Search Market Research Report

Built-in Sanitary Napkin Market Size, Share Global Analysis Report, 2023 – 2030

Built-in Sanitary Napkin Market Size, Share, Growth Analysis Report By Distribution Channel (Offline And Online), By Size (XXL Pads, Extra Large, Large, Regular, And Small), By Pack Size (Above 30 Napkins, 20 to 30 Napkins, 15 to 20 Napkins, 8 to 15 Napkins, 6 to 8 Napkins, And Others), By Wings (Without Wings Napkins And With Wings Napkins), By Usage (Reusable And Disposable Napkins), By Material (Dry-Feel Napkins And Cottony Comfort Napkins), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

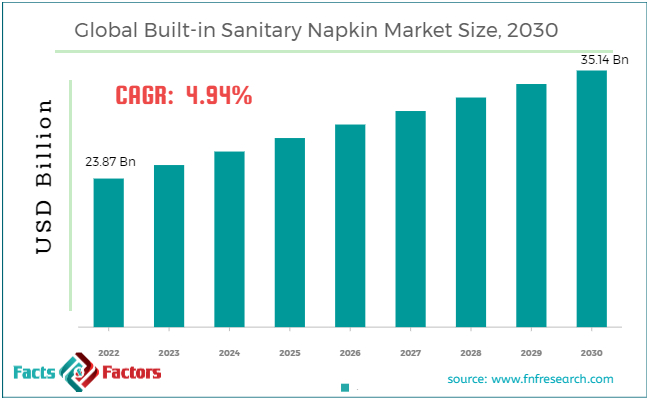

[210+ Pages Report] According to Facts and Factors, the global built-in sanitary napkin market size was valued at USD 23.87 billion in 2022 and is likely to surpass USD 35.14 billion by the end of 2030. The built-in sanitary napkin industry is expected to grow with a CAGR of 4.94% during the forecast period.

Market Overview

Market Overview

Built-in sanitary napkin refers to the pad napkin with unique features and technology to offer protection, absorbency, and comfort. It could involve eco-friendly material, unique designs, moisture lock, leak protection, or odor control properties.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global built-in sanitary napkin market size is estimated to grow annually at a CAGR of around 4.94% over the forecast period (2023-2030).

- In terms of revenue, the global built-in sanitary napkin market size was valued at around USD 23.87 billion in 2022 and is projected to reach USD 35.14 billion by 2030.

- Rising awareness regarding menstrual hygiene is driving the growth of the global built-in sanitary napkin market.

- Based on the distribution channel, the online segment is growing at a high rate and is projected to dominate the global market.

- Based on the size, the regular segment is projected to swipe the largest market share.

- Based on the pack size, the 8-15 napkin segment is the fastest-growing segment in the global market.

- Based on the wings, the wing napkins segment is projected to witness notable growth in the global market.

- Based on the usage, the disposable napkin segment is growing at a high rate and is projected to dominate the global market.

- Based on the material, the cottony comfort napkin segment accounts for the largest share of the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Rising awareness regarding menstrual hygiene is likely to drive the growth of the global market.

The growing awareness among people regarding menstrual hygiene is driving the demand for sanitary napkins. People are going away from their traditional methods and are looking forward to more hygienic and convenient alternatives like sanitary napkins. Also, the constantly increasing female population globally is another major reason contributing to the high growth rate of the industry.

Restraints

Restraints

- Limited or no access to menstrual products is likely to hamper the growth of the global market.

There is no proper access to sanitary napkins in underserved or remote areas, which leads to the slow growth of the global built-in sanitary napkin market. Moreover, the inconsistent distribution network in the less developed areas is another reason restricting the growth of the industry.

Opportunities

Opportunities

- Government initiatives are likely to foster growth opportunities in the global market.

Governments and non-government organizations in several countries are running educational programs and have launched initiatives to encourage menstrual hygiene, which in turn is expected to foster growth opportunities in the global built-in sanitary napkin market. Their efforts are making these napkins more accessible to people, particularly in the underserved, rural, or remote areas.

For instance, Corman, a subsidiary of Organyc partnered with National Nutrition in 2022 to carry the full range of feminine hygiene products in absorbencies to help consumers have a better menstrual cycle.

Challenges

Challenges

- Competition from alternative products is a big challenge in the global market.

There are a wide variety of alternative menstrual hygiene products available in the markets, like tampons and menstrual cups. These products are gaining immense popularity in the market, which is expected to be a big challenge in the built-in sanitary napkin industry.

Segmentation Analysis

Segmentation Analysis

The market can be segmented into the distribution channel, size, pack size, wings, material, and region.

By distribution channel, the market can be segmented into offline and online. The online segment is expected to swipe the largest share of the global built-in sanitary napkin market. Online shopping offers a convenient shopping experience from the comfort of their own place. It is advantageous to people who have limited access to advanced physical stores with unique products.

Also, online shopping offers privacy to people who prefer to shop for feminine hygienic products discreetly. E-commerce stores offer a wide variety of brands with different specifications, thereby allowing people to choose according to their preferences.

By size, the market can be segmented into XXL pads, extra large, large, regular, and small. The regular segment accounts for the largest share of the global built-in sanitary napkin industry. One of the major reasons for the growth of the segment is its widespread availability.

These pads are versatile in nature and are comfortably used by a significant portion of the female population, thereby making it an on-the-go choice. The regular-size pads are priced competitively and are more affordable than other available options.

By pack size, the market can be segmented into above 30 napkins, 20 to 30 napkins, 15 to 20 napkins, 8 to 15 napkins, 6 to 8 napkins, and others. The 8-15 napkin segment is anticipated to witness significant growth in the forthcoming years. It is an age-appropriate packing size. The segment typically covers the pack size ideal for teenagers or young girls.

Also, the smaller sizes are widely preferred by people because they feel it is a safe and suitable solution for their concerns. Females with normal flow can complete a month's cycle with this pack. However, the 15-20 napkin segment is also likely to see a steady growth rate in the forthcoming years due to its growing sales in the market.

By wings, the market can be segmented into without wings napkins and with wings napkins. Wing napkins are the fastest-growing segment in the built-in sanitary napkin industry. The sanitary napkins with wings have side flaps that fold on the sides of the underwear to properly secure the pad in place. These wings prevent leakage and offer extra protection during physical activities.

Additionally, these pads are widely preferred by individuals who have heavy menstrual flows or are active throughout the cycle period. It helps them stay confident and comfortable during the entire menstrual cycle. The wing napkin segment is gaining high popularity among people because manufacturers have introduced a variety of napkins with better absorbency and sizes to cater to different consumer requirements.

By usage, the market can be segmented into reusable and disposable napkins. The disposable napkin segment is expected to swipe the largest share of the global built-in sanitary napkin market. The disposable sanitary napkins are convenient because they do not involve the hassle of washing and maintaining the items. The segment has continually swiped the largest share of the market for the past many years.

Another major advantage contributing to the high growth rate is its hygiene power. The disposable napkin provides a high level of hygiene as they need to be disposed of after usage, which eliminates the risk of bacterial growth or the hassle of keeping the clothes clean and sanitized. However, the reusable napkin segment is expected to see huge growth in the market in the forthcoming years because of the growing awareness among people.

By material, the market can be segmented into dry-feel napkins and cottony comfort napkins. The cottony comfort napkin segment is projected to witness notable growth in the built-in sanitary napkin industry. The major reason behind the high growth rate of the segment is its natural feel of cotton.

These napkins are designed to mimic the comfort and skin-friendly experience like the cotton materials. Moreover, people are using eco-friendly and sustainable materials in napkins to align with the surging trend of moving towards environmentally friendly natural hygiene products.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 23.87 Billion |

Projected Market Size in 2030 |

USD 35.14 Billion |

CAGR Growth Rate |

4.94% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Procter & Gamble (P&G), Kimberly-Clark, Johnson & Johnson, Edgewell Personal Care, Essity (formerly SCA), Lil-Lets, Seventh Generation, Organyc, Lola, The Honest Company, Eco by Naty, Blossom, Rael, NatraCare, Saathi, and Others. |

Key Segment |

By Distribution Channel, By Size, By Pack Size, By Wings, By Usage, By Material, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America accounts for a large share of the global built-in sanitary napkin market because of the presence of a diverse range of products and brands in the region. Also, there is high awareness among people in the region regarding menstrual hygiene.

This awareness has led to the high use of safe and reliable sanitary pads, which also encourages the scrutiny of product quality and soars the demand for organic products. Product innovation is another key driver propelling the growth of the regional market. Improved absorbencies, moisture-wicking materials, and several others are leading feature parameters attracting the target audience.

Asia Pacific is likely to grow high in the forthcoming year because of its sheer population size and diverse consumer base. Also, the presence of emerging and mature markets in the region further contributes to the high growth rate of the market. Manufacturers in the region are innovating unique products to cater to the growing preferences of people.

Moreover, there is higher awareness among people regarding environmental sustainability in the region, which significantly encourages manufacturers to move towards biodegradable and eco-friendly sanitary napkins, which is further expected to positively impact the growth trajectory of the regional market.

Competitive Analysis

Competitive Analysis

The key players in the global built-in sanitary napkin market include:

- Procter & Gamble (P&G)

- Kimberly-Clark

- Johnson & Johnson

- Edgewell Personal Care

- Essity (formerly SCA)

- Lil-Lets

- Seventh Generation

- Organyc

- Lola

- The Honest Company

- Eco by Naty

- Blossom

- Rael

- NatraCare

- Saathi

For instance, the Femtech startup launched a ‘go-with-your-flow’ campaign in March 2022. The campaign features Bollywood actor Deepika Padukone and the campaign works on a story based on true events.

The global built-in sanitary napkin market is segmented as follows:

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Offline

- Online

By Size Segment Analysis

By Size Segment Analysis

- XXL Pads

- Extra Large

- Large

- Regular

- Small

By Pack Size Segment Analysis

By Pack Size Segment Analysis

- Above 30 Napkins

- 20 to 30 Napkins

- 15 to 20 Napkins

- 8 to 15 Napkins

- 6 to 8 Napkins

- Others

By Wings Segment Analysis

By Wings Segment Analysis

- Without Wings Napkins

- With Wings Napkins

By Usage Segment Analysis

By Usage Segment Analysis

- Reusable Napkins

- Disposable Napkins

By Material Segment Analysis

By Material Segment Analysis

- Dry-Feel Napkins

- Cottony Comfort Napkins

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Procter & Gamble (P&G)

- Kimberly-Clark

- Johnson & Johnson

- Edgewell Personal Care

- Essity (formerly SCA)

- Lil-Lets

- Seventh Generation

- Organyc

- Lola

- The Honest Company

- Eco by Naty

- Blossom

- Rael

- NatraCare

- Saathi

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors