Search Market Research Report

Pet Supplement Market Size, Share Global Analysis Report, 2024 – 2032

Pet Supplement Market Size, Share, Growth Analysis Report By Pet Type (Cats, Dogs, and Others), By Form (Powders, Chewables, Pills & Tablets, and Others), By Type (Prescription and Over-the-counter (OTC)), By Application (Prebiotics & Probiotics, Hip & Joint, Skin & Coat, Multivitamins, Calming, Digestive Health, Weight Management, Allergy Relief, and Others), By Distribution Channel (Online and Offline), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

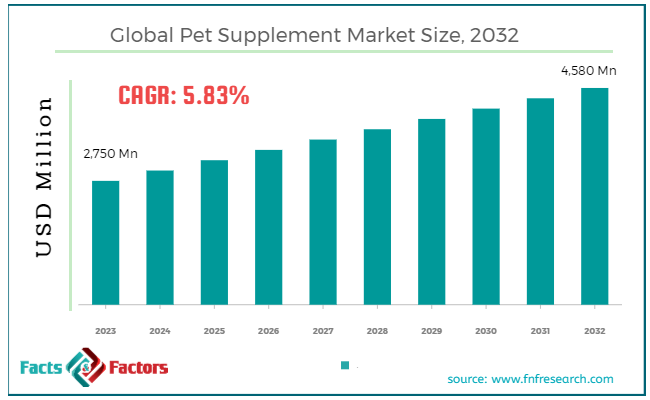

[222+ Pages Report] According to Facts & Factors, the global pet supplement market size in terms of revenue was valued at around USD 2,750 million in 2023 and is expected to reach a value of USD 4,580 million by 2032, growing at a CAGR of roughly 5.83% from 2024 to 2032. The global pet supplement market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

A pet supplement is a product designed to provide nutritional or health benefits to pets that they might not receive from their regular diet. These supplements aim to address various health issues such as joint health, digestive function, skin and coat improvement, and overall wellness. They come in various forms including tablets, chews, powders, and liquids, and are formulated specifically for different types of pets such as dogs, cats, horses, and birds.

The pet supplement market has seen significant growth, driven by the increasing awareness among pet owners of the health needs of their pets and the desire to extend their pets' longevity and quality of life. This industry includes a wide range of products targeting specific health concerns, supported by advancements in veterinary science and pet nutrition. The market is also influenced by trends in human nutrition and wellness, reflecting a broader tendency of pet owners to treat their pets as family members. As a result, the demand for high-quality and tailored pet supplements is on the rise, contributing to the expansion of this niche market within the global pet care industry.

Key Highlights

Key Highlights

- The pet supplement market has registered a CAGR of 5.83% during the forecast period.

- In terms of revenue, the global pet supplement market was estimated at roughly USD 2,750 million in 2023 and is predicted to attain a value of USD 4,580 million by 2032.

- The growth of the pet supplement market is being propelled by growing awareness of pet health, increased pet ownership and rising disposable income.

- On the basis of pet type, the dogs dominate the pet supplement market in terms of volume and variety.

- Based on the form, the chewables segment is projected to swipe the largest market share.

- By type, the over-the-counter (OTC) segment is expected to dominate the global market.

- In terms of application, the hip & joint segment is growing at a high rate and is projected to dominate the global market.

- Based on the distribution channel, the offline segment is expected to dominate the global market.

- By region, the North America traditionally dominates the global pet supplement market due to its mature market status, high consumer awareness, and willingness to spend on pet health.

Growth Drivers:

Growth Drivers:

- Pet Humanization: People are increasingly treating pets like family, leading to a willingness to spend more on their health and well-being. This fuels the demand for supplements that promote pet longevity and vitality.

- Rising disposable income: With more financial resources, pet owners are able to invest in preventative healthcare and additional wellness products like supplements.

- Increasing Awareness of Pet Health and Nutrition: As pet owners become more knowledgeable about the specific health needs of their pets, there is a growing demand for supplements that can enhance wellbeing, such as those targeting joint health, cognitive function, and overall vitality.

Restraints:

Restraints:

- Regulation and labeling: Regulations around ingredients and claims for pet supplements can vary. This can create uncertainty for both pet owners and manufacturers.

- Veterinary oversight: While some pet supplements offer well-researched benefits, veterinarian guidance is crucial to ensure they are appropriate for your pet's individual needs and don't interact negatively with any medications.

- Lack of standardization: The pet supplement market can be crowded with varying product quality. Consumers need to be discerning when choosing supplements, looking for reputable brands and clear labeling.

Opportunities:

Opportunities:

- Functional and targeted supplements: The market is moving towards supplements that address specific health concerns, like joint health for senior pets or anxiety relief for stressed animals.

- Natural and organic ingredients: Pet owners are increasingly seeking supplements made with natural and organic ingredients, perceived as safer and healthier for their pets.

- Online platforms: The rise of e-commerce provides convenient access to a wider range of pet supplements and educational resources.

Challenges:

Challenges:

- Misinformation and misleading claims: Navigating the abundance of information online and on product labels can be challenging for pet owners. Verifying claims and consulting veterinarians is crucial for responsible use.

- Product safety and quality concerns: With a growing market comes the risk of counterfeit or low-quality supplements. Careful research and brand selection are essential.

Pet Supplement Market: Segmentation Analysis

Pet Supplement Market: Segmentation Analysis

The global pet supplement market is segmented based on pet type, form, type, application, distribution channel, and region.

By Pet Type Insights

By Pet Type Insights

Based on Pet Type, the global pet supplement market is divided into cats, dogs, and others. Dog supplements dominated the pet supplement market in 2023 with 40.8% revenue share. Dog supplements are also predicted to dominate the forecast period. Dogs are often considered the primary consumers of pet supplements due to their widespread ownership and the strong emotional bond owners share with them.

Supplements for dogs commonly target joint health, digestion, immunity, and coat condition. The segment is driven by a broad range of specialized products catering to size, breed, and age-specific needs. Innovation in this sector is robust, with continuous development in ingredients and supplement delivery systems like chews, liquids, and powders. An aging dog population and increased prevalence of lifestyle diseases in dogs, such as obesity and arthritis, strongly drive demand for these products.

The market for cat supplements is significant but generally smaller than that for dogs. The cat segment is anticipated to grow at the fastest CAGR from 2024 to 2032. Cat supplements often focus on feline-specific issues such as hairball control, urinary health, and renal function. Product development for cats can be challenging due to their particular dietary requirements and palatability preferences. However, there's growing interest in natural and preventive health products among cat owners. As cats are typically less visible in their symptoms of disease or discomfort, there's an increasing market focus on educational efforts to inform owners about the benefits of supplementation for preventative health.

Others segment includes a variety of animals such as birds, horses, rabbits, and reptiles. Each category requires distinctly formulated supplements suited to their unique nutritional needs and health issues. The market is niche but growing with increased awareness of comprehensive health needs for a variety of pets. Horse supplements, for instance, are a substantial market segment, focusing on performance enhancement, joint health, and digestive stability. Diverse pet ownership and the increasing adoption of less common pets encourage the development of targeted supplements. Additionally, the competitive landscape in areas like equine sports drives innovation and growth in the supplement offerings for horses.

By Form Insights

By Form Insights

On the basis of Form, the global pet supplement market is bifurcated into powders, chewables, pills and tablets, and others. Powder supplements are popular due to their versatility and ease of incorporation into pet food. They are often used for supplements that require larger dosages, such as probiotics or joint support formulas. Powders can be more cost-effective and have a longer shelf life. They are preferred for their ease of mixing with both wet and dry pet foods, allowing for straightforward dosage adjustments. The growing market for customizable and multi-pet household solutions supports the demand for powder supplements, as they can be easily adapted to suit different diets and pet sizes.

Chewable supplements have captured a market share of around 69.8% in 2023. Chewable supplements are highly favored for their convenience and palatability. They are particularly popular for dogs and are often formulated to taste like treats, which helps in administering supplements to pets. The innovation in flavor and texture makes chewables a growing segment. They are ideal for pets that are resistant to pills or traditional medicine forms. As pet owners look for stress-free ways to ensure their pets take necessary supplements, the demand for chewables continues to rise, particularly in the form of functional treats.

Pills & tablets are a traditional form of supplementation for pets, suited for precise dosage and typically used for more concentrated or potent supplements. This segment faces challenges in palatability and administration, as some pets may refuse or struggle with swallowing pills. However, innovations such as coated tablets or those that can be mixed with food are improving compliance. Pills & tablets remain popular for their stability and precise dosing, appealing to owners who are focused on addressing specific health conditions in their pets.

Others segment includes various other forms like liquids, gels, and pastes. Liquids are particularly useful for seamless mixing with food and water, gels can be beneficial for topical applications, and pastes are often used for direct feeding or as part of a treat. These forms are adaptable and can be particularly effective for quick absorption or when dealing with animals that are very young, very old, or have dental issues. The versatility and ease of administration of these forms drive their popularity, especially in households with pets that have specific dietary restrictions or preferences.

By Type Insights

By Type Insights

Based on Type, the global pet supplement market is categorized into prescription and over-the-counter (OTC). Prescription pet supplements are predicted to achieve the fastest CAGR throughout the forecast period (2024-2032). Prescription supplements are those that require a veterinarian's authorization. These supplements are often used to treat specific health conditions or deficiencies diagnosed by a professional. Common examples include highly concentrated joint supplements, specialized probiotics, or therapeutic vitamins and minerals.

This segment is closely regulated, ensuring that products meet stringent standards for safety and efficacy. The need for veterinary consultation can increase consumer trust in these products but may also limit accessibility due to the requirement for a vet visit and potentially higher costs. The increasing prevalence of chronic conditions in pets and the expanding scope of veterinary medicine are significant drivers for the prescription supplement market. As pet owners continue to seek specialized care for their animals' health issues, the demand for these targeted treatments is expected to rise.

Over-the-Counter (OTC) pet supplements segment accounted for 85.7% of revenue share in 2023. The segment will likely stay dominant throughout the forecast period. Over-the-Counter (OTC) pet supplements can be purchased without a prescription and are typically used for general wellness rather than specific ailments. These include vitamins for coat health, general joint supplements, and nutritional additives like omega fatty acids. The OTC segment offers a wide range of products available through various channels, including pet stores, supermarkets, and online platforms.

While this accessibility drives sales, it also presents challenges in maintaining product quality and consumer education about the supplements' appropriate use. The ease of purchase and the broad promotion of these products contribute to their popularity. Increasing awareness of pet health and preventive care encourages pet owners to invest in these supplements to maintain or enhance their pets' health, propelling the growth of the OTC market.

By Application Insights

By Application Insights

Based on Application, the global pet supplement market is divided into prebiotics & probiotics, hip & joint, skin & coat, multivitamins, calming, digestive health, weight management, allergy relief, and others. Prebiotics & Probiotics supplements are designed to enhance gastrointestinal health and improve immune function. They are particularly beneficial for pets with sensitive stomachs, those undergoing antibiotic treatment, or pets in stressful situations affecting their digestive systems. Increasing awareness of the gut-health connection to overall wellbeing drives the growth of this segment. The challenge lies in formulating products that maintain viable bacteria levels through the shelf-life of the supplement.

Hip & Joint segment accounted for 22.15% of revenue share in 2023 and is expected to dominate the global market during the forecast period. Hip & Joint is targeted at older pets and breeds prone to joint issues, these supplements typically contain ingredients like glucosamine, chondroitin, and MSM to support joint health and mobility. The aging pet population is a significant driver for this category. However, the effectiveness and clinical validation of some ingredients remain challenges that the industry must address.

Skin & Coat segment is projected to swipe the largest CAGR during the forecast period between 2024 to 2032. Skin & Coat supplements are formulated to improve the skin and fur health of pets, often containing omega fatty acids, zinc, and vitamins. They are popular among owners of pets with allergies, dry skin, or dull coats. The visibility of benefits (like shinier coats) helps drive sales, but competition with dietary solutions that also promote skin and coat health can impact market growth.

Multivitamins provide a balanced spectrum of nutrients to support overall health and are used as a dietary supplement for pets of all ages and types. This segment benefits from the broad appeal to preventive health care but must navigate the challenges of differentiating products in a saturated market.

Calming supplements are aimed at reducing anxiety and stress in pets, often containing ingredients like L-theanine, chamomile, and tryptophan. The increasing recognition of behavioral health needs in pets spurs interest in this category, though proving efficacy without pharmacological effects is a primary challenge.

Digestive Health supplements focus on improving digestion and nutrient absorption, helping to alleviate common issues such as diarrhea or constipation in pets. Effective marketing and clear demonstration of benefits are crucial for growth in this segment, as digestive issues are common complaints from pet owners.

By Distribution Channel Insights

By Distribution Channel Insights

On the basis of Distribution Channel, the global pet supplement market is bifurcated into online and offline. The offline distribution channel dominated the pet supplements market and captured a market share of around 78.2% in 2023. The online distribution channel includes e-commerce platforms, brand-specific websites, and online pet specialty retailers. This channel has experienced rapid growth due to the convenience of browsing, purchasing, and receiving products directly at home. The key drivers for this segment are the increasing comfort of consumers with online shopping and the expanding availability of a wide range of products. Detailed product information and customer reviews online also aid in the decision-making process for buyers.

Additionally, the rise of subscription services for regular deliveries of supplements has enhanced customer retention for online vendors. The convenience of online shopping, coupled with the impact of the COVID-19 pandemic, which accelerated the shift towards digital purchases, continues to propel this segment forward. Online platforms can quickly adapt to trends and consumer demands, offering a broad selection of brands and products.

On other hand, Offline channels include pet stores, veterinary clinics, and supermarkets. This segment is expanding at a CAGR of 9.1% from 2024 to 2032. These traditional retail outlets offer the advantage of immediate product availability and the opportunity for consumers to receive in-person advice and support.

While facing competition from the online segment, offline stores maintain relevance through personalized customer service, the ability to offer immediate solutions, and the benefit of physical examination of products before purchase. Veterinary clinics, in particular, play a crucial role in the distribution of prescription supplements, where professional advice directs consumer choices. The trust and credibility associated with buying directly from veterinarians or knowledgeable sales staff in pet stores continue to support the offline market. Additionally, the tactile shopping experience where pet owners can directly assess product quality and suitability remains a significant draw.

Recent Developments:

Recent Developments:

- Mars Petcare Enters the Supplement Arena (March 2023): Recognizing the growing trend of pet health supplements, Mars Petcare is venturing into this category with Pedigree Multivitamins. This product line offers three types of soft chews designed to address key pet needs – supporting immunity, promoting healthy digestion, and providing joint care. The soft chew format caters to convenient and mess-free administration for pet owners.

- Virbac Launches Targeted Cat Food for Urinary Tract Health (March 2022): Understanding the specific health concerns faced by felines, Virbac introduced two new wet food options under their Veterinary HPM line. These diets are specially formulated to help prevent and manage Feline Lower Urinary Tract Disease (FLUTD), a common health issue in cats.

- Virbac Debuts Pet Nutrition Line (February 2022): Expanding their offerings beyond veterinary products, Virbac launched their inaugural pet nutrition line under the Veterinary HPM Pet Nutrition banner. This comprehensive range caters to both cats and dogs, with a focus on the needs of spayed and neutered pets. The product line consists of six distinct formulas across two cat food and four dog food options, allowing pet owners to choose the ideal diet based on their pet's age and size.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 2,750 Million |

Projected Market Size in 2032 |

USD 4,580 Million |

CAGR Growth Rate |

5.83% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Ainsworth Pet Nutrition, Ark Naturals, Big Heart Pet Brands, Blue Buffalo, Champion Petfoods, Diamond Pet Foods, FoodScience Corporation, Hill's Pet Nutrition, Mars Petcare, Merrick Pet Care, Nestlé Purina Petcare, NOW Foods, Nutramax Laboratories Inc., Pet Honesty, Virbac, Wellness Pet Food, Zesty Paws, Zoetis Inc., and Others. |

Key Segment |

By Pet Type, By Form, By Type, By Application, By Distribution Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Pet Supplement Market: Regional Analysis

Pet Supplement Market: Regional Analysis

- North America dominated the global market and captured a market share of around 47.6% in 2023

North America, particularly the United States, is a leader in the pet supplement market due to high rates of pet ownership and considerable spending on pet health. The market is supported by advanced veterinary care and a widespread cultural acceptance of pets as family members, which drives demand for health-enhancing products. The region benefits from robust regulatory frameworks that ensure product quality and safety, encouraging consumer trust. However, the market also faces challenges such as high competition and market saturation with numerous products. The U.S. pet supplements market is likely to reach at a CAGR of 5.7% from 2024 to 2032.

Europe follows closely with similar trends to North America. Countries like Germany, the UK, and France show strong market growth driven by high pet care standards and increasing demand for premium pet products. Europe has a mature pet supplement market with a strong emphasis on product safety and efficacy, driven by stringent EU regulations. High awareness about pet health and preventative care among pet owners fuels the demand for supplements. The market is experiencing growth due to increasing demand for organic and natural supplements, although it also deals with challenges such as diverse regulatory environments across countries that can complicate distribution.

Asia-Pacific region is experiencing the fastest growth in the pet supplement market, spurred by increasing pet ownership in emerging economies like China, Japan and India, along with rising disposable incomes and urbanization. The market's expansion is facilitated by a growing middle class interested in pet wellbeing.

However, the lack of stringent regulations in some countries poses risks related to product quality and safety. Asia-Pacific is projected to have the highest CAGR, reflecting the region's economic growth and changing cultural attitudes towards pet care.

The pet supplement market in Latin America is growing, with Brazil and Mexico leading due to their large pet populations. Increased urbanization and rising incomes contribute to greater expenditure on pet care. Growth is supported by an increasing awareness of pet health needs, though economic instability in some countries can affect consumer spending power and market stability.

Middle East and Africa region’s market here is emerging, with an increasing number of people adopting pets and becoming aware of the benefits of pet supplements. The growth is primarily seen in affluent parts of the Middle East and South Africa. The market potential is significant due to a young, growing population with disposable income. Challenges include cultural perceptions about pet ownership and a nascent distribution network for pet health products.

Pet Supplement Market: List of Key Players

Pet Supplement Market: List of Key Players

Some of the main competitors dominating the global pet supplement market include;

- Ainsworth Pet Nutrition

- Ark Naturals

- Big Heart Pet Brands

- Blue Buffalo

- Champion Petfoods

- Diamond Pet Foods

- FoodScience Corporation

- Hill's Pet Nutrition

- Mars Petcare

- Merrick Pet Care

- Nestlé Purina Petcare

- NOW Foods

- Nutramax Laboratories, Inc.

- Pet Honesty

- Virbac

- Wellness Pet Food

- Zesty Paws

- Zoetis, Inc.

The global pet supplement market is segmented as follows:

By Pet Type Segment Analysis

By Pet Type Segment Analysis

- Cats

- Dogs

- Others (birds, horses, rabbits, etc.)

By Form Segment Analysis

By Form Segment Analysis

- Powders

- Chewables

- Pills & Tablets

- Others

By Type Segment Analysis

By Type Segment Analysis

- Prescription

- Over-the-counter (OTC)

By Application Segment Analysis

By Application Segment Analysis

- Prebiotics & Probiotics

- Hip & Joint

- Skin & Coat

- Multivitamins

- Calming

- Digestive Health

- Weight Management

- Allergy Relief

- Others

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Online

- Offline

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Ainsworth Pet Nutrition

- Ark Naturals

- Big Heart Pet Brands

- Blue Buffalo

- Champion Petfoods

- Diamond Pet Foods

- FoodScience Corporation

- Hill's Pet Nutrition

- Mars Petcare

- Merrick Pet Care

- Nestlé Purina Petcare

- NOW Foods

- Nutramax Laboratories, Inc.

- Pet Honesty

- Virbac

- Wellness Pet Food

- Zesty Paws

- Zoetis, Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors