Search Market Research Report

Active Wound Care Market Size, Share Global Analysis Report, 2023 – 2030

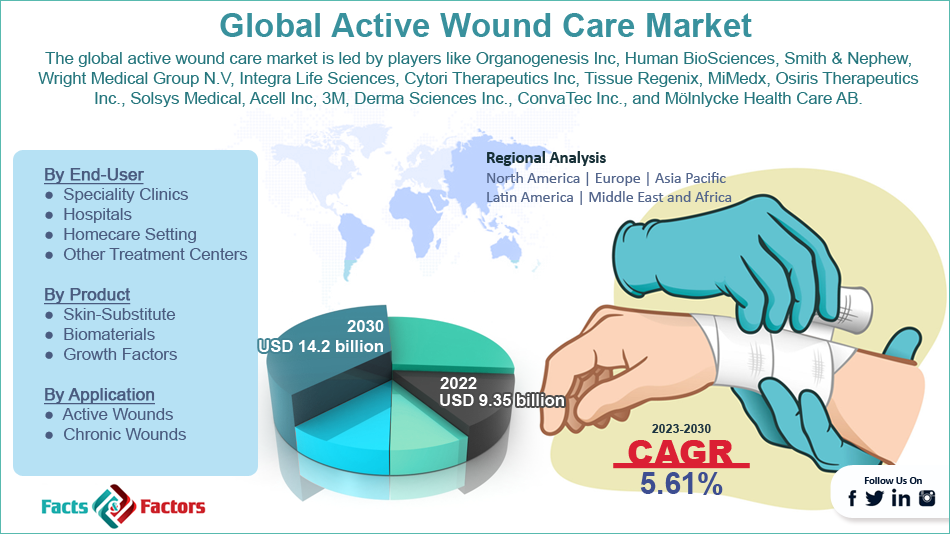

Active Wound Care Market Size, Share, Growth Analysis Report By End-User (Speciality Clinics, Hospitals, Homecare Setting, and Other Treatment Centers), By Product (Skin-Substitute, Biomaterials, and Growth Factors), By Application (Active Wounds and Chronic Wounds), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

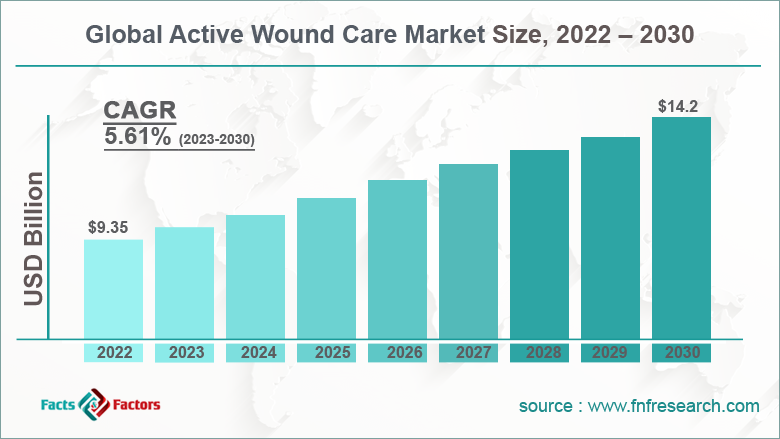

[224+ Pages Report] According to the report published by Facts and Factors, the global active wound care market size was worth around USD 9.35 billion in 2022 and is predicted to grow to around USD 14.2 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.61% between 2023 and 2030. The report analyzes the global active wound care market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the active wound care market.

Market Overview

Market Overview

The global industry deals with products, services, and processes involved in the treatment of chronic and acute wounds. The stakeholders in the industry are responsible for promoting the healing of wounds that have long persisted in the patients causing life-quality degradation.

To achieve the goal, the responsible personnel make use of multiple products including wound care devices, wound dressings, and other topical agents that can accelerate the healing process, prevent further infection or reduce inflammation and associated pain. The products available in the segment are generally used by professionals working in institutes like clinics, hospitals, or any unit that provides medical care to patients. It also includes home care settings which is a rising segment in the industry.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global active wound care market is estimated to grow annually at a CAGR of around 5.61% over the forecast period (2022-2030)

- In terms of revenue, the global active wound care market size was valued at around USD 9.35 billion in 2022 and is projected to reach USD 14.2 billion, by 2030.

- The market is projected to grow at a significant rate due to the rising prevalence of chronic diseases to promote growth

- Based on end-user segmentation, hospitals were predicted to show maximum market share in the year 2022

- Based on application segmentation, chronic wounds was the leading application in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Growth Drivers

Growth Drivers

- Rising prevalence of chronic diseases to promote growth

The global active wound care market is projected to grow owing to the rising prevalence of chronic diseases across the world. These are medical conditions that have a slow progression rate but persist for a longer duration, sometimes the entire lifetime of the patient. There are several factors that can cause the onset of a chronic condition including genetic influence, other medical conditions, and environmental factors. Some examples of the most common chronic conditions are hypertension, diabetes, asthma, chronic obstructive pulmonary disorder (COPD), cancer, arthritis, and chronic kidney disease. They are known to have a severe negative impact on the patient's quality of life and require continuous medical care or management. These conditions are responsible for taking up most of the resources available in the healthcare sector and hence there are ongoing efforts directed toward early detection or prevention of the diseases. Across the world, every year, millions of people get diagnosed with some form of a chronic condition and the numbers have been rising annually. These factors could promote global market growth.

Restraints

Restraints

- High cost to restrict market expansion

Although not all types of wound care are expensive, the advanced version can be costly. When taking into consideration the lifelong medical care required by patients with chronic conditions, the total expense can cross more than thousands of dollars. In under-developed economies or nations that are suffering from natural disasters, social or political unrest, or any financial concern, the healthcare sector may be overburdened while the population struggles to afford basic healthcare. For instance, as per the American Diabetes Association, a person suffering from diabetes spends close to USD 16,752 annually on medical care.

Opportunities

Opportunities

- Technological advancements to support further growth

Since the global industry demand has risen significantly over the years and it could grow to higher numbers in the coming years, it is registering a surge in investments directed toward technological advancements. This in turn is anticipated to create further growth opportunities as the medical community becomes equipped with handling rare cases that seemed impossible a few years ago. This involves development in wound dressing, therapies, devices, or any other process. The improvements can aid in faster healing along with the reduced risk of complications.

Challenges

Challenges

- The intense competition to challenge market growth

The global industry is extremely intense in terms of competition since it is full of players offering similar products and services and consistently trying to improve their offerings. Pharmaceutical and healthcare sectors are continuously investing in research & development with players trying to stay ahead in the game. This could act as a challenge for new entrants who are trying to make a mark as they face tough competition for the giants.

Segmentation Analysis

Segmentation Analysis

The global active wound care market is segmented based on end-user, product, application, and region

Based on end-user, the global market is divided into specialty clinics, hospitals, home care settings, and other treatment centers

- In 2022, the largest contributing segment comprised hospitals since they are the most trusted units in terms of medical care

- They are well-equipped to treat complex wounds and manage patient care

- Furthermore, with years of service, hospitals have gained patient trust due to the availability of skilled personnel, necessary infrastructure, and other resources that helps them provide the necessary medical care without putting the patient under a lot of stress

- The large funds allow them to buy wound care products in bulk and improve their services

- In 2019, the US registered more than 36 million patients visiting hospitals

Based on product, the global market is divided into skin-substitute, biomaterials, and growth products.

Based on application, the global market segments are active wounds and chronic wounds

- Although the market for both segments is high, chronic wounds are treated more frequently

- Since these types of wounds take a long time to heal and there are several factors that can cause the condition to trigger, most of the patients suffering from chronic conditions require constant medical care

- Chronic wounds can lead to further infections that may turn serious and become life-threatening and hence require intense care

- Patients with diabetic foot ulcers have a 5-year mortality rate of 40% as per Jupiter et al.

Recent Developments:

Recent Developments:

- In September 2021, Human Biosciences, a US-based service provider in the wound healing industry, announced that it will launch 2 wound care-related products in the Indian market. The products are named Skill Temp and Medfill and will be introduced in the regional market using exclusive distribution and marketing technique

- In November 2022, scholars from the Indiana University School of Medicine were conducting research on inventing a new method of treating diabetes-related wounds. The research aims to activate a hidden healing protein that is found in fetuses. However, with age, the protein becomes inactive and is completely absent in people with diabetes

- In October 2022, Healthium Medtech, an India-based service provider in the healthcare sector, announced the launch of a new portfolio in the wound dressing segment. Theruptor Novo will be used to manage chronic wounds like leg ulcers and diabetic foot ulcers

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 9.35 Billion |

Projected Market Size in 2030 |

USD 14.2 Billion |

CAGR Growth Rate |

5.61% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Organogenesis Inc, Human BioSciences, Smith & Nephew, Wright Medical Group N.V, Integra Life Sciences, Cytori Therapeutics Inc, Tissue Regenix, MiMedx, Osiris Therapeutics Inc., Solsys Medical, Acell Inc, 3M, Derma Sciences Inc., ConvaTec Inc., Mölnlycke Health Care AB, and others. |

Key Segment |

By End-User, Product, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to register the highest growth

The global active wound care market is projected to witness the highest growth in North America mainly due to the increasing prevalence of chronic diseases in the region. The Centers for Disease Control and Prevention (CDC) claims that almost 11.3% of the US population lives with diabetes. Factors like poor lifestyle choices, inappropriate eating habits, high-stress levels, and the growing elderly population are resulting in more people dealing with chronic conditions.

Furthermore, the advanced healthcare infrastructure allows the population to have higher access to medical care. The presence of excellent medical reimbursement policies, insurance plans, and other financial aids is responsible for encouraging additional people to undertake medical care programs when required. Asia-Pacific is anticipated to emerge as an important regional market delivering high CAGR due to the growing population and increasing investments in the healthcare sector.

Competitive Analysis

Competitive Analysis

- Organogenesis Inc

- Human BioSciences

- Smith & Nephew

- Wright Medical Group N.V

- Integra Life Sciences

- Cytori Therapeutics Inc

- Tissue Regenix

- MiMedx

- Osiris Therapeutics Inc.

- Solsys Medical

- Acell Inc

- 3M

- Derma Sciences Inc.

- ConvaTec Inc.

- Mölnlycke Health Care AB

The global active wound care market is segmented as follows:

By End-User Segment Analysis

By End-User Segment Analysis

- Specialty Clinics

- Hospitals

- Homecare Setting

- Other Treatment Centers

By Product Segment Analysis

By Product Segment Analysis

- Skin-Substitute

- Biomaterials

- Growth Factors

By Application Segment Analysis

By Application Segment Analysis

- Active Wounds

- Chronic Wounds

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Organogenesis Inc

- Human BioSciences

- Smith & Nephew

- Wright Medical Group N.V

- Integra Life Sciences

- Cytori Therapeutics Inc

- Tissue Regenix

- MiMedx

- Osiris Therapeutics Inc.

- Solsys Medical

- Acell Inc

- 3M

- Derma Sciences Inc.

- ConvaTec Inc.

- Mölnlycke Health Care AB

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors