Search Market Research Report

Enterprise Governance, Risk & Compliance Market Size, Share Global Analysis Report, 2020–2026

Enterprise Governance, Risk & Compliance Market By Components (Software and Services), Deployment Modes (Cloud and On-Premises), Enterprise Size (Small and Medium-Sized Enterprises (SMEs), and Large Enterprises), Business Functions (Finance, IT, Legal, and Operation), and Verticals (BFSI, Construction and Engineering, Energy and Utility, Government, Healthcare, Manufacturing, Mining and Natural Resources, Retail and Consumer Goods, Telecom and IT, Transportation and Logistics, and Others): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

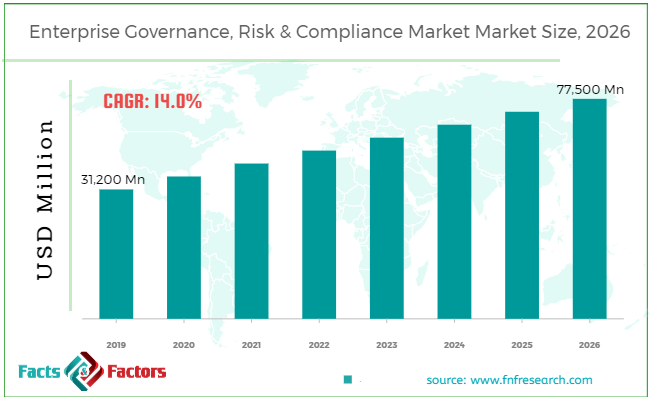

[162+ Pages Report] According to the report published by Facts Factors, the global enterprise governance, risk & compliance market size was worth around USD 31,200 million in 2019 and is predicted to grow to around USD 77,500 million by 2026 with a compound annual growth rate (CAGR) of roughly 14.0% between 2020 and 2026. The report analyzes the global enterprise governance, risk & compliance market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the enterprise governance, risk & compliance market.

This specialized and expertise oriented industry research report scrutinizes the technical and commercial business outlook of the enterprise governance, risk & compliance industry. The report analyzes and declares the historical and current trends analysis of the enterprise governance, risk & compliance industry and subsequently recommends the projected trends anticipated to be observed in the enterprise governance, risk & compliance market during the upcoming years.

The enterprise governance, risk & compliance market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire enterprise governance, risk & compliance market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of value (USD Million) from FY 2016 – 2026.

Key Insights from Primary Research

Key Insights from Primary Research

- From our primary survey respondents we gathered insights that the global enterprise governance, risk & compliance market is expected to grow at a CAGR of nearly 14% till 2026.

- Growing emphasize by organization in gaining consumer as well as investor confidence has boosted the adoption of GRC programs adopted by many organization which has driven the global enterprise governance, risk & compliance market.

- Our primary interviewees predicted that the North America region held a major share of nearly 35% in the global enterprise governance, risk & compliance market in 2019

- Growing number of security and data breaches has boosted the demand for governance and risk management strategies in big companies, which has also contributed to the growth of the GRC market.

- By component, the service segment is expected to record the highest CAGR over the projected period in the global enterprise governance, risk & compliance market.

Key Recommendations from Analysts

Key Recommendations from Analysts

- The global enterprise governance, risk & compliance market in 2019 was valued at approximately USD 31 billion and is expected to grow to a market value of USD 77.5 billion by 2026.

- Our analysts predict that the growing dependency on software for governance and compliance is expected to be a key growth fueling factor for the global enterprise governance, risk & compliance market.

- Based on region, the Asia Pacific region is expected to grow at the fastest rate over the projected period in the global enterprise governance, risk & compliance market.

- Based on component, the software segment dominated the global enterprise governance, risk & compliance market in 2019, accounting for a market share of nearly 60%.

- In terms of enterprise size, the large enterprises segment constituted for a share of 75% in the global enterprise governance, risk & compliance market in 2019.

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the enterprise governance, risk & compliance industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the enterprise governance, risk & compliance industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the enterprise governance, risk & compliance market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the enterprise governance, risk & compliance industry. The enterprise governance, risk & compliance market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market position in the enterprise governance, risk & compliance sector. Key strategic developments in the enterprise governance, risk & compliance market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the enterprise governance, risk & compliance market are appropriately highlighted in the report.

The enterprise governance, risk & compliance market research report delivers an acute valuation and taxonomy of the enterprise governance, risk & compliance industry by practically splitting the market on the basis of different types, application, and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026. The regional segmentation of the enterprise governance, risk & compliance industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. Further, country-wise data for the enterprise governance, risk & compliance industry is provided for the leading economies of the world.

Governance, Risk and Compliance (GRC) is a term that covers various approaches of a company of practices related to governance, risk management, and compliance. Governance refers to the combination of management strategies that are executed by the top management of a company. Compliance refers to conformity to legal boundaries (laws and regulations) and to mutual limits (company rules, procedures, etc.). Risk management refers to set of steps taken by top management of a company which involves analyzing, indentifying, and responding to the risk that may harm the company. When organizations grow, they need control over the governance, risk and compliance activities.

Governance, risk and compliance is critical for companies for exhibiting flexibility, allocating funds, and making effective risk management decisions while ensuring these decisions comply with regulations. By not adopting governance, risk and compliance program the company may expose itself to various risks and may fail to respond to risks effectively. Hence, organizations all around the world are adopting GRC programs that can help them make effective risk and compliance management decision, which has driven the global enterprise governance, risk & compliance market.

The enterprise governance, risk & compliance market is segmented based on components, deployment modes, enterprise size, business functions, verticals, and region. On the basis of components segmentation, the market is classified into software and services. On the basis of deployment modes, the market is classified into cloud and on-premises. On the basis of enterprise size, the market is classified into small and medium-sized enterprises (SMEs) and large enterprises. On the basis of business functions, the market is classified into finance, IT, legal, and operation. On the basis of verticals, the market is classified into BFSI, construction and engineering, energy and utility, government, healthcare, manufacturing, mining and natural resources, retail and consumer goods, telecom and IT, transportation and logistics, and others.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 31,200 Million |

Projected Market Size in 2026 |

USD 77,500 Million |

CAGR Growth Rate |

14.0% CAGR |

Base Year |

2019 |

Forecast Years |

2019-2026 |

Key Market Players |

IBM, Microsoft, Oracle, SAP, SAS Institute, Thomson Reuters, Wolters Kluwer, Dell EMC, FIS, MetricStream, Software AG, SAI Global, ProcessGene, LogicManager, NAVEX Global, Ideagen, Alyne, MEGA International, and others. |

Key Segment |

By Application, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the leading players in the global market include

Some of the leading players in the global market include

- IBM

- Microsoft

- Oracle

- SAP

- SAS Institute

- Thomson Reuters

- Wolters Kluwer

- Dell EMC

- FIS

- MetricStream

- Software AG

- SAI Global

- ProcessGene

- LogicManager

- NAVEX Global

- Ideagen

- Alyne

- MEGA International

The taxonomy of the enterprise governance, risk & compliance industry by its scope and segmentation is as follows:

By Components Segmentation Analysis

By Components Segmentation Analysis

- Software

- Services

By Deployment Modes Segmentation Analysis

By Deployment Modes Segmentation Analysis

- Cloud

- On-premises

By Enterprise Size Segmentation Analysis

By Enterprise Size Segmentation Analysis

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Business Functions Segmentation Analysis

By Business Functions Segmentation Analysis

- Finance

- IT

- Legal

- Operation

By Verticals Segmentation Analysis

By Verticals Segmentation Analysis

- BFSI

- Construction and Engineering

- Energy and Utility

- Government

- Healthcare

- Manufacturing

- Mining and Natural Resources

- Retail and Consumer Goods

- Telecom and IT

- Transportation and Logistics

- Others

By Regional Segmentation Analysis

By Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Industry Major Market Players

- IBM

- Microsoft

- Oracle

- SAP

- SAS Institute

- Thomson Reuters

- Wolters Kluwer

- Dell EMC

- FIS

- MetricStream

- Software AG

- SAI Global

- ProcessGene

- LogicManager

- NAVEX Global

- Ideagen

- Alyne

- MEGA International

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors