Search Market Research Report

Polyglycerol Polyricinoleate Market Size, Share Global Analysis Report, 2022 – 2028

Polyglycerol Polyricinoleate Market Size, Share, Growth Analysis Report By Channel (Online and Offline), By Application (Oils & Fats and Personal Care Items), By Organization Size (Small & Medium-Sized Enterprises and Large Enterprises), and By Type (Confectionery and Bakery), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

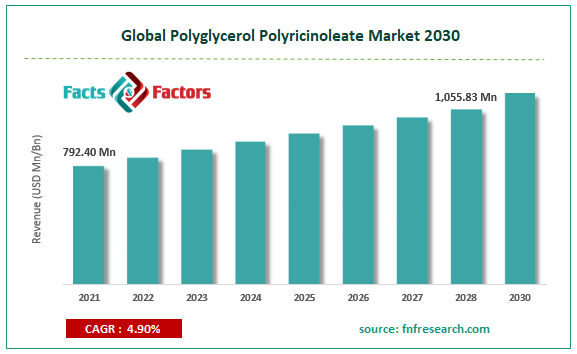

[225+ Pages Report] According to Facts and Factors, the global polyglycerol polyricinoleate market size was worth USD 792.40 million in 2021 and is estimated to grow to USD 1,055.83 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.90% over the forecast period. The report analyzes the polyglycerol polyricinoleate market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the polyglycerol polyricinoleate market.

Market Overview

Market Overview

Polyglycerol is a transparent, viscous and non-volatile liquid obtained by dehydration of glycerol with an epoxy intermediate using an alkaline catalyst. Fatty acid esters, safe, biodegradable, non-ionic surfactants, are used as antistatic and antifogging agents in food packaging in the Food and Beverage industry. Mold inhibitors and emulsifiers are also used to prepare low-fat baked goods, chewing gum and cakes. Polyglycerol is also used in the pharmaceutical and cosmetic fields due to its amphiphilic properties. Furthermore, cost-effective procedures and high utilization of polyglycerol polyricinoleate in the pharmaceutical industry are expected to drive market growth during the forecast period. However, fluctuation in raw material prices and negative effects on health may hamper the market expansion in the coming years.

COVID-19 Impact:

COVID-19 Impact:

The recent coronavirus outbreak has moderately affected the polyglycerol market. At the beginning of the COVID phase, the market saw the closure of various industries, the cessation of various manufacturing activities, and supply chain disruptions. Much of the industry depends on China for raw materials. As a result, supply chain disruptions have had a significant impact on industrial production. The pandemic has had a negative impact on sales of molded elastomer manufacturers in the first and second quarters of 2021.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global polyglycerol polyricinoleate market value is expected to grow at a CAGR of 4.90% over the forecast period.

- In terms of revenue, the global polyglycerol polyricinoleate market size was valued at around USD 792.40 million in 2021 and is projected to reach USD 1,055.83 million by 2028.

- The cost-effective procedures and high utilization of polyglycerol polyricinoleate in the pharmaceutical industry are expected to drive market growth during the forecast period.

- By application, the personal care category dominated the market in 2021.

- By channel, the offline category dominated the market in 2021.

- Asia-Pacific dominated the global polyglycerol polyricinoleate market in 2021.

Growth Drivers

Growth Drivers

- The cost-effective procedure is expected to drive market growth

The key element in synthesizing polyglycerol is glycerol, which is usually made from biodiesel and oleochemicals, both inexpensive and readily available. As a result, polyglycerol production is often considered a cost-effective process since the price of polyglycerol is directly proportional to the raw material price. The esterification of fatty acids, either highly saturated or monounsaturated depending on the number of hydroxyl groups present, is involved in the generation of polyglycerol from glycerol. Moreover, increased cosmetics and the personal care industry are also driving market growth during the forecast period.

Restraints

Restraints

- Fluctuation in raw material prices is expected to hinder the market growth

The raw materials used in polyglycerol are very sensitive to price fluctuations. Therefore, fluctuations in the price of raw materials for the production of polyglycerol are expected to limit the market growth during the forecast period. Furthermore, the side effects of polyglycerol polyricinoleate on an individual’s health may also hamper the market growth during the forecast period.

Opportunity

Opportunity

- Rising focus on research and development activities to present market opportunities

The rising focus on research and development activities for producing non-GMO crops is expected to provide huge growth opportunities for the players in the polyglycerol polyricinoleate market. In addition, strict local government regulations regarding food quality and excessive use of chemicals are also expected to create various market opportunities during the forecast period.

Segmentation Analysis

Segmentation Analysis

The global polyglycerol polyricinoleate market has been segmented into channel, application, organization size, and type.

Based on channel, the online and offline segments of the global polyglycerol polyricinoleate market. The offline segment dominated the market in 2021 due to the limited availability of polyglycerol polyricinoleate on online channels. As a result, the market consumers need to purchase this in the offline channel, which supports the offline segment growth.

Based on application, the market is classified into oils & fats and personal care items. In 2021, personal care items dominated the global market. The use of polyglycerol as a humectant and thickener in the personal care industry also benefits from a growing preference for organic products. Sales of personal care products are also driven by the growing influence of social media and growing interest in health and cleanliness worldwide. Thus, such factors are expected to drive the personal care item’s growth during the forecast period.

Based on organization size, the global polyglycerol polyricinoleate market is segmented into small & medium-sized enterprises and large enterprises. The large enterprise segment dominates the market due to its benefits to the food and beverage and pharmaceutical industry as manufacturers use polyglycerol polyricinoleate in high quantities to improve the quality of the products. Therefore, these factors are expected to drive the large enterprise segment during the forecast period.

Recent Developments

Recent Developments

- May 2021: Palsgaard has launched a PGPR product that offers chocolate makers the ultimate functionality and efficiency. PGPR (polyglycerol polyricinoleate) is used in chocolate production for mold optimization, flow control and viscosity reduction.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 792.40 Million |

Projected Market Size in 2028 |

USD 1,055.83 Million |

CAGR Growth Rate |

4.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Croda International Plc, Estelle Chemicals Pvt Ltd, Fine Organics, Hefei TNJ Chemical Industry Co Ltd, DPO International, Savannah Surfactants, Palsgaard, Oleon NV, Ervesa, and Others |

Key Segment |

By Channel, Application, Organization Size, Type and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia-Pacific dominates the polyglycerol polyricinoleate market in 2021-2028

The Asia-Pacific region is expected to be the dominant market for polyglycerol consumption. Indeed, the region dominates the market for end-consumer industries such as food and beverage and cosmetics. The Asian food and beverage market is expected to grow at a significant CAGR during the forecast period, mainly driven by increasing population and purchasing power. This will create demand for polyglycerol derivatives used as additives and emulsifiers in the food and beverage industry. In addition, emulsifiers derived from polyglycerol are also used as raw materials in cosmetic products. Furthermore, Japan, Singapore, South Korea, Hong Kong and China are among the top 10 cosmetic exporters in the world. Some major polyglycerol producers operating in the Asia-Pacific region are Mitsubishi Chemical Holdings Corporation and Estelle Chemicals Pvt. Ltd.

Competitive Landscape

Competitive Landscape

Key players within the global Polyglycerol Polyricinoleate market include

- Croda International Plc

- Estelle Chemicals Pvt Ltd

- Fine Organics

- Hefei TNJ Chemical Industry Co Ltd

- DPO International

- Savannah Surfactants

- Palsgaard

- Oleon NV

- Ervesa

Global Polyglycerol Polyricinoleate Market is segmented as follows:

By Channel Segment Analysis

By Channel Segment Analysis

- Online

- Offline

By Application Segment Analysis

By Application Segment Analysis

- Oils & Fats

- Personal Care Items

By Organization Size Segment Analysis

By Organization Size Segment Analysis

- Small & Medium-Sized Enterprises

- Large Enterprises

By Type Segment Analysis

By Type Segment Analysis

- Confectionery

- Bakery

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Croda International Plc

- Estelle Chemicals Pvt Ltd

- Fine Organics

- Hefei TNJ Chemical Industry Co Ltd

- DPO International

- Savannah Surfactants

- Palsgaard

- Oleon NV

- Ervesa

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors