Search Market Research Report

India Renewable Energy Certificate Market Size, Share Global Analysis Report, 2024 – 2032

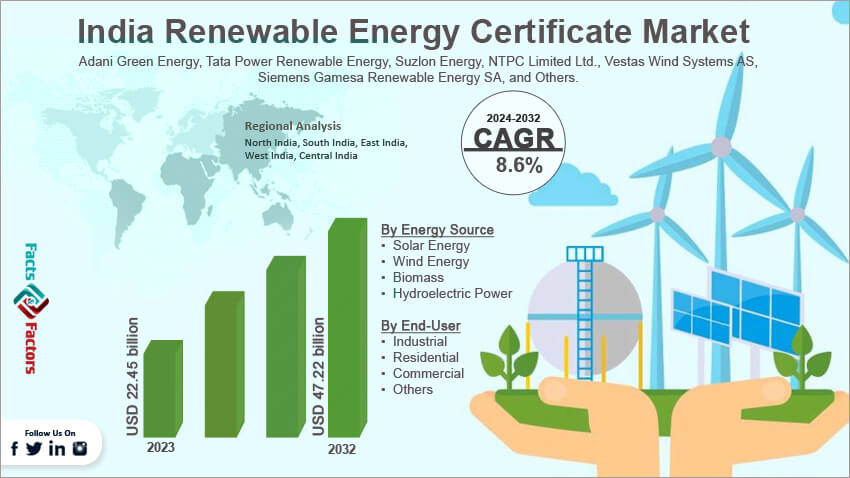

India Renewable Energy Certificate Market Size, Share, Growth Analysis Report By Energy Source (Solar Energy, Wind Energy, Biomass, Hydroelectric Power, and Others), By End-User (Industrial, Residential, Commercial, and Others), and By Region - India Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

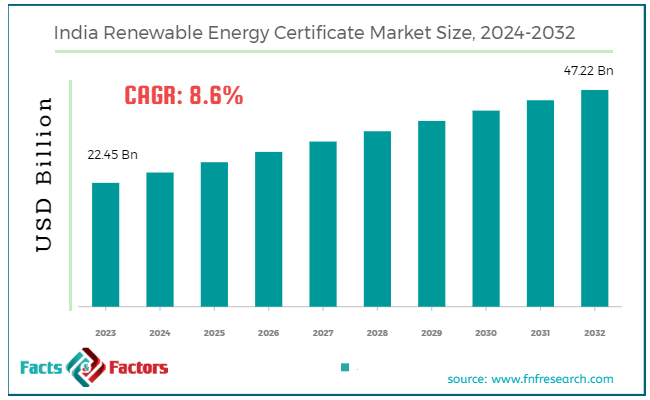

[226+ Pages Report]According to Facts & Factors, the India renewable energy certificate market size in terms of revenue was valued at around USD 22.45 billion in 2023 and is expected to reach a value of USD 47.22 billion by 2032, growing at a CAGR of roughly 8.6% from 2024 to 2032. The India renewable energy certificate market is projected to grow at a significant growth rate due to several driving factors.

What is an India Renewable Energy Certificate? India Renewable Energy Certificate Market Overview

What is an India Renewable Energy Certificate? India Renewable Energy Certificate Market Overview

An India Renewable Energy Certificate (REC) is a market-based instrument that represents the environmental attributes of electricity generated from renewable sources. Each REC corresponds to 1 MWh of electricity generated from renewable sources such as wind, solar, biomass, or small hydro. The REC mechanism was introduced to facilitate the compliance with Renewable Purchase Obligations (RPOs), which mandate specific entities to source a portion of their electricity from renewable sources. The REC market provides a flexible and efficient way for obligated entities to meet their RPOs by allowing them to purchase RECs if they are unable to generate or procure sufficient renewable energy directly. This market not only promotes the generation of renewable energy but also provides a revenue stream for renewable energy producers, thereby supporting the growth of the renewable energy sector in India.

Key Highlights

Key Highlights

- The renewable energy certificate market has registered a CAGR of 8.6% during the forecast period.

- In terms of revenue, the India renewable energy certificate market was estimated at roughly USD 22.45 billion in 2023 and is predicted to attain a value of USD 47.22 billion by 2032.

- The growth of the renewable energy certificate market is being propelled by soaring renewable energy targets, stricter purchase obligations, and declining renewable costs.

- Based on the energy source, the solar energy segment is growing at a high rate and is projected to dominate the Indian market.

- Based on the end-user, the industrial segment is projected to swipe the largest market share.

- Geographically, South India is the dominating region, driven by significant renewable energy capacities and supportive policies.

Key Growth Drivers:

Key Growth Drivers:

- Government Support and Policies: The Indian government has introduced several policies and initiatives to promote renewable energy, including the National Action Plan on Climate Change (NAPCC) and Renewable Purchase Obligations (RPOs), which mandate the use of renewable energy.

- Increasing Renewable Energy Capacity: India aims to achieve significant renewable energy capacity targets, with plans to reach 175 GW by 2024 and 450 GW by 2030. The expansion of solar and wind projects will drive the supply and demand for RECs.

- Corporate Sustainability Goals: Many corporates are increasingly purchasing RECs voluntarily to meet their sustainability and carbon neutrality goals, thereby boosting demand.

Restraints:

Restraints:

- Market Volatility: The REC market experiences price fluctuations due to varying demand and supply dynamics, creating uncertainty for market participants.

- Regulatory Challenges: Frequent changes in policies and inconsistent enforcement of RPOs across states can create uncertainties and hinder market growth.

Opportunities:

Opportunities:

- Technological Advancements: Innovations in renewable energy technologies can enhance efficiency and reduce costs, making renewable projects more viable and increasing the supply of RECs.

- Expansion in Rural and Remote Areas: Developing renewable energy projects in rural and remote areas can provide new opportunities for REC generation and contribute to rural electrification.

Challenges:

Challenges:

- Limited Awareness and Participation: Many small-scale renewable energy producers lack awareness about the benefits and processes involved in RECs, limiting market potential.

- Infrastructure and Grid Integration Issues: Technical challenges related to integrating renewable energy into the existing grid infrastructure need to be addressed to ensure smooth market operations.

Segmentation Analysis Analysis

Segmentation Analysis Analysis

The India renewable energy certificate market can be segmented by energy source, end-user, and region.

By Energy Source Insights

By Energy Source Insights

Based on Energy Source, the India renewable energy certificate market is divided into solar energy, wind energy, biomass, hydroelectric power, and others. Solar energy is the dominant source in the Indian REC market. India has vast solar potential, with high solar insolation levels across many regions. The government's ambitious solar capacity targets, such as the National Solar Mission, have spurred significant investments in solar projects, making it a major contributor to REC generation. Solar energy projects account for the largest share of renewable energy certificates in India, driven by large-scale solar parks and rooftop solar installations. States like Rajasthan, Gujarat, and Tamil Nadu are leading in solar capacity. The solar energy segment is expected to grow at a CAGR of approximately 15% during the forecast period (2024-2032).

Wind energy is another significant contributor to the Indian renewable energy certificate market. India has substantial wind energy potential, particularly in states like Tamil Nadu, Gujarat, Maharashtra, and Karnataka. The development of onshore and emerging offshore wind projects further enhances this segment's contribution. Wind energy projects have been a stable source of RECs, especially in states with high wind speeds.

Biomass energy, derived from organic materials, is a smaller but important segment in the REC market. This energy source includes agricultural waste, forest residues, and organic municipal solid waste. Biomass projects are particularly beneficial for rural areas, providing energy and supporting local economies. While smaller in scale compared to solar and wind, biomass projects contribute to the diversification of renewable energy sources.

Hydroelectric power includes both small and large hydro projects, although RECs are typically generated by small hydro projects (up to 25 MW) due to their classification as renewable under Indian regulations. Small hydro projects play a crucial role in rural electrification and local energy supply. Small hydro projects are spread across various states, particularly in hilly and mountainous regions.

By End-User Insights

By End-User Insights

On the basis of End-User, the India renewable energy certificate market is bifurcated into industrial, residential, commercial, and others. The industrial segment is one of the largest consumers of energy in India and is subject to stringent Renewable Purchase Obligations (RPOs). Industrial users often have significant energy demands and are mandated to source a portion of their electricity from renewable sources, driving substantial REC purchases. Industrial users dominate the REC market due to their large energy consumption and regulatory requirements. This segment includes heavy industries such as manufacturing, steel, cement, and textiles. The industrial segment is expected to grow at a CAGR of approximately 12% during the forecast period (2024-2032), driven by increasing regulatory pressure and a growing commitment to corporate sustainability.

The residential segment, although smaller in terms of individual energy consumption, represents a growing area for REC purchases, particularly as more households invest in rooftop solar and other renewable energy solutions. While not mandated by RPOs, some residential consumers voluntarily purchase RECs to support green energy initiatives. The residential segment is seeing gradual growth as awareness about renewable energy and its benefits increases. Government incentives for residential solar installations also contribute to this trend.

Commercial entities, including office buildings, shopping malls, hotels, and hospitals, are significant consumers of electricity and are increasingly participating in the renewable energy certificate market in India. Similar to industrial users, commercial entities are often obligated to meet RPOs and are also driven by corporate social responsibility (CSR) goals. The commercial segment is an important player in the REC market, with growing participation from businesses aiming to achieve sustainability targets and reduce carbon footprints.

Recent Developments:

Recent Developments:

- In June 2022, Ayana Renewable Power Pvt Ltd (Ayana) announced a major expansion in Karnataka, planning to set up 2 gigawatts (GW) of renewable energy projects with an investment of USD 1.53 billion. This significant move highlights the growing focus on clean energy solutions in India.

- In February 2021, Tata Power Renewable Energy Limited (TPREL) fortified its position in the solar sector by acquiring a 100% stake in Sterling and Wilson Private Limited's (SWPL) operational solar projects. This acquisition, valued at approximately INR 1,600 crore (around USD 219 million), added 253 MW of operating solar capacity to Tata Power's renewable energy portfolio.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 22.45 Billion |

Projected Market Size in 2032 |

USD 47.22 Billion |

CAGR Growth Rate |

8.6% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Adani Green Energy, Tata Power Renewable Energy, Suzlon Energy, NTPC Limited Ltd., Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, and Others. |

Key Segment |

By Energy Source, By End-User, and By Region |

Regions Covered in India |

North India, South India, East India, West India, Central India |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

The India Renewable Energy Certificate (REC) market in India exhibits significant regional diversity, influenced by the varying renewable energy capacities and policies across different states. Here's a detailed regional analysis with a focus on the dominating region and its expected Compound Annual Growth Rate (CAGR).

- South India dominates the India renewable energy certificate market

South India is the leading region in the India Renewable Energy Certificate (REC) market, primarily due to its substantial renewable energy capacity, particularly in wind and solar energy. States like Tamil Nadu, Karnataka, and Andhra Pradesh are key contributors.

- Tamil Nadu: Tamil Nadu is a powerhouse in wind energy, accounting for a significant portion of India's total wind capacity. The state has also been aggressive in expanding its solar capacity. With favorable government policies and incentives, Tamil Nadu is expected to see a robust growth rate, with a projected CAGR of approximately 14% during the forecast period (2024-2032).

- Karnataka: Karnataka has made significant strides in both solar and wind energy. The state has implemented several initiatives to attract investments in renewable energy, making it one of the top states in terms of installed renewable capacity. The REC market in Karnataka is expected to grow at a CAGR of around 12% during the forecast period.

- Andhra Pradesh: Andhra Pradesh is another major player with considerable investments in solar and wind energy. The state's policies and incentives for renewable energy projects have led to increased REC generation, contributing to a projected CAGR of 11%.

Western India, particularly Gujarat and Maharashtra, plays a crucial role in the Renewable Energy Certificate (REC) market in India due to its strategic policies and substantial renewable energy capacities.

- Gujarat: Gujarat has emerged as a leader in solar energy, with significant solar parks and initiatives. The state also has a considerable wind energy capacity. With ongoing projects and supportive policies, Gujarat's REC market is expected to grow at a CAGR of approximately 13% over the forecast period.

- Maharashtra: Maharashtra has a diverse renewable energy portfolio, including wind, solar, and biomass. The state's commitment to increasing its renewable energy share has spurred growth in REC generation. The REC market in Maharashtra is projected to grow at a CAGR of about 10%.

Northern and Eastern India are gradually increasing their participation in the India Renewable Energy Certificate (REC) market, driven by growing investments in solar and wind projects.

- Rajasthan: Rajasthan is a significant player in solar energy due to its high solar insolation levels. The state has seen substantial investments in large-scale solar projects. The REC market in Rajasthan is expected to grow at a CAGR of around 12%.

- Uttar Pradesh: Uttar Pradesh has been focusing on solar energy projects, aiming to increase its renewable energy capacity. The state's initiatives to promote solar energy are expected to contribute to a CAGR of approximately 9%.

- West Bengal and Odisha: These states are also making progress in renewable energy, particularly in solar and small hydro projects. The REC market in these states is anticipated to grow at a CAGR of around 8%.

Northeast India, although currently contributing a smaller share to the REC market, has emerging potential due to its untapped renewable energy resources, particularly in small hydro and biomass.

- Assam and Meghalaya: These states have started investing in renewable energy projects, focusing on small hydro and biomass. The REC market in Northeast India is expected to grow at a CAGR of approximately 7% as these projects come online.

Renewable Energy Certificate Market: List of Key Players

Renewable Energy Certificate Market: List of Key Players

The analysis-intensive report provides key insights into companies and organizations operating in the Indian renewable energy certificate market. The study further makes a relative examination of the organizations highlighting essential business parameters such as geographic presence, business overviews, product offerings, segment-based market share, operational strategies, and SWOT analysis. Recent enterprise developments including novel product launches, joint ventures, partnerships, strategic alliances, mergers & acquisitions, and product development are elaborated upon in the report. The in-depth study thus facilitates a comprehensive analysis of market competition.

Some of the main competitors dominating the Indian renewable energy certificate market include;

- Adani Green Energy

- Tata Power Renewable Energy

- Suzlon Energy

- NTPC Limited Ltd.

- Vestas Wind Systems AS

- Siemens Gamesa Renewable Energy SA

The India renewable energy certificate market is segmented as follows:

By Energy Source

By Energy Source

- Solar Energy

- Wind Energy

- Biomass

- Hydroelectric Power

- Others

By End-User

By End-User

- Industrial

- Residential

- Commercial

- Others

By Region

By Region

- North India

- South India

- East India

- West India

- Central India

Industry Major Market Players

- Adani Green Energy

- Tata Power Renewable Energy

- Suzlon Energy

- NTPC Limited Ltd.

- Vestas Wind Systems AS

- Siemens Gamesa Renewable Energy SA

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors