Search Market Research Report

Aircraft Heat Exchanger Market Size, Share Global Analysis Report, 2025 – 2034

Aircraft Heat Exchanger Market Size, Share, Growth Analysis Report By Product (Plate-Fin Type, Flat Tube Type), By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft, Unmanned Aerial Vehicles [UAVs]), By Application (Electronic Pod Cooling, Environment Control System [ECS], Engine System, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

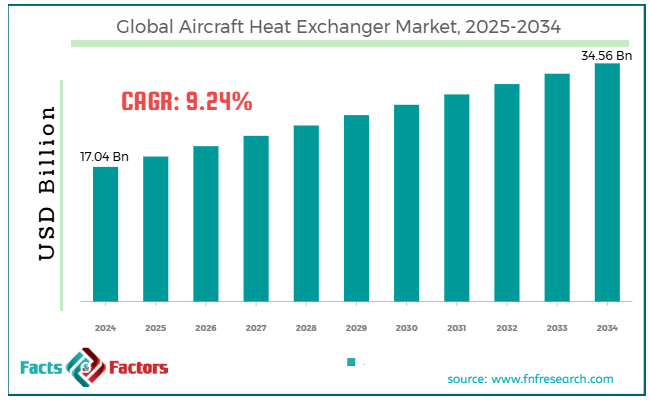

[217+ Pages Report] According to Facts & Factors, the global aircraft heat exchanger market size was worth around USD 17.04 billion in 2024 and is predicted to grow to around USD 34.56 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.24% between 2025 and 2034.

Market Overview

Market Overview

An aircraft heat exchanger is crucial in managing temperature in different aircraft systems by transmitting heat between fluids without blending them. These heat exchangers are in the engine cooling circuits and the ECS, or environmental control system. They regulate cabin air temperature and cool hydraulic fluid or engine oil. The growing defense expenditure, electrification of aircraft systems, and improvements in propulsion systems lead the worldwide aircraft heat exchanger market. Military spending is increasing globally, especially in nations like India, China, and the United States. This notably propels the procurement of enhanced aircraft systems like heat exchangers.

Moreover, the inclination towards hybrid-electric and electric propulsion systems demands effective thermal management technologies, thus offering prospects for heat exchanger makers. In addition, adopting next-generation propulsion systems like hybrid and turboelectric engines needs effective heat exchangers to handle extreme heat loads, thus fueling the global market demand.

However, the market is restrained by high initial investment, strict regulatory standards, and disturbances in the supply chain. The cost of advanced heat exchange technologies, manufacturing processes, and materials could be high, mainly for small and medium-sized businesses. Also, compliance with stringent aviation environmental and safety regulations may increase costs and delay product development. Global supply chain problems, geopolitical stresses, and material scarcity may adversely affect the price of components and raw materials.

Nonetheless, the opportunities progressing the aircraft heat exchanger industry include developing advanced materials, using additive manufacturing, and increasing focus on sustainability. 3D printing allows the production of low-weight and complex heat exchanger components, decreasing material wastage and minimizing lead times.

Moreover, the growth of high-performing and lightweight materials offers avenues to reduce aircraft weight and enhance heat exchanger efficiency. Furthermore, the growing focus on sustainability motivates the production of environmentally friendly heat exchangers that reduce emissions and improve fuel efficiency.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global aircraft heat exchanger market is estimated to grow annually at a CAGR of around 9.24% over the forecast period (2025-2034)

- In terms of revenue, the global aircraft heat exchanger market size was valued at around USD 17.04 billion in 2024 and is projected to reach USD 34.56 billion by 2034.

- The aircraft heat exchanger market is projected to grow significantly owing to the rising demand for fuel efficiency, advancements in materials and designs, and surging defense expenditure.

- Based on product type, the plate-fin type segment is expected to lead the market, while the flat tube type segment is expected to grow considerably.

- Based on the platform, the fixed-wing aircraft segment is the dominating segment, among others. In contrast, the rotary-wing aircraft segment is projected to witness sizeable revenue over the forecast period.

- Based on the application, the electronic pod cooling segment is expected to lead the market compared to the Environment Control System (ECS) segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Technological improvements in heat exchanger design spur market growth

Technological modernizations are continuously enhancing the performance and design of airplane heat exchangers. Novel materials, enhanced production processes, and improved cooling solutions are increasing the efficiency and durability and reducing the weight of heat exchangers. A remarkable improvement is the use of composite materials like CFRPs, which offer optimal resistance to corrosion and a strength-to-weight ratio. These materials enable producers to develop lightweight heat exchangers, decreasing the overall weight of the airplane and enhancing fuel efficiency.

Besides, 3D printing is gaining traction in the aerospace sector. This technique enables the manufacturing of complex interior geometries that enhance transfer efficiency.

- How will growth in the aerospace and defense sectors positively impact the aircraft heat exchanger market expansion?

The aerospace and defense industries are prominent contributors to the development of the aircraft heat exchanger market. Increased defense spending is fueling the demand for improved aerospace technologies like heat exchangers. According to recent reports, China’s 2023 financial plan was approximately USD 290 billion, which fueled the development of next-generation military aircraft, missiles, and drone systems. These platforms need effective heat management technologies to maintain optimal performance in high conditions, fueling the need for improved heat exchangers.

Moreover, the expansion of aerospace and defense sectors is surging the demand for heat exchangers, potentially managing thermal intricacies brought on by superior military technologies.

Restraints

Restraints

- Material shortages and supply chain disturbances adversely impact market progress

The aerospace market relies on the worldwide supply chain for advanced materials like aluminum alloys, titanium, and composites. The latest geopolitical stresses, lingering impacts of COVID-19, and trade restrictions have resulted in disturbances in the cost and accessibility of these crucial materials. These supply chain exposures may postpone production timelines, raise costs, and impact the on-time delivery of heat exchanger parts, thus hindering the overall market progress.

Opportunities

Opportunities

- Innovations in additive manufacturing contribute to market growth

Additive manufacturing, usually known as 3D printing, transforms aircraft components' production, including heat exchanges. This technology allows the development of complicated geometries that reduce weight and enhance heat transfer. Moreover, additive manufacturing enables customization and speedy prototyping, lowering costs and shortening development cycles.

Moreover, the growth of UAVs and UAM platforms, which need efficient and compact thermal management solutions, is projected to fuel the demand for improved heat exchangers. This positively contributes to the global aircraft heat exchanger industry.

Challenges

Challenges

- Will compliance requirements and stringent regulations limit the growth of the aircraft heat exchanger market?

The aerospace industry is subject to strict regulatory standards imposed by authorities like the EASA (European Union Aviation Safety Agency) and the FAA (Federal Aviation Administration). Heat exchangers should undergo extensive certification and testing procedures to comply with performance, safety, and environmental criteria. These strict demands may result in increased development costs and prolonged approval timelines, hampering the speedy deployment of novel thermal management solutions in the market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 17.04 Billion |

Projected Market Size in 2034 |

USD 34.56 Billion |

CAGR Growth Rate |

9.24% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Honeywell International Inc., TAT Technologies Ltd., Parker Hannifin Corporation, RTX Corporation, Safran SA, Triumph Group Inc., Wall Colmonoy Corporation, Boyd Corporation, IHI Corporation, AMETEK Inc., Conflux Technology Pty Ltd., Liebherr-International AG, Meggitt PLC, Woodward Inc., Eaton Corporation PLC., and others. |

Key Segment |

By Product, By Platform, By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global aircraft heat exchanger market is segmented based on product type, material type, end-user industry, and region.

Based on product, the global aircraft heat exchanger industry is divided into plate-fin type and flat tube type. The plate-fin type segment registered a majority of the market share in the past years and is expected to grow further, backed by its prominence in compact design and high thermal efficacy. This increases their suitability for uses where weight and space are paramount. They are largely used in engine and environmental systems, where efficient thermal management is vital. Their complex arrangement of plates and fins enables effective heat exchange in light and small forms. This is especially beneficial in newer airplanes like military, unmanned aerial vehicles, and commercial vehicles.

Based on the platform, the global aircraft heat exchanger industry is segmented into fixed-wing aircraft, rotary-wing aircraft, and unmanned aerial vehicles (UAVs). The fixed-wing aircraft segment held a substantial market share backed by its broader use in military operations, commercial aviation, and cargo transport. They need innovative heat exchangers for environmental control systems, engine systems, and avionics cooling. The need for practical thermal management tools in these airplanes is fueled by growing air traffic, the surging need for consistent performance over long distances, and increasing fuel efficiency.

Based on application, the global market is segmented into electronic pod cooling, environment control systems (ECS), engine systems, and others. The electronic pod cooling category is projected to register a larger share with a 9.99% CAGR over the estimated period. This growth is attributed to the rising demand for automation and the need to accommodate more electronic packages in increasingly tight and smaller spaces. Electronic pod cooling involves cooling electric devices like integrated circuit packages, chips, and other airtight-packed devices, which are essential in newer aircraft systems.

Regional Analysis

Regional Analysis

- North America to witness significant growth over the forecast period

North America held a dominating position in the aircraft heat exchanger market in 2024. The region is expected to lead over the forecast period owing to developed aerospace infrastructure, high defense spending, technological improvements, and aftermarket services. Canada, Mexico, and the United States boast a sophisticated aerospace industry, featuring leading players such as Lockheed Martin, Boeing, and Raytheon Technologies.

Even today, the United States is the world's biggest defense spender, resulting in heavy investments in military airplanes. This noticeable spending propels the demand for high-performing heat exchangers that have the potential to operate in demanding and diverse environments. The region is leading in incorporating next-generation technologies in airplanes.

Modernizations in electric and hybrid propulsion and implementation of the MEA (more electric aircraft) concept need improved thermal management tools like effective heat exchangers. Adding to the regional growth, the aging fleet in North America has elevated the demand for aftermarket services like refurbishments and replacements in heat exchangers. This ultimately fuels global market growth.

- Will Europe continue its dominance as the second-leading region in the aircraft heat exchanger market?

Europe is the second-leading aircraft heat exchanger market region owing to excellence in aerospace manufacturing, sustainability initiatives, ecological regulations, and surging defense sector investments. Europe is a hub for leading manufacturers, mainly Airbus, which delivered almost 720 commercial airplanes in 2023. This increased manufacturing volume fuels the demand for innovative heat exchanger systems.

The European Union has set ambitious goals to decrease emissions by 55% in aviation in the coming 5 years. These regulations motivate the implementation of low-weight and efficient heat exchangers and the installation of hybrid-electric propulsion systems. The European defense spending surged by 12%, emphasizing innovative programs like Eurodrone and FCAS (Future Combat Air System). These programs must develop thermal management solutions, driving the need for competent heat exchangers.

Competitive Analysis

Competitive Analysis

The prominent players profiled in the global aircraft heat exchanger market comprise:

- Honeywell International Inc.

- TAT Technologies Ltd.

- Parker Hannifin Corporation

- RTX Corporation

- Safran SA

- Triumph Group Inc.

- Wall Colmonoy Corporation

- Boyd Corporation

- IHI Corporation

- AMETEK Inc.

- Conflux Technology Pty Ltd.

- Liebherr-International AG

- Meggitt PLC

- Woodward Inc.

- Eaton Corporation PLC.

What are the key trends in the global aircraft heat exchanger market?

What are the key trends in the global aircraft heat exchanger market?

- The growing use of advanced coatings and materials:

The use of composite materials like CFRPs, carbon fiber-reinforced polymers, and advanced coatings is increasing substantially. These materials offer enhanced heat transfer capabilities, better durability, and reduced weight, which are vital for the efficacy and performance of airplane heat exchangers.

- Mounting demand for UAM and UAVs:

The growth of UAVs and urban air mobility offers new prospects in the global market. These platforms require efficient and compact thermal management solutions to achieve optimal, performance. With the increasing adoption of UAM and UAVs, the demand for advanced heat exchanger solutions modified for these uses also rises.

The global aircraft heat exchanger market is segmented as follows:

By Product Segment Analysis

By Product Segment Analysis

- Plate-Fin Type

- Flat Tube Type

By Platform Segment Analysis

By Platform Segment Analysis

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

- Unmanned Aerial Vehicles (UAVs)

By Application Segment Analysis

By Application Segment Analysis

- Electronic Pod Cooling

- Environment Control System (ECS)

- Engine System

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Honeywell International Inc.

- TAT Technologies Ltd.

- Parker Hannifin Corporation

- RTX Corporation

- Safran SA

- Triumph Group Inc.

- Wall Colmonoy Corporation

- Boyd Corporation

- IHI Corporation

- AMETEK Inc.

- Conflux Technology Pty Ltd.

- Liebherr-International AG

- Meggitt PLC

- Woodward Inc.

- Eaton Corporation PLC.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors