Search Market Research Report

Additive Masterbatch Market Size, Share Global Analysis Report, 2022 – 2028

Additive Masterbatch Market Size, Share, Growth Analysis Report By Type (Antimicrobial, Antioxidant, Flame-retardant, Others), By Carrier Resin (Polyethylene, Polypropylene, Polystyrene, Others), By End-use Industry (Packaging, Automotive, Consumer Goods, Building & Construction, Agriculture, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

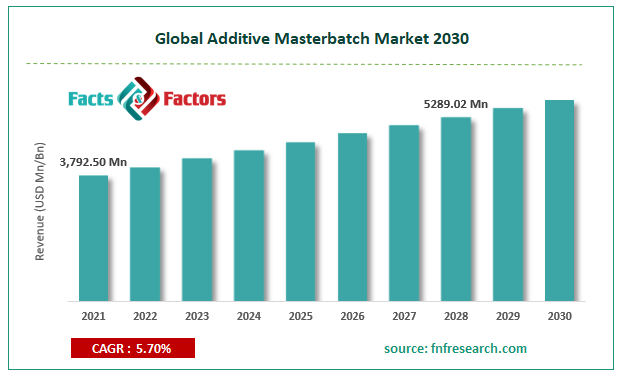

[239+ Pages Report] According to Facts and Factors, the global additive masterbatch market size was worth USD 3,792.50 million in 2021 and is estimated to grow to USD 5289.02 million by 2028, with a compound annual growth rate (CAGR) of approximately 5.70% over the forecast period. The report analyzes the additive masterbatch market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the additive masterbatch market.

Market Overview

Market Overview

A concentrated plastic mixture with encapsulated additives is called masterbatch. It is employed in the plastics industry to change the basic polymer's dispersion, elasticity, and aesthetic qualities. They are used to add color and improve polymers' beneficial features, such as antistatic, anti-fog, anti-locking, UV stabilizing, and flame retardancy. White masterbatch, filler masterbatch, black masterbatch, color masterbatch, and additive masterbatch come in various forms. Each class has distinct characteristics and uses. The primary industries utilizing masterbatches are film extrusion, blow molding, and injection. Over the upcoming years, the additive masterbatch market is anticipated to be driven by the rising replacement of metal parts with plastic and the effectiveness in the service life of plastic materials & plastic goods. Also expected to drive the market over the anticipated period is the growing emphasis on using plastic in the automotive industry to reduce vehicle weight and consequently increase fuel economy.

Covid-19 Impact:

Covid-19 Impact:

The development of COVID-19 has slowed the expansion of the additive masterbatch business, but thanks to the lifting of the lockdown, markets are again beginning to pick up speed. The demand for the growth of the additive masterbatch market, which will revert to pre-pandemic levels after the pandemic is ended, caused the abrupt increase in CAGR. The worldwide additive masterbatch market has developed fierce competition between regional and international businesses. As lockdowns are being removed in several nations, additive masterbatch companies are anticipated to boost market growth through strategic alliances and technical advancements considerably.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global additive masterbatch market value is expected to grow at a CAGR of 5.70% over the forecast period.

- In terms of revenue, the global additive masterbatch market size was valued at around USD 3,792.50 million in 2021 and is projected to reach USD 5289,023 million by 2028.

- Over the upcoming years, the Masterbatch Market is anticipated to be driven by the rising replacement of metal parts with plastic and the effectiveness in the service life of plastic materials & plastic goods.

- By type, the antimicrobial category dominated the market in 2021.

- By carrier resin, the polyethylene category dominated the market in 2021.

- The Asia-Pacific dominated the global additive masterbatch market in 2021.

Growth Drivers

Growth Drivers

- Industrial sectors in emerging economies are expanding quickly, which drives the market growth

The global additive masterbatch market is anticipated to be driven by rapid industrialization in emerging nations like India, Indonesia, Brazil, and Mexico. The market in these nations is developing due to their recent, exponential economic expansion. Countries like China, India, South Korea, Indonesia, Thailand, Taiwan, Mexico, Brazil, and Argentina have significantly expanded important industrial industries. Over the years, these nations' industries have seen substantial growth in the automotive, packaging, chemicals, building & construction, textiles, consumer goods, and pharmaceutical sectors. Government regulations that encourage the development of these sectors, cheaper labor costs, a qualified workforce, the availability of raw resources, and rising urbanization make it possible for local and foreign businesses to establish operations in these nations.

Restraints

Restraints

- Raw material price fluctuations may hinder the market growth

The primary basic materials utilized in masterbatch processing are polymers, titanium dioxide, and calcium carbonate. A medium via which color pigments are administered, polymers account for around 50% of the overall cost of manufacturing and are thus crucial. Since polymers are derived from crude oil, their prices fluctuate much like the price of crude oil. The cost of imported raw materials, such as polymers and other compounds like titanium dioxide, is notoriously unstable. Polymer prices are very volatile and dependent on changes in crude oil prices.

Opportunity

Opportunity

- High demand in the automotive and transportation sectors for high-performance polymers provides market opportunities

Automobile OEMs are migrating to high-performance polymers in the production of vehicle parts due to the inherent advantages and rigorous government emission control regulations. The surge in demand for innovative polymers for automotive applications will drive the rising need for additive masterbatch, driving market expansion during the forecasted period.

Segmentation Analysis

Segmentation Analysis

The global additive masterbatch market is segregated based on type, carrier resin, and end-user industry.

The market is segmented by type: antimicrobial, antioxidant, flame-retardant, and others. In 2021, an antimicrobial additive masterbatch was thought to be the biggest and fastest-growing form of a masterbatch, depending on the type. The demand for plastic goods is increasing, which is why the master batch of antimicrobial additives is performing poorly.

Based on carrier resin, the market is segmented into polyethylene, polypropylene, polystyrene, and others. In 2021, the polyethylene category will hold a monopoly on the market because of its low density, excellent durability, and moisture resistance, making it the most popular carrier resin.

Based on the end-user industry, the market is segmented into packaging, automotive, consumer goods, building & construction, agriculture, and others. Packaging masterbatch had the greatest revenue share in 2021. Retail, industrial, and consumer packaging are all included in the packaging sector, as are rigid and flexible choices. The rise in the number of city dwellers who need packaged items is causing an increase in packaging demand. Consumers want practical, eco-friendly, adaptable packaging that provides protection and is simple to track. Plastic packaging is likely to become increasingly popular as it meets all of these requirements, which is therefore anticipated to increase demand for the product. The packaging sector has tremendous development potential in developing nations like China and India.

Recent Development:

Recent Development:

- November 2020: Ampacet introduced halogen-free masterbatches for flame retardancy in polyethylene film, HALO FREE 709 and HALO FREE 229. These masterbatches include low addition rates for flame retardancy in polyethylene film and adherence to environmental and health safety rules. According to the business, its new masterbatches offer "outstanding optics and film clarity" and may be colored using masterbatches from Ampacet's color palette.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 3,792.50 Million |

Projected Market Size in 2028 |

USD 5289.02 Million |

CAGR Growth Rate |

5.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Clariant AG, Schulman Inc., Polyone Corporation, Plastika Kritis S.A., Plastiblends India Ltd., Ampacet Corporation, DOW Corning Corporation, O'neil Color & Compounding, Penn Color Inc., Polyplast Muller GmbH, RTP Company, Tosaf Group, and Others |

Key Segment |

By Type, Carrier Resin, End-use Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia-Pacific dominated the additive masterbatch market in 2021

The Asia Pacific had the largest revenue share in 2021. Numerous end-use sectors, including packaging, building and construction, automotive and transportation, and consumer products, are responsible for the rise in demand. Over the next eight years, it is anticipated that the expansion of these industries will increase demand for the product. Due to the relocation of European automakers to Asia's low-cost markets and the expansion of vehicle manufacturing facilities in this area, Asia Pacific will have the biggest market share.

Competitive Landscape

Competitive Landscape

- Clariant AG

- Schulman Inc.

- Polyone Corporation

- Plastika Kritis S.A.

- Plastiblends India Ltd.

- Ampacet Corporation

- DOW Corning Corporation

- O'neil Color & Compounding

- Penn Color Inc.

- Polyplast Muller GmbH

- RTP Company

- Tosaf Group

Global Additive Masterbatch Market is segmented as follows:

By Type

By Type

- Antimicrobial

- Antioxidant

- Flame-retardant

- Others

By Carrier Resin

By Carrier Resin

- Polyethylene

- Polypropylene

- Polystyrene

- Others

By End-use Industry

By End-use Industry

- Packaging

- Automotive

- Consumer Goods

- Building & Construction

- Agriculture

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Clariant AG

- Schulman Inc.

- Polyone Corporation

- Plastika Kritis S.A.

- Plastiblends India Ltd.

- Ampacet Corporation

- DOW Corning Corporation

- O'neil Color & Compounding

- Penn Color Inc.

- Polyplast Muller GmbH

- RTP Company

- Tosaf Group

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors