Search Market Research Report

Energy as a Service Market Size, Share Global Analysis Report, 2022 – 2028

Energy as a Service Market Size, Share, Growth Analysis Report By Service (Supply, Demand, Energy Optimization), By End User (Industrial and Commercial), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

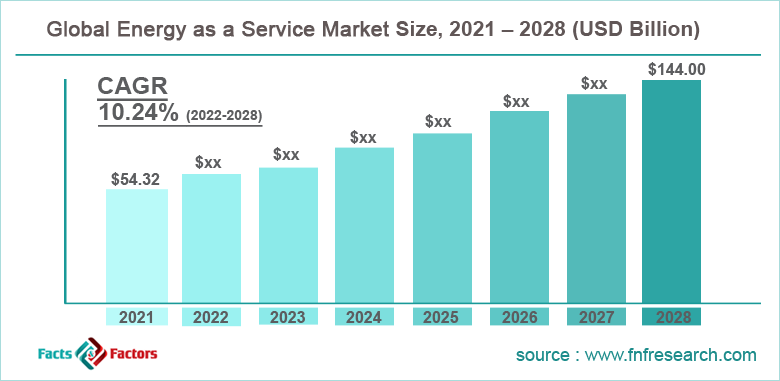

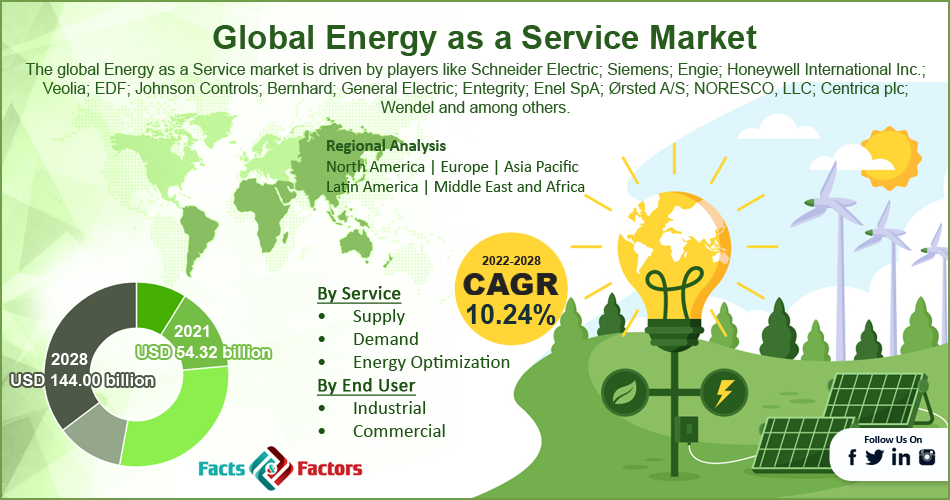

[231+ Pages Report] According to Facts and Factors, the global Energy as a Service market size was worth around USD 54.32 billion in 2021 and is predicted to grow to around USD 144.00 billion by 2028 with a compound annual growth rate (CAGR) of roughly 10.24% between 2022 and 2028. The report analyzes the global Energy as a Service market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the global Energy as a Service market.

Market Overview

Market Overview

Technology, energy, analytics, access to the grid, and specialized services are all sold under the umbrella term "energy as a service" (EaaS). Environmental protection is seriously threatened by the problem of carbon emissions. With the growing use of renewable energy sources to provide electricity, decentralized energy distribution has been observed. Rapid industrialization drives up global energy demand and contributes to the depletion of fossil fuels in developing nations. The demand for renewable energy sources has increased as a result of the growing need to lessen our reliance on fossil fuels and reduce the carbon emissions that result from burning them. This, in turn, is expected to continue to drive the growth of the EaaS market over the course of the time period under consideration.

The COVID-19 pandemic has negatively impacted every industry. Since 2020, the majority of the world's nations have seen a dramatic increase in the number of impacted cases. The pandemic's aftermath caused instability in the economics of several quickly developing nations. The onset of this global epidemic has had an immediate impact on the EaaS business. Many countries and regions have seen a sharp reduction in commercial and industrial activity, which has decreased many vertical energy demands. The sharp decline in energy intake has limited the adoption of new technology around the world.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global Energy as a Service market is estimated to grow annually at a CAGR of around 10.24% over the forecast period (2022-2028).

- In terms of revenue, the global Energy as a Service market size was valued at around USD 54.32 billion in 2021 and is predicted to grow to around USD 144.00 billion by 2028.

- Due to a variety of driving factors, the market is predicted to rise at a significant rate. The increasing adoption of distributed energy generation in commercial & industrial sectors, stringent energy efficiency regulations, and supportive government initiatives are expected to drive the market during the forecast period.

- Based on service, the supply segment was predicted to show maximum market share in the year 2021

- Based on end user, the commercial segment was predicted to show maximum market share in the year 2021

- On the basis of region, North America was the leading revenue generator in 2021.

Growth Drivers

Growth Drivers

- Increasing Adoption of Renewables Owing to their Environmental and Economic Advantages to Favor Overall Market Growth.

The principal goals of governing authorities in nations all over the world are to reduce greenhouse gas (GHG) emissions and the rising demand for energy. Following this, the installation of renewable energy sources is anticipated to increase significantly during the following ten years, which will result in the market's rise. The global energy as a service market size has been positively impacted by new energy targets that have been introduced by various governments to encourage the tendency toward sustainable electricity. For instance, by the end of 2023, Brazil wants 42.5% of its primary energy supply to come from renewable sources. Similar to this, the U.K. government intends to have around half of its electricity come from renewable sources by 2025, according to the carbon short analysis.

Restraints

Restraints

- Heavy Capital Investment for Establishment and Switch to Advanced Grids to Impede Market Growth

Energy produced by renewable energy sources requires a substantial investment. For instance, according to Bloomberg, from 2010 to 2019, investments in renewable energy sources totaled over USD 2.9 trillion. Only 8% of the world's energy is produced by solar energy, and 9% by wind energy. As a result, the majority of initiatives require the assistance of government-owned businesses. Additionally, governments only contribute a small portion of the total investment; the remainder is up to the business. The cost of the grid upgrade work, which calls for the installation of smart equipment at both the utility and customer ends, may restrain the growth of the EaaS market.

Opportunity

Opportunity

- Growing Peak Energy Demand and Favorable Regulation Framework to Aid Industry Outlook

Peak energy demand is a result of the expanding population and increasing activities to increase rural electrification. The cost of funding, installing, owning, and managing the operation of an asset that produces energy is transferred from the end user to the service provider under the EaaS model. The market's development was aided by favorable regulatory rules that were implemented by various agencies to support low-carbon technologies. The development of new, high-value infrastructure projects and acceleration of urbanization have also increased the supply and demand of power from utilities.

Challenges

Challenges

- Uncertainty about the agreement structure

The need for energy efficiency has been bolstered by the energy as a service model, allowing for the update of the newest technology without the need for an initial capital outlay. Owners of commercial building are apprehensive about entering into long-term financing arrangements or service procurement contracts with energy as a service provider. Customers could be unsure of whether to approach the contract as a service agreement or a lease because energy as a service owns and maintains the energy equipment. The worry of investing in an upgrade with the wrong cost, life span, or outcome may induce risk-averse clients to pause. The customer's confusion can be reduced by education on energy as a service contracts, which can also make communication between the many departments engaged in the decision-making process easier.

Segmentation Analysis

Segmentation Analysis

The global Energy as a Service market is segmented based on service, end-user, and region

Based on service, the market has been segmented into supply, demand, and optimization services. The demand services category is expected to grow at the quickest CAGR throughout the projected period, while the supply service sector held the greatest market share in 2021. Rising government initiatives to promote renewable energy together with the requirement for cost control and energy conservation are projected to favorably impact the segment's expansion in the next years. Demand services held the largest market share in 2021, and it is projected that they will hold that position throughout the forecast period. Consumers are searching for reliable energy sources without a grid due to rising rates. This element is anticipated to accelerate the segment's growth in the near future.

Based on end-user, the market has been segmented into commercial and industrial users. During the forecast period, the commercial segment is anticipated to increase at the fastest rate. The segment includes businesses including hospitals, educational institutions, information hubs, and airports, among others. Buildings alone account for more than 30% of total consumption in the commercial sector. According to the American Council for Energy-Efficient Economy (ACEEE), these organizations and establishments use more than 18% of the energy consumed by different American industries. Furthermore, lighting and heating consume 50% of the energy used in the commercial sector.

Recent Developments:

Recent Developments:

- In October 2021, British Petroleum and Infosys, a provider of information and technology services, jointly announced plans to create a pilot Energy as a Service (EaaS) solution project aimed at assisting companies in increasing the effectiveness of their energy infrastructures and achieving their decarburization objectives. The businesses plan to work together to create a digital platform data center that will gather information from various energy sources and utilize artificial intelligence to balance the supply and demand for energy for things like power, heat, cooling, and EV charging. The project needs a setting that resembles a small city, where energy is produced, stored, and used at various locations. At the Infosys Pune Development Center in the Indian city of Pune, the businesses will test the digital platform there.

- In November 2021, Rolls-Royce and Sustainable Development Capital (SDCL), a major worldwide investor, have decided to work together to provide Energy as a Service (EaaS) solutions that can hasten the adoption of cleaner energy. The agreement, which was signed at the 26th annual meeting of the "Conference of the Parties" (COP26), permits Rolls-Royce to offer customers electricity and/or heat produced by an efficient and sustainable energy system as a subscription service, eliminating the need for customers to obtain upfront infrastructure financing or manage the system themselves.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 54.32 Billion |

Projected Market Size in 2028 |

USD 144.00 Billion |

CAGR Growth Rate |

10.24% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Schneider Electric, Siemens, Engie, Honeywell International Inc., Veolia, EDF, Johnson Controls, Bernhard, General Electric, Entegrity, Enel SpA, Ørsted A/S, NORESCO LLC, Centrica plc, Wendel, and others. |

Key Segment |

By Service, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead the market growth during the projection period

During the projection period, North America is anticipated to hold the largest share of the global energy as a service market, with the U.S. accounting for the majority of demand. The nation is well-known for having used EaaS in a number of industries. The area has embraced a number of projects, particularly in the business sector, that are anticipated to improve energy storage efficiency and lower operating costs. The area has also seen notable investment in the production, exploration, and refining sectors, which is expected to increase demand for energy as a service model in the upcoming years.

Furthermore, Europe's market benefits from supportive organizational and governmental policy frameworks that encourage the implementation of green energy solutions and considerable installation of power generation technology in various locations. Currently, among other nations, Germany, the U.K., and Italy are the main nations making significant contributions to the region's EaaS industry. Additionally, it is projected that rising investments and plans to strengthen and expand grid infrastructure networks to support the rising installation of renewable energy will further advance the business.

Competitive Analysis

Competitive Analysis

- Schneider Electric

- Siemens

- Engie

- Honeywell International Inc.

- Veolia

- EDF

- Johnson Controls

- Bernhard

- General Electric

- Entegrity

- Enel SpA

- Ørsted A/S

- NORESCO LLC

- Centrica plc

- Wendel

The global Energy as a Service market is segmented as follows:

By Service

By Service

- Supply

- Demand

- Energy Optimization

By End User

By End User

- Industrial

- Commercial

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Schneider Electric

- Siemens

- Engie

- Honeywell International Inc.

- Veolia

- EDF

- Johnson Controls

- Bernhard

- General Electric

- Entegrity

- Enel SpA

- Ørsted A/S

- NORESCO LLC

- Centrica plc

- Wendel

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors