Search Market Research Report

Grafted Polyolefins Market Size, Share Global Analysis Report, 2025 – 2034

Grafted Polyolefins Market Size, Share, Growth Analysis Report By End-Users (Adhesives & Sealants, Textiles, Construction, Packaging, Automotive, And Others), By Applications (Bonding, Compatibilization, Impact Modification, Adhesion Promotion, And Others), By Processing Technology (Extrusion, Emulsion, And Others), By Types (Maleic Anhydride Grafted EVA, Maleic Anhydride Grafted PP, Maleic Anhydride Grafted PE, And Others),And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

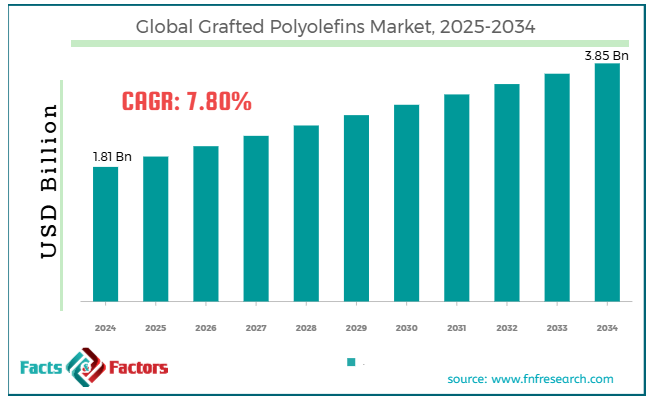

[221+ Pages Report] According to Facts & Factors, the global grafted polyolefins market size was valued at USD 1.81 billion in 2024 and is predicted to surpass USD 3.85 billion by the end of 2034. The grafted polyolefins industry is expected to grow by a CAGR of 7.80% between 2025 and 2034.

Market Overview

Market Overview

Grafted polyolefins refer to the chemically modified polymers processed through a technique called grafting. This process helps improve their compatibility with and adhesion to other products. Grafted polyolefins are non-polar, and therefore, they do not bond with materials like nylons and metals. This property makes them more reactive, adhesive, and compatible, thereby catering to diverse applications.

Grafted polyolefins are widely used in manufacturing automotive components like bumpers, interior parts, and other similar materials. These also find a wide number of applications in multilayer packaging, where they are used to tie layers between the materials in the films. Also, these materials are lightweight and easy to recycle.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global grafted polyolefins market size is estimated to grow annually at a CAGR of around 7.80% over the forecast period (2025-2034).

- In terms of revenue, the global grafted polyolefins market size was valued at around USD 1.81 billion in 2024 and is projected to reach USD 3.85 billion by 2034.

- Growing applications in diverse sectors are driving the growth of the global grafted polyolefins market.

- Based on the end-users, the automotive segment is growing at a high rate and is projected to dominate the global market.

- Based on applications, the adhesion promotion segment is anticipated to grow with the highest CAGR in the global market.

- Based on the processing technology, the extrusion segment is projected to swipe the largest market share.

- Based on types, the maleic anhydride grafted PE segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing applications in diverse sectors are driving the growth of the global market.

The automotive sector is posing high demand for grafted polyolefins in the market because manufacturers are increasing their focus on coming up with more fuel-efficient and lightweight vehicles as demanded by modern consumers. Grafted polyolefins improve the adhesion between fillers and polyolefins, thereby gaining immense traction among manufacturers in the automotive industry.

The multilayer packaging sector is also witnessing a surge in demand for hybrid multilayer films because of the growing FMCG, e-commerce, and pharmaceutical sectors. Grafted polyolefins offer better scalability, compatibility, and recyclability, which are also fueling factors in the market.

In addition, the electric and electronics sector is positively influencing the growth of the market because of the growing demand for miniaturization and better performance elements, which require grafted polyolefins as a crucial component. The increasing use of polymer blends and composites in sports equipment and electronics is further fueling the growth of the industry. These materials are used as compatibilizers for better dispersion and adhesion of the fillers.

Therefore, all these factors are expected to support the growth of the global grafted polyolefins market in the coming years. For instance, Dow came up with automotive seats made out of ideal materials, an alternative to POE-based artificial leather in 2024. These alternatives are known for their color stability and soft tactility.

Restraints

Restraints

- High production costs are likely to hinder the growth of the global market.

Grafted polyolefins are more expensive than other available options in the market, and they are emerging as a significant restraining factor in the grafted polyolefins industry. Such materials require complex processing, which further increases their overall prices. Also, thermal degradation impacts their performance, which has a direct impact on the growth of the industry.

Opportunities

Opportunities

- Surging trend of sustainability is expected to foster growth opportunities in the global market.

Grafted polyolefins help recycle plastics, which is a significant factor in propelling the industry's growth. However, there is a growing interest in the circular economy, which also encourages the use of eco-friendly materials. Consequently, there is a significant rise in demand for grafted polyolefins in the market. Technological advancements in grafting techniques are another key driver likely to revolutionize the market. Customization is another driving force fueling the growth of the market.

Moreover, rapid infrastructure development is a transformative force expected to accentuate the growth of the market manifold in the coming years. Also, governments all across the globe are installing geothermal membranes, roofing sheets, and insulation solutions, which is intensifying the demand for these materials in the market. These materials are used because of their high chemical resistance and mechanical strength.

The ongoing urbanization in underdeveloped and developing economies is also likely to support the growth trajectory of the global grafted polyolefins market. For instance, Clariant came up with AddWorks PPA for their customers in the market. The product is likely to add the highest possible optical film qualities by providing dye build-up effects.

Challenges

Challenges

- Regulatory measures are a big challenge in the global market.

There are many regional, national, and international regulations that restrict the use of grafting agents. However, the heightened scrutiny regarding the regulatory landscape is further making the market more complex. Limited compatibility of grafted polyolefins with some polymers also negatively influences the growth of the grafted polyolefins industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 1.81 Billion |

Projected Market Size in 2034 |

USD 3.85 Billion |

CAGR Growth Rate |

7.80% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

COACE, Dow, SI Group Inc., Borealis AG, Clariant, Arkema, Mitsui Chemicals Asia Pacific Ltd., LyondellBasell Industries Holdings B.V., Guangzhou Lushan New Materials Co. Ltd., Mitsubishi Chemical Group Corporation, and others. |

Key Segment |

By End-Users, By Applications, By Processing Technology, By Types, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global grafted polyolefins market can be segmented into end-users, applications, processing technology, types, and regions.

On the basis of end-users, the market can be segmented into adhesives & sealants, textiles, construction, packaging, automotive, and others. The automotive segment is anticipated to account for the largest share of the grafted polyolefins industry during the forecast period. There is a significant surge in demand for lightweight vehicles and vehicle parts in the market, which is emerging as a crucial reason for the high growth rate of the segment. The primary advantage of using grafted polyolefins is that they offer better impact resistance and superior adhesion properties.

In addition, they are well-compatible with different materials like metal and polymer substrates used for manufacturing vehicles. These polyolefins are used in manufacturing bumpers and other thermoplastic composites, which have a large number of applications in door panels and dashboards.

On the basis of applications, the grafted polyolefins industry can be segmented into bonding, compatibility, impact modification, adhesion promotion, and others. The adhesion promotion segment is expected to register the highest growth in the anticipated period. Its high demand in the automotive and electronics sector is driving the segment's growth as these materials are widely utilized in under-the-hood, exterior trims, and automotive interiors.

Therefore, it is emerging as a key contributor to propelling the demand in the global grafted polyolefins market. Also, these find a good number of applications in the construction sector in building materials to provide long-lasting bonding in harsh environments. These are also used in insulation and panels. Furthermore, these are ideal materials for recycling purposes and are therefore considered a sustainable manufacturing practice.

On the basis of processing technologies, the grafted polyolefins industry can be segmented into extrusion, emulsion, and others. The extrusion segment is expected to record the fastest CAGR growth from 2025 to 2030. Extrusion is widely used in the automotive, packaging, and construction sectors. Grafted polyolefins have high compatibility with extrusion techniques as they help with better thermal stability, melt strength, and adhesion. The skyrocketing demand for multilayer packaging, particularly in the food and beverage sector, is also intensifying the need for packaging films made with extrusion to offer improved interlayer adhesion.

On the basis of types, the market can be segmented into maleic anhydride grafted EVA, maleic anhydride grafted PP, maleic anhydride grafted PE, and others. Maleic anhydride grafted PE is likely to dominate the global grafted polyolefins market during the forecast period as it facilitates excellent adhesion properties, thereby making it suitable for films that find a number of applications in the industrial and food packaging sectors.

Grafted PE attracts end-users across different industries like consumer goods, wires & cables, construction, automotive, and packaging sectors. Also, it is a highly preferred material in extrusion and blow molding processes, which is further expected to foster new growth opportunities in the segment.

Regional Analysis

Regional Analysis

- North America is expected to dominate the global market.

North America is projected to account for the largest share of the global grafted polyolefins market during the forecast period. One of the major factors for the high growth rate of the regional market is the presence of prominent companies in North America.

Also, the companies that have been operating for many years in North America have diversified their product portfolio to cater to global audiences and expand their distribution networks worldwide. In addition, the fast-growing automotive sector in Mexico and the US is also emerging as a significant growth driver of the regional market.

Moreover, electric vehicles are witnessing a surge in demand in North America, which is further solidifying the demand for lightweight vehicle parts, thereby contributing to the growth of the industry in the region. Canada is also expected to stay ahead in the regional market in the coming years because of the growing construction and electronics sector, owing to the high use of grafted polyolefins in insulating materials and roofing membranes. Therefore, these factors are expected to strengthen North America's position in the global market.

Asia-Pacific is also a fast-growing region in the grafted polyolefins industry owing to a number of factors, including a growing regional economy, people's disposable incomes, and public projects. China is likely to be a dominant region in the APAC market because of the presence of a strong industrial base and vast manufacturing capacity.

Also, the fast-growing automotive, construction, and packaging sector in the country is further anticipated to contribute immensely towards the growth of the market in APAC. India is likely to be a leading contributor to the regional market because of the fast-growing e-commerce and logistics sector, which is posing a high demand for advanced packaging materials.

Also, the easy availability of cost-effective production and raw materials is further expected to support the growth trajectory of the regional market. Japan and South Korea are also emerging as highly contributing countries in APAC due to the presence of advanced technical infrastructure, along with the high investments in research and development projects to come up with innovative products.

For instance, The Compound Co. successfully took over ExxonMobil in 2022. The acquired company is a natural gas company with a capacity of 70,000 tons per year.

Competitive Analysis

Competitive Analysis

The key players in the global grafted polyolefins market include:

- COACE

- Dow

- SI Group Inc.

- Borealis AG

- Clariant

- Arkema

- Mitsui Chemicals Asia Pacific Ltd.

- LyondellBasell Industries Holdings B.V.

- Guangzhou Lushan New Materials Co. Ltd.

- Mitsubishi Chemical Group Corporation

For instance, Borealis successfully took over Rialti S.p.A in 2023. This action is likely to add 50,000 tons of mechanical recyclates to the company's portfolio, thereby increasing the offerings of sustainable solutions.

The global grafted polyolefins market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Adhesives & Sealants

- Textiles

- Construction

- Packaging

- Automotive

- Others

By Applications Segment Analysis

By Applications Segment Analysis

- Bonding

- Compatibilization

- Impact Modification

- Adhesion Promotion

- Others

By Processing Technology Segment Analysis

By Processing Technology Segment Analysis

- Extrusion

- Emulsion

- Others

By Types Segment Analysis

By Types Segment Analysis

- Maleic Anhydride Grafted EVA

- Maleic Anhydride Grafted PP

- Maleic Anhydride Grafted PE

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- COACE

- Dow

- SI Group Inc.

- Borealis AG

- Clariant

- Arkema

- Mitsui Chemicals Asia Pacific Ltd.

- LyondellBasell Industries Holdings B.V.

- Guangzhou Lushan New Materials Co. Ltd.

- Mitsubishi Chemical Group Corporation

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors