Search Market Research Report

Industrial Robotics Market Size, Share Global Analysis Report, 2023 – 2030

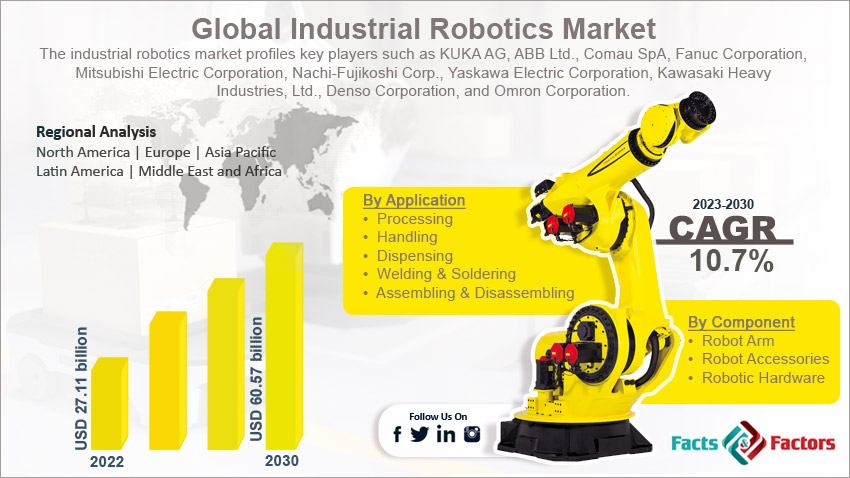

Industrial Robotics Market Size, Share, Growth Analysis Report By Type (Traditional Robots and Collaborative Robots), By Component (Robot Arm, Robot Accessories, and Robotic Hardware), By Application (Assembling & Disassembling, Processing, Handling, Dispensing, and Welding & Soldering), By End-Use Industry (Automotive, Electrical & Electronics, Metals & Machinery, Food & Beverages, Optics, Precision Engineering, Cosmetics, Pharmaceuticals, Plastics & Rubbers, and Chemicals), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

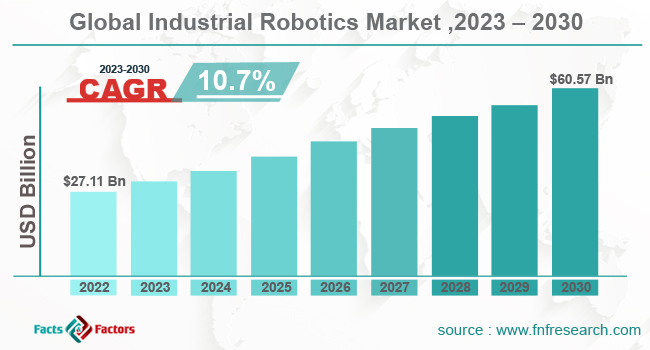

[226+ Pages Report] According to the report published by Facts & Factors, the global industrial robotics market size was evaluated at $27.11 billion in 2022 and is slated to hit $60.57 billion by the end of 2030 with a CAGR of nearly 10.7% between 2023 and 2030. The market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global marketspace.

The industrial robotics industry report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, PESTEL analysis, SWOT analysis, Porter’s five force analysis, and value chain analysis. Additionally, the industrial robotics market report explores the investor and stakeholder space to help companies make data-driven decisions.

Market Overview

Market Overview

Industrial robotics is referred to as robotic arms having sensors and controllers which can perform a plethora of functions in manufacturing establishments. Moreover, these products minimize the involvement of humans in production, thereby increasing the processing speed and quality of production. Industrial robotics is utilized for product assembly, welding, and painting along with enhancing the loading capacity & production capacity of firms.

Apart from this, it reduces the operational costs. In the last quarter of 2022, Kuka AG, a German player manufacturing industrial robots & systems for factory automation, delivered industrial arm robots to Tesla Inc. for helping the latter manufacture electric vehicles.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global industrial robotics market is projected to expand annually at the annual growth rate of around 10.7% over the forecast timespan (2023-2030)

- In terms of revenue, the global industrial robotics market size was evaluated at nearly $27.11 billion in 2022 and is expected to reach $60.57 billion by 2030.

- The global industrial robotics market is anticipated to record massive growth over the forecast period owing to the rise in the Industrial 4.0 revolution has boosted the application of robotics & smart manufacturing in the industrial sector.

- Based on the component, the robot accessories segment is predicted to contribute majorly towards the global market share over the forecast timeline.

- In terms of application, the handling segment is projected to record the highest CAGR over 2023-2030.

- Based on the end-use industry, the electrical & electronics segment is slated to dominate the segmental surge over the forecast period.

- Region-wise, the Middle East & African industrial robotics market is projected to register the highest CAGR during the assessment period.

Industry Growth Factors

Industry Growth Factors

- The need for increasing production capacities will boost the demand for industrial robotics in a slew of sectors

The rise in the Industrial 4.0 revolution has boosted the application of robotics & smart manufacturing in the industrial sector, thereby driving the global industrial robotics market trends. Moreover, in June 2023, Telefonica, S.A., a key Spanish player in the telecommunications industry, opened an international robotics center for boosting Industry 4.0 in Spain.

Such initiatives will steer the expansion of the market globally. Product manufacturers are expanding their manufacturing capacities to fulfill the growing demand for industrial robotics. For instance, in the last quarter of 2022, ABB Limited opened a new robotics unit in China for increasing the production of industrial robotics.

Furthermore, firms are developing robots embedded with new technologies and features. For instance, in the first half of 2022, Epson, a firm in the industrial robot manufacturing business, introduced a range of GX4 and GX8 SCARA robots. Such moves are predicted to prop up the expansion of the industrial robotics market across the globe.

Restraints

Restraints

- Surging installation costs will hinder the global industry expansion over 2023-2030

With high costs incurred due to the deployment of industrial robots, the industrial robotics industry can witness a decline in growth in the forthcoming years. Less availability of skilled personnel for handling industrial robots can pose a big threat to the growth of the global industry.

Opportunities

Opportunities

- Launching of smart factory concept will create new facades of growth for the global market

An increase in the number of smart factories will open new growth opportunities for the global industrial robotics market in the years to come. With the growing concept of Industry 5.0, the market for industrial robotics is likely to expand by leaps & bounds in the years ahead.

Challenges

Challenges

- Security concerns associated with industrial robotics systems use have put up a big challenge for the global industry

Safety concerns pertaining to industrial robotics systems can pose a huge challenge in the global industrial robotics industry in the upcoming years.

Segmentation Analysis

Segmentation Analysis

The global industrial robotics market is sectored into the type, component, application, end-use industry, and region.

In terms of components, the global industrial robotics market is sectored into robot arms, robot accessories, and robotic hardware segments. Furthermore, the robot accessories segment, which accrued more than 50% of the global market share in 2022, is forecast to maintain its number one position in the projected timespan. The segmental expansion in the estimated timeframe can be a result of the growing demand for robot accessories that will facilitate long-term productivity.

In October 2022, Neato Robotics, a Silicon Valley-based consumer robotics firm, launched fragrance pods and filters for its D-series robot vacuums. The new accessory adds to the accessories line of pet brushes, fragrance pods, and software upgrades.

Application-wise, the industrial robotics industry across the globe is divided into assembling & disassembling, processing, handling, dispensing, and welding & soldering segments. Moreover, the handling segment, which gathered a major share of the global market in 2022, is forecast to register the fastest CAGR in the forecast timeline.

The growth of the segment over 2023-2030 can be owing to growing e-commerce shopping activities and quick service deliveries. Citing an instance, in the second quarter of 2022, Amazon launched an autonomous robot for handling packages on the company premises. Moreover, these robots could handle materials without any human assistance or errors. Industrial robots are used for handling heavy materials in the automotive and electronics sectors.

On the basis of the end-use industry, the global industrial robotics market is divided into automotive, electrical & electronics, metals & machinery, food & beverages, optics, precision engineering, cosmetics, pharmaceuticals, plastics & rubbers, and chemicals segments.

Moreover, the electrical & electronics segment, which accumulated a major share of the global market in 2022, is forecast to dominate the end-use industry segment over the forecast timeframe. The growth of the segment over 2023-2030 can be owing to a rise in demand for industrial robotics in the electrical & electronics sector for performing a slew of tasks such as labeling, dispensing, screw driving, and insertion.

Based on the type, the global industrial robotics industry is sectored into traditional robots and collaborative robots.

Recent Breakthroughs:

Recent Breakthroughs:

- In the first half of 2022, ABB Limited, a Swiss-based firm, launched the next-gen of flexible automation products under the new OmniVanceTM brand. The move will boost the demand for industrial robotics across Europe.

- In the first quarter of 2022, Yaskawa Electric Corporation, a Japanese firm manufacturing industrial robots, acquired a stake in Doolim-Yaskawa Company Limited for expanding its business in robotic painting and sealing systems.

- In the first half of 2022, FANUC launched new kinds of collaborative robots, thereby expanding its current product portfolio. The move will provide impetus to the growth of the industrial robotics business globally.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 27.11 Billion |

Projected Market Size in 2030 |

USD 60.57 Billion |

CAGR Growth Rate |

10.7% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

KUKA AG, ABB Ltd., Comau SpA, Fanuc Corporation, Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd., Denso Corporation, Omron Corporation, and others. |

Key Segment |

By Type, Component, Application, End-Use Industry, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Insights

Regional Insights

- Asia-Pacific Industrial Robotics market to establish a dominant status over the forecast timeline

Asia-Pacific, which garnered more than half of the global industrial robotics market revenue in 2022, is anticipated to record humungous growth during the projected timeline. The regional market expansion over 2023-2030 can be subject to a rise in the number of end-use industries in the countries such as India, Japan, Taiwan, Singapore, Malaysia, and Japan. Apart from this, the rise in demand for AI and automation will embellish the growth of the regional market.

Furthermore, the industrial robotics industry in the Middle East & Africa is predicted to record the highest CAGR in the anticipated timeframe. The factors that are likely to impact the growth of the regional industry are favorable government initiatives toward the use of industrial robotics.

For instance, in the third quarter of 2022, the government of UAE introduced the Dubai Robotics and Automation program and this initiative will boost the demand for industrial robotics in the country. As per the program, the government will offer nearly 2 lac robots to industrial & logistics sectors for enhancing their manufacturing capacities.

Competitive Space

Competitive Space

- KUKA AG

- ABB Ltd.

- Comau SpA

- Fanuc Corporation

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries Ltd.

- Denso Corporation

- Omron Corporation

The global Industrial Robotics market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Traditional Robots

- Collaborative Robots

By Component Segment Analysis

By Component Segment Analysis

- Robot Arm

- Robot Accessories

- Robotic Hardware

By Application Segment Analysis

By Application Segment Analysis

- Assembling & Disassembling

- Processing

- Handling

- Dispensing

- Welding & Soldering

By End-Use Industry Segment Analysis

By End-Use Industry Segment Analysis

- Automotive

- Electrical & Electronics

- Metals & Machinery

- Food & Beverages

- Optics

- Precision Engineering

- Cosmetics

- Pharmaceuticals

- Plastics & Rubbers

- Chemicals

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- KUKA AG

- ABB Ltd.

- Comau SpA

- Fanuc Corporation

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries Ltd.

- Denso Corporation

- Omron Corporation

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors