Search Market Research Report

Mitigation Banking Market Size, Share & Trends Analysis Report Forecast 2022-2028

Mitigation Banking Market Size, Share, Growth Analysis Report By Type (Wetland or Stream Banks, Forest Conservation and Conservation Banks), By Verticals (Construction & Mining, Transportation, Energy & Utilities, Healthcare and Manufacturing), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

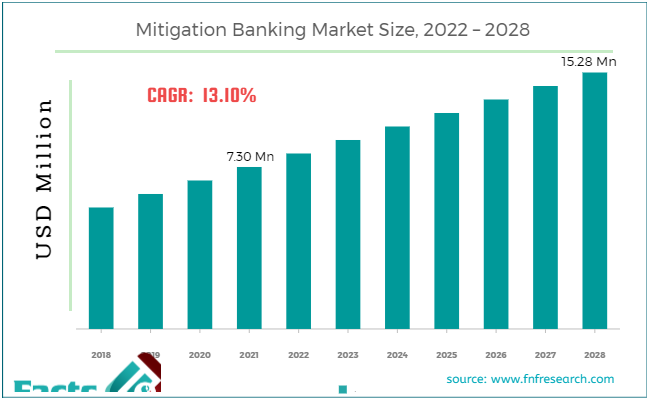

[231+ Pages Report] According to Facts and Factors, the global mitigation banking market size was worth around USD 7.30 million in 2021 and is estimated to grow to about USD 15.28 million by 2028, with a compound annual growth rate (CAGR) of approximately 13.10% over the forecast period. The report analyzes the mitigation banking market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the mitigation banking market.

Market Overview

Market Overview

The system of debits and credits known as "mitigation banking" was created to ensure that the environmental harm to streams and wetlands caused by development projects is made up for by maintaining and restoring wetlands, streams, and natural habitats. Mitigate banking aids in reducing the intensity of the environmental harm caused. The national mitigation banking association defines mitigation banking as restoring, constructing, upgrading, or maintaining the wetland and stream or any other habitat to compensate for non-preventive resource losses of development operations.

Rising government displeasure over biodiversity protection is predicted to fuel the development of the mitigation banking sector shortly. Protection from political, social, economic, and environmental harm strengthens the country's earning potential and negotiating position. In exchange, this encourages sizable foreign investment and materially aids in preserving the country's biodiversity.

COVID-19 Impact:

COVID-19 Impact:

COVID-19 hampered the growth of the mitigation banking market. The global economy suffered a decline during the COVID-19 epidemic. The consequences of the pandemic were seen during the first three months of the crisis due to strict lockdown measures and movement restrictions. Lockdowns were implemented in various places, delaying new development projects and slowing industry growth. As the government's attention turned to the healthcare sector, investments were reduced. Foreign investment also dropped during the COVID-19 pandemic.

Key Insights

Key Insights

- Per the analysis shared by our research analyst, the global mitigation banking market value will grow at a CAGR of 13.10% over the forecast period.

- The global healthcare market was valued at around USD 7.30 million in 2021 and is projected to reach USD 15.28 million by 2028.

- Rising government displeasure over biodiversity protection is predicted to fuel the development of the mitigation banking sector shortly.

- By type, the wetland or stream banks segment will dominate the market in 2021.

- By verticals, the construction &mining segment will dominate the market in 2021.

- North America dominated the global mitigation banking market in 2021.

Growth Drivers

Growth Drivers

- Need to protect biodiversity likely to pave the way for global market growth

Growing government concerns about biodiversity protection are expected to drive the growth of the mitigation banking business throughout the forecast period. Political, social, economic, and environmental safeguards improve the country's bargaining position and earning potential. This, in turn, helps to attract large amounts of foreign investment while also playing an essential part in preserving the country's biodiversity. Mitigation banking contributes to the preservation of natural diversity. It helps to mitigate the detrimental impact of increasing industrialization on wetlands, natural ecosystems, and streams.

Restraints

Restraints

- Fluctuation of inaccurate economic or monetary value may hamper the global market growth.

Giving accurate economic or monetary value for ecological damage is challenging for regulatory authorities, especially when using environmental assessment tools. Although mitigation banks must be in the same watershed as the effect to be deemed acceptable compensation, mitigation banks are frequently positioned far from the actual impact location. As a result, retaining the original value and function is complex. The effectiveness of mitigation banks is the biggest obstacle regulatory organizations encounter when effectively measuring ecological losses in commercial or monetary terms.

Segmentation Analysis

Segmentation Analysis

The global mitigation banking market is segregated based on type, verticals, and region.

By type, the market is divided into wetland or stream banks, forest conservation and conservation banks. Among these, the wetland or stream banks segment will dominate the market in 2021. The government policy supporting the establishment of other mitigation banks is credited with the rise of the wetland or stream banks segment. This will assist state regulatory authorities in ensuring the purchase of wetland credits by developers to quantify functional more properly and type values of damaged wetlands.

By vertical, the market is divided into construction & mining, transportation, energy & utilities, healthcare and manufacturing. Over the forecast period, the construction &mining segment is expected to develop at the fastest rate in 2021. The segment's growth can be attributable to the widespread usage of the mitigation banking system in the construction and mining industries. Mitigation banks offer numerous functional economic advantages in building and mining, facilitating development. They enable a developer to make the best use of a selected development site rather than dividing it into sub-optimal property uses.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 7.30 Million |

Projected Market Size in 2028 |

USD 15.28 Million |

CAGR Growth Rate |

13.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Wetland Studies and Solutions Inc., THabitat Bank LLC, Burns & McDonnell, Mitigation Credit Services LLC, EarthBalance, Ecosystem Investment Partners (EIP), The Loudermilk Companies, Weyerhaeuser, WRA Inc. LLC, theWetlandsbank Company (TWC), Alafia River Wetland Mitigation Bank Inc., Wildwood Environmental Credit Company, The Mitigation Banking Group Inc., Great Ecology, LJA Environmental Services Inc., Ecosystem Services LLC., and Others |

Key Segment |

By Type, Verticals, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Development-

Recent Development-

- In 2019 - The Florida Association of mitigation bankers (FAMB) enacted HB 521, which modifies mitigation decisions for wetlands damaged by construction. With this project, the FAMB assured that road building could be completed on time while safeguarding Florida's valuable natural resources.

Regional Landscape

Regional Landscape

- The high demand for mitigation banking technology will likely help North America dominate the global market.

North America dominated the mitigation banking market in 2021. The regional market is also anticipated to generate significant revenue growth during the expected time frame. Due to the high demand for mitigation banking technology in developed nations like the U.S., the National Wetlands Mitigation Action Plan was established, which further contributed to the development of the mitigation banking system in the U.S. Throughout the forecast period, the worldwide mitigation banking market is expected to grow at a faster rate because to these taxes for limiting pollution and incentives for achieving environmental balance.

Government organizations are looking into public-private partnership methods to implement mitigation banking projects. The expanding number of mitigation banks has opened opportunities for mitigation banking concepts to be used in construction, mining, energy and utilities, and manufacturing industries. As a result, the mitigation banking market will likely be driven by such factors over the forecast period.

Competitive Landscape

Competitive Landscape

Key players within the global mitigation banking market include

- Wetland Studies and Solutions Inc.

- THabitat Bank LLC

- Burns & McDonnell

- Mitigation Credit Services LLC

- EarthBalance

- Ecosystem Investment Partners (EIP)

- The Loudermilk Companies

- Weyerhaeuser

- WRA Inc. LLC

- theWetlandsbank Company (TWC)

- Alafia River Wetland Mitigation Bank Inc.

- Wildwood Environmental Credit Company

- The Mitigation Banking Group Inc.

- Great Ecology

- LJA Environmental Services Inc.

- Ecosystem Services LLC.

Global Mitigation Banking Market is segmented as follows:

By Type

By Type

- Wetland or Stream Banks

- Forest Conservation

- Conservation Banks

By Verticals

By Verticals

- Construction & Mining

- Transportation

- Energy & Utilities

- Healthcare

- Manufacturing

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Wetland Studies and Solutions Inc.

- THabitat Bank LLC

- Burns & McDonnell

- Mitigation Credit Services LLC

- EarthBalance

- Ecosystem Investment Partners (EIP)

- The Loudermilk Companies

- Weyerhaeuser

- WRA Inc. LLC

- theWetlandsbank Company (TWC)

- Alafia River Wetland Mitigation Bank Inc.

- Wildwood Environmental Credit Company

- The Mitigation Banking Group Inc.

- Great Ecology

- LJA Environmental Services Inc.

- Ecosystem Services LLC.

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors