Search Market Research Report

Autonomous Robot Market Size, Share Global Analysis Report, 2022 – 2028

Autonomous Robot Market Size, Share, Growth Analysis Report By Mode of Operation (Human Operated, Autonomous), By Mobile Product (Unmanned Ground Vehicle (UGV), Unmanned Marine Vehicle (UMV), Unmanned Aerial Vehicle (UAV)), By End-User (Industrial & Manufacturing, Power & Energy, Logistics & Warehouse, Aerospace & Defense, Oil & Gas, Forest & Agriculture, Medical & Healthcare, Mining & Minerals), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

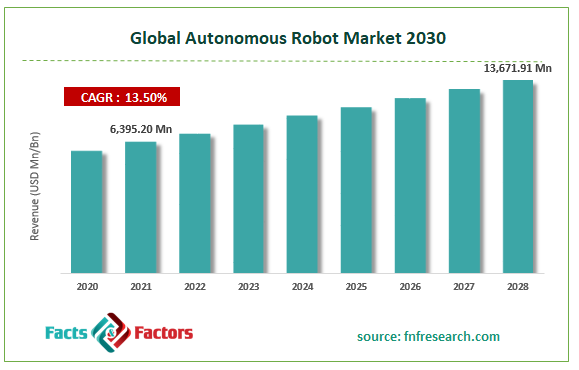

[231+ Pages Report] According to Facts and Factors, the global autonomous robot market size was worth USD 6,395.20 million in 2021 and is estimated to grow to USD 13,671.91 million by 2028, with a compound annual growth rate (CAGR) of approximately 13.50% over the forecast period. The report analyzes the autonomous robot market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the autonomous robot market.

Market Overview

Market Overview

Autonomous robots are those created primarily to interact with their surrounding environmental automatically and without human supervision. Like individuals, these machines can make independent decisions. They employ a range of sensors to address any problems without involving people. They are widely utilized in many industries, including mining and minerals, oil and gas, medicine, and healthcare, as they improve safety and productivity. Some of the major factors influencing the growth of the autonomous robot market include the transition from single-purpose to multipurpose machines and their use in industrial applications like part packing and assembly, customer support and engagement, and logistics activities, among others.

COVID-19 Impact:

COVID-19 Impact:

COVID-19 will likely be in effect for a few years, but its effect on the market for autonomous robots is uncertain. Governments worldwide were driven by the COVID-19 breakout to enact strict lockdown measures and ban the import and export of raw materials for the majority of 2020 and a few months of 2021. As a result, the supply of crucial parts needed to make autonomous robot components suddenly decreased. Furthermore, a widespread shutdown led factories that produce autonomous robots to halt production entirely or partially. The COVID-19 pandemic's negative effects have caused delays in global operations and programs aimed at developing sophisticated autonomous robots.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global autonomous robot market value is expected to grow at a CAGR of 13.50% over the forecast period.

- In terms of revenue, the global autonomous robot market size was valued at around USD 6,395.20 million in 2021 and is projected to reach USD 13671.91 million by 2028.

- Some of the major factors influencing the growth of the autonomous robot market include the transition from single-purpose to multipurpose machines and their use in industrial applications like part packing and assembly, customer support and engagement, and logistics activities, among others.

- By mode of operation, the autonomous category dominated the market in 2021.

- By mobile products, the unmanned ground vehicle (UGV) category dominated the market in 2021.

- North America dominated the global autonomous robot market in 2021.

Growth Drivers

Growth Drivers

- Machines' transition from single- to multipurpose use, as well as their use in industrial settings, drives the market growth

The shift from single-purpose to multipurpose machines and their use in industrial applications like part packing and assembly, customer service and engagement, and logistics processes, among others, are some of the key reasons driving the growth of the autonomous robot market. These robots are becoming increasingly necessary due to several variables, including increased supply chain efficiency, automation of quality control and testing processes, and automation of the entire production process. Artificial intelligence's growing application in robotics and the capacity of these robots to perform tasks more precisely impact the market for autonomous robots. An increase in R&D, rising manufacturing costs, and greater investment are all factors that favorably affect the market for autonomous robots.

Restraints

Restraints

- High-cost associated with the implementation of autonomous robots may hinder the market growth

Inexpensive parts are combined into autonomous robots, including sensors, CPUs, gyroscopes, locomotion systems, and others. Due to this, autonomous robot implementation and maintenance are quite expensive. Additionally, planning when estimating the quantity needed and being aware of associated costs are essential to preventing spending overwhelms and unexpected costs. Software, installation, upgrades, and service agreements are additional expenses. These elements raise the overall cost of autonomous robot implementation. The rise in microprocessing component prices during the projected period is anticipated to restrain the market's expansion.

Segmentation Analysis

Segmentation Analysis

The global autonomous robot market has been segmented into the mode of operation, mobile product, and end-user.

Based on the mode of operation, the market is segregated into human-operated and autonomous. In 2021, the autonomous segment dominated the global autonomous robot market. Robots designed to interact with their surroundings autonomously do so spontaneously and unsupervised by humans. These machines have the same capacity for free will as people. To solve any issues without involving people, they use a variety of sensors. They are frequently used because they increase safety and productivity in various industries, including mining and minerals, oil and gas, medicine, and healthcare.

Based on the mobile product, the market is segregated into unmanned ground vehicles (UGV), unmanned marine vehicles (UMV), and unmanned aerial vehicles (UAV). In 2021, the unmanned ground vehicle (UGV) category dominated the global autonomous robot market. Since UGVs can be utilized for activities like perimeter security of hazardous locations, rescue operations during disasters, and handling hazardous products, their application in business is growing. Due to their operations in enclosed spaces and other GNSS-denied environments, UGVs are outfitted with various sensors and payloads. UGVs may also rely on LiDAR sensors in conjunction with inertial navigation systems and vehicle odometers for precise navigation. Due to growing terrorist threats and the ongoing conflict with ISIS, the Americas have a high need for UGVs, which is also responsible for their expansion.

Based on end-user, the market is segregated into industrial & manufacturing, power & energy, logistics & warehouse, aerospace & defense, oil & gas, forest & agriculture, medical & healthcare, and mining & minerals. In 2021, the logistics & warehouse category dominated the global autonomous robot market. Due to increased e-commerce sales, the logistics and warehouse sector will likely hold the largest market share, which will pressure facility owners to increase storage space to keep up with demand. Rising labor costs and inventory levels also force warehouse owners to automate their operational processes, driving up logistics and warehouse building costs.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 6,395.20 Million |

Projected Market Size in 2028 |

USD 13,671.91 Million |

CAGR Growth Rate |

13.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Omron Adept Technologies, Seegrid Corporation, Clearpath Robotics, Hi-Tech Robotics Systemz, Swisslog, Fetch Robotics, Locus Robotics, GeckoSystems, Aethon, Aviation Industry Corporation of China, Oceaneering, Mobile Industrial Robots, SAAB, SMP Robotics, Bluefin Robotic, Cimcorp Automation, Vecna, and Others |

Key Segment |

By Mode of Operation, Mobile Product, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments:

Recent Developments:

- In August 2020: A new autonomous robot from Sesto Robotics was presented, intended to automate material handling procedures in the manufacturing, commercial, and healthcare sectors.

Regional Landscape

Regional Landscape

- North America dominated the autonomous robot market in 2021

In 2021, North America dominated the global autonomous robot market. The market is expected to grow due to mounting regional and global security risks and rising terrorist activity due to continued technical improvements and increased demand from the local logistics industry. In addition to rising labor costs, this region's market is growing due to technological developments. The region's expanding e-commerce sector is one factor that specifically supports the use of autonomous robots for inventory management. In their warehouses, e-commerce companies deploy autonomous robots to automate intralogistics processes, including picking, sorting, and palletizing. Process automation in other industries and industrial verticals will keep driving the local market.

Competitive Landscape

Competitive Landscape

- Omron Adept Technologies

- Seegrid Corporation

- Clearpath Robotics

- Hi-Tech Robotics Systemz

- Swisslog

- Fetch Robotics

- Locus Robotics

- GeckoSystems

- Aethon

- Aviation Industry Corporation of China

- Oceaneering

- Mobile Industrial Robots

- SAAB

- SMP Robotics

- Bluefin Robotic

- Cimcorp Automation

- Vecna

Global Autonomous Robot Market is segmented as follows:

By Mode of Operation

By Mode of Operation

- Human Operated

- Autonomous

By Mobile Product

By Mobile Product

- Unmanned Ground Vehicle (UGV)

- Unmanned Marine Vehicle (UMV)

- Unmanned Aerial Vehicle (UAV)

By End-User

By End-User

- Industrial & Manufacturing

- Power & Energy

- Logistics & Warehouse

- Aerospace & Defense

- Oil & Gas

- Forest & Agriculture

- Medical & Healthcare

- Mining & Minerals

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Omron Adept Technologies

- Seegrid Corporation

- Clearpath Robotics

- Hi-Tech Robotics Systemz

- Swisslog

- Fetch Robotics

- Locus Robotics

- GeckoSystems

- Aethon

- Aviation Industry Corporation of China

- Oceaneering

- Mobile Industrial Robots

- SAAB

- SMP Robotics

- Bluefin Robotic

- Cimcorp Automation

- Vecna

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors