Search Market Research Report

Construction Bid Management Market Size, Share Global Analysis Report, 2022 – 2028

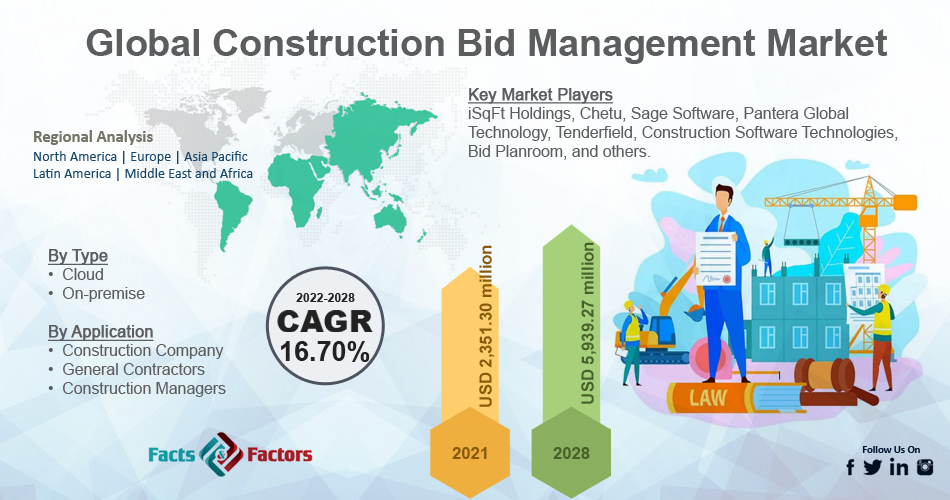

Construction Bid Management Market Size, Share, Growth Analysis Report By Type (On-premise, Cloud-based), By Application (Construction Company, General Contractors, Construction Managers, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

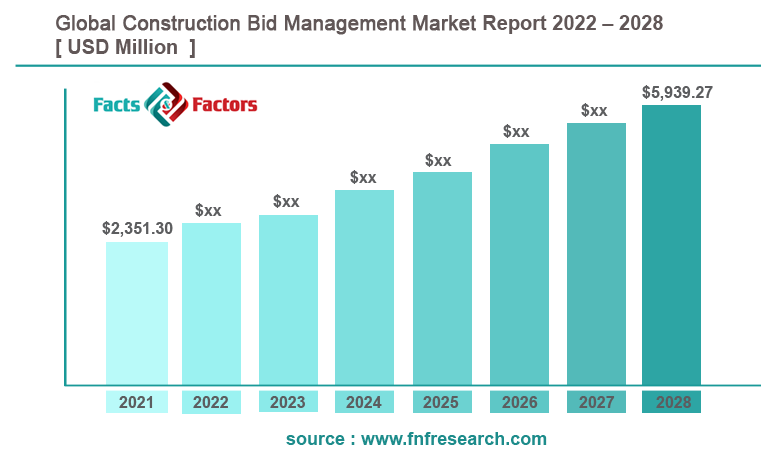

[208+ Pages Report] According to the report published by Facts Factors, the global construction bid management market size was worth USD 2,351.30 million in 2021 and is estimated to grow to USD 5,939.27 million by 2028, with a compound annual growth rate (CAGR) of approximately 16.70% over the forecast period. The report analyses the construction bid management market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the construction bid management market.

Market Overview

Market Overview

Construction bidding involves a project owner who wants to build a project and contractors who can provide construction services. Making a construction project proposal comprises submitting a construction bid. The construction bid lists potential customers. Construction bidding refers to the methods used by a construction business and its customer to submit & approve bids and the methods used by the contractor to assign work to subcontractors after a deal has been accepted. A building bid depends on accuracy to succeed or fail. To make the project economically viable, the bidder uses blueprints, building plans, and material quantity takeoffs to estimate a reasonable cost. The bidding process is an essential construction process that enables firms or enterprises to hire skilled contractors. To manage and complete a project, contractors submit tenders as proposals throughout the bidding process. Construction projects are complex, and these scenarios greatly use web-based information management technologies. Routine documentation may be formatted more easily and reliably using computers and software. Tracked document transfers can be tracked. Additionally, the degree of responsibility that the builder, engineer, and contractor hold depends on the accuracy of the data or information. These elements will impact the construction bid management market's growth during the anticipated time.

COVID-19 Impact:

COVID-19 Impact:

Due to the COVID-19 pandemic, the market's growth experienced a downturn. This is a result of the worldwide suspension of various building site activities. The global pandemic has also negatively impacted the businesses of numerous engineers, builders, and architects with diverse business models across multiple industries and geographical locations. The market for construction bid management will likely develop in the future due to factors such as the increased demand for large-scale project management, an increase in the acceptance rate of cloud-based solutions, and the increased use of smart devices. The development of commercial and research operations would also open up new growth opportunities for the construction bid management market.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global construction bid management market value will grow at a CAGR of 16.70% over the forecast period.

- In terms of revenue, the global construction bid management market size was valued at around USD 2,351.30 million in 2021 and is projected to reach USD 5,939.27 million by 2028.

- The increasing requirement for large-scale project management, usage of smart devices, and growing adoption of cloud-based solutions across the globe are the major factors driving the market's growth.

- By type, the cloud-based category dominated the market in 2021.

- By application, the general contractor workflow category dominated the market in 2021.

- North America dominated the global construction bid management market in 2021.

Growth Drivers

Growth Drivers

- Increasing the use of cloud-based solutions drives the market growth

Due to their flexibility and convenience, cloud-based solutions are increasingly being used by major industry players worldwide in construction and design software. The cloud-based software may also be accessed from anywhere and anytime, making it appropriate for building activities everywhere. Land developers, general contractors, specialists, and home builders can use cloud-based construction management software.

Restraints

Restraints

- On-premise deployment type outlook to hinder the market growth

The market is divided into on-premise and cloud segments based on deployment type. With cloud-based deployment, businesses can manage data more effectively while having greater flexibility and control over how their IT infrastructure and system software are designed. The leading market participants in the construction sector are less inclined to embrace on-premise solutions due to various variables, including the rise in complexity for real-time communication among project stakeholders, significant upfront capital requirements, low scalability, and larger storage needs.

Opportunity

Opportunity

- The growing importance of lean management to reduce operating costs through the adoption of software will present market opportunities

With the aid of design, planning, activation, and maintenance, lean construction contains key components that produce a set of objectives aimed at project efficiency through resource optimization. Technology integration will simplify lean management in the construction bid management market because it is tough and complicated to monitor in real-time. This will directly impact the global construction bid management market.

Segmentation Analysis

Segmentation Analysis

The global construction bid management market is segregated based on deployment type, application, and region.

There are two categories of the market: cloud-based and on-premise. The market for cloud-based construction management software will be rapidly growing in 2021. The inherent usefulness, affordability, adaptability, and innovation of cloud security motivate SMEs and large companies to embrace cloud solutions more frequently. To increase productivity, the cloud-based solution enables the outsourcing of IT tasks. It allows project managers to synchronize with several teams and communicate with them to access real-time data across all project sites. It has emerged as the most popular method of implementing construction bid management software, and it is anticipated that it will continue to hold sway during the projected period. Software for managing construction bids is available in the cloud from many prominent companies, including Oracle Corporation and Sage Group. Employing data to streamline procedures improves the system's performance and cost-efficiency and fosters productivity. These advantages of cloud adoption will accelerate the sector's expansion.

Based on the application, the market comprises the construction firm, general contractors, construction managers, and other categories. General contractors made up the largest portion of the global construction bid management market in 2021. The segment's expansion can be linked to the demand for the design expertise, which is necessary to capitalize on project opportunities, including planned building, development, and building parameter approval. Additionally, the increasing use of BIM by architects enables the coordination of design and construction planning, conflict detection, and visualization, all of which will improve the planning, design, and management of construction projects. In addition to these services, general contractors provide designs tailored to their client's budgets. They help them cut costs by providing comprehensive information about the construction process and ensuring scheme delivery on schedule.

Recent Developments

Recent Developments

- February 2021: Buildertrend revealed that it had acquired CoConstruct to establish itself as the industry leader in construction management software. Bain Capital Tech Opportunities and HGGC acquired Buildertrend through a growth investment.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2,351.30 Million |

Projected Market Size in 2028 |

USD 5,939.27 Million |

CAGR Growth Rate |

16.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

iSqFt Holdings, Chetu, Sage Software, Pantera Global Technology, Tenderfield, Construction Software Technologies, Bid Planroom, and others. |

Key Segment |

By Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the construction bid management market in 2021

The largest share in the global construction bid management market was held by North America in 2021. The reason for the regional development is the increasing use of digital technology in the infrastructure industry and BIM by engineers, designers, architects, and constructors. The government's promotion of technology utilization for higher-quality construction projects also helps the construction bid management market in the region. A decrease in design time will be the main factor driving the growth of the North American construction bid management industry. The US and Canadian companies dominate the area's construction bid management market.

Competitive Landscape

Competitive Landscape

- iSqFt Holdings

- Chetu

- Sage Software

- Pantera Global Technology

- Tenderfield

- Construction Software Technologies

- Bid Planroom.

Global construction bid management market is segmented as follows:

By Type

By Type

- Cloud

- On-premise

By Application

By Application

- Construction Company

- General Contractors

- Construction Managers

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- iSqFt Holdings

- Chetu

- Sage Software

- Pantera Global Technology

- Tenderfield

- Construction Software Technologies

- Bid Planroom.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors