17-Jun-2020 | Facts and Factors

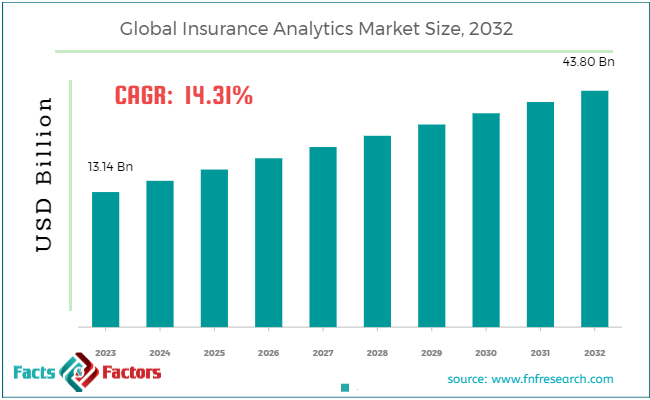

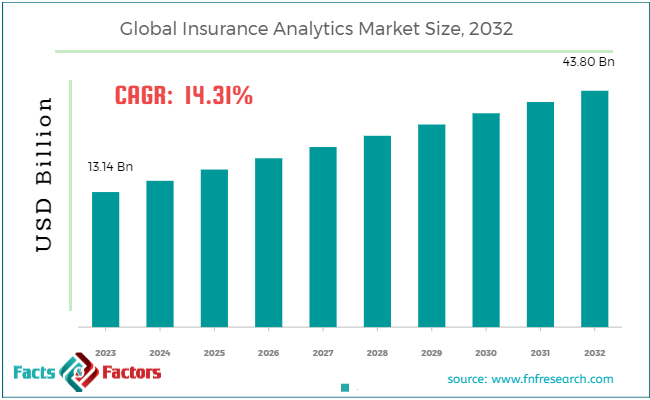

Findings from Facts and Factors report “Insurance Analytics Market By End-Users (Third-Party Administrators, Government Agencies, Insurance Companies, And Others), By Enterprise Size (Small & Medium Enterprises And Large Enterprises), By Deployment Model (Cloud And On-Premise), By Applications (Customer Management & Personalization, Process Optimization, Risk Management, Claim Management, And Others), By Components (Services And Tools), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast, 2024 to 2032” states that the global Insurance Analytics market in 2023 was approximately USD 13.14 Billion. The market is expected to grow at a CAGR of 14.31% and is anticipated to reach around USD 43.80 Billion by 2032.

Analytics supports insurers by providing data and smart knowledge about life insurance. The insurance industry produces massive quantities of data such as for an individual who is insured by a term plan and will experience several life changes including work assignments, personal milestones such as marriage and having children, resulting in various data regarding changing heath and income parameters. Insurance firms should evaluate and use this knowledge because it will assist them to forecast their consumer actions and future insurance product demand.

Browse the full “Insurance Analytics Market By End-Users (Third-Party Administrators, Government Agencies, Insurance Companies, And Others), By Enterprise Size (Small & Medium Enterprises And Large Enterprises), By Deployment Model (Cloud And On-Premise), By Applications (Customer Management & Personalization, Process Optimization, Risk Management, Claim Management, And Others), By Components (Services And Tools), And By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast, 2024 to 2032" https://www.fnfresearch.com/insurance-analytics-market

Rising adoption of the advanced analytics techniques and data driven decision making process are the major factors expected to drive the global insurance analytics market. In addition, increasing demand for the advanced analytical technologies across various applications such as marketing, banking, and healthcare sector. However, uncertainty in the market and rising cost of policies are estimated to hinder the growth of the global insurance analytics market. Nonetheless, the strategy of focusing more on customer needs, lifestyle and offering customized coverage policies by insurers are expected to open new alluring opportunities in the market.

By components, the global insurance analytics market is divided into tools and services. The services segment is estimated to register major market share over the forecast period, owing to the high demand for the analytics solutions in the managed and professional services across various enterprises. On the basis of business application, the global insurance analytics market is further classified into risk management, claims management, process optimization, customer management and personalization, and others. Furthermore, the market has been bifurcated into on-premises and on-cloud in terms of deployment.

The demand for on-cloud insurance analytics solutions is estimated to grow at high CAGR, due to its easy accessibility and cost effective features. In terms of end-user, the market has been fragmented into insurance companies, government agencies, and third-party administrators, brokers, and consultancies. The third party administrator, brokers, and consultancies segment is estimated to grow at highest rate over the forecast period, due to the ability to handle water damage, construction defect, restoration, general liability, property and casualty and automobile. It acts as a buffer between customers and insurers.

North America emerged as dominating region in 2023, and it is expected to continue its dominance over the projected years. The growth is primarily attributed to the presence of developed countries such as U.S. and Canada along with the strong focus on the modernizations in technology and research and development across various applications. In addition, the presence of major players in the U.S. such as IBM, Microsoft, Oracle, and SAP also contributes in providing analytics solutions across various verticals.

Europe is expected to witness noticeable growth in the market over the forecast years due to the increasing adoption of the analytics solutions and deployment of artificial intelligence by the insurance organizations across various verticals in the region. Asia Pacific is expected to be the fastest growing market over the projected period owing to the rapid digitalization and rising adoption of cloud based technologies.

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 13.14 Billion |

Projected Market Size in 2032 |

USD 43.80 Billion |

CAGR Growth Rate |

14.31% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Verisk Analytics Inc., Tableau Software LLC, Sapiens International, PEGASYSTEMS INC., Oracle Corporation, OpenText, MicroStrategy Inc., Microsoft Corporation, LexisNexis Risk Solutions, Hexaware Technologies, and Others. |

Key Segment |

By End-Users, By Enterprise Size, By Deployment Model, By Applications, By Components, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Some of the major players in the insurance analytics market

The key players in the global insurance analytics market include Verisk Analytics, Inc., Tableau Software, LLC, Sapiens International, PEGASYSTEMS INC., Oracle Corporation, OpenText, MicroStrategy Inc., Microsoft Corporation, LexisNexis Risk Solutions, Hexaware Technologies, others

This report segments the Insurance Analytics market as follows:

By End-Users Segment Analysis

- Third-Party Administrators

- Government Agencies

- Insurance Companies

- Others

By Enterprise Size Segment Analysis

- Small & Medium Enterprises

- Large Enterprises

By Deployment Model Segment Analysis

By Applications Segment Analysis

- Customer Management & Personalization

- Process Optimization

- Risk Management

- Claim Management

- Others

By Components Segment Analysis

By Regional Segmentation Analysis

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com