Search Market Research Report

HVAC Equipment Market Size, Share Global Analysis Report, 2023 – 2030

HVAC Equipment Market Size, Share, Growth Analysis Report By Type (Air Conditioning Equipment, Heat Pumps, Humidifiers/Dehumidifiers, and Heating Equipment), By End-User (Residential, Commercial, and Industrial), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

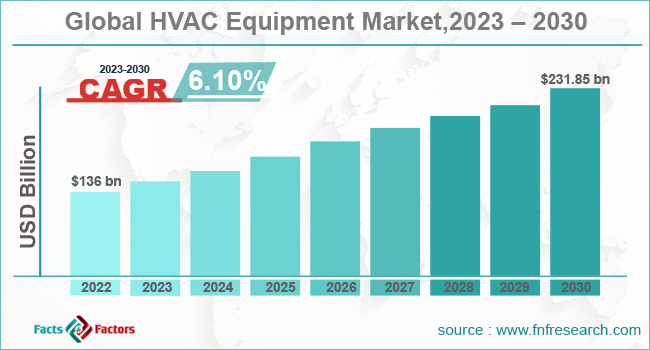

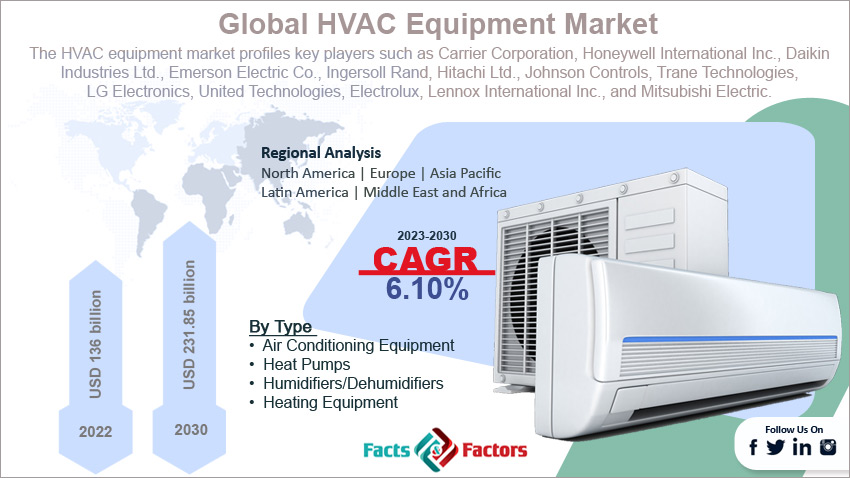

[212+ Page Report] According to the report published by Facts & Factors, the global HVAC equipment market size was evaluated at $136 billion in 2022 and is slated to hit $231.85 billion by the end of 2030 with a CAGR of nearly 6.1% between 2023 and 2030. The market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global marketspace.

The HVAC equipment industry report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, PESTEL analysis, SWOT analysis, Porter’s five force analysis, and value chain analysis. Additionally, the HVAC equipment market report explores the investor and stakeholder space to help companies make data-driven decisions.

Market Overview

Market Overview

HVAC equipment is an indoor & vehicle environment comfort technology providing thermal comfort and adequate indoor air quality. Reportedly, HVAC plays a key role in residential buildings that include apartments, hostels, medium-range & large industrial buildings, senior living units, hospitals, single-family households, skyscrapers, submarines, trains, and ships.

Reportedly, HVAC device offers the necessary heating environment at cost-efficient prices. Moreover, the HVAC sector is aiming to offer cost-efficient devices for fulfilling the energy requirements of commercial & industrial sectors along with fulfilling the green energy needs of its end-users, thereby driving the demand for HVAC equipment.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global HVAC equipment market is projected to expand annually at the annual growth rate of around 6.1% over the forecast timespan (2023-2030)

- In terms of revenue, the global HVAC equipment market size was evaluated at nearly $136 billion in 2022 and is expected to reach $231.85 billion by 2030.

- The global HVAC equipment market is anticipated to record massive growth over the forecast period owing to a rise in construction activities in residential and commercial sectors.

- Based on type, the air conditioning equipment segment is predicted to contribute majorly towards the global market share over the forecast timeline.

- On the basis of end-user, the residential segment is set to register the fastest CAGR over the period from 2023 to 2030.

- Region-wise, the Asia-Pacific HVAC equipment market is projected to register the highest CAGR during the assessment period.

Industry Growth Factors

Industry Growth Factors

- Growing product penetration in commercial & residential constructions to boost the global market trends

Rise in construction activities in residential and commercial sectors will drive the growth of the HVAC equipment market across the globe. A large number of HVAC equipment including heat pumps, boilers, air-cooled chillers, and furnaces are used in residential & commercial structures. Surge in demand for heating and cooling equipment will bolster the expansion of the market globally.

Humungous demand for technologically innovative products in power-efficient HVAC systems will elevate the global market demand. Apparently, seasonal fluctuations have led to large-scale demand for HVAC equipment across the globe.

Furthermore, the rise in urbanization and industrialization across the globe has translated into immense demand for HVAC equipment in recent years. Integrating smart systems with HVAC tools will enlarge the scope of the growth of the global market.

Restraints

Restraints

- Rise in energy consumption by the product to put brakes on the global industry expansion

Growing power usage by HVAC equipment is likely to decimate the growth of the global HVAC equipment industry. Lack of a skilled workforce can further decline the expansion of the global industry.

Opportunities

Opportunities

- Demand for sustainable products to open new vistas of growth for the global market

Growing demand for smart households is likely to offer new growth avenues for the global HVAC equipment market in the years ahead. Large-scale use of green systems is projected to shape the growth of the market across the globe in the forthcoming years.

Challenges

Challenges

- Huge component costs to be a major threat to the global industry surge over 2023-2030

Rise in costs of products as well as raw materials can pose a big threat to the expansion of the global HVAC equipment industry. Changes in government regulations can impact the growth of the industry across the globe.

Segmentation Analysis

Segmentation Analysis

The global HVAC equipment market is sectored into type, end-user, and region.

In terms of type, the global HVAC equipment market is sectored into air conditioning equipment, heat pumps, humidifiers/dehumidifiers, and heating equipment segments. Furthermore, the air conditioning equipment segment, which accounted for more than 50% of the global market share in 2022, is set to maintain its segmental dominance in the forecast time interval.

The segmental expansion in the next few years can be a result of technological innovation in the HVAC equipment featuring IoT-based integration with HVAC systems, smaller units, and remote functioning helping in cost-savings and enhancement in energy efficiency as well as comfort.

On the basis of end-user, the global HVAC equipment industry is divided into residential, commercial, and industrial segments. Moreover, the residential segment, which accounted for over 40% of the global industry share in 2022, is predicted to register the fastest CAGR in the upcoming years. The segmental expansion over the forecast timeline can be attributed to the large-scale deployment of HVAC equipment in tenements, flats, row houses, and apartments.

Recent Breakthroughs:

Recent Breakthroughs:

- In the second half of 2022, Therma-HEXX Corporation, a key U.S-based firm in the heating equipment supplying business, introduced ThermaPANEL, a modular hydronic heat exchanging system. Reportedly, the new product is likely to be used in commercial, industrial, and residential sectors. The move will boost the growth of the HVAC equipment market across the globe.

- In the first half of 2022, Johnson Controls International PLC, a U.S.-based firm manufacturing HVAC equipment, introduced Next-Generation YORK® Residential Package Equipment. The move is likely to contribute majorly towards the global HVAC equipment industry earnings in the coming years.

- In the third quarter of 2022, Daikin Industries, Ltd., decided to make investments of about $291 million for setting up a new heat pump manufacturing unit in Poland. The move will help in expanding the HVAC equipment manufacturing business of the firm in Poland.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 136 Billion |

Projected Market Size in 2030 |

USD 231.85 Billion |

CAGR Growth Rate |

6.10% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Carrier Corporation, Honeywell International Inc., Daikin Industries Ltd., Emerson Electric Co., Ingersoll Rand, Hitachi Ltd., Johnson Controls, Trane Technologies, LG Electronics, United Technologies, Electrolux, Lennox International Inc., Mitsubishi Electric., and others. |

Key Segment |

By Type, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Insights

Regional Insights

- Asia-Pacific HVAC Equipment market to register the highest CAGR over the forecast period

Asia-Pacific, which accounted for more than 61% of the global HVAC equipment market revenue in 2022, is anticipated to record the highest CAGR during the assessment timeline. The regional market expansion over 2023-2030 can be due to a rise in demand for HVAC equipment from the residential sectors in the countries such as India and China.

Moreover, the thriving energy sector in the sub-continent has resulted in the growing demand for heating equipment, thereby driving regional market trends.

Furthermore, the North American HVAC equipment industry is set to witness mammoth growth in the forecasting years. The factors that are likely to determine the growth of the regional market include the presence of giant players in the countries such as the U.S. and Canada.

Competitive Space

Competitive Space

- Carrier Corporation

- Honeywell International Inc.

- Daikin Industries Ltd.

- Emerson Electric Co.

- Ingersoll Rand

- Hitachi Ltd.

- Johnson Controls

- Trane Technologies

- LG Electronics

- United Technologies

- Electrolux

- Lennox International Inc.

- Mitsubishi Electric

The global HVAC Equipment market is segmented as follows:

By Type

By Type

- Air Conditioning Equipment

- Heat Pumps

- Humidifiers/Dehumidifiers

- Heating Equipment

By End-User

By End-User

- Residential

- Commercial

- Industrial

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Carrier Corporation

- Honeywell International Inc.

- Daikin Industries Ltd.

- Emerson Electric Co.

- Ingersoll Rand

- Hitachi Ltd.

- Johnson Controls

- Trane Technologies

- LG Electronics

- United Technologies

- Electrolux

- Lennox International Inc.

- Mitsubishi Electric

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors