Search Market Research Report

Cable Conduit Systems Market Size, Share Global Analysis Report, 2025 - 2034

Cable Conduit Systems Market Size, Share, Growth Analysis Report By Type (Rigid, Flexible), By End User (Manufacturing, Construction, IT & Telecommunication, Healthcare, Energy, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

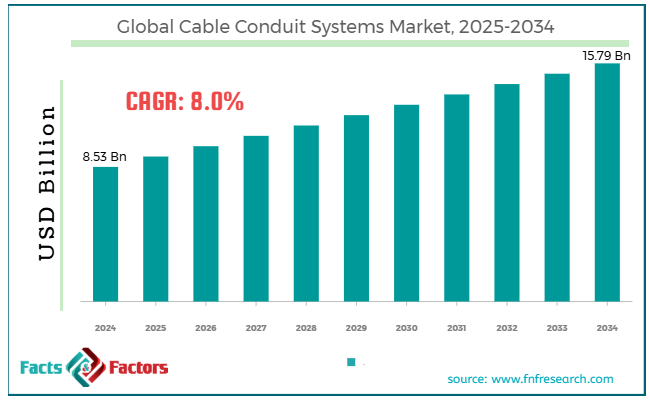

[215+ Pages Report] According to Facts & Factors, the global cable conduit systems market size was worth around USD 8.53 billion in 2024 and is predicted to grow to around USD 15.79 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.0% between 2025 and 2034.

Market Overview

Market Overview

Cable conduit systems are channels or tubes to route and protect electrical wiring and cables in industrial setups, buildings, or infrastructure. These conduits protect the wiring from environmental factors like chemicals or water, mechanical damage, and aid in securing and organizing the cables. The leading drivers of the cable conduit systems market include growing urbanization and infrastructure development, increasing demand for protection and safety, and progress in the utilities and energy sectors.

Worldwide, speedy urbanization increases the demand for novel development projects, such as commercial complexes, buildings, transportation systems, and more. This leads to an elevated demand for more wiring and cables to be installed for telecom, electricity, and data networks, thus propelling the need for conduit systems.

Moreover, with the growing concerns regarding electrical risks, the demand for cable conduits that can efficiently defend cables from external factors and mechanical damage is also increasing. Also, the growth of energy generation plants, energy transmission lines, and renewable projects fuels the demand for fire-resistant, durable, and corrosion-resistant systems to guarantee safe cable management.

However, the global cable conduit systems market is hampered by growing complexity in maintenance and installation, and rising competition from substitute cable management systems. Most conduit systems cannot be easily installed, particularly in areas with complex designs or tight spaces. Maintenance in current systems may also be complicated, mainly in cases of retrofitting.

In addition, flexible cable management systems are gaining traction owing to their cost-effectiveness and simple installation process. This may significantly restrict the adoption of conventional conduit systems. Yet, the global market is opportune for technical improvements in cable conduit systems, eco-friendly materials, and sustainability trends.

Modernizations like modular and flexible conduits, which are simply adjusted to diverse building designs, offer a key growth opportunity. Producers can also discover intelligent conduit systems with sensors to monitor the cable's health.

Furthermore, growing regulatory and consumer demand for environmentally friendly materials offers opportunities to grow eco-friendly systems made of biodegradable or recyclable materials.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global cable conduit systems market is estimated to grow annually at a CAGR of around 8.0% over the forecast period (2025-2034)

- In terms of revenue, the global cable conduit systems market size was valued at around USD 8.53 billion in 2024 and is projected to reach USD 15.79 billion by 2034.

- The cable conduit systems market is projected to grow significantly owing to surging demand for safe, organized, and secure cable management in numerous industries, speedy urbanization and industrialization, and the growing need for installation systems and strong cable protection.

- Based on type, the rigid segment is expected to lead the market, while the flexible segment is expected to register considerable growth.

- Based on end use, the construction segment is expected to lead the market as compared to the energy segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Growth Drivers

Growth Drivers

- How will the expansion of telecommunication networks and data centers propel the cable conduit systems market growth?

The exponential rise in data consumption fueled by cloud computing, IoT, and 5G technologies drives the growth of telecom infrastructures and data centers. These technologies need strong cable management systems, comprising cable conduit systems, to protect and organize huge quantities of wiring.

According to the reports, the launch of 5G technology is projected to generate USD 13.1 trillion in gross output by 2035.

To capitalize on the burgeoning demand for telecommunication cabling and data transmission, the Prysmian Group, a cable technology leader, acquired Channell Commercial Corp in March 2025 for USD 1.15 billion. This initiative aims to enhance its ranking in North America and capitalize on the growing demand for advanced cabling systems for telecom networks and data centers.

- Manufacturing growth and industrial automation to spur market growth notably

The inclination towards Industry 4.0 and the growth of smart factories have fueled the need for automation in manufacturing. As industries adopt more automated solutions, the demand for wiring systems rises. Cable conduits are vital for secure housing and protecting the growing number of wires in control systems and automated machinery.

As more industries are using automation solutions, the demand for durable and superior-quality cable management systems is projected to increase. Conduit systems play a vital role in safeguarding cables in complex automated machines.

Franklin Electric launched a CableTight system in July 2023. It is designed to tolerate extreme weather conditions and prevent water ingress, flawlessly complying with the propelled automation in the industries.

Restraints

Restraints

- Will the instability of raw material costs unfavorably impact the progress of the cable conduit systems market?

The raw materials required to manufacture conduit systems, like aluminum, steel, and PVC, majorly impact price variations, mainly due to global supply chain disturbances, commodity market disparities, and geopolitical stresses. This instability may result in amplified costs for producers, which are mostly shifted to the end users or consumers. Hence, price sensitivity in the global cable conduit systems industry poses a barrier, mainly for budget-conscious projects and industries, thus affecting the market's growth.

With the growing prices of raw materials, the cost of conduit systems made of plastics and metals also rises. The steel conduit industry was estimated to be worth USD 3.2 billion in 2023 and is anticipated to impact the global demand for more conventional systems.

Opportunities

Opportunities

- How does the growth of infrastructure and smart buildings positively fuel the cable conduit systems market growth?

The growth of smart buildings incorporating improved solutions like security, IoT for energy management, and automation is generating major demand for cable conduit solutions. These buildings need complicated data networks and wiring to back interconnected devices. This ultimately demands highly flexible, durable, and fire-resistant cable conduit systems.

Siemens declared the building of smart cities in April 2024 in Singapore and Germany. The company will aim for sustainable urbanization and energy-efficient constructions. These projects are expected to drive demand for conduit systems, which will safeguard widespread data transmission networks and wiring required for building automation.

Challenges

Challenges

- Technical challenges in adapting to Industry 4.0 limit the growth of the cable conduit systems market

With the emergence of Industry 4.0, industries are progressively shifting towards more flexible, automated, and smart manufacturing. While this inclination ensures cost-effectiveness and improved efficiency, the transformation present intricacies for manufacturers of cable conduit systems. Several former conduit systems are not easily adaptable to smart machinery and solutions, which require high-speed transmission, advanced wiring, and real-time monitoring. Producers should adapt their designs to incorporate these systems.

- Shortage of an expert workforce for installation and maintenance to challenge the industry growth

The maintenance and fixing of cable conduit systems, mainly rigid metal systems, requires highly skilled labor. Skilled technicians and electricians are essential for correct installation, as conduit systems usually need accurate securing and cutting. Nonetheless, most regions are witnessing the lack of workforce, resulting in increased costs, delays, and sometimes suboptimal installations that may raise safety concerns.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 8.53 Billion |

Projected Market Size in 2034 |

USD 15.79 Billion |

CAGR Growth Rate |

8.0% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Schneider Electric, Legrand, Atkore International, Aperçu (Aperçu Cables), Thomas & Betts (A subsidiary of ABB), HellermannTyton, Emerson Electric Co., Panduit Corporation, IBS Electrical Ltd., Amphenol Industrial, Koch Industries (Invista), Prysmian Group, Flexible Conduit Systems Ltd., Eaton Corporation, Siemens AG., and others. |

Key Segment |

By Type, By End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global cable conduit systems market is segmented based on type, end-use, and region.

Based on type, the global cable conduit systems industry is divided into rigid and flexible. The rigid segment held a substantial market share in 2024 owing to protection and durability, progress in industrial construction, and regulatory compliance. Rigid conduits provide enhanced mechanical protection, making them a preferred choice in high-risk environments such as the chemical, construction, oil and gas, and mining industries, where safety protocols are stringent.

With the growth in industrial construction, rigid conduits are witnessing surging demand. This is because of their capability to tolerate extreme physical effects and defend electrical cables from external damage. Several industries require protocols like the (NEC) National Electrical Code in the United States to utilize rigid conduits in some installations. This is especially used where high mechanical protection is required.

Based on end-use, the global cable conduit systems industry is segmented into manufacturing, construction, IT & telecommunication, healthcare, energy, and others. The construction segment is leading due to growing demand for safety standards, infrastructure growth, urbanization, and smart buildings. In the construction sector, regulations often comprise protective and durable conduit systems to protect electrical wiring from environmental conditions, fire, and damage.

Moreover, the rise in commercial, residential, and industrial construction on a global scale is propelling the demand for flexible and rigid conduit systems to course electrical cables securely. The growth of sustainable and smart buildings has resulted in an elevated number of installations of improved electrical systems that need superior-quality conduit systems.

Regional Analysis

Regional Analysis

- What factors will help North America witness significant growth in the cable conduit systems market over the forecast period?

North America held a leading position in the global cable conduit systems market in 2024 backed by strong infrastructure and construction growth, robust renewable energy investments, and energy sector, and smart infrastructure and technological improvements. North America, mainly Canada and the United States, is facing continuous growth in infrastructure development and construction. This progress is a key propeller of the demand for cable conduit systems, which are crucial in protecting and safely installing electrical cables. The energy sector, mainly in the United States, plays a vital role in demand for cable conduit systems. Investments in renewable energy and conventional energy infrastructure are fueling the demand for installing cable conduits.

Moreover, the region is leading in smart buildings, smart city initiatives, and data center construction. They need improved cable management technologies, comprising data-carrying cables and smart conduits.

Asia Pacific is projected to progress as the second-leading segment in the global cable conduit systems market owing to speedy urbanization and growing industrialization, rising demand for electrification and renewable energy, and the growth of smart cities. Asia Pacific is among the expanding regions, and the growing industrialization and speedy urbanization majorly fuel its economic development. As nations grow economically, the demand for infrastructure, industrial facilities, and housing also increases, thus surging the demand for cable conduit systems.

Furthermore, the region is experiencing remarkable growth in the renewable energy industry, with nations such as Japan, China, and India investing heavily in hydropower, wind, and solar energy sources. This has substantially expanded the demand for cable conduit systems to protect cables in transmission systems and energy generation. The region also invests in smart city infrastructure and data centers, which need improved cable management systems. The rising adoption of smart technologies, cloud computing, and 5G fuels the need for organized cable routing solutions.

Competitive Analysis

Competitive Analysis

The global cable conduit systems market is led by players like:

- Schneider Electric

- Legrand

- Atkore International

- Aperçu (Aperçu Cables)

- Thomas & Betts (A subsidiary of ABB)

- HellermannTyton

- Emerson Electric Co.

- Panduit Corporation

- IBS Electrical Ltd.

- Amphenol Industrial

- Koch Industries (Invista)

- Prysmian Group

- Flexible Conduit Systems Ltd.

- Eaton Corporation

- Siemens AG

Key Market Trends

Key Market Trends

- The growing number of renewable energy projects:

As more nations invest in renewable energy sources like wind and solar, the demand for cable conduit systems in energy transmission and generation is rapidly increasing. These systems safeguard cables in extreme climate conditions and high-voltage settings.

- Technological improvements in conduit systems:

Smart technologies and novel materials are currently incorporated in conduit systems. For instance, temperature-resistant, fire-resistant, and corrosion-resistant conduits have been developed to meet the growing needs of diverse industries, including electronics, automotive, and data centers, where durability and reliability are crucial.

The global cable conduit systems market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Rigid

- Flexible

By End Use Segment Analysis

By End Use Segment Analysis

- Manufacturing

- Construction

- IT & Telecommunication

- Healthcare

- Energy

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Schneider Electric

- Legrand

- Atkore International

- Aperçu (Aperçu Cables)

- Thomas & Betts (A subsidiary of ABB)

- HellermannTyton

- Emerson Electric Co.

- Panduit Corporation

- IBS Electrical Ltd.

- Amphenol Industrial

- Koch Industries (Invista)

- Prysmian Group

- Flexible Conduit Systems Ltd.

- Eaton Corporation

- Siemens AG

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors