Search Market Research Report

Anticoagulants Market Size, Share Global Analysis Report, 2022 – 2028

Anticoagulants Market Size, Share, Growth Analysis Report By Drug Class (NOACs, Heparin & LMWH, Vitamin K Antagonist, Others), By Route of Administration (Oral anticoagulant, Injectable anticoagulant), By Application (Atrial fibrillation & heart attack, Stroke, Deep vein embolism (PE), Others), and By Region - Global Industry Insights, Comparative Analysis, Trends, Statistical Research, Market Intelligence, and Forecast 2022 – 2028

Industry Insights

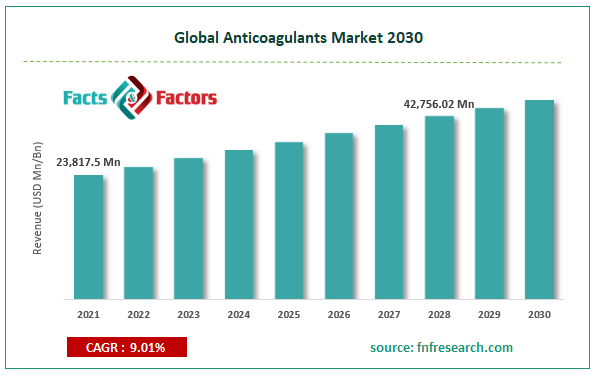

[211+ Pages Report] According to Facts and Factors, the global anticoagulants market size was valued at USD 23,817.5 million in 2021 and is predicted to increase at a CAGR of 9.01% to USD 42,756.02 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries. The report analyses the global anticoagulants market’s drivers and restraints, as well as the impact they have on-demand throughout the projection period. In addition, the report examines global opportunities in the anticoagulants market.

Market Overview

Market Overview

When blood thickens and forms a semi-solid mass in any part of the body, blood clots occur. This can lead to significant complications such as stroke, heart attack, pulmonary embolism, transient ischemic attack, and deep vein thrombosis (DVT). As a result, doctors all across the world are prescribing anticoagulant medicines to patients who are at high risk of clotting. These medications aid in blood thinning, preventing or lowering blood clotting, and extending clotting time.

Growth Drivers

Growth Drivers

The global anticoagulants market is expected to rise significantly over the projected period, owing to an increase in the prevalence of ischemic heart disease and venous thromboembolism (VTE), as well as increased awareness of novel oral anticoagulants (NOACs). Increased awareness of cardiovascular health, as well as the associated increase in innovative pharmaceutical introductions, is one of the key drivers of global market growth. Additionally, the growing geriatric population and the rising prevalence of obesity are likely to drive up demand for anticoagulants throughout the projection period.

Moreover, an increase in the number of obese and aged people increased unmet needs, and a surge in demand for innovative therapies all contribute to market growth. Other important driving reasons include the global high prevalence of cardiovascular diseases (CVD) and the growing desire for more effective blood thinners. However, the worldwide anticoagulants market is hampered by rigorous regulations imposed by various governments. Furthermore, the danger of side effects and difficulties connected with the use of oral anticoagulants impedes the global anticoagulants market's growth.

COVID – 19 Impact

COVID – 19 Impact

Due to the rapid pace of research, COVID-19 infection is predicted to have a significant impact on the anticoagulant business. According to a study published in the American Journal of Cardiovascular Drugs in 2020, more than ten clinical trials are currently underway to assess the potential of anticoagulants in COVID-19 patients, and research on parenteral administration strategies for these drugs is being conducted for use in critically ill COVID-19 patients. As a result, the COVID-19 pandemic is projected to have both direct and indirect effects on the market.

Major anticoagulant companies are focusing on launching clinical trials of anticoagulant drugs to reduce the risk of COVID-19-related blood clotting in adults. Over the pandemic period, almost every industry in the world has suffered a setback. This is owing to significant interruptions in their respective production and supply-chain activities caused by multiple precautionary lockdowns and other restrictions imposed by governing bodies throughout the world.

Segmentation Analysis

Segmentation Analysis

The global Anticoagulants market is segregated based on Drug Class, Route Of Administration, and Application.

In terms of Route of Administration, oral anticoagulants are expected to earn the most market revenue. Oral anticoagulants are one of the most prevalent and conventional modalities of anticoagulant therapy delivery, and their use is expected to increase during the projection period. The oral anticoagulants category is expected to increase further as a result of notable product introductions in this segment. This category is expected to increase further during the forecast period as a result of technological breakthroughs in anticoagulants and their contribution to a significant reduction in risk.

In terms of Drug Class, the NOACs category is now a key revenue-generating area in the anticoagulants market and is likely to dominate during the projection period because of increased NOAC adoption in developing countries and rising usage of NOACs over warfarin. NOAC medicines, including rivaroxaban, betrixaban, apixaban, edoxaban, and dabigatran, are available on the market. Furthermore, NOACs offer a speedier onset of action, less drug and food interaction, predictable pharmacokinetic activity, a shorter half-life, and no dietary restrictions when compared to warfarin. These have aided the market's expansion.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 23,817.5 Million |

Projected Market Size in 2028 |

USD 42,756.02 Million |

CAGR Growth Rate |

9.01% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Aspen Holdings, Bayer AG, Boehringer Ingelheim GmbH, Bristol-Myers Squibb Company, Daiichi Sankyo Company, Limited GlaxoSmithKline plc., johnson & johnson, janssen Pharmaceuticals, Inc., Portola Pharmaceuticals, Inc., Sanofi S.A., and Others |

Key Segment |

By Drug Class, Route of Administration, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

Throughout the projected period, North America is likely to lead the worldwide market. The high frequency of cardiovascular illnesses that require anticoagulant treatment, together with new product launches throughout the region, will fuel market expansion in the region. Furthermore, rising R&D initiatives, as well as increased awareness and prevalence of risk factors such as obesity and diabetes in the general population, are likely to boost the market in North America during the forecast period.

The Asia Pacific is expected to have the highest market value growth. Due to rising disposable incomes in the region, there is a greater awareness of cardiovascular diseases. The region's key countries' increasing prevalence of cardiovascular illnesses, adoption of improved anticoagulants, and the increasing status of cardiovascular diseases as the leading cause of mortality are also expected to boost blood thinners’ market growth.

Competitive Landscape

Competitive Landscape

The report contains qualitative and quantitative research on the Anticoagulants Market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts. The study examines, among other things, each company's global presence, competitors, service offers, and standards.

List of Key Players in the Anticoagulants Market:

- Aspen Holdings

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company

- Limited GlaxoSmithKline plc.

- johnson & johnson

- janssen Pharmaceuticals, Inc.

- Portola Pharmaceuticals, Inc.

- Sanofi S.A.

The global anticoagulants market is segmented as follows:

By Drug Class

By Drug Class

- NOACs

- Heparin & LMWH

- Vitamin K Antagonist

- Others

By Route of Administration

By Route of Administration

- Oral anticoagulant

- Injectable anticoagulant

By Application

By Application

- Atrial fibrillation & heart attack

- Stroke

- Deep vein embolism (PE)

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Aspen Holdings

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company

- Limited GlaxoSmithKline plc.

- johnson & Johnson

- janssen Pharmaceuticals Inc.

- Portola Pharmaceuticals Inc.

- Sanofi S.A.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors