Search Market Research Report

Coal Water Slurry Market Size, Share Global Analysis Report, 2022 – 2028

Coal Water Slurry Market Size, Share, Growth Analysis Report By Application (Chemical Industry, Electrical Power Industry, Metal Industry, and Others), By Type (High Concentration, Medium Concentration, and Low Concentration), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

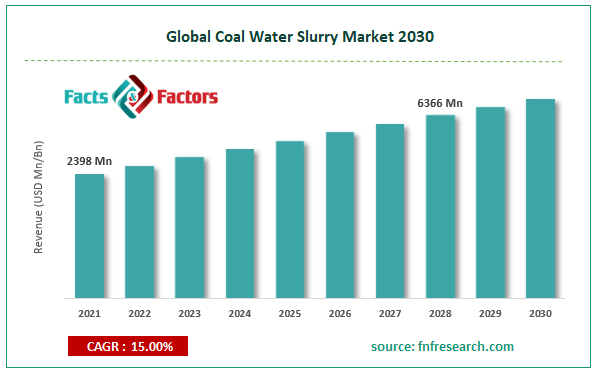

[205+ Pages Report] According to the report published by Facts Factors, the global coal water slurry market size was worth around USD 2398 million in 2021 and is predicted to grow to around USD 6366 million by 2028 with a compound annual growth rate (CAGR) of roughly 15% between 2022 and 2028. The report analyzes the global coal water slurry market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the coal water slurry market.

Market Overview

Market Overview

Coal water slurry (CWS) is created by suspending fine particles of coal in water. It is a new but potentially combustible mixture that can be used to power industrial furnaces and power boilers. Some of the key factors that are essential properties of coal water slurry fuel are the rate of sedimentation, viscosity, particle size, combustion temperature, ignition rate, calorific value, and ash content. The ignition temperature of the fuel lies between 800 and 850 °C while the combustion temperature ranges between 950 to 1,150 °C. During the combustion of CWS, more than 99% of the carbon content is used up. The slurry is getting high attention across industries since it cannot cause an explosion and is fire-proof, making it one of the rare combustible items that cannot cause severe industrial mishaps. Although for the product to be used to power diesel engines, there is no limit on ash content, it has to be less than 10% to be used to power boilers.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global coal water slurry market is estimated to grow annually at a CAGR of around 15% over the forecast period (2022-2028)

- In terms of revenue, the global coal water slurry market size was valued at around USD 2398 million in 2021 and is projected to reach USD 6366 million, by 2028

- Due to a variety of driving factors, the market is predicted to rise at a significant rate

- Based on application segmentation, the metal industry was predicted to show maximum market share in the year 2021

- Based on type segmentation, high concentration CWS was the leading application in 2021.

- On the basis of region, Asia-Pacific was the leading revenue generator in 2021

Covid-19 Impact:

Covid-19 Impact:

The global market cap was heavily impacted during the pandemic owing to the difficulty in running production units in 2020 since most of the manufacturing fasciitis across industries had to be shut down. In the second and third quarters of 2020, the global market slowly picked up the pace with slight signs of growth as the demand for more sources of fuel grew and the pressure on the oil & gas sector increased tremendously.

Growth Drivers

Growth Drivers

- Increasing need for substitutes of natural gas to propel market demand

The global coal water slurry market is projected to benefit from the rising pressure on global leaders to invest and make use of substitutes for oil and natural gas since the abundant use of these non-renewable sources of energy is not only against sustainable growth plans but regular drilling for oil & gas has a severe impact on the living communities as well as wildlands. The petroleum industry is one of the largest contributors to global pollution, climate change, and a general disruption of natural ecosystems. Globalization, modernization, and rampant industrial growth along with increasing population are some of the major reasons why the demand for power sources has increased significantly in the last few years.

Restraints

Restraints

- Questionable impact on the environment to restrict the market growth

Coal water slurry consists of very fine particles of coal that can become a leading cause of blackwater, a form of coal-induced pollution. Since this form of water pollution cannot be purified by any form of treatment plan, blackwater is stored in pools surrounding all areas. This makes the storage area prone to various fatal diseases. The incident of Buffalo Creek of Flood in 1972 is a prime example of such an incident. Unless leaders can tackle this concern, the global market cap is projected to witness a restricted growth trend.

Opportunities

Opportunities

- Increasing number of projects undertaken to provide excellent growth opportunities

In recent times, various countries and market players from different regions have shown interest in CWS projects which may be further fueled by the growing political turmoil. Earlier, the United States was one of the only major countries dealing in CWS projects but the tremendous potential of the fuel and the increasing R & D related to fuel substitutes may lead the global coal water slurry market toward better growth opportunities.

Challenges

Challenges

- High cost of production poses challenges to market expansion

In theory, coal water slurry is made of water and crushed coal, the separation of which is extremely simple. However, in reality, the cost of separation increases multifold due to the vast amount of water required to carry out the process, resulting in the concerns over cost-efficiency of the production process. Other issues like water pollution may also create challenges for global market expansion.

Segmentation Analysis

Segmentation Analysis

- The global coal water slurry market is segmented based on application, type, and region

Based on application, the global market segments are the chemical industry, electrical power industry, metal industry, and others. The global market is currently dominated by the metal industry, where boilers are used extensively in the steel sector. For instance, the world’s biggest steel and iron company, China Baowu Steel Group was recorded to generate a revenue of USD 150.75 billion in 2021. In the foreseeable future, the demand for coal water slurry may also witness high growth driven by the applications in the electrical power industry owing to the growing need for constant power supply in the modernized world.

Based on type, the global market segments are high concentration, medium concentration, and low concentration. Currently, the global market leaders are investing more in understanding varied applications of high-concentration coal-water slurries, this is to reduce the economic impact of having to evaporate water during the process. As per research findings, 70% solid concentration can be used along with additives to aid viscosity reduction.

Recent Developments:

Recent Developments:

- In September, Siberian Coal Energy Company, Russia’s largest coal supplier, announced that the company is planning to expand its global footprint by investing in the Indian market by opening offices in the country’s cities. In the first half of 2022, India has increased coal shipments from Russia to 1.25 million tonnes in the backdrop of the ongoing Russia-Ukraine war.

- In March 2022, Reuters, a global news agency, reported that China is expected to boost the country’s coal output and reserves to ensure the growing demand for electricity supply is met. The National Development and Reform Commission (NDRC) also claimed that it will ensure constant coal transpiration while simultaneously working on developing more effective coal pricing systems.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2398 Million |

Projected Market Size in 2028 |

USD 6366 Million |

CAGR Growth Rate |

15% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Mao Ming Clean Energy, Datong Huihai, Sanrang Jieneng, 81 LiaoYuan, Pingxiang Shui Mei Jiang, and others. |

Key Segment |

By Application, Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- China to lead the market revenue in Asia-Pacific

The global coal water slurry market is projected to be dominated by Asia-Pacific in the coming years and China acting as a major revenue generation region. This could be due to the robust undertakings by the Chinese government to help the region become a leading economy in the coming industries. This can be seen with the growing investments the country is making in the developing the oil & gas sector while also strengthening its political alliance with other countries that lead the oil & gas industry like Russia. The growing industrialization and population along with the infrastructure development have resulted in an increased demand for power supply across China. To fulfill this requirement, the government as well as private players are investing heavily in developing power generation sources. As per a Bloomberg report, in 2021, the biggest oil & gas companies in China raised their capital expenditures to USD 77 billion, a rise of 18% from the previous year.

Competitive Analysis

Competitive Analysis

- Mao Ming Clean Energy

- Datong Huihai

- Sanrang Jieneng

- 81 LiaoYuan

- Pingxiang Shui Mei Jiang

The global coal water slurry market is segmented as follows:

By Application

By Application

- Chemical Industry

- Electrical Power Industry

- Metal Industry

- Others

By Type

By Type

- High Concentration

- Medium Concentration

- Low Concentration

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Mao Ming Clean Energy

- Datong Huihai

- Sanrang Jieneng

- 81 LiaoYuan

- Pingxiang Shui Mei Jiang

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors