Search Market Research Report

Environmental, Social and Governance Investing Market Size, Share Global Analysis Report, 2024 – 2032

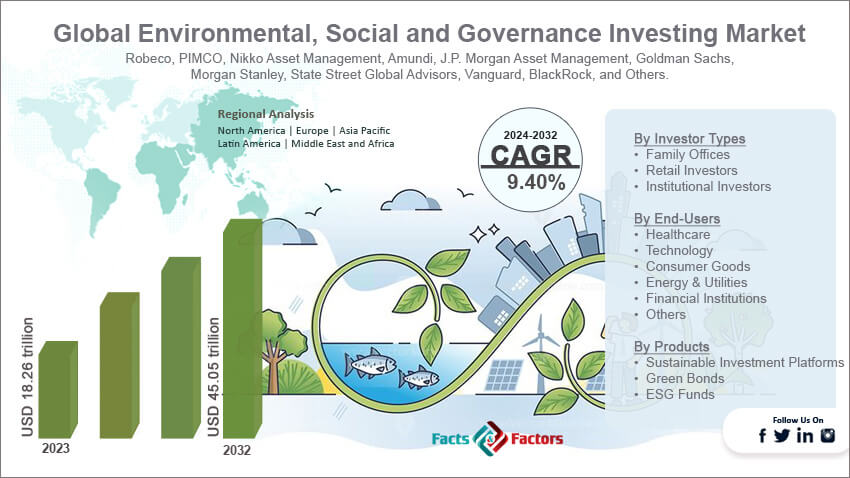

Environmental, Social and Governance Investing Market Size, Share, Growth Analysis Report By Investor Types (Family Offices, Retail Investors, Institutional Investors, And Others), By End-Users (Healthcare, Technology, Consumer Goods, Energy & Utilities, Financial Institutions, And Others), By Products (Sustainable Investment Platforms, Green Bonds, ESG Funds, And Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

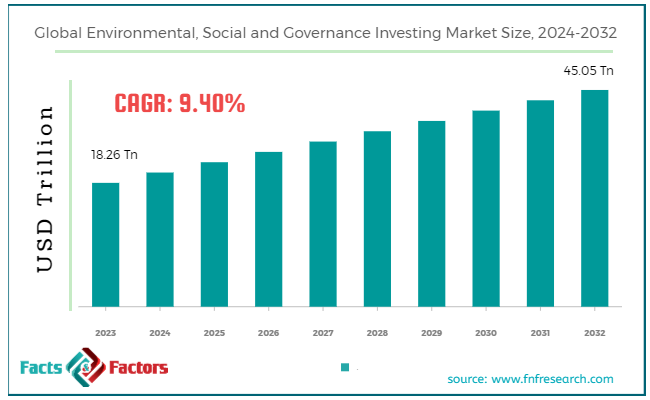

[208+ Pages Report] According to Facts & Factors, the global environmental, social, and governance investing market size was valued at USD 18.26 trillion in 2023 and is predicted to surpass USD 45.05 trillion by the end of 2032. The environmental, social, and governance investing industry is expected to grow by a CAGR of 9.40% between 2024 and 2032.

Market Overview

Market Overview

Environmental, social, and governance investing refers to an investing approach integrating ESG factors into the investment decision-making process. ESG investing focuses on the broader impact of investment on society and the environment. There are many ESG investing strategies like screening, thematic investing, impact investing, engagement, and stewardship, among others. Also, there are several benefits of ESG investing, like risk management, long-term returns, and reputation & values.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global environmental, social, and governance investing market size is estimated to grow annually at a CAGR of around 9.40% over the forecast period (2024-2032).

- In terms of revenue, the global environmental, social, and governance investing market size was valued at around USD 18.26 trillion in 2023 and is projected to reach USD 45.05 trillion by 2032.

- Rising investor demand is driving the growth of the global environmental, social, and governance investing market.

- Based on the investor types, the financial investors segment is growing at a high rate and is projected to dominate the global market.

- Based on the end-users, the financial institution segment is projected to swipe the largest market share.

- Based on products, the ESG funds segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Environmental, Social, and Governance Investing Market: Growth Drivers

Environmental, Social, and Governance Investing Market: Growth Drivers

- Rising investor demand is driving the growth of the global market.

There is a growing awareness among investors regarding the importance of sustainable and responsible investing, which is likely to drive the growth of the global environmental, social, and governance investing market. Additionally, investors are more inclined towards the investment values associated with environmental sustainability, social responsibility, and good governance. Investors are increasingly incorporating ESG criteria in their investment policies. Also, the government is coming up with diverse regulations to disclose ESG-associated information, which in turn will pose greater transparency and standardization in ESG reporting.

Also, many countries are implementing different policies that are likely to support sustainable finance, like incentives for green investments. It is evident that companies with strong ESG practices perform better with the lowest risk profile in the market, which is another major factor attracting investors. ESG factors have become vital for identifying and managing investment risks associated with social controversies, government failure, and environmental issues. Therefore, all these factors are expected to foster growth opportunities in the market.

Restraints

Restraints

- Greenwashing is likely to hinder the growth of the global market.

Many misleading claims in the market undermine the investor's trust in the ESG portfolio. There is a rising risk of greenwashing, where investment products seem to be more environmentally and socially responsible than they are. Therefore, these factors are expected to hamper the growth of the environmental, social, and governance investing industry.

Opportunities

Opportunities

- Growing awareness regarding environmental and social issues is expected to foster market growth opportunities.

Climate change is an emerging issue that needs climate resilience practices and investment in sustainable solutions like energy efficiency and renewable energy. Additionally, there are many concerns regarding social justice, inclusion, and diversity, which is driving investors to fund companies that are actively fulfilling social responsibility.

However, companies are increasingly adopting ESG practices under their sustainability commitments and reputational considerations. Therefore, such a landscape is expected to grow opportunities in the global environmental, social, and governance investing market in the coming years.

Challenges

Challenges

- Limited availability of ESG investment products is a big challenge in the global market.

There are only a handful of ESG investment products available in many market segments, which do not offer investors a wide product range. Moreover, the available ESG products are quite expensive as compared to traditional investment options. Therefore, such a landscape is a big challenge in the environmental, social, and governance investing industry.

Segmentation Analysis

Segmentation Analysis

The global environmental, social, and governance investing market can be segmented into investor types, end-users, products, and regions.

On the basis of investor types, the market can be segmented into family offices, retail investors, institutional investors, and others. The financial investor segment accounts for the largest share of the environmental, social, and governance investing industry. Financial investors like insurance companies manage the assets floating in the market, and therefore, it gives them more influence. Large-scale investments by these investors help them frame ESG-focused strategies. However, the regulatory mandates encourage them to adopt ESG criteria in their investment processes.

However, institutional investors focus mainly on long-term investments that help people align with ESG investing. ESG factors positively impact financial performance in the long run, thereby making them more sustainable investments. Large institutional investors also have dedicated teams for ESG analysis, stewardship, and integration. It helps them access ESG criteria to invest and manage ESG-associated risks and opportunities. Also, institutional investors influence the demand for ESG products. However, the decisions taken by these institutional investors are likely to shape the development of ESG standards and practices.

Additionally, investors also face pressure from regulatory bodies, society, and other beneficiaries, which further drives them to prioritize their ESG investment practices. The pension fund is a significant institution investor that includes large funds like Ontario Teachers’ Pension Plan, California Public Employee Retirement System, and many others. It also includes many big insurance companies like Prudential and Allianz.

Additionally, institutional investors have some endowments and foundations like Harvard University's Endowment and the Bill & Melinda Gates Foundation. Institutional investors are at the forefront of ESG investing, and therefore, they are the only people responsible for shaping its growth and direction.

On the basis of end-users, the market can be segmented into healthcare, technology, consumer goods, energy & utilities, financial institutions, and others. The financial institution segment is likely to dominate the environmental, social, and governance investing industry during the forecast period. Financial institutions like investment firms, asset managers, insurance companies, and banks.

Also, they are the only person in charge of managing global assets. Their long-term investments and institutional financial support make them important participants in the industry. Financial institutions work on comprehensive strategies to offer different kinds of ESG-focused investment products, such as substantial ETFs, ESG, mutual funds, and green bonds.

Also, these institutions help manage ESG-associated portfolios. Financial institutions need to align with the regulatory requirements of ESG disclosure and reporting. Financial institutions have a wide range of offerings in ESG investment products like green bonds, impact investments, mutual funds, and many others. Growth in demand for investments in industry is the major factor driving the growth of the segment. Financial institutions highly influence corporate behavior with their investment decisions.

On the basis of products, the market can be segmented into sustainable investment platforms, green bonds, ESG funds, and others. The ESG funds segment is expected to grow significantly during the forecast period. ESG funds include a wide range of investment products like index funds, exchange-traded funds, and mutual funds to cater to the requirements and preferences of the number of investors in the market. The rising demand from both retail and institutional investors for funds that include ESG criteria is likely to positively impact the growth of the segment. ESG funds help investors to align with sustainable investment goals.

Additionally, ESG funds are now a well-established market with a widespread availability of products. Several rules and regulations are increasingly including ESG factors in their investment strategies, which in turn is also expected to foster growth opportunities in the segment. ESG funds are proving to be a competitive and attractive option compared to traditional funding options, which further attract investors and are expected to accentuate the growth of the segment. The educational tools and resources offered by big financial institutions help investors know more about the ESG investing market, which is further expected to positively impact the growth of the segment.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 18.26 Trillion |

Projected Market Size in 2032 |

USD 45.05 Trillion |

CAGR Growth Rate |

9.40% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Robeco, PIMCO, Nikko Asset Management, Amundi, J.P. Morgan Asset Management, Goldman Sachs, Morgan Stanley, State Street Global Advisors, Vanguard, BlackRock, and Others. |

Key Segment |

By Investor Types, By End-Users, By Products, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America will account for the largest share of the global environmental, social, and governance investing market during the forecast period. The market is highly driven by the asset under management and investor interests. The rising adoption of ESG principles by both retail and institutional investors is also likely to positively impact the growth of the regional market. There is a surging awareness among people regarding sustainability issues in every sector, which is also anticipated to encourage the growth of the regional market.

However, the US is the largest market in the region because the ESG disclosure requirements impact people's investment decisions and practices. Many countries in the US and Canada have already implemented the rules and regulations to support ESG investing.

Additionally, the growing interest of retail investors in ESG products and services is also expected to foster growth in the regional market. There is a growing demand for ESG-focused mutual funds and ETFs in North America. Large institutional investors like insurance companies, endowments, and pension funds are the significant drivers of the market because of their increasing participation in adopting ESG criteria for their investment strategies.

Asia Pacific is another major region likely to witness growth in the environmental, social, and governance investing industry in the coming years. The ESG investing market in APAC is growing because of the increasing interest of both retail and institutional investors in the region. Countries like India, China, Japan, and Australia are leading the growth of the regional market. Many countries in APAC are coming up with regulations to promote ESG investing.

However, the rising regulatory requirements for ESG disclosures are fostering the practice of offering clearer and more transparent information among investors. Advancements in ESG data and reporting standards for a better evaluation of ESG performance are important for making many informed decisions.

Additionally, ESG investment products are expanding in number in APAC, which is also expected to positively impact the growth of the regional market. Therefore, all these factors are likely to foster growth opportunities in the regional market.

Competitive Analysis

Competitive Analysis

The key players in the global environmental, social, and governance investing market include:

- Robeco

- PIMCO

- Nikko Asset Management

- Amundi

- J.P. Morgan Asset Management

- Goldman Sachs

- Morgan Stanley

- State Street Global Advisors

- Vanguard

- BlackRock

For instance, JP Morgan Asset Management unveiled the launch of JP Morgan Fundamental Data Science (FDS) Suite in 2024 on the Nasdaq Stock Exchange. This suite includes three new products namely, Large Core ETF (LCDS), Mid Core ETF (MCDS), and Small Core ETF (SCDS).

The global environmental, social, and governance investing market is segmented as follows:

By Investor Types Segment Analysis

By Investor Types Segment Analysis

- Family Offices

- Retail Investors

- Institutional Investors

- Others

By End-Users Segment Analysis

By End-Users Segment Analysis

- Healthcare

- Technology

- Consumer Goods

- Energy & Utilities

- Financial Institutions

- Others

By Products Segment Analysis

By Products Segment Analysis

- Sustainable Investment Platforms

- Green Bonds

- ESG Funds

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Robeco

- PIMCO

- Nikko Asset Management

- Amundi

- J.P. Morgan Asset Management

- Goldman Sachs

- Morgan Stanley

- State Street Global Advisors

- Vanguard

- BlackRock

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors