Search Market Research Report

Oral Anticoagulants Market Size, Share Global Analysis Report, 2022 – 2028

Oral Anticoagulants Market Size, Share, Growth Analysis Report By Product (Warfarin and Novel Oral Anticoagulant), By Disease Indication (Atrial Fibrillation (AF)/ Stroke Prevention and Deep Vein Thrombosis/ Pulmonary Embolism), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

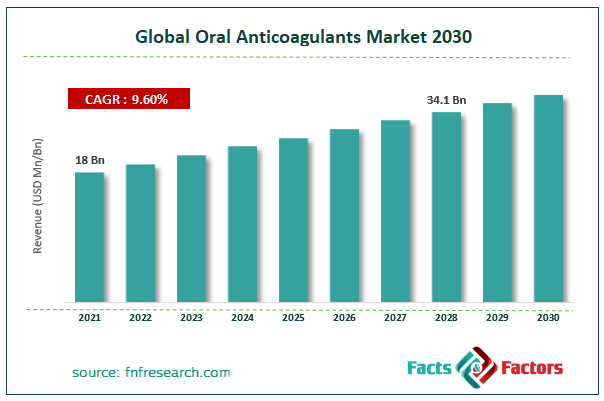

[236+ Pages Report] According to the report published by Facts Factors, the global oral anticoagulants market size was worth around USD 18 billion in 2021 and is predicted to grow to around USD 34.1 billion by 2028 with a compound annual growth rate (CAGR) of roughly 9.6% between 2022 and 2028. The report analyzes the global Oral Anticoagulants market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Oral Anticoagulants market.

Market Overview

Market Overview

The preferred method of drug delivery in the pharmaceutical industry is oral administration. Oral anticoagulants, often known as blood thinners, are medications that function in conjunction with the body's natural blood-thickening system to prevent and cure unusual blood clots. Patients who have blood clots in the legs (also known as deep vein thrombosis or DVT) or in the lungs (also known as pulmonary embolism or PE), different types of blood clusters in the veins, an irregular heartbeat known as atrial fibrillation that increases the risk of stroke, and mechanical heart valves are all treated with oral anticoagulants. Oral anticoagulants have increased their market share significantly in recent years due to pharmaceutical scientists' improved and full understanding of the biochemical and physicochemical properties and improved patient compliance. Oral anticoagulants have become a popular substitute for traditional pills and capsules. Three novel oral anticoagulant medications have received FDA approval in recent years: Pradaxa (dabigatran), Xarelto (rivaroxaban), and Eliquis (apixaban). All three are "blood thinners," like warfarin, that lower the risk of stroke associated with atrial fibrillation but also induce bleeding.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global oral anticoagulants market is estimated to grow annually at a CAGR of around 9.6% over the forecast period (2022-2028).

- In terms of revenue, the global oral anticoagulants market size was valued at around USD 18 billion in 2021 and is projected to reach USD 34.1 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on the product, the warfarin segment held the largest market share in 2021.

- Based on end users, the hospital pharmacies segment accounted for the major market share in 2021 and is expected to show its dominance during the forecast period.

- Based on region, North America is projected to dominate the market during the forecast period.

Covid-19 Impact

Covid-19 Impact

Due to the rapid pace of research, COVID-19 infection is anticipated to have a significant influence on the anticoagulant industry. According to a study published in the American Journal of Cardiovascular Drugs in 2020, there are currently more than ten clinical trials evaluating the potential of anticoagulants in COVID-19 patients. Additionally, research is being done on parenteral administration techniques for these medications for use in critically ill COVID-19 patients. As a result, the COVID-19 pandemic is anticipated to have an impact on the market in question both directly and indirectly. Furthermore, patients with COVID-19, both confirmed and suspected, should have access to follow-up care with low-dose anticoagulants, according to the World Health Organization Update from January 2021. Thus, the COVID-19 pandemic positively influenced the market growth of oral anticoagulants.

Growth Drivers

Growth Drivers

- The increasing geriatric population coupled with the growing prevalence of chronic disease drives the market

The increasing geriatric population coupled with the growing prevalence of chronic disease is expected to propel the global oral anticoagulants market growth during the forecast period. The market for oral anticoagulants has seen widespread drug use, particularly among elderly patients at risk for heart attacks. With increasing age, atrial fibrillation (AF) becomes a more common cause of avoidable, incapacitating stroke. Worldwide public health concerns with AF-related stroke are developing as people live longer. The majority of AF patients are elderly (average age, 75), and getting older is a reliable, independent risk factor for an AF-related stroke. Anticoagulation with warfarin is quite efficient at preventing strokes in AF patients, but it is rarely used, especially in the elderly. Oral anticoagulants increase the risk of hemorrhage in senior people, however for the majority of these patients, the benefit of ischemic stroke reduction outweighs the risk of hemorrhage.

Restraints

Restraints

- The possible side effect associated with oral anticoagulants hamper the market growth

The development of the global oral anticoagulants market during the forecast period may be hampered by potential negative effects from anticoagulants or blood thinners. Excessive bleeding is the main negative side effect of taking these medications. A common example is an anticoagulant warfarin, which also carries an increased risk of other side effects such as skin necrosis, blue or purple toes, congenital impairments, and miscarriages. Anticoagulants are typically not recommended for persons with AFib, high blood pressure, or other conditions to prevent problems.

Opportunities

Opportunities

- Technological advancements in the development of oral anticoagulant products and approvals provide a lucrative opportunity for market expansion

The technological advancements in the development of oral anticoagulant products and approvals are also considerable factors that propel the market growth during the forecast period. For Instance, in June 2021, the United States Food and Drug Administration approved Boehringer Ingelheim's dabigatran etexilate (Pradaxa) anticoagulant oral pellets as the first oral anticoagulant to treat children aged 3 months to less than 12 years old with venous thromboembolism after they have received at least five days of treatment with a blood thinner given by injection.

Segmentation Analysis

Segmentation Analysis

The global oral anticoagulants market is segmented based on product, disease indication, distribution channel, and region.

Based on the product, the global market is bifurcated into warfarin and novel oral anticoagulant. The warfarin segment held the largest market share in 2021 and is expected to show its dominance during the forecast period. Warfarin is an oral anticoagulant that is commonly used to treat and prevent blood clots. Warfarin has multiple FDA-approved and off-label clinical uses such as Prophylaxis and treatment of venous thrombosis and arising pulmonary embolisms, Prophylaxis and treatment of thromboembolic complications from atrial fibrillation or cardiac valve replacement, reduction in the risk of death, recurrent myocardial infarction, thromboembolic events (e.g., stroke, systemic embolization) after myocardial infarction, and secondary prevention of recurrent stroke and transient ischemic attacks. On the other hand, novel oral anticoagulants are expected to grow at the highest CAGR during the forecast period. The novel oral anticoagulants include dabigatran etexilate, rivaroxaban, edoxaban and apixaban. These anticoagulants have major pharmacologic preferences over vitamin K antagonists, including counterbalance of functional activity, and unsurprising pharmacokinetics, disposing of the prerequisite for general coagulation observing. Thus, driving the segment growth.

Based on distribution channels, the global market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment accounted for the largest market share in 2021 and is expected to dominate over the forecast period. Hospital pharmacies offer several advantages, including better access to medications. A significant share of CVD patients visits hospital outpatient departments (OPDs) to receive treatment and medication prescriptions since these departments have more sophisticated infrastructure and medical staff. Anticoagulant sales across in-house pharmacies will increase at a large rate as more patients choose to receive their treatments at hospitals to receive high-quality care.

Recent Developments:

Recent Developments:

- In December 2021, The Janssen Pharmaceutical Companies of Johnson & Johnson announced that the U.S. Food and Drug Administration (FDA) has approved XARELTO® (rivaroxaban) for two pediatric indications: the treatment of venous thromboembolism (VTE, or blood clots), and reduction in the risk of recurrent VTE in patients from birth to less than 18 years after at least five days of initial parenteral (injected or intravenous) anticoagulant treatment and thromboprophylaxis (prevention of blood clots and blood-clot related events) in children aged two years and older with congenital heart disease who have undergone the Fontan procedure. XARELTO® is the only direct oral anticoagulant (DOAC) FDA-approved for primary prevention of clots in pediatric patients following the Fontan procedure and the only DOAC in the U.S. to offer an oral suspension formulation for flexible, body weight-adjusted dosing options for pediatric patients.

- In February 2019, Novartis AG and Blackstone’s life science launched Anthos Therapeutics for the development of cardiovascular drugs and anticoagulants, in its pipeline.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 18 Billion |

Projected Market Size in 2028 |

USD 34.1 Billion |

CAGR Growth Rate |

9.6% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Johnson & Johnson, Bayer AG, Boehringer Ingelheim GmbH, Bristol-Myers Squibb Company, Daiichi Sankyo Company, Abbott Laboratories, Aspen Holdings, Sanofi, Pfizer Inc, Alexion Pharmaceuticals Inc., Leo Pharma AS, Dr. Reddy’s Laboratories, and others. |

Key Segment |

By Product, Disease Indication, Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America is expected to dominate the market during the forecast period

North America is expected to dominate the global oral anticoagulants market during the forecast period. Due to the strong demand for cutting-edge products and the rising prevalence of cardiovascular diseases, North America is predicted to hold a significant market share in the global market for oral anticoagulants. For instance, in 2021, the American Heart Association estimates that around 2,300 Americans would die daily from cardiovascular disorders, or one every 38 seconds. Moreover, according to the Center for Disease Control and Prevention in February 2022, about 659,000 Americans die of heart disease annually. This represents almost 25% of all United States deaths. Thus increase in cardiovascular diseases the demand for anticoagulants increases in the region thereby boosting the market.

Competitive Analysis

Competitive Analysis

- Johnson & Johnson

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company

- Abbott Laboratories

- Aspen Holdings

- Sanofi

- Pfizer Inc

- Alexion Pharmaceuticals Inc.

- Leo Pharma AS

- Dr. Reddy’s Laboratories

The global oral anticoagulants market is segmented as follows:

By Product

By Product

- Warfarin

- Novel Oral Anticoagulant

By Disease Indication

By Disease Indication

- Atrial Fibrillation (AF)/ Stroke Prevention

- Deep Vein Thrombosis/ Pulmonary Embolism

By Distribution Channel

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Johnson & Johnson

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company

- Abbott Laboratories

- Aspen Holdings

- Sanofi

- Pfizer Inc

- Alexion Pharmaceuticals Inc.

- Leo Pharma AS

- Dr. Reddy’s Laboratories

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors