Search Market Research Report

Insurance Analytics Market Size, Share Global Analysis Report, Analytics Market By End-Users (Third-Party Administrators, Government Agencies, Insurance Companies, And Others), By Enterprise Size (Small & Medium Enterprises And Large Enterprises), By Deployment Model (Cloud And On-Premise), By Applications (Customer Management & Personalization, Process Optimization, Risk Management, Claim Management, And Others), By Components (Services And Tools), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast, 2024 to 2032

Insurance Analytics Market By End-Users (Third-Party Administrators, Government Agencies, Insurance Companies, And Others), By Enterprise Size (Small & Medium Enterprises And Large Enterprises), By Deployment Model (Cloud And On-Premise), By Applications (Customer Management & Personalization, Process Optimization, Risk Management, Claim Management, And Others), By Components (Services And Tools), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast, 2024 to 2032

Industry Insights

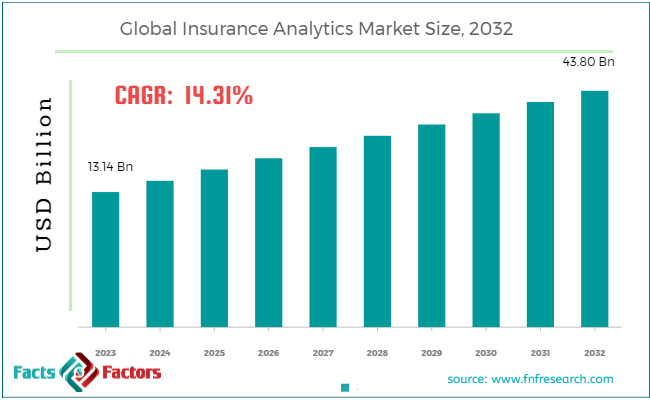

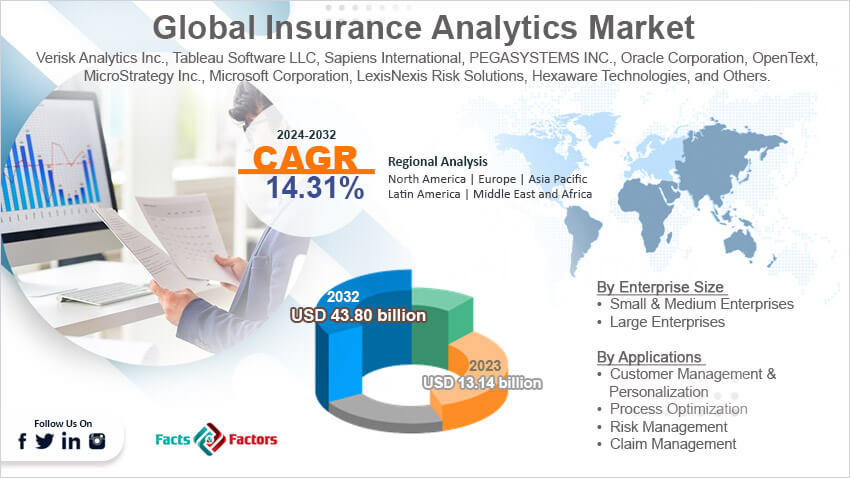

[228+ Pages Report] According to Facts and Factors, the global insurance analytics market size was valued at USD 13.14 billion in 2023 and is predicted to surpass USD 43.80 billion by the end of 2032. The insurance analytics industry is expected to grow by a CAGR of 14.31% between 2024 and 2032.

Market Overview

Market Overview

Insurance analytics refers to the usage of different data analytic tools and techniques to find valuable information, optimize operations, and make informed decisions. Insurance analytics help businesses in data integration from diverse sources. Also, it uses statistical algorithms to predict future patterns and risk probabilities. Therefore, it helps insurers to customize their marketing strategy accordingly.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global insurance analytics market size is estimated to grow annually at a CAGR of around 14.31% over the forecast period (2024-2032).

- In terms of revenue, the global insurance analytics market size was valued at around USD 13.14 billion in 2023 and is projected to reach USD 43.80 billion by 2032.

- Growing analytical data is driving the growth of the global insurance analytics market.

- Based on the end-users, the insurance companies segment is growing at a high rate and is projected to dominate the global market.

- Based on the enterprise size, the large size enterprises segment is projected to swipe the largest market share.

- Based on the deployment model, the cloud segment is expected to dominate the global market.

- Based on the applications, the risk management segment is expected to dominate the global market.

- Based on the components, the service segment is projected to witness huge growth in the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing analytical data is expected to propel the growth of the market.

The insurance sector is exposed to a vast amount of data from different sources. Therefore, in order to analyze and drive insights from big data sets, it is vital to improve customer experience in risk management and make data-driven decisions.

Additionally, the integration of advanced technologies like artificial intelligence and machine learning also helps streamline and automate tasks, thereby helping companies offer more personalized products and services. Also, predictive analytics help users identify the potential risks and future parts in order to optimize the risks.

Moreover, customer-centric strategies help end users with customer behaviors and improve overall satisfaction. Therefore, such a landscape is expected to accentuate the growth of the global insurance analytics market during the forecast period. For instance, MS Amlin Insuarance S.E. adopted Sapein in February 2023. IDITSuite from Sapein is an award-winning modular insurance platform driven by technology.

Restraints

Restraints

- Data privacy is expected to hamper the growth of the global market.

The insurance sector deals with a vast amount of personal and sensitive information, which creates security concerns among people, which in turn is expected to hinder the growth of the insurance analytics industry during the forecast period.

However, lack of professional skill is another major variant in the industry. The deployment of insurance analytics technology needs expertise and skilled professionals, and therefore, it is expected to slow down the growth trajectory of the insurance analytics industry.

Opportunities

Opportunities

- Digital transformation is expected to foster growth opportunities in the global market.

The ongoing digital transformation is expected to foster growth in the global insurance analytics market by propelling the adoption of analytics among people globally. Insurers leverage digitization to meet evolving market demands.

However, the growing cyber security concerns are also encouraging people to adopt insurance analytics in order to improve cyber security preparedness. For instance, LexisNexis Risk Solutions came up with Gravitas Network in October 2022. This product is a real-world data hub that works by connecting technologies and data sets from strategic data partners.

Challenges

Challenges

- Integration is a big challenge in the global market.

Insurance companies still work on existing frameworks that are compatible with modern analytic solutions. Therefore, integration with legacy infrastructure is a big challenge in the global insurance analytics market. Also, integrating and renovating the whole infrastructure with analytics tools can be costly and complex.

Segmentation Analysis

Segmentation Analysis

The global insurance analytics market can be segmented into end-users, enterprise size, deployment model, applications, components, and region.

By end-users, the market can be segmented into third-party administrators, government agencies, insurance companies, and others. The insurance companies segment is projected to grow significantly during the forecast period. The growing awareness among people regarding the benefits of insurance is leading to the high demand for insurance companies in the market.

Moreover, the advancements in technologies like machine learning, artificial intelligence, and data analytics are further anticipated to enhance the operational efficacy of insurance companies by streamlining their processes and swiping a large market area. Digital transformation is the key to growth in the market. Companies are embracing digital transformation by offering higher customer engagement rates and online services, thereby facilitating enhanced consumer experiences.

By enterprise size, the market can be segmented into small & medium enterprises and large enterprises. Large-scale enterprises segment accounts for the largest share of the insurance analytics industry during the forecast period. Large organizations have more financial resources than small organizations.

Therefore, they can easily invest in insurance policies that cover a larger number of risks. Also, large-size organizations indulge in complex operations and, therefore, need insurance to cover the risk associated with diverse assets. Big organizations operate on a global scale, which also drives high demand for insurance products to cover global risks.

By deployment model, the market can be segmented into cloud and on-premise. The cloud segment is expected to dominate the global insurance analytics market during the anticipated period. The rising need for cloud-based solutions because of the requirement for scalability and flexibility with existing systems is driving the growth of the segment.

Moreover, the cloud-based solutions are cost-effective, which helps insurance companies lower the need for physical infrastructure and maintenance costs. Therefore, it is expected to foster growth opportunities in the segment.

By applications, the market can be segmented into customer management & personalization, process optimization, risk management, claim management, and others. The risk management segment is likely to grow with a high CAGR in the forthcoming years. Growing awareness among businesses regarding the evolving nature of risk is boosting the demand for comprehensive risk management solutions.

Also, the regulatory landscape in different regions across the world poses a huge burden on businesses to comply with various standards and regulations. Therefore, companies look forward to efficient risk management solutions to avoid legal and financial consequences.

By component, the market can be segmented into services and tools. The service segment is expected to witness a high growth rate in the forthcoming years. There is a growing practice of outsourcing non-core functions to let the businesses specializing in certain services focus on their core competencies, which, in turn, is a primary reason for the high growth rate of the segment.

Also, the digital transformation across different end-user sectors led to the growing need for advice to navigate the complex market challenges, and therefore, it is expected to foster growth opportunities in the segment. The managed service providers also support the growth of the segment by offering comprehensive solutions for IT management and service security. All these factors are anticipated to propel the growth of the segment during the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 13.14 Billion |

Projected Market Size in 2032 |

USD 43.80 Billion |

CAGR Growth Rate |

14.31% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Verisk Analytics Inc., Tableau Software LLC, Sapiens International, PEGASYSTEMS INC., Oracle Corporation, OpenText, MicroStrategy Inc., Microsoft Corporation, LexisNexis Risk Solutions, Hexaware Technologies, and Others. |

Key Segment |

By End-Users, By Enterprise Size, By Deployment Model, By Applications, By Components, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America accounts for the largest share of the global insurance analytics market. The region is focusing strongly on leveraging analytics for customer engagement, risk management, and decision-making, particularly in regions like the United States and Canada. The region is at the forefront of technological innovations. Organizations in the region are adopting data analytics, machine learning, and artificial intelligence technologies to strengthen their business and attract a wider customer base in the market.

Analytics help insurers extract deep insights into customer behavior and preferences. This personalized approach to products and services is attracting a large customer base in the North American market. Insurance analytics play a vital role in risk management. People are looking forward to prevention and fraud detection applications, thereby driving huge growth in the regional market.

Asia Pacific is expected to see significant developments in the coming years. The growth is largely driven by the growing awareness regarding the benefits of insurance and analytics. The fast expansion of the insurance industry in the region is expected to support the growth of the regional market. The demand for analytic solutions to improve engagement rate, claim processing, and underwriting is anticipated to support the growth of the regional market.

Also, insurers in the region are adopting customer-centric approaches. Vendors in the region use analytics to extract customer behavior, thereby offering personalized solutions to end users. For instance, One Inc. and Guidewire collaborated in October 2022 to offer insurers to hasten the delivery of a smooth payment experience for suppliers, agents, adjusters, and clients.

Competitive Analysis

Competitive Analysis

The key players in the global insurance analytics market include:

- Verisk Analytics Inc.

- Tableau Software LLC

- Sapiens International

- PEGASYSTEMS INC.

- Oracle Corporation

- OpenText

- MicroStrategy Inc.

- Microsoft Corporation

- LexisNexis Risk Solutions

- Hexaware Technologies

For instance, IBM renovated its Business Analytics Enterprise hub in November 2022 by coming up with new analytics tools to help organizations in avoiding data silos so that companies can make data-driven choices to navigate business bottlenecks.

The global insurance analytics market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Third-Party Administrators

- Government Agencies

- Insurance Companies

- Others

By Enterprise Size Segment Analysis

By Enterprise Size Segment Analysis

- Small & Medium Enterprises

- Large Enterprises

By Deployment Model Segment Analysis

By Deployment Model Segment Analysis

- Cloud

- On-Premise

By Applications Segment Analysis

By Applications Segment Analysis

- Customer Management & Personalization

- Process Optimization

- Risk Management

- Claim Management

- Others

By Components Segment Analysis

By Components Segment Analysis

- Services

- Tools

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Verisk Analytics Inc.

- Tableau Software LLC

- Sapiens International

- PEGASYSTEMS INC.

- Oracle Corporation

- OpenText

- MicroStrategy Inc.

- Microsoft Corporation

- LexisNexis Risk Solutions

- Hexaware Technologies

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors