Search Market Research Report

Crypto Asset Management Market Size, Share Global Analysis Report, et Management Market By Market Type (Solution and Services), By Solution (Custodian Solution, Tokenization Solutions, Transfer & Remittance Solutions, Trading Solutions and Wallet Management), By Operating System (iOS, Android and Others), By Application (Web-Based and Mobile), By End User (Individual and Enterprise), By Industry Vertical (BFSI, Retail & E-commerce, Media & Entertainment, Institutions, Healthcare, Travel and Hospitality and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2021 – 2028

Crypto Asset Management Market By Market Type (Solution and Services), By Solution (Custodian Solution, Tokenization Solutions, Transfer & Remittance Solutions, Trading Solutions and Wallet Management), By Operating System (iOS, Android and Others), By Application (Web-Based and Mobile), By End User (Individual and Enterprise), By Industry Vertical (BFSI, Retail & E-commerce, Media & Entertainment, Institutions, Healthcare, Travel and Hospitality and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2021 – 2028

Industry Insights

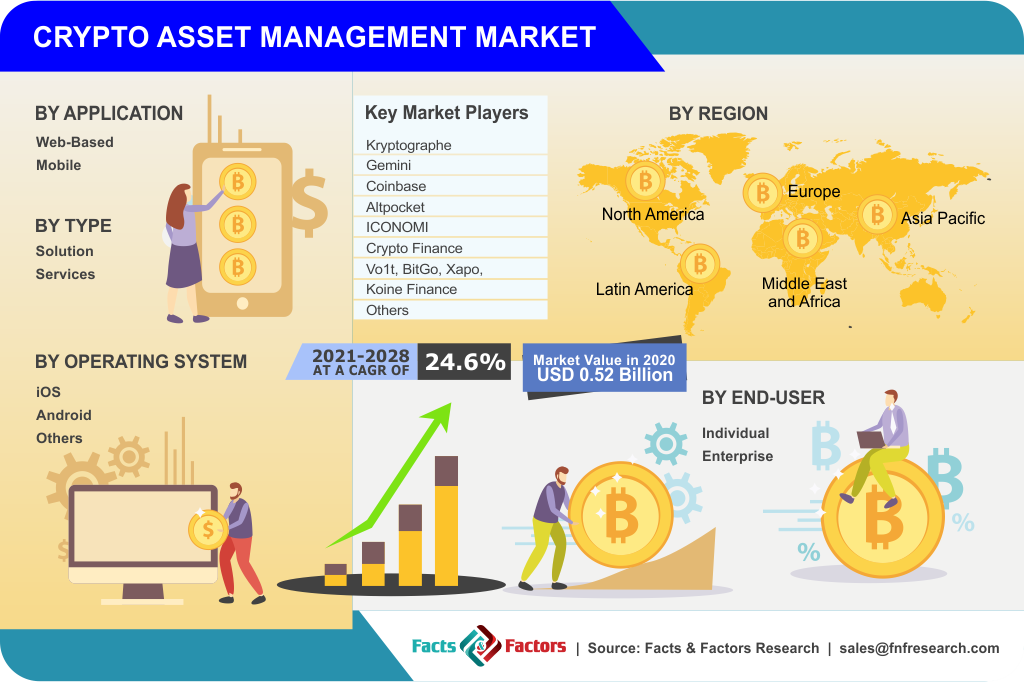

[215+ Pages Report] According to a Facts and Factors market research report, the global crypto asset management market is estimated at around USD 0.52 Billion in 2020 and is expected to reach around USD 2.4 Billion by 2028 along with a CAGR of around 24.6% from 2021 to 2028.

Market Overview

Market Overview

People are investing more in secondary assets like digital currencies, the crypto market in the last few years. It is because of the gaining popularity of crypto-asset across the globe and high return in a short period of time. Multiple choices of investment and easy entry and exit attract investors more in digital currency due to the multiple availabilities of the trading platforms. Crypto assets are centralized and investors apply their own rule of trading and making profits. The increase in cryptocurrency users throughout the world belong to the rise in digital processing of transactions without government taxes, the rapid increase in the number of blockchain technology. As the cryptocurrency market is highly volatile and may affect the overall portfolio of investors positively or negatively, crypto asset management is an important consideration.

Crypto asset management provides guidance and suggestions to users so that they can manage their crypto wallets prior to market ups and downs. Cryptocurrencies are digitally available in the form of tokens. They vary from currency to currency and, country to country. Users acquire a large number of crypto token which needs custody or security to store safely. Crypto asset management provides a custodian solution to users independent of storage and holds large quantities of currency tokens in the portfolio.

Due to the high penetration of smartphone users and internet availability, crypto asset management is accessible via multiple devices like smartphones, laptops, or desktops and on various operating systems such as iOS, Android, and others like Mac OS, Windows having the same user login details. This will help users to access digital currency and manage their own portfolio if one system may fail.

Crypto asset management helps investors to make proper decisions, manage a suite of high-quality indices, complexity-free offerings, and customized investment programs for high-net-worth individuals and institutions.

Industry Growth Factor

Industry Growth Factor

Crypto asset management tracks the record of each cryptocurrency from minute wise to year wise. With the help of this, the system provides a decisive view of suitable crypto and the performance of the most liquid, secure, and investable crypto assets. This will drive the demand of the crypto asset management market. Furthermore, applications and web-based platforms of services provide users with ease of access by just enabling internet connection. Also, once the user makes trading in the desired price and sets orders, it will automatically trade-in without internet connectivity. This is a must-have facility provided by crypto asset management.

With the help of a decentralized ledger payment platform that charges very little and enabling payments via P2P platform by individual management system provides high security. Users will get notified via payment partner regarding all transactions on emails, massages as high investment made by the BFSI sector in payment gateway options. These add-on facilities boost market demand for the crypto asset management market globally.

Crypto asset management set a competition between players to make strong customer data to use services and solutions. Key players are adding trading competition in asset management so that one can trade high and win more profit without compromising security aspects. This is also a demanding crypto asset management market.

Segmentation Analysis

Segmentation Analysis

The global crypto asset management market is segmented into type, solution, operating system,end-user, and industry verticals. The type segment is categorized into solution and services. Custodian solution, tokenization solutions, transfer & remittance solutions, trading solutions, and wallet management are the type of solution. Additionally, the operating system is classified into iOS, Android, and others. The application segment is categorized into web-based and mobile platforms. The end-user segment is further bifurcated into individual and enterprise. BFSI, retail & e-commerce, media & entertainment, institutions, healthcare, travel, and hospitality among others are the various industry verticals that use crypto asset management.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 0.52 Billion |

Projected Market Size in 2028 |

USD 2.4 Billion |

CAGR Growth Rate |

24.6% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2028 |

Key Market Players |

Kryptographe, Gemini, Coinbase, Altpocket, ICONOMI, Crypto Finance, Vo1t, BitGo, Xapo, Koine Finance, Ledger, Amberdata, CoinTracker Tradeium, Metaco SA, WazirX, Opus labs, Bakkt, Blox, Groww, Huobi, Binance, Koinly, Mintfort, Coinstats, Anchorage, itBit, OctaFX, and Upstox among others. |

Key Segment |

By Type, Solution, Operating System, Application, End User, Industry Verticals, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

North America holds the largest global market share. Due to the huge presence of several prominent market players providing crypto asset management solutions, increased research and development activities, stable economic conditions in the North American region, the market demand has grown over the past few decades.

Competitive Players

Competitive Players

The key players in the global crypto asset management market are :

- Kryptographe

- Gemini

- Coinbase

- Altpocket

- ICONOMI

- Crypto Finance

- Vo1t

- BitGo

- Xapo

- Koine Finance

- Ledger

- Amberdata

- CoinTracker Tradeium

- Metaco SA

- WazirX

- Opus labs

- Bakkt

- Blox

- Groww

- Huobi

- Binance

- Koinly

- Mintfort

- Coinstats

- Anchorage

- itBit

- OctaFX

- Upstox

By Type Segment Analysis

By Type Segment Analysis

- Solution

- Services

By Solution Segment Analysis

By Solution Segment Analysis

- Custodian Solution

- Tokenization Solutions

- Transfer & Remittance Solutions

- Trading Solutions

- Wallet Management

By Operating System Segment Analysis

By Operating System Segment Analysis

- iOS

- Android

- Others

By Application Segment Analysis

By Application Segment Analysis

- Web-Based

- Mobile

By End-User Segment Analysis

By End-User Segment Analysis

- Individual

- Enterprise

By Industry Vertical Segment Analysis

By Industry Vertical Segment Analysis

- BFSI

- Retail & E-commerce

- Media & Entertainment

- Institutions

- Healthcare

- Travel and Hospitality

- Others

Regional Segment Analysis

Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Industry Major Market Players

- Kryptographe

- Gemini

- Coinbase

- Altpocket

- ICONOMI

- Crypto Finance

- Vo1t

- BitGo

- Xapo

- Koine Finance

- Ledger

- Amberdata

- CoinTracker Tradeium

- Metaco SA

- WazirX

- Opus labs

- Bakkt

- Blox

- Groww

- Huobi

- Binance

- Koinly

- Mintfort

- Coinstats

- Anchorage

- itBit

- OctaFX

- Upstox

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors