Search Market Research Report

Digital Banking Market Size, Share Global Analysis Report, 2022 – 2028

Digital Banking Market Size, Share, Growth Analysis Report By Type (Credit Unions, Co-operative Banks and Consumer Bank), By Services (Digital payments and Digital sales), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

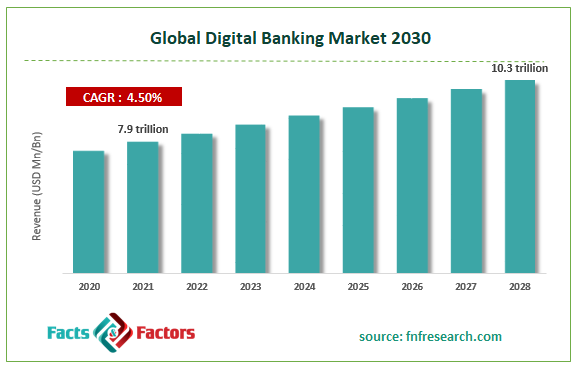

[237+ Pages Report] According to Facts and Factors, the global digital banking market was worth USD 7.9 trillion in 2021 and is estimated to grow to USD 10.3 trillion by 2028, with a compound annual growth rate (CAGR) of approximately 4.50% over the forecast period. The report analyzes the digital banking market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the digital banking market.

Market Overview

Market Overview

The automated delivery of new and old banking services and products to end users through informal communication channels is made possible by digital banking. Additionally, many banks and financial institutions offer digital banking to their customers to expand their global customer base and ease them. Vendors of digital banking platforms are currently creating smarter and smarter banking platforms to fulfill the needs of banks and clients. Digital banking includes the requirement for channel integration support, a dynamic customer experience to enable core banking to be more easily implemented, and the necessity for accessible and desirable devices for users. Digital banking helps banks and their customer's complete end-to-end processing of completed transactions, daily operations, and other everyday tasks without any obstacles. The spread of modernized smart gadgets has made it possible for state bankers to transform their old banking system into a modern one, thanks to the most recent and advanced technology in many aspects of daily banking operations. Most banks are adjusting to meet customer needs by setting up ATMs, mobile banking, internet banking, SMS banking, and many more. It has been discovered that in today's advanced culture, the market, where smart devices are used to an extreme degree, outweighs the high consumption of these digital devices.

COVID-19 Impact:

COVID-19 Impact:

Many banks and financial institutions offer their customers new digital tools and techniques in the COVID-19 pandemic, where businesses deal with operational challenges. Among these, digital banking has seen significant growth. Additionally, the market for digital banking has room to develop due to the rise of online and mobile banking among end consumers throughout the pandemic. Additionally, many banks and Fintech companies have developed enticing banking methods to encourage consumers and SMEs to use digital banking, opening up a wide range of market potential.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global digital banking market value is expected to grow at a CAGR of 4.50% over the forecast period.

- In terms of revenue, the global digital banking market size was valued at around USD 7.9 trillion in 2021 and is projected to reach USD 10.3 trillion by 2028.

- The expanding millennial generation (aged 16 to 34) is pushing banks to offer digital banking services, which drives the growth of the digital banking market.

- By type, the consumer bank category dominated the market in 2021.

- By services, the digital payments category dominated the market in 2021.

- North America dominated the global digital banking market in 2021.

Growth Drivers

Growth Drivers

- Growing demand among banks for delivering enhanced customer experience to drive market growth

Customer-centric solutions assist banks in increasing consumer loyalty by providing better services and responding quickly to customer inquiries. Banks put a high priority on using effective communication to attract new customers and create client retention practices. Digital banking's omnichannel features let banks facilitate personalized conversations through various channels, including voice, online, and mobile. Customer preference for quick transactions makes digital banking services more dependable and efficient. Furthermore, the expanding millennial generation (aged 16 to 34) is pushing banks to offer digital banking services, which drives the growth of the digital banking market.

Restraints

Restraints

- Lack of digital literacy in emerging countries hinders the market growth

Digital illiteracy is still a problem in many developing nations, which makes it difficult for online and mobile payments to become widely used. The market expansion of digital banking is hampered as a result. Digital literacy refers to various abilities that enable people to use and operate digital devices, including the capacity to read and comprehend technical information. The low volume of digital transactions discourages technology companies from investing. Therefore, it is anticipated that the market for digital banking will grow more slowly in emerging nations due to low levels of digital literacy.

Opportunity

Opportunity

- The emergence of the banking as a service (BaaS) model presents market opportunities

The digital banking sector has experienced substantial expansion thanks to the Banking as a Service (BaaS) paradigm. In this arrangement, authorized banks include their online banking solutions right into the offerings of other non-bank companies. This allows non-bank business to provide their clients with digital banking services, including mobile bank accounts, loans, debit cards, and payment services, without obtaining their banking license.

Challenges

Challenges

- Rising security concerns hinder the market growth

Concerns about securely keeping consumer and financial data have increased among enterprises due to the widespread usage of digital banking. Organizations need stronger security and privacy measures to prevent intrusions as IoT usage grows. The security issue threatens the success of digitization. A potential target for hackers will be every endpoint, sensor, gateway, and smartphone as the number of IoT-enabled systems grows. These issues include social phishing, distributed attacks, brute-force attacks, and distributed attacks.

Segmentation Analysis

Segmentation Analysis

The global digital banking market has been segmented into types and services.

The market is segmented based on type: credit unions, cooperative banks and consumer banks. In 2021, the consumer bank segment dominated the market over the forecast period. It is anticipated that rising top-line revenue cost reductions and decreasing risks at consumer banks would fuel the expansion of this market sub-segment. They are governed for and by the people. Their fundamental value is serving their members. Thus they initially provided that service through their physical branches and are now entirely going toward digitization.

The market is segmented based on services: digital payments and digital sales. In 2021, digital payments' largest service sector in the digital banking market was anticipated to dominate during the forecast period. Digital sales by banks throughout the world are being driven by the growth of the sale of banking products and services through online platforms.

Recent Developments

Recent Developments

- September 2021: The TCS BaNCS cloud, which enables the servicing of assets of all classes, was created by TCS and released. Targets of their debut include custodians, dealers, brokers, etc.

- June 2020: During COVID-19, Temenos and Next Neobank will collaborate to construct a digital banking infrastructure to quickly deliver essential digital banking services.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 7.9 Trillion |

Projected Market Size in 2028 |

USD 10.3 Trillion |

CAGR Growth Rate |

4.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Industrial and Commercial Bank of China Limited, Bank of China Limited, Bank of America, Citigroup, China Construction Bank, Agricultural Bank of China, Wells Fargo, JPMorgan Chase, HSBC Group, China Merchants Bank., and Others |

Key Segment |

By Type, Services, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the digital banking market in 2021

One of the main objectives of most financial organizations is to keep a customer for life. As a result, large American banks like Bank of America and others are using crucial developmental methods like product releases and others to preserve the client and customer data so that they may get in touch with their current customers to increase their sales. The presence of significant competitors and the quick uptake of advanced technologies are the main factors driving this region's growth. This region competes with other regions of Canada and the United States thanks to the presence of important players.

Competitive Landscape

Competitive Landscape

Key players within global Digital Banking market include

- Industrial and Commercial Bank of China Limited

- Bank of China Limited

- Bank of America

- Citigroup

- China Construction Bank

- Agricultural Bank of China

- Wells Fargo

- JPMorgan Chase

- HSBC Group

- China Merchants Bank

Global Digital Banking Market is segmented as follows:

By Type

By Type

- Credit unions

- Cooperative Banks

- Consumer Bank

By Services

By Services

- Digital payments

- Digital sales

By Regional Segment Analysis

By Regional Segment Analysis

-

North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Industrial and Commercial Bank of China Limited

- Bank of China Limited

- Bank of America

- Citigroup

- China Construction Bank

- Agricultural Bank of China

- Wells Fargo

- JPMorgan Chase

- HSBC Group

- China Merchants Bank

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors