Search Market Research Report

Agriculture Autonomous Retrofit Market Size, Share Global Analysis Report, 2025 - 2034

Agriculture Autonomous Retrofit Market Size, Share, Growth Analysis Report By Product (Planting Automation Kit, Driverless Tractor Kit, In-Cab Display and Spot Spraying Kit), By Application (Implement Autonomy and Tractor Autonomy) And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

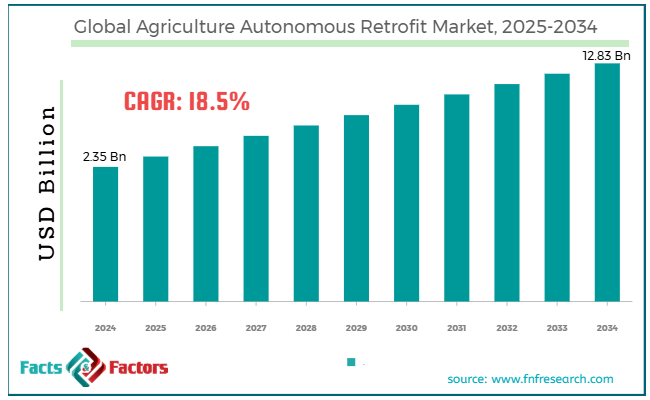

[221+ Pages Report] According to Facts & Factors, the global agriculture autonomous retrofit market size was worth around USD 2.35 billion in 2023 and is predicted to grow to around USD 12.83 billion by 2032 with a compound annual growth rate (CAGR) of roughly 18.5% between 2024 and 2032.

Market Overview

Market Overview

The process of incorporating autonomous technologies into current agricultural systems to upgrade conventional farming methods to increase production, sustainability, and efficiency is known as "agricultural autonomous retrofit." To do this, tractors, harvesters, irrigation systems, and other farming equipment may need to have sensors, AI algorithms, and automation features added. Several factors influence the growth of the global agriculture autonomous retrofit market which includes labor shortages, the growing trend of precision agriculture, technological advancement, rising government initiatives and the growing investment in the development of advanced equipment integrated with modern technology.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global agriculture autonomous retrofit market is estimated to grow annually at a CAGR of around 18.5% over the forecast period (2024-2032).

- In terms of revenue, the global agriculture autonomous retrofit market size was valued at around USD 2.35 billion in 2023 and is projected to reach USD 12.83 billion, by 2032.

- The rising government initiative and technological advancement are expected to drive market growth over the forecast period.

- Based on the product, the driverless tractor kit segment is expected to dominate the market during the forecast period.

- Based on the application, the tractor autonomy segment is expected to capture the largest market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Growth Drivers

Growth Drivers

- Labor shortage drives market growth

It is difficult to find and keep skilled agricultural workers in many areas. By automating repetitive operations like planting, harvesting, and weeding, autonomous retrofit solutions might lessen the impact of labor shortages by using less human labor. The agriculture sector is facing a severe labor shortage, which the Canadian Agricultural Human Resource Council (CAHRC) estimates will cost on-farm firms $3.5 billion in lost income by 2023. With a 7.4% vacancy rate, two out of every five farmers find it difficult to hire the necessary employees.

To alleviate the labor deficit, the agriculture industry is looking into autonomous tractor technology to boost production and reduce reliance on human labor. Thus, the labor shortage is one of the most prominent factors that propel the agriculture autonomous retrofit industry over the projected timeframe.

Restraints

Restraints

- Security and technical challenges hinder the market growth

For autonomous retrofit solutions to work properly, data must be collected, processed, and transmitted. Farmers can be worried about the security and privacy of their data, especially if it is handled or kept by outside companies. Problems like data leaks, illegal access, or improper use of private data might erode public confidence in self-driving technology and hinder its uptake.

Furthermore, it can be technically difficult to incorporate autonomous technology into currently manufactured agricultural equipment. Adoption can be hampered by compatibility problems, software bugs, and the requirement for specialist knowledge to install and maintain these systems, especially for smaller farms or individuals with less technological know-how.

Opportunities

Opportunities

- Increasing agreement among market players offers a lucrative opportunity for market growth

Increasing agreement among the market players is expected to offer a lucrative opportunity for market growth during the forecast period. For instance, in March 2023, the largest known deployment of retrofit autonomy kits for autonomous tractors in the agricultural industry was announced by Ouster, Inc., a leading provider of high-performance lidar sensors, and Fieldin, a leading AgTech company with a smart farming platform and autonomous technology, after they signed a multi-year supply agreement. Fieldin has already installed many kits at the farms of its clients, and by 2023, it intends to install more than 100 autonomous retrofit kits on tractors—each with an Ouster OS1—for significant clients around the country.

Ouster fulfilled its legally binding agreement with Fieldin by shipping 100 sensors at the end of 2022, and it plans to export several hundred more through 2024.

Challenges

Challenges

- Lack of awareness poses a major challenge to market expansion

The possible advantages of autonomous retrofit solutions may not be well known to farmers, or they may not have the skills necessary to assess and properly implement these technologies. Aiming to increase knowledge and develop capacity for autonomous agriculture, educational outreach and training initiatives could assist in removing this obstacle.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 2.35 Billion |

Projected Market Size in 2034 |

USD 12.83 Billion |

CAGR Growth Rate |

18.5% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Braun Maschinenbau GmbH, ONE SMART SPRAY, GPX Solutions, ARAG, GOtrack, AGCO Corporation, Fieldin, Sabanto Inc., WEED-IT, TOPCON CORPORATION, Hexagon AB, Ag Leader Technology, CNH Industrial N.V., Deere & Company, and others. |

Key Segment |

By Product, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global agriculture autonomous retrofit industry is segmented based on product, application and region.

Based on the product, the global agriculture autonomous retrofit market is bifurcated into planting automation kit, driverless tractor kit, in-cab display and spot spraying kit. The driverless tractor kit segment is expected to dominate the market during the forecast period. Both industrialized and emerging nations have played a significant role in this transformation, especially with strong government support for lower taxes, incentives, and infrastructure development. In addition, businesses are developing new goods and adopting calculated risks to seize market share.

During its Tech Day in the U.S. in December 2022, CNH Industrial N.V. showcased its most recent automation and autonomy solutions. These include novel solutions from Raven for Driverless Tillage and Driver Assist Harvest, and from Case IH and New Holland for Baler Automation. The main issues facing farming today are increased productivity and reaching sustainability targets with fewer resources. These developments in automation and autonomous machinery are meant to solve these issues.

Based on the application, the global agriculture autonomous retrofit industry is segmented into implement autonomy and tractor autonomy. The tractor autonomy segment is expected to capture the largest market share over the forecast period. This is a result of the growing need for economical and productive farming solutions, particularly in areas with labor scarcity and outdated machinery. Many farmers opt to retrofit their existing tractors with autonomous capabilities since it provides both operational and financial benefits. Furthermore, the increasing funding for autonomous tractors is expected to drive the segment growth.

For instance, in January 2024, Bluewhite declared that the company had obtained Series C funding of $39 million. The company, which is headquartered in Tel Aviv, Israel, claimed to already collaborate with over 20 of the top permanent crop growers in the United States. It intends to use the money to grow into new international markets and further develop its autonomous tractor and other agricultural equipment.

Regional Analysis

Regional Analysis

- North America is expected to dominate the market during the forecast period

North America is expected to dominate the market over the forecast period. The regional expansion of the market is attributed to the presence of major players and an increasing number of startups. These companies invested heavily in autonomous farming and consequently in the commercialization of agricultural products. In July 2023, with the launch of Steward technology, swarming farm autonomy firm Sabanto, Inc. made significant progress toward commercializing autonomous farming and mowing operations. The goal is to automate current tractors so they may operate without an operator present. This might have a significant impact on productivity and performance by freeing up staff to work on other duties related to the farm or operation while the tractors operate autonomously. The company's autonomous technology is designed to be affordable, easy to use, and safety-focused. From common farm tractor applications to mowing operations at airports, military sites, and sod farms, it might have significant effects on labor, time savings, and operational efficiencies. In addition, the increasing shortage of human workers is also an influencing factor for market development.

The Farm Labor Survey (NASS FLS) of the National Agricultural Statistical Service revealed a 73% decrease in family and self-employed farmworkers between 1950 and 2000. In the same time frame, there was a 52% decrease in the number of hired farmhands. For these workers, the decreased trend is translating into greater labor wages. Thus, the aforementioned stats drive the regional market growth.

Competitive Analysis

Competitive Analysis

The global agriculture autonomous retrofit market is dominated by players like:

- Braun Maschinenbau GmbH

- ONE SMART SPRAY

- GPX Solutions

- ARAG

- GOtrack

- AGCO Corporation

- Fieldin

- Sabanto Inc.

- WEED-IT

- TOPCON CORPORATION

- Hexagon AB

- Ag Leader Technology

- CNH Industrial N.V.

- Deere & Company

The global agriculture autonomous retrofit market is segmented as follows:

By Product

By Product

- Planting Automation Kit

- Driverless Tractor Kit

- In-Cab Display

- Spot Spraying Kit

By Application

By Application

- Implement Autonomy

- Tractor Autonomy

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Braun Maschinenbau GmbH

- ONE SMART SPRAY

- GPX Solutions

- ARAG

- GOtrack

- AGCO Corporation

- Fieldin

- Sabanto Inc.

- WEED-IT

- TOPCON CORPORATION

- Hexagon AB

- Ag Leader Technology

- CNH Industrial N.V.

- Deere & Company

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors