Search Market Research Report

Air Starter Market Size, Share Global Analysis Report, 2023 – 2030

Air Starter Market Size, Share, Growth Analysis Report By Type (Turbine Starter and Vane Starter), By Industry Vertical (Oil & Gas, Aviation, Mining, Marine, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

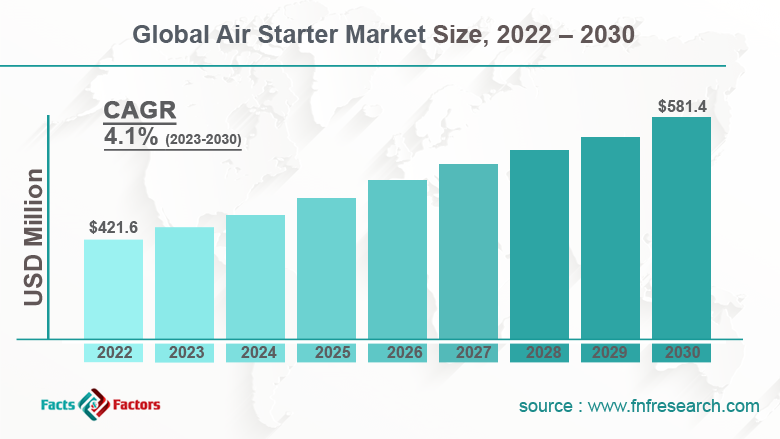

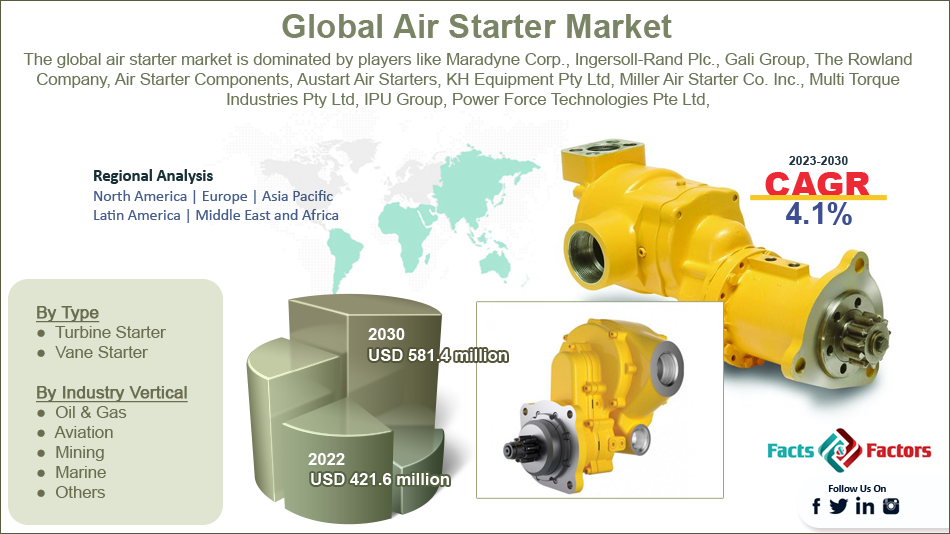

[235+ Pages Report] According to the report published by Facts and Factors, the global air starter market size was worth around USD 421.6 million in 2022 and is predicted to grow to around USD 581.4 million by 2030 with a compound annual growth rate (CAGR) of roughly 4.1% between 2023 and 2030. The report analyzes the global air starter market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the air starter market.

Market Overview

Market Overview

An air-start method is a source of power used to supply the primary rotation to begin gas turbine engines and large diesel. In comparison to a petrol engine; a Diesel engine has a huge compression quotient, an important design characteristic, as it is considered as the high temperature of compression that flames the fuel. An electric starter with adequate power to "eccentric" a huge diesel engine would itself be so huge as to be not viable; thus, it is a call for an alternative system. While starting the engine, condensed air is admitted to any cylinder, which has a piston over top dead in the midpoint, forcing it down. As the engine starts to rotate, the air-start regulator on the subsequent cylinder in line opens to carry on the rotary motion. After quite a few rotations, fuel has penetrated the cylinders, the engine begins running and the air starts cutting off.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global air starter market is estimated to grow annually at a CAGR of around 4.1% over the forecast period (2023-2030).

- In terms of revenue, the global air starter market size was valued at around USD 421.6 million in 2022 and is projected to reach USD 581.4 million, by 2030.

- The growing demand for air starters from various end-use industries such as oil & gas, aviation, and others is expected to drive the growth of the air starter industry during the forecast period.

- Based on the type, the turbine starter segment is expected to hold the largest market share during the forecast period.

- Based on the industry vertical, the oil & gas segment is expected to dominate the market over the forecast period.

- Based on region, North America is expected to hold the largest revenue share during the forecast period.

Growth Drivers

Growth Drivers

- Growing demand for air starters from various end-use industries drives the market growth

One of the main factors propelling the expansion of the global air starter market is the aviation industry's growing demand for better air starters. Air starter demand is rising quickly as a result of the need for advanced turbine engines in military aircraft for them to perform better. Since almost every sector in the world uses this technology, demand for it has been rising steadily for a while. Due to rising customer demand for sophisticated, advanced vehicles, the automotive industry has also emerged as a key factor in the development of the air starter market.

As the demand for better turbines for the shipping industry has increased, the marine industry has proven to be a fantastic opportunity for the development of the air starter market. The market's expansion during the anticipated period will be fueled by several factors that have emerged.

Restraints

Restraints

- The high cost and the availability of substitute act as a major restraint

The high cost of producing advanced air starters has become a significant barrier to the expansion of the air starter industry and is predicted to continue to do so in the future. Due to the numerous restrictions put in place by governments around the globe, the pandemic outbreak had a significant negative effect on the growth of the air starter market. Moreover, a significant market restraint has been identified as the availability of inexpensive alternatives to air starters.

Opportunities

Opportunities

- Growing exploration and production activities in the oil & gas industry offer a lucrative opportunity

The global air starter market is expanding due to an increase in oil and gas E&P activities. Alternatives to conventional output include unconventional oil and gas exploration and production (E&P). Several nations intend to begin producing from offshore oil and gas sources. Norway, for instance, intends to increase its offshore oil E&P operations. Therefore, it is anticipated that increased oil and gas exploration and production will increase demand for air starters. During the forecast period, these variables will fuel market growth.

Challenges

Challenges

- The high failure of air turbine components poses a major challenge

The air starter industry's ability to expand is hampered by the high failure rate of air engine parts. A power source called an air starter system gives air turbine engines the beginning rotation they need to run. Turbines must be extremely dependable. Any harm to the air turbine system could have a negative effect on how the air turbine operates as a whole and lead to a breakdown. The development of the air starter market during the anticipated time may be significantly hampered by this.

Segmentation Analysis

Segmentation Analysis

The global air starter industry is segmented based on type, industry vertical, and region.

Based on the type, the global market is bifurcated into turbine starters and vane starters. The turbine starter segment is expected to hold the largest market share during the forecast period. The growth in the segment is attributed to compatibility, healthy construction, simple design, and low preservation with all industrial applications. The most popular kind of air starter used in industrial uses is the turbine air starter.

These air starters are powered by compressed gas or steam from a different source and function as air compressors that are closely related to turbine engines. This technology was initially developed for use with diesel engines, which led to its use in other sectors such as oil & gas, mining, maritime, etc. It can be used either directly, with no need for external power transfer, or indirectly, with the aid of a belt drive system and the necessary auxiliary gearbox and coupling devices. Thus, driving segmental growth.

Based on the industry vertical, the global air starter industry is segmented into oil & gas, aviation, mining, marine, and others. The oil & gas segment is expected to dominate the market over the forecast period. One of the major industries using air starters, which are used in upstream sectors as a power source to supply the main rotation to start the diesel engines, is the oil and gas industry. Air starters, as opposed to electrical starters, produce high power at much lower rpm and require less maintenance.

Additionally, using electrical starters is not advised for operations like oil and gas because there is a constant danger of ignition due to the presence of extremely flammable gases. 2018 saw roughly 4.47 billion tonnes of crude and 3867.9 billion cubic meters of natural gas produced globally in the upstream oil & gas sector. By 2030, the oil demand is anticipated to be around 105.4 million barrels per day due to industrialization and the rising population. The increase in investment due to the rise in oil demand is expected to boost the market for air starters in the near future.

Recent Developments:

Recent Developments:

- In December 2022, the introduction of Altivar Soft Starter ATS480 in the Indian market was revealed by Schneider Electric, the industry pioneer in the digital transformation of energy management and automation.

- In October 2022, Yanmar America signed a definitive agreement to acquire Controlled Air, a privately held, premier provider of HVAC solutions in Connecticut and surrounding northeastern states. Controlled Air has built a legacy of technology and innovation with market-leading HVAC services and solutions with a strong focus on the customer for over 40 years.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 20.9 Billion |

Projected Market Size in 2030 |

USD 27.5 Billion |

CAGR Growth Rate |

3.5% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Maradyne Corp., Ingersoll-Rand Plc., Gali Group, The Rowland Company, Air Starter Components, Austart Air Starters, KH Equipment Pty Ltd., Miller Air Starter Co. Inc., Multi Torque Industries Pty Ltd, IPU Group, Power Force Technologies Pte Ltd., Fokker, Energotech AG., Domnick hunter-RL Co. Ltd., Tech Development Inc. (TDI), Hilliard Corporation, Universal Starter Inc. |

Key Segment |

By Type, Product, Lubrication, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America is expected to hold the largest revenue share during the forecast period

One of the top regions with a sizable presence in the mining, oil & gas, and power generation industries in North America. High air starter installations on gas turbines and diesel engines are considered to be present in these industries on a greater scale. In the upcoming years, the region is likely to experience strong growth due to the rising number of oil and gas projects in nations like the United States, Canada, and Mexico. Approximately 15% and 21.5% of the world's output of crude oil and natural gas, respectively, were produced in the United States in 2018. The robust drilling in its shale reserves, headed by the Permian Basin, was a major factor in the output increase in 2017.

Moreover, the world's second-largest tight oil reserves are found in the United States, which also has one of the largest technically recoverable shale gas reserves. Air starters for diesel engines are in high demand as a result of the technological advancements in hydraulic fracturing, which have supported upstream oil and gas activities in the onshore region. One of the world's top producers of both oil and gas is Canada. The economics of the nation is significantly influenced by the oil and gas sector.

Over 90% of the nation's total oil reserves are found in oil sands, which continue to be the country's major source of hydrocarbon production. The Canadian Association of Petroleum Producers (CAPP) predicts that the nation's oil production will reach 5.4 billion barrels per day (bbl/d) in 2030, with oil sands anticipated to make up 70.7% of the total production. Thus, the aforementioned facts support the industry expansion during the forecast period.

Competitive Analysis

Competitive Analysis

- Maradyne Corp.

- Ingersoll-Rand Plc.

- Gali Group

- The Rowland Company

- Air Starter Components

- Austart Air Starters

- KH Equipment Pty Ltd

- Miller Air Starter Co. Inc.

- Multi Torque Industries Pty Ltd

- IPU Group

- Power Force Technologies Pte Ltd

- Fokker

- Energotech AG.

- Domnick hunter-RL Co. Ltd.

- Tech Development Inc. (TDI)

- Hilliard Corporation

- Universal Starter Inc.

The global air starter market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Turbine Starter

- Vane Starter

By Industry Vertical Segment Analysis

By Industry Vertical Segment Analysis

- Oil & Gas

- Aviation

- Mining

- Marine

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Maradyne Corp.

- Ingersoll-Rand Plc.

- Gali Group

- The Rowland Company

- Air Starter Components

- Austart Air Starters

- KH Equipment Pty Ltd

- Miller Air Starter Co. Inc.

- Multi Torque Industries Pty Ltd

- IPU Group

- Power Force Technologies Pte Ltd

- Fokker

- Energotech AG.

- Domnick hunter-RL Co. Ltd.

- Tech Development Inc. (TDI)

- Hilliard Corporation

- Universal Starter Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors