Search Market Research Report

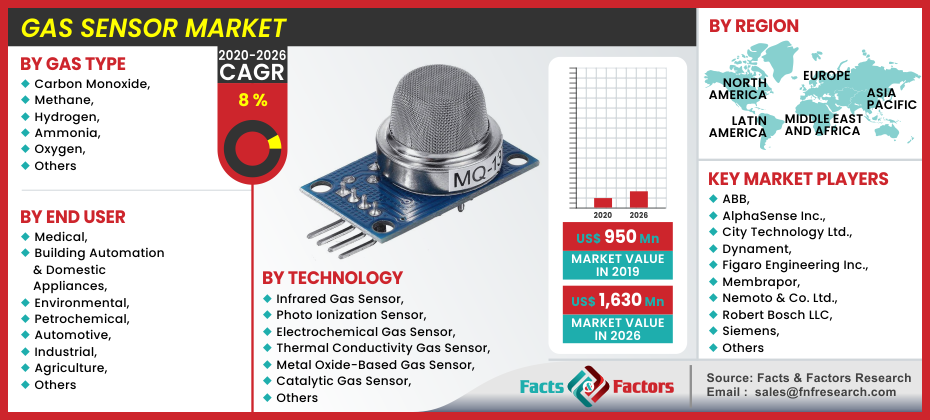

Gas Sensor Market Size, Share Global Analysis Report, Market by Gas Type (Carbon Monoxide, Methane, Hydrogen, Ammonia, Oxygen, and Others), By Technology (Infrared Gas Sensor, Photo Ionization Sensor, Electrochemical Gas Sensor, Thermal Conductivity Gas Sensor, Metal Oxide-Based Gas Sensor, Catalytic Gas Sensor, and Others), By End User (Medical, Building Automation & Domestic Appliances, Environmental, Petrochemical, Automotive, Industrial, Agriculture, Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 – 2026

Gas Sensor Market by Gas Type (Carbon Monoxide, Methane, Hydrogen, Ammonia, Oxygen, and Others), By Technology (Infrared Gas Sensor, Photo Ionization Sensor, Electrochemical Gas Sensor, Thermal Conductivity Gas Sensor, Metal Oxide-Based Gas Sensor, Catalytic Gas Sensor, and Others), By End User (Medical, Building Automation & Domestic Appliances, Environmental, Petrochemical, Automotive, Industrial, Agriculture, Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 – 2026

Industry Insights

[195+ Pages Report] According to the report published by Facts and Factors, the global Gas Sensor market was valued at approximately USD 950 Million in 2019, and is expected to generate revenue of around USD 1,630 Million by end of 2026, growing at a CAGR of around 8 % between 2020 and 2026.

Market Overview

Market Overview

A gas sensor senses the traces or concentration of gases in the air or atmosphere. The gas sensor shows a change in resistance of the material used in the sensor depending on the concentration of gases in the atmosphere, which is then used to determine the output voltage. The form and concentration of gas are detected as a result of this shift in voltage value. Volatile compounds such as gases and air quality can be detected by gas sensors. These sensors calculate and record gas concentrations and can transform analyte gas concentrations into electronic or electrical signals. Gas sensors are designed to determine the concentration of gases in the atmosphere. There are various ways available depending on what you choose to measure. The MQ-4 gas sensor can calculate the concentrations of Condensed Petroleum Gas (CPG), Methane (CH4), Hydrogen (H2), Carbon Monoxide (CO), liquor, and smoke in this case. The sensor has an intrinsic variable resistor that changes its value as gas centralization increases. If the fixation is solid, the obstruction will be lessened. When the focus is poor, the obstruction increases. A heap resistor, in addition to the underlying resistor, must be used. This resistor modifies the sensor's affectability and precision. The value can be anywhere between 2k Ohms and 47k Ohms. The higher the value, the more sensitive is the sensor. The value is determined by whether or not high gas centralizations must be quantified. If you plan to measure high centralizations of gas while using a high motivation for the heap resistor, the readings would be imprecise. Finally, another implicit resistor is used to keep the sensor warm. The need to continuously screen and monitor gas discharges through various modern cycles necessitates the use of gas sensors. The numerous applications of gas sensors range from modern to home-grown end applications. Checking air pollution, compound cycles, and fumes from burning motors are a few examples of gas sensor applications.

Industry Growth Factors

Industry Growth Factors

Wireless gas sensors based on IoT can be used in smart cities to detect air pollution levels, predict fire conditions, and track gas combustion, among other things. Air quality data can be obtained, processed, and exchanged in real-time using IoT gas sensors, which will potentially lead to healthier smart cities. According to projections presented by SmartCitiesWorld, a publishing company, smart city spending will rise by 20% in 2020 compared to the previous year's investments. Singapore invested the most on smart cities, followed by the United States and Japan Technology advancements are encouraging vendors to create smart gas sensors. AerNos, Inc., for example, launched and demonstrated new nano gas sensor products at CES 2020. These nano gas sensors will be used in smart home and smart city projects being built in regions such as North America, Europe, and Asia Pacific. Over the forecast period, the continued development of smart gas sensors is expected to open up new market opportunities. HVAC system eliminates contaminants from the atmosphere by proper ventilation and pressurization. HVAC systems provide fresh and pure indoor air. These systems are being used in a number of industries, including manufacturing and electricity. These companies use processes that transport combustible or hazardous materials. Gas sensors deployed in HVAC systems in various industry domains require the presence of combustible gases and toxic elements to detect and measure the amount of toxic substances present in the atmosphere.

Segmentation Analysis

Segmentation Analysis

The global Gas Sensor market is segmented on the basis of gas type as carbon monoxide, methane, hydrogen, ammonia, oxygen, and others. In 2019, the carbon dioxide gas sensor gathered the largest share, accounting for more than 31.0 percent of global sales. Carbon dioxide sensors are primarily used to measure the quality of indoor air in classrooms, office buildings, households, and hospitals. Given that excessive carbon dioxide exposure can cause health problems such as headaches and restlessness, among other things, the market for carbon dioxide sensors is skyrocketing. Carbon dioxide sensors are often used to track the freshness, efficiency, and protection of agricultural products in real-time. By technology the market is divided into infrared gas sensor, photo ionization sensor, electrochemical gas sensor, thermal conductivity gas sensor, metal oxide-based gas sensor, catalytic gas sensor, and others. The market for electrochemical sensors is increasing because they are inherently safer to operate, use less fuel, and provide better specificity to the target gas. The Occupational Safety and Health Administration's regulations on the exposure to toxic gas fumes are especially driving the demand for gas sensors. The ability of electrochemical sensors to detect harmful gases, landfill gases, and other gases bode well for the segment's development. By end-use, the market is divided into medical, building automation & domestic appliances, environmental, petrochemical, automotive, industrial, agriculture, others. The gas sensors in the industry are used to track and detect dangerous vapors and gases, as well as to trigger visual and audible alarms. The Clean Air Act, which is enforced by the Environmental Protection Agency, stimulates industry demand for gas sensors. The Clean Air Act enforces states to create a network of air monitoring stations based on EPA-established requirements. Strict rules and regulations drafted by policymakers around the world to ensure cleaner air are expected to drive the segment's development over the forecast period.

Regional Analysis

Regional Analysis

Asia Pacific region is estimated to be the fastest-growing in terms of regions. Increasing awareness about the effect of air pollution on human health in Asia Pacific countries such as India and China is driving demand for gas sensors for air quality monitoring. The region's continued urbanization is also adding to the growing demand for gas sensors. Europe is expected to rise steadily over the projected period. Stringent regulations governing gas emissions, as well as the resulting need for emissions monitoring, are expected to drive regional market development. For example, the European Union announced in October 2020 that it is proposing binding standards for natural gas to restrict methane emissions. Methane is the second-largest contributor to global warming after carbon dioxide. The North America market is growing due to the excessive demand for building automation and domestic purposes. The Middle East and Africa region the demand is cornered by oil and gas industries operating the region.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 950 Million |

Projected Market Size in 2026 |

USD 1,630 Million |

CAGR Growth Rate |

8% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

ABB, AlphaSense Inc., City Technology Ltd., Dynament, Figaro Engineering Inc., Membrapor, Nemoto & Co. Ltd., Robert Bosch LLC, Siemens, GfG Gas Detection UK Ltd., FLIR Systems, Inc. |

Key Segment |

By Gas Type, By Technology, By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Players

Competitive Players

Major players in the market are :

- ABB

- AlphaSense Inc.

- City Technology Ltd.

- Dynament

- Figaro Engineering Inc.

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Siemens

- GfG Gas Detection UK Ltd.

- FLIR Systems Inc.

Regional Segment Analysis

Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Industry Major Market Players

- ABB

- AlphaSense Inc.

- City Technology Ltd.

- Dynament

- Figaro Engineering Inc.

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Siemens

- GfG Gas Detection UK Ltd.

- FLIR Systems Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors