Search Market Research Report

Autosamplers Market Size, Share Global Analysis Report, 2024 – 2032

Autosamplers Market Size, Share, Growth Analysis Report By Product (Autosampler Systems [Liquid Handling Autosamplers, Headspace Autosamplers, Solid Phase Microextraction (SPME) Autosamplers, Other] & Autosampler Accessories [Vials, Syringes, Needles, and Other Consumables]), By End User (Pharmaceutical and Biotechnology Companies, Chemical Industries, Food and Beverage Industry, Environmental Testing Industry, and Others),And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

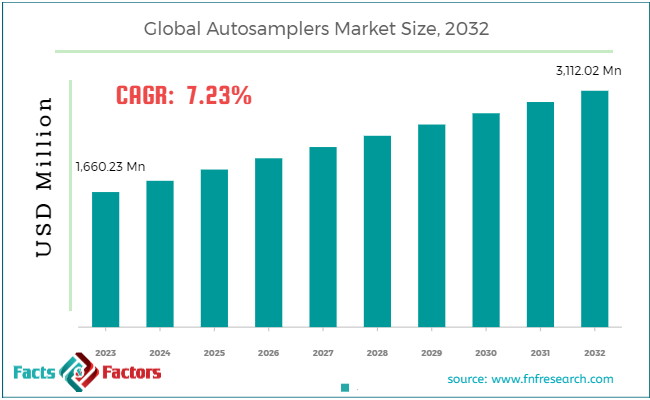

[250+ Pages Report] According to Facts & Factors, the global autosamplers market size in terms of revenue was valued at around USD 1,660.23 million in 2023 and is expected to reach a value of USD 3,112.02 million by 2032, growing at a CAGR of roughly 7.23% from 2024 to 2032. The global autosamplers market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Autosamplers are critical components in modern analytical laboratories that automate the sampling process, improving efficiency, accuracy, and reproducibility. They are essentially robotic arms that can precisely select, transport, and inject samples into instruments like gas chromatographs (GC) and high-performance liquid chromatography (HPLC) for analysis. Autosamplers free up scientists' time by automating repetitive tasks, allowing them to focus on other crucial aspects of their research or analysis.

By eliminating human error in sample handling, autosamplers ensure consistent and precise sample injection, leading to more reliable and reproducible data. They enable the processing of large numbers of samples in a shorter timeframe, significantly increasing laboratory productivity.

Key Highlights

Key Highlights

- The autosamplers market has registered a CAGR of 7.23% during the forecast period.

- In terms of revenue, the global autosamplers market was estimated at roughly USD 1,660.23 million in 2023 and is predicted to attain a value of USD 3,112.02 million by 2032.

- The growth of the autosamplers market is being propelled by the increasing importance of chromatography in drug approvals.

- On the basis of Product, the autosampler systems segment dominates the market.

- Based on End User, the pharmaceutical and biotechnology companies segment is the fastest-growing due to increased R&D activities.

- By region, the Asia Pacific region is experiencing rapid growth due to rising government investments in healthcare and environmental monitoring.

Key Growth Drivers:

Key Growth Drivers:

- Increased automation in laboratories: Autosamplers automate the process of sample injection, leading to improved efficiency, reduced human error, and increased laboratory throughput. This is particularly beneficial in high-throughput screening and routine analysis.

- Growing importance of chromatography in drug approvals: Chromatography is a crucial analytical technique used in the development and approval of new drugs. Increased investment in drug discovery and development is driving the demand for autosamplers, which are essential for automating sample injection in chromatographic analyses.

- Rising environmental concerns: Regulatory requirements for environmental monitoring and analysis are increasing the demand for autosamplers in environmental testing laboratories. These instruments aid in precise and automated sample analysis for various environmental contaminants.

Restraints:

Restraints:

- High upfront cost: Autosamplers, especially high-end models with advanced features, can be expensive for smaller laboratories or those with limited budgets. This can hinder market growth, particularly in developing regions.

- Lack of skilled personnel: Operating and maintaining sophisticated autosamplers requires specialized knowledge and training. The lack of skilled personnel in some regions can create challenges for laboratories considering adopting these technologies.

Opportunities:

Opportunities:

- Technological advancements: Advancements in microfluidics miniaturization, integration with other analytical instruments, and the development of user-friendly interfaces are creating opportunities for the development of more accessible and cost-effective autosamplers.

- Emerging markets: Growing economies in the Asia Pacific region, coupled with increasing investments in life sciences research and environmental monitoring, present significant growth opportunities for the autosamplers market.

- Increased demand for remote analysis: The growing trend of remote analysis in laboratories and environmental monitoring is creating a demand for portable and remotely operated autosamplers.

Challenges:

Challenges:

- Stringent regulatory requirements: Stringent regulations for data integrity and instrument validation in regulated industries like pharmaceuticals can create challenges for the adoption of new autosamplers, as validation processes can be time-consuming and expensive.

- Competition from low-cost alternatives: The emergence of low-cost, non-branded autosamplers from emerging markets may pose a challenge to established players in the market.

Autosamplers Market: Segmentation Analysis

Autosamplers Market: Segmentation Analysis

The global autosamplers market is segmented based on Product, End User, and region.

By Product Insights

Based on Product, the global autosamplers market is bifurcated into autosampler systems and autosampler accessories. The autosampler systems segment dominates the market, accounting for over 72.6% revenue share in 2023, and is expected to grow at the fastest CAGR of 7.9% due to its comprehensive functionality and efficiency.

These are complete units with integrated injection functionalities and offer faster processing and higher accuracy. The autosampler accessories segment includes vials, syringes, needles, and other consumables used with autosamplers. It contributes significantly to the market but holds a smaller share compared to systems.

By End User Insights

Based on End User, the global autosamplers market is categorized into pharmaceutical and biotechnology companies, chemical industries, food and beverage industry, environmental testing industry, and others. The pharmaceutical and biotechnology companies segment is the largest and fastest-growing with a CAGR of 8.1% due to increased R&D activities and rising demand for automation in drug discovery and development. The chemical industries segment utilizes autosamplers for quality control, environmental monitoring, and process analysis. The food and beverage industry segment uses autosamplers to ensure food safety and quality control.

Recent Developments:

Recent Developments:

- May 2022: Agilent Technologies Inc. partnered with APC Ltd. in May 2022 to merge their technologies and offer specialized workflows to customers for automated process analysis using liquid chromatography (LC).

- February 2022: Thermo Scientific introduced a new range of chromatography and mass spectrometry consumables named SureStart in February 2022. The collection comprises caps, vials, inserts, kits, healthy plates, and mats, as stated by the business. The SureStart product line is compatible with all add-ons and chromatography autosamplers, enabling analysts to utilize the expanded portfolio regardless of the instrument vendor.

- January 2022: Bruker Corporation acquired Prolab Instruments GmbH in January 2022. Prolab is a Swiss technology business that specializes in low-flow, high-precision liquid chromatography technology, and equipment.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 1,660.23 Million |

Projected Market Size in 2032 |

USD 3,112.02 Million |

CAGR Growth Rate |

7.23% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Agilent Technologies, Bio-Rad Laboratories Inc., Gilson Inc., PerkinElmer Inc., Restek Corporation, Shimadzu Corporation, Thermo Fisher Scientific Inc., Waters Corporation, Merck KGaA, Teledyne ISCO, and Others. |

Key Segment |

By Product, By End User, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Autosamplers Market: Regional Analysis

Autosamplers Market: Regional Analysis

- Asia Pacific (APAC): Based on the CAGR, the Asia Pacific (APAC) region is expected to be the fastest-growing market for autosamplers, with a CAGR of over 8.4% due to factors like rising disposable incomes, rapid economic growth, and increasing investments in healthcare and environmental sectors. China and India are expected to be the key growth drivers in this region.

- North America: Currently holds the dominant position in the autosamplers market due to the presence of major players, well-developed research infrastructure, and high adoption of advanced technologies. However, the growth rate is expected to be moderate due to market saturation.

- Europe: This region holds a significant share of the autosamplers market due to stringent regulations and a high focus on quality control in various industries. The market is expected to grow steadily due to increasing government funding for research activities.

- Rest of the World (RoW): This region is expected to experience moderate growth due to the presence of emerging economies with growing research activities and increasing investments in laboratory infrastructure.

Autosamplers Market: Competitive Landscape

Autosamplers Market: Competitive Landscape

Some of the major players in the global autosamplers market include:

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- Gilson, Inc.

- PerkinElmer, Inc.

- Restek Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

- Merck KGaA

- Teledyne ISCO

The global Autosamplers market is segmented as follows:

By Product Segment Analysis

By Product Segment Analysis

- Autosampler Systems

- Liquid Handling Autosamplers

- Headspace Autosamplers

- Solid Phase Microextraction (SPME) Autosamplers

- Other

- Autosampler Accessories

- Vials

- Syringes

- Needles

- Other Consumables

By End User Segment Analysis

By End User Segment Analysis

- Pharmaceutical and Biotechnology Companies

- Chemical Industries

- Food and Beverage Industry

- Environmental Testing Industry

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Agilent Technologies

- Bio-Rad Laboratories Inc.

- Gilson Inc.

- PerkinElmer Inc.

- Restek Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

- Merck KGaA

- Teledyne ISCO

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors