operating System (Android, iOS, Windows, and Others), By Sales Channel (Online Retail, Offline Retail, Manufacturer Refurbished), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

What is the size of the global refurbished smartphone market during the forecast period?

What is the size of the global refurbished smartphone market during the forecast period?

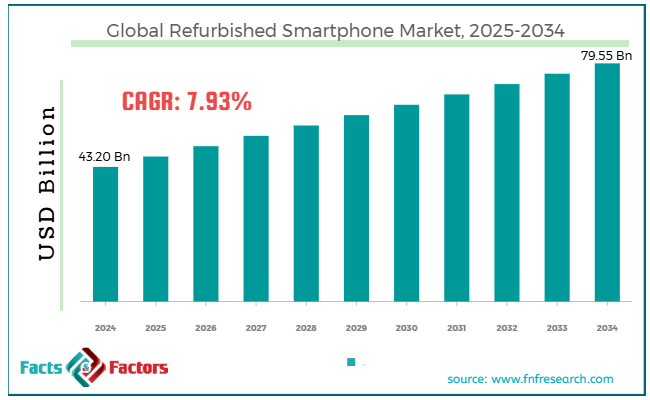

According to Facts & Factors, the global refurbished smartphone market size was worth around USD 43.20 billion in 2024 and is predicted to grow to around USD 79.55 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.93% between 2025 and 2034.

Market Overview

Market Overview

Refurbished smartphones are pre-owned devices that are returned to the seller or manufacturer, examined, repaired if required, and restored to complete working condition. These phones go through severe testing and may have faulty components replaced with new ones. The leading drivers of the global refurbished smartphone market include technological improvements in refurbishment processes, the rise of e-commerce platforms, and rising consumer education and awareness. Modernizations such as automated diagnostics and AI-powered testing systems have improved the accuracy and efficiency of refurbishment, resulting in superior quality devices and low failure rates after purchase. The rising dispersion of online marketplaces for refurbished products has increased their accessibility. Most prominent platforms offer a broader range of refurbished smartphones, with better customer support and warranties, thus boosting customer trust.

Moreover, initiatives for consumer awareness and educational campaigns have played a vital role in dispelling myths about refurbished smartphones, underscoring their affordability, environmental benefits, and quality, thereby expanding the consumer base.Nevertheless, the global market is restrained by the low availability of high-end models and short warranty periods. Customers mostly look for flagship models like the Samsung Galaxy S23 and the iPhone 14 Pro in refurbishment. However, low return rates and high demand for these models reduce their availability in the market. This limits options for customers wanting premium features at a lower price point.

Also, many refurbished devices have restricted warranty durations, usually 3 - 12 months. Hence, short warranty periods prevent buyers from taking on greater risk when buying pre-owned devices with no extended protection. Yet, the market is anticipated to grow considerably over the coming years due to several opportunities. A few include collaboration with telecom operators and developing certified refurbishment standards. Associations between telecommunications companies and refurbishers may result in numerous offers, such as discounted devices with the best service contracts, thereby increasing their attraction to a broader population.Moreover, forming standardized certification processes may improve consumer trust in renovated devices. This ensures reliability and consistent quality in the global market, thus driving their adoption rates.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global refurbished smartphone market is estimated to grow annually at a CAGR of around 7.93% over the forecast period (2025-2034)

- In terms of revenue, the global refurbished smartphone market size was valued at around USD 43.20 billion in 2024 and is projected to reach USD 79.55 billion by 2034.

- The refurbished smartphone market is projected to grow significantly owing to changing consumer behavior, improvements in refurbishment processes, and the rise of e-commerce platforms.

- Based on smartphone type, the luxury smartphone segment is expected to lead the market, while the mid-range smartphone segment is expected to grow considerably.

- Based on condition, the like-new segment is the dominating segment among others, while the good segment is projected to witness sizeable revenue over the forecast period.

- Based on operating system, the iOS segment is the leading segment, while the Android segment is projected to witness sizeable revenue over the forecast period.

- Based on sales channel, the manufacturer refurbished programs segment is expected to lead the market as compared to the online retail segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- How will affordability, amid rising smartphone prices, spur growth in the refurbished smartphone market?

Rising prices of new smartphones have led people to seek money-saving alternatives. Refurbished smartphones offer significant savings, thus making them the best option.

The average selling price of mobiles in India surged by 14% to Rs. 17000/- in 2021, triggering consumers to shift to refurbished choices.

Purchasing a refurbished model may help users save up to 60% compared to new devices.

The latest United States tariffs on China-based mobile parts increased the costs of new smartphones. This increased the appeal of refurbished smartphones, as they do not belong to the tariff category.

- Rising consumer demand for premium features at low prices propels the market growth

Consumers are actively seeking high-end smartphone features without the premium price tag, and there is growing interest in refurbished models, particularly among Gen Z consumers. Young consumers are choosing refurbished electronics, especially iPhone smartphones, valuing money savings on the advanced features, with a few saving more than USD 650 by opting for second-hand models. Refurbished models like the iPhone 13 Pro are accessible at significantly reduced costs. This makes premium features accessible to a larger audience.

Research reports show a 5% rise in the refurbished smartphone market, with Apple ranking high in the resale industry. This indicates a robust consumer interest in premium refurbished electronics.

Restraints

Restraints

- Supply chain concerns negatively impact the progress of the refurbished smartphone market

Sourcing superior-quality components for refurbishing is a costly and complex process, which impacts the affordability and availability of quality refurbished mobiles. The supply of cutting-edge components, mainly for outmoded models, is restricted. This scarcity is intricate for refurbishers to obtain the necessary parts, thus impacting the final product's quality.

Importing parts increases operational costs for refurbishers, which may negatively impact the prices of refurbished mobile models and their competitiveness in the industry.

Opportunities

Opportunities

- Do environmental sustainability initiatives contribute to the progress of the refurbished smartphone market?

The rising focus on decreasing electronic wastage is boosting companies and consumers to adopt more refurbished smartphones as environmentally friendly substitutes. Refurbishing notably expands the lifespan of smartphones, thus reducing the need for new resources and lessening the ecological impact. Prominent firms like Back Market promote the 'right to repair' movement. It supports sustainable technology consumption.

Moreover, studies denote that many consumers praise the sustainability of refurbished smartphones. For example, a survey showed that 51% of customers value the ecological benefits of buying refurbished electronics, underscoring a rising ecological awareness among buyers.

Challenges

Challenges

- Will negative perceptions regarding quality restrict the growth of the refurbished smartphone market?

Several consumers associate refurbished smartphones with low quality, leading to hesitation when buying them and other electronics. A recent survey found that nearly 55% of individuals were concerned about battery issues, and 48% abstained due to limited warranty coverage.

In India, the unorganized sector led the refurbished smartphone industry, registering for over 77% of total sales. This division leads to consumer distrust and poor quality.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 43.20 Billion |

Projected Market Size in 2034 |

USD 79.55 Billion |

CAGR Growth Rate |

7.93% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Back Market, Gazelle, Rebuy, ecoATM, Decluttr, Amazon Renewed, eBay Refurbished, Apple Certified Refurbished, Samsung Certified Pre-Owned, Best Buy Renewed, RefurbMe, The RealReal, Phone Daddy, MusicMagpie, Walmart Refurbished, and others. |

Key Segment |

By Smartphone Type, By Condition, By Operating System, By Sales Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global refurbished smartphone market is segmented based on smartphone type, condition, operating system, sales channel, and region

- Why is the luxury smartphone segment expected to lead the refurbished smartphone market?

Based on smartphone type, the global refurbished smartphone industry is divided into luxury smartphones, mid-range smartphones, and budget smartphones. The luxury smartphone segment has gained huge popularity and growth in the past few years and has been impacted by elevated consumer demand and brand loyalty for high-end devices at lower prices. The segmental growth is further spurred by surging demand for premium features and long-lifespan. Several consumers are favoring renovated luxury smartphones, especially iPhones, for better features like powerful processors, lasting software updates, and high-resolution cameras.

In addition, Apple's official certified renovation program offers thorough testing and warranties. This majorly boosts consumer confidence in buying high-end smartphones like iPhones. Also, Apple devices are known to have long lifespans because of continuous software support and high build quality. This increases their appeal in the global market, as people view Apple products as lasting devices rather than budget devices.

- What factors will help the iOS segment continue its dominance in the refurbished smartphone market?

Based on operating system, the global refurbished smartphone industry is segmented into Android, iOS, Windows, and others. In 2024, the iOS segment led the global market and is expected to continue its dominance in the future. In the past years, iOS devices were the most resold and refurbished smartphones across the globe. This is backed by Apple’s brand loyalty and high resale value. Consumers prefer renovated smartphones for their long-term support, superior build quality, and reliability guaranteed by certified refurbishment programs, thereby increasing their market share globally.

- Why will manufacturer's refurbished segment hold a significant share in the refurbished smartphone market?

Based on sales channel, the global market is segmented as online retail, offline retail, and manufacturer refurbished. The manufacturer refurbished segment held a notable market share in previous years and is expected to continue growing in the future as well. These programs are usually operated by OEMs like Samsung, Apple, and other companies that have renovated electronics that have been returned, mended, and certified by the companies themselves.

A couple of years ago, Apple held 49% of the global market, boosting the major role of manufacturer-led refurbished programs in surging sales.

Regional Analysis

Regional Analysis

- What factors will help North America to witness significant growth in the refurbished smartphone market over the forecast period?

North America has held a leading share of the global refurbished smartphone market in the past few years and is expected to progress further owing to consumer behavior and technological infrastructure. North America brags about its advanced technological system, with broader access to advanced online platforms and high-speed internet. This streamlines the purchase of renovated smartphones via online sales channels. The growing consumer trust in quality assurance, ecological sustainability, and awareness propels the region's growth. The presence of trustworthy programs and strict quality rules has improved consumer confidence and trust in refurbished smartphones. Most manufacturers and retailers offer return policies and warranties, boosting consumer confidence in refurbished devices.

For instance, companies like Gazelle and ecoATM promote the resale and recycling of old phones, thus increasing sustainability awareness in the tech sector. Furthermore, rising ecological consciousness has led consumers to seek sustainable options, such as refurbished smartphones, to reduce electronic waste. This trend complies with the worldwide sustainability objectives and is supported by organizations as well. It encourages electronic retailers and manufacturers to associate with certified refurbishers.

- Which is the second fastest-growing region in the refurbished smartphone industry?

Europe is projected to advance as the second-largest region in the refurbished smartphone market, driven by rising consumer demand, expanding distribution channels, and the expansion of e-commerce and technological infrastructure. The European market for second-hand mobiles reached approximately 309 million units, with estimates indicating growth of over 430 million units in the coming 5 years. Remarkably, more than 52% of individuals expressed a desire to buy renovated smartphones in the coming period.

The growing ecological concerns and affordability fuel this. The regional market is classified by a broad range of distribution channels, comprising traditional retail, online marketplaces, and manufacturer refurbishment programs. E-commerce platforms have gained massive popularity in recent years due to their vast offerings, while manufacturers' programs assure reliability and quality, thus boosting user trust. Furthermore, Europe's high internet penetration and advanced technological infrastructure have bolstered the rise of online platforms focused on refurbished devices.

Competitive Analysis

Competitive Analysis

The global refurbished smartphone market is led by players like:

- Back Market

- Gazelle

- Rebuy

- ecoATM

- Decluttr

- Amazon Renewed

- eBay Refurbished

- Apple Certified Refurbished

- Samsung Certified Pre-Owned

- Best Buy Renewed

- RefurbMe

- The RealReal

- Phone Daddy

- MusicMagpie

- Walmart Refurbished

What are the key trends in the global Refurbished Smartphone Market?

What are the key trends in the global Refurbished Smartphone Market?

- Sustainability and eco-conscious purchase:

Consumers actively seek refurbished smartphones rather than buying expensive new ones to support sustainability and reduce electronic waste. This is fueled by the growing number of regulations promoting economic practices and rising consumer environmental awareness.

- Manufacturer certification programs:

Leading brands like Samsung, Apple, and others are extending their certified refurbishment programs, offering warranties, quality assurance, and certified products. It increases consumer trust and confidence in buying refurbished devices.

The global refurbished smartphone market is segmented as follows:

By Smartphone Type

By Smartphone Type

- Luxury Smartphones

- Mid-Range Smartphones

- Budget Smartphones

By Condition

By Condition

- Like New

- Good

- Fair

By Operating System

By Operating System

- Android

- iOS

- Windows

- Others

By Sales Channel

By Sales Channel

- Online Retail

- Offline Retail

- Manufacturer Refurbished

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Back Market

- Gazelle

- Rebuy

- ecoATM

- Decluttr

- Amazon Renewed

- eBay Refurbished

- Apple Certified Refurbished

- Samsung Certified Pre-Owned

- Best Buy Renewed

- RefurbMe

- The RealReal

- Phone Daddy

- MusicMagpie

- Walmart Refurbished

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors