Search Market Research Report

Polyacrylamide Market Size, Share Global Analysis Report, 2022 – 2028

Polyacrylamide Market Size, Share, Growth Analysis Report By Product (Anionic, Cationic, Non-ionic), By Application (Water Treatment, Oil & Gas, Paper Making), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

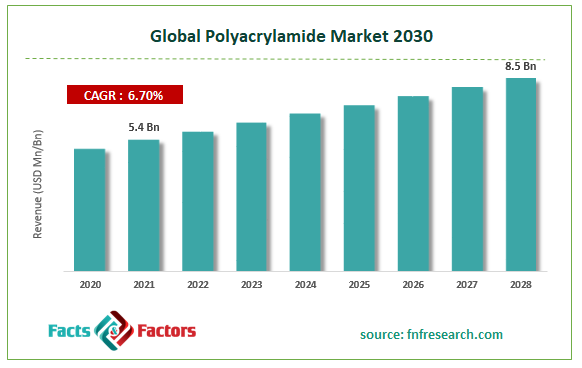

[238+ Pages Report] According to the report published by Facts Factors, the global Polyacrylamide market size was worth around USD 5.4 billion in 2021 and is predicted to grow over USD 8.5 billion by 2028 with a compound annual growth rate (CAGR) of roughly 6.7% between 2022 and 2028. The report analyzes the global Polyacrylamide market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Polyacrylamide market.

Market Overview

Market Overview

Polyacrylamide is a polymer with many potential uses in industry and research. Its popularity is growing, as users uncover new benefits to this versatile material. For instance, the market has been witnessing its growing use as an adhesive for medical SCS devices. Polyacrylamide adhesive has the ability to adhere strongly to many types of surfaces, making it ideal for use with SCS devices that need to stay on the body. This adhesive also offers resistance to chemical and thermal degradation, which makes it a desirable option for medical devices that need to be durable and compliant with safety standards. In addition to medical devices, polyacrylamide can also be used in packaging and manufacturing. Its stretchy properties make it a useful material for creating flexible packaging, and its toughness makes it an ideal choice for materials that need to withstand high-stress levels.

It has many applications in industrial and consumer products, including food packaging, water filters, pharmaceuticals, and insulation. PA is also used in the production of fiberglass and carbon fiber composites. Some key reasons for this growth include increasing demand from the automotive industry for lightweight, strong vehicles; increased use of PA in solar panels and wind turbines; and increasing sales of electronic devices that require low-wattage or no-wattage power sources.

As per our findings, polyacrylamide is being heavily used as an insulation material. This type of insulation typically uses polyacrylamide in combination with other materials, such as fiberglass or cellulose acetate, to create a thermal insulator. This enables buildings to have reduced energy costs while still maintaining adequate levels of comfort. In addition, because insulation using Polyacrylamide can last for decades, it can play an important role in reducing greenhouse gas emissions.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global polyacrylamide market is estimated to grow annually at a CAGR of around 6.7% over the forecast period (2022-2028).

- In terms of revenue, the global polyacrylamide market size was valued at around USD 5.4 billion in 2021 and is projected to reach USD 8.5 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type segmentation, anionic segment held maximum market share in the year 2021.

- Based on application segmentation, water treatment was the leading revenue-generating grade in 2021.

- Based on region, North America was the leading revenue generator in 2021.

COVID-19 Impact

COVID-19 Impact

The Covid pandemic has had a significant impact on the demand for polyacrylamide, a versatile water-repellent polymer. In the short term, the pandemic has led to a decrease in the global demand for polyacrylamide, as consumers turn to less-frequent washings, reduce industrial activities, and limited public movement, among others. Long-term, however, the pandemic could spur technological advancement in the production of polyacrylamide products. In addition, novel applications for this polymer could be developed as researchers explore ways to enhance its water-repellency and breathability.

Growth Drivers

Growth Drivers

- Growing applications in industrial and consumer sectors to drive market growth

The market for polyacrylamide is growing as industrial and consumer applications increasingly rely on the material. Its structure, properties, and chemical easiness make it a popular choice for many products. Some of the factors driving demand for polyacrylamide include the increased affordability of polyacrylamide compared to other materials with similar properties along with lower prices attributable to increased production volumes as well as technological innovation.

The global demand for polyacrylamide (PA) is growing at a fast pace due to its many benefits, including its high tensile strength, low volatility, and good thermal stability. The key factors driving this demand are the increasing need for high-quality insulation materials in various industries, and the increasing use of plastics in various applications.

Restraints

Restraints

- Impact on environment likely to limit the market expansion

One obstacle to polyacrylamide’s widespread adoption is its high impact on the environment. Environmental concerns have led to regulations that may impact the use of PAM. For example, Europe requires all food packaging to be made from compostable materials by the end of 2025. The increasing popularity of natural fabrics and materials has led to a decline in demand for PAM-coated fabrics and products.

Another reason for the decline in demand for polyacrylamide is that there are alternative materials that can be used to make similar products. For example, nylon and polypropylene can both be used to make plastic sheets and bags, whereas polyacrylamide cannot. In addition, some consumers are choosing to switch to synthetic materials because they are concerned about the environmental impact of using natural resources such as oil.

Opportunities

Opportunities

- Demand from Solar Energy & Automotive Manufacturing Industries

Growth in demand from solar energy applications: Large-scale deployment of solar energy worldwide is leading to an increased demand for PA in solar panels, which is benefiting both small and large players in the market. Also, there are multiple solar manufacturers globally.

Expansion of automotive manufacturing sectors: The growing popularity of electric vehicles is also resulting in increased demands for PA across a number of automotive manufacturing sectors such as body panels, soundproofing material, and electrical wiring harnesses.

Challenges

Challenges

- Rising pet plastic demand and mounting environmental concerns challenge market growth

Rising pet plastic demand and mounting environmental concerns are driving innovation in polyacrylamide's production, delivery, and disposable materials. The need for sustainable polyacrylamide production is also being driven by the development of environmentally friendly applications for the materials.

Segmentation Analysis

Segmentation Analysis

The global polyacrylamide market is segmented by type, application, and region.

By type, the market is categorized into anionic and cationic polyacrylamide. Wherein, anionic polyacrylamide is dominating the global market by holding over 70% market share. There is a growing demand for anionic polyacrylamide flocculant (APF) in the water treatment industry due to its low flocculation and high settling capacities. APF is a highly efficient coagulant that quickly disperses suspended particles, leading to improved water clarity. This natural flocculant can be used in industrial and municipal wastewater treatment facilities, as well as surface water bodies.

One reason why anionic polyacrylamide flocculants are gaining popularity in water treatment is that they are relatively easy to use. Unlike some other flocculants, such as alginates, which require high concentrations to achieve effective results, anionic polyacrylamide flocculants can be diluted easily. This makes them suitable for use in a wide range of applications.

Recent Development

Recent Development

- In February 2022, Kamira started the production of bio-based polyacrylamide.

- In August 2019, SNF announced to invest $1.2 billion to increase the production of polyacrylamide.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 5.4 Billion |

Projected Market Size in 2028 |

USD 8.5 Billion |

CAGR Growth Rate |

6.7% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Shandong Polymer Bio-chemicals Co. Ltd., Ashland Inc., SNF Group, BASF SE, Anhui Jucheng Fine Chemical Co. Ltd., Kemira, Black Rose Industries Ltd, and others. |

Key Segment |

By Product, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead owing to the increasing adoption of flexible electronics

The North American market accounted for 52% of global polyacrylamide consumption in 2021. This is expected to continue to grow as the US and Canada aim to increase the share of recycled materials in their total polymer consumption from 20% by 2025 to 35%. In addition, the European market is also expected to grow significantly over the next few years owing to the increased adoption of flexible electronics and emerging packaging materials applications.

Polyacrylamide is a popular polymer used in a variety of industries across the US and Canada, but its use in wastewater treatment has been increasing in recent years. Most of the states in the US make use of polyacrylamide to reduce the amount of water needed to treat wastewater, making it an attractive option for areas with limited resources and improving stream flows & reducing the amount of water needed to treat wastewater.

Competitive Analysis

Competitive Analysis

Some of the major players operating in the global polyacrylamide market are Shandong Polymer Bio-chemicals Co., Ltd., Ashland Inc., SNF Group, BASF SE, Anhui Jucheng Fine Chemical Co, Ltd., and Kemira, Black Rose Industries Ltd. These companies are focusing on R&D and product development to stay ahead of their competition. The key factors favoring the growth of the global polyacrylamide market include increased adoption of advanced polymer technologies in various industrial applications, rising demand from various end-users across geographies, and increasing investments in R&D activities by the players.

Some challenges that the global polyacrylamide market is facing include sluggish global economic conditions and increasing environmental concerns. However, these challenges are expected to be addressed by the Players through diversification into new markets, emphasis on product innovation, and expansion into new geographies.

Key players within global Polyacrylamide market include :

Key players within global Polyacrylamide market include :

- Shandong Polymer Bio-chemicals Co. Ltd.

- Ashland Inc.

- SNF Group

- BASF SE

- Anhui Jucheng Fine Chemical Co. Ltd.

- Kemira

- Black Rose Industries Ltd.

Global global Polyacrylamide market is segmented as below:

By Product

By Product

- Non-ionic (NPAM)

- Cationic (CPAM)

- Anionic (APAM)

- Others

By Application

By Application

- Water treatment

- Petroleum

- Paper-making

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Shandong Polymer Bio-chemicals Co. Ltd.

- Ashland Inc.

- SNF Group

- BASF SE

- Anhui Jucheng Fine Chemical Co. Ltd.

- Kemira

- Black Rose Industries Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors