Search Market Research Report

Floriculture Market Size, Share Global Analysis Report, 2024 – 2032

Floriculture Market Size, Share, Growth Analysis Report By Type (Cut Flowers, Potted Plants, Bedding Plants, and Others), By Application (Gifting, Personal Use, and Conferences & Activities), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

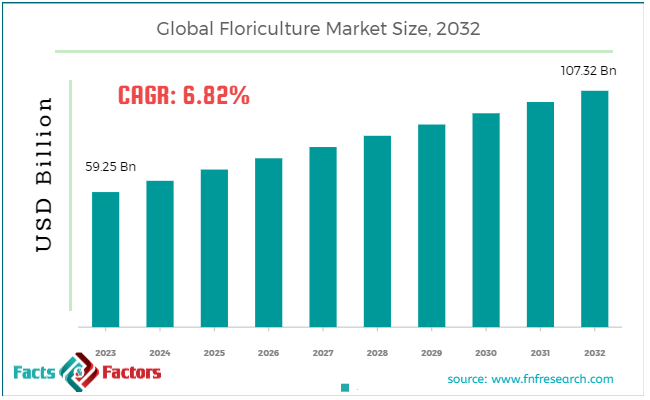

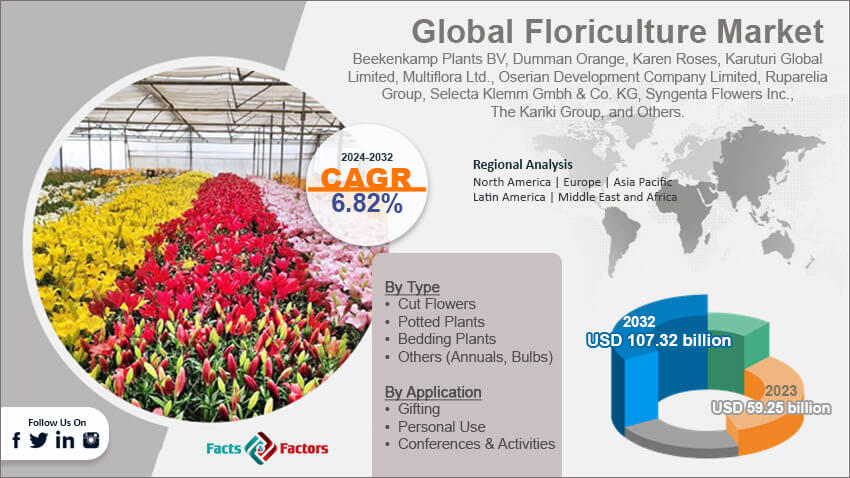

[221+ Pages Report]According to Facts & Factors, the global floriculture market size in terms of revenue was valued at around USD 59.25 billion in 2023 and is expected to reach a value of USD 107.32 billion by 2032, growing at a CAGR of roughly 6.82% from 2024 to 2032. The global floriculture market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Floriculture, in essence, is the art and science of cultivating flowers and ornamental plants. It encompasses a wide range of activities, from growing and breeding these plants to marketing and selling them. It involves studying how to efficiently cultivate these plants for human enjoyment and beautification of the environment.

Floriculture is a commercially important sector of agriculture practiced around the world. Floriculturists (people who work in floriculture) apply production techniques to grow a wide variety of flowers, foliage plants, and bedding plants. These are then sold directly to consumers or used as raw materials in industries like cosmetics and pharmaceuticals.

Key Highlights

Key Highlights

- The floriculture market has registered a CAGR of 6.82% during the forecast period.

- In terms of revenue, the global floriculture market was estimated at roughly USD 59.25 billion in 2023 and is predicted to attain a value of USD 107.32 billion by 2032.

- The growth of the floriculture market is being propelled by people are increasingly using flowers and ornamental plants to spruce up their homes and businesses.

- Increased urbanization and disposable income in some parts of the world are also contributing to the growth of the floriculture market.

- On the basis of Type, the Cut Flowers segment dominates the market, primarily due to its popularity for gifting, celebrations, and home décor purposes.

- Based on Application, the gifting segment is currently exerting dominance over the global market, with a Compound Annual Growth Rate (CAGR) of 2.4%.

- By region, Asia Pacific region holds the largest market share, estimated at around 46% in 2023.

Key Growth Drivers:

Key Growth Drivers:

- Rising Disposable Income: As people's financial well-being improves globally, they're more likely to spend on non-essential items like flowers and plants for decoration and gifting.

- Urbanization and Growing Demand for Aesthetics: More people are moving to cities, and with limited space for gardens, there's a surge in demand for indoor plants and compact flowering varieties for balconies and apartments.

- E-commerce Boom: Online flower delivery platforms are making it easier and faster to purchase flowers, increasing accessibility and convenience for consumers.

- Focus on Health and Wellness: The link between indoor plants and improved mental well-being is gaining traction, driving demand for houseplants.

Restraints:

Restraints:

- Climate Fluctuations: Extreme weather events like droughts and floods can disrupt flower production and lead to price volatility.

- Perishable Nature of Products: Flowers and plants have a short shelf life, which can lead to spoilage and waste within the supply chain.

- Seasonality of Demand: Demand for flowers fluctuates throughout the year, impacting producer income and potentially leading to oversupply during off-seasons.

Opportunities:

Opportunities:

- Sustainable Practices: Consumers are increasingly eco-conscious, and floriculture companies that adopt sustainable practices like organic farming and water conservation can attract a loyal customer base.

- Exotic and Unique Varieties: Offering a wider variety of flowers, especially unique and exotic blooms, can attract new customers and cater to a growing desire for novelty.

- Value-added Services: Providing additional services like floral arrangements, gift wrapping, and same-day delivery can enhance customer experience and increase order value.

Challenges:

Challenges:

- Labor Shortages: The floriculture industry often relies on manual labor, and finding skilled workers can be a challenge, especially in developed countries.

- Price Fluctuations: Competition and varying production costs can lead to price fluctuations, making it difficult for floriculture businesses to maintain stable profit margins.

- Competition from Artificial Flowers: Artificial flowers offer a more affordable and long-lasting alternative, posing a competitive threat to the natural flower market.

Floriculture Market: Segmentation Insights

Floriculture Market: Segmentation Insights

The global floriculture market is segmented based on type, application, and region. The floriculture market boasts a vibrant variety of flowers and caters to diverse consumer needs. To understand this flourishing industry, segmenting it provides valuable insights.

By Type Insights:

By Type Insights:

Based on Type, the global floriculture market is bifurcated into cut flowers, potted plants, bedding plants, others.

Cut Flowers segment holds the largest market share, driven by gifting occasions, events, and home decoration. Roses, lilies, and carnations remain popular, with seasonal blooms like tulips and hydrangeas adding flair. With 3.5% CAGR, the cut flowers segment is expected to be steady, driven by online flower delivery and continued demand for special occasions.

Potted Plants is a Rising Segment. Millennials and Gen Z are fueling the rise of potted plants. Low-maintenance varieties like succulents and air plants are trendy, bringing a touch of nature indoors and promoting well-being. This segment boasts a healthy CAGR due to the focus on mental health and indoor living. Bedding Plants is a mainstay for garden enthusiasts, these beauties add pops of color and fragrance to outdoor spaces. Seasonality plays a major role, with spring and summer witnessing peak demand.

The DIY gardening trend and focus on outdoor living contribute to a positive CAGR. Others (annuals, bulbs) segment caters to niche interests and seasonal preferences. Vibrant annuals and elegant flower bulbs offer variety, attracting experienced gardeners and flower connoisseurs. CAGR may vary based on specific flower types and trends.

By Application Insights:

By Application Insights:

Based on Application, the global floriculture market is categorized into gifting, personal use, and conferences & activities.

Gifting segment is a dominating the global market with 2.4% CAGR. Flowers remain a universal language of love, appreciation, and sympathy. Online delivery platforms have significantly boosted this segment's growth. CAGR is expected to remain stable with potential for growth in emerging economies. The focus on self-care and stress relief is propelling the personal use segment. Indoor plants contribute to a sense of calm and well-being, while cut flowers add moments of joy and beauty to everyday life. This segment boasts a promising CAGR due to the rising focus on mental health. While not the largest segment, flowers play a role in conferences, weddings, and other events. CAGR may fluctuate depending on economic conditions and event trends.

Recent Developments

Recent Developments

- In March 2024, The Indian floriculture industry is blooming! Recognized as a major agribusiness in March 2024, this reflects the growing significance of flowers in the Indian economy. Jammu and Kashmir, a union territory known for its religious tourism and favorable climate, is a prime player in this fragrant field.

- In June 2022, Across the globe, the love for flowers is flourishing too. In the United States, the floriculture industry saw a surge of nearly 16% in revenue between 2019 and 2021, exceeding $6 billion for the first time.

- In 2022, Dümmen Orange (Netherlands) acquired Quick Plug (US, Canada), expanding its offerings in both floriculture and food production.

- Agri-tech company Bluelab (New Zealand) acquired Autogrow (global) to strengthen its technology portfolio in the horticulture sector.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 59.25 Billion |

Projected Market Size in 2032 |

USD 107.32 Billion |

CAGR Growth Rate |

6.82% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Beekenkamp Plants BV, Dumman Orange, Karen Roses, Karuturi Global Limited, Multiflora Ltd., Oserian Development Company Limited, Ruparelia Group, Selecta Klemm Gmbh & Co. KG, Syngenta Flowers Inc., The Kariki Group, and Others. |

Key Segment |

By Type, By Application, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Floriculture Market: Regional Insights

Floriculture Market: Regional Insights

- Asia Pacific: Asia Pacific currently holds the largest market share, estimated at around 48.02% in 2023. This dominance is driven by factors like Growing disposable income in developing economies like India and China. Increased cultivation of flowers and plants to cater to international markets.

- Europe: This region has a well-established floriculture industry with a significant market share, likely due to a strong tradition of flower gifting and ornamental gardening.

- North America: The North American market is also significant, driven by factors like high consumer spending and a growing preference for unique and exotic flowers.

- Latin America and Middle East & Africa: These regions are expected to show promising growth potential due to rising disposable incomes and an increasing awareness of aesthetics.

Floriculture Market: Competitive Landscape

Floriculture Market: Competitive Landscape

Some of the main competitors dominating the global floriculture market include;

- Beekenkamp Plants BV

- Dumman Orange

- Karen Roses

- Karuturi Global Limited

- Multiflora Ltd.

- Oserian Development Company Limited

- Ruparelia Group

- Selecta Klemm Gmbh & Co. KG

- Syngenta Flowers Inc.

- The Kariki Group

The global floriculture market is segmented as follows:

By Type

By Type

- Cut Flowers

- Potted Plants

- Bedding Plants

- Others (Annuals, Bulbs)

By Application

By Application

- Gifting

- Personal Use

- Conferences & Activities

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Beekenkamp Plants BV

- Dumman Orange

- Karen Roses

- Karuturi Global Limited

- Multiflora Ltd.

- Oserian Development Company Limited

- Ruparelia Group

- Selecta Klemm Gmbh & Co. KG

- Syngenta Flowers Inc.

- The Kariki Group

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors