Search Market Research Report

In-Pipe Inspection Robots Market Size, Share Global Analysis Report, 2022 – 2028

In-Pipe Inspection Robots Market Size, Share, Growth Analysis Report By Product Type (Thickness Measuring Robot, Diameter Robot, Welding Pipe Robot, Others) By Application (Water Supply Facilities, Oil Pipeline, Gas Pipeline, Plant), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

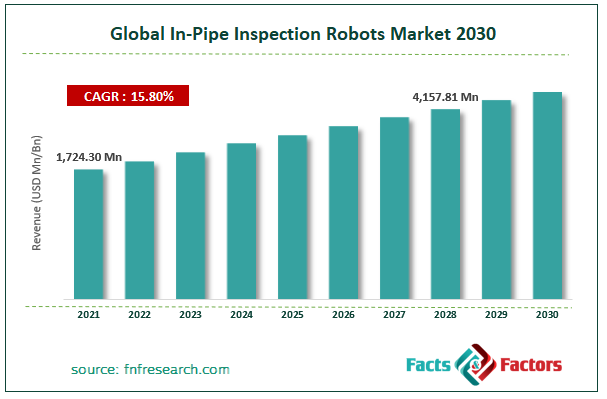

[210+ Pages Report] According to Facts and Factors, the global in-pipe inspection robots market size was worth USD 1,724.30 million in 2021 and is estimated to grow to USD 4157.81 million by 2028, with a compound annual growth rate (CAGR) of approximately 15.80% over the forecast period. The report analyzes the in-pipe inspection robots market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the in-pipe inspection robots market.

Market Overview

Market Overview

Robots are often developed to replace human labor in demanding and dangerous workplaces. The robots are also used to explore hot-weather locales and remote workplaces. Additionally, because pipelines carry dangerous chemicals and fluids and have a small interior diameter that prevents humans from accessing them, robots are utilized to inspect pipes. Due to the intricate internal structure of pipes and the hazardous compounds they contain, robotic inspection, measurement of the rust proportion in pipes, sludge sample, and development of scale on the internal pipe surface are needed. Robots used for in-pipe inspection are useful for analyzing the debris produced inside the pipe. These robots communicate with the in-pipe inspection robot's controller via video answers sent from the ground.

Customers can assess the true state of the pipe and gauge the depth of encrustation on its walls through this. These robots are designed to function in environments requiring extreme skill and can operate in hazardous environments. This is one of the main drivers propelling the market for in-pipe inspection robots. Since the pipeline is constrained by numerous environmental conditions that restrict the aspect of examination inside them, it is thought to be a good methodology to inspect using in-pipe inspection robots.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic severely impacted almost every industry. Activities were terminated due to restricted movement. On a worldwide scale, supply networks were impeded. This resulted in a decrease in in-pipe inspection robot manufacturing and market demand, limiting the growth of the in-pipe inspection robot market. Furthermore, all government and private sector financing and concentration have shifted to the healthcare industry, limiting market expansion.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global in-pipe inspection robots market value is expected to grow at a CAGR of 15.80% over the forecast period.

- In terms of revenue, the global in-pipe inspection robots market size was valued at around USD 1,724.30 million in 2021 and is projected to reach USD 4157.81 million by 2028.

- These robots are designed to function in environments requiring extreme skill and can operate in hazardous environments. This is one of the main drivers propelling the market for in-pipe inspection robots.

- By product type, the diameter robot category dominated the market in 2021.

- By application, the gas pipeline category dominated the market in 2021.

- The Asia Pacific dominated the global in-pipe inspection robots market in 2021.

Growth Drivers

Growth Drivers

- Flourishing petrochemical activities drive the market growth

Due to the petrochemical industry's heavy reliance on pipelines for transportation, the in-pipe inspection robot market is expected to increase throughout the forecast period. Additionally, the pipeline needs regular maintenance and inspection because pollution of the oil and gas in the pipeline might have disastrous effects. Furthermore, huge one-time investments in the deployment of in-pipe inspection robots can further boost the market growth as the product will deliver accurate & exact results along with creating positive cash flow during the forecast period. Additionally, manually examining the pipelines takes a long time, needs large personnel, and costs the company a lot of money. All the factors above will aid in the market's scaling-up ascent to new heights during the anticipated time frame.

Restraints

Restraints

- Restricted movement of inspection robots inside T-shaped pipes may hinder the market growth

The market for in-pipe inspection robots is anticipated to encounter various difficulties, including a large initial outlay of funds and restricted movement inside T-shaped pipes. Over the forecast period, this is anticipated to have a detrimental effect on in-pipe inspection robots. Furthermore, the in-pipe inspection robot's inspection and maintenance procedures need enormous costs, which businesses find difficult to provide, consequently limiting the market's expansion.

Segmentation Analysis

Segmentation Analysis

The global in-pipe inspection robot market has been segmented into product types and applications.

Based on product type, the market is segregated into thickness measuring robots, diameter robots, welding pipe robots and others. In 2021, the diameter robot segment dominated the global in-pipe inspection robot market. The capacity of the diameter robots to go through tiny pipes is responsible for the segment's rise throughout the projection period. They can also analyze and carry out tasks in various pipeline sizes, ranging from 150 to 5000 millimeters.

Based on the application, the market is segregated into water supply facilities, oil pipelines, gas pipelines and plants. In 2021, the gas pipeline will dominate the global in-pipe inspection robots market. The development of a wax-like substance on the pipeline walls is the primary cause of the increase in the use of in-pipe inspection robots in gas pipeline applications. Due to changes in the temperature of the pipeline wall, this deposition happens often. Due to the flow's negative radial temperature gradient, a crystalline or wax-like substance may accumulate on the pipeline walls. In gas pipes, deposition on the walls occurs more frequently. Thus, the examination of gas pipelines makes extensive use of in-pipe inspection robots.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1,724.30 Million |

Projected Market Size in 2028 |

USD 4157.81 Million |

CAGR Growth Rate |

15.80% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

CUES Inc., Envirosight LLC, GE Inspection Robotics, IBAK Helmut Hunger GmbH & Co. KG., MISTRAS Group Inc., RIEZLER Inspektions Systeme GmbH & Co. KG, Medit Inc. (Fiberscope), RedZone Robotics Inc., Inuktun Services Ltd., Xylem Inc., Honeybee Robotics Ltd., and Others |

Key Segment |

By Product Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- The Asia Pacific dominated the in-pipe inspection robots market in 2021

In 2021, Asia Pacific will dominate the global in-pipe inspection robots market. The expansion of investment in petrochemical product transportation through the pipeline network drives the market growth for in-pipe inspection robots in the Asia Pacific region. In the Asia Pacific, this is predicted to open up a lot of prospects for in-pipe inspection robots. The massive funding allocated for infrastructural expansion and the region's extensive industry further contribute to its rise. Asian nations like Japan, China, and India are projected to present the region's industry with tremendous growth opportunities. The market is expanding due to rising programs to reduce greenhouse gas emissions and the desire for energy-efficient alternatives, both of which call for the widespread usage of in-pipe inspection robots.

Competitive Landscape

Competitive Landscape

- CUES Inc.

- Envirosight LLC

- GE Inspection Robotics

- IBAK Helmut Hunger GmbH & Co. KG.

- MISTRAS Group Inc.

- RIEZLER Inspektions Systeme GmbH & Co. KG

- Medit Inc. (Fiberscope)

- RedZone Robotics Inc.

- Inuktun Services Ltd.

- Xylem Inc.

- Honeybee Robotics Ltd.

Global In-pipe Inspection Robots Market is segmented as follows:

By Product Type

By Product Type

- Thickness Measuring Robot

- Diameter Robot

- Welding Pipe Robot

- Others

By Application

By Application

- Water Supply Facilities

- Oil Pipeline

- Gas Pipeline

- Plant

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- CUES Inc.

- Envirosight LLC

- GE Inspection Robotics

- IBAK Helmut Hunger GmbH & Co. KG.

- MISTRAS Group Inc.

- RIEZLER Inspektions Systeme GmbH & Co. KG

- Medit Inc. (Fiberscope)

- RedZone Robotics Inc.

- Inuktun Services Ltd.

- Xylem Inc.

- Honeybee Robotics Ltd.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors