Search Market Research Report

Agrivoltaics Market Size, Share Global Analysis Report, 2025 - 2034

Agrivoltaics Market Size, Share, Growth Analysis Report By System Design (Dynamic and Fixed Solar Panles), By Cell Type (Polycrystalline and Monocrystalline), By Crop (Fruits, Vegetables, Crops and Others) And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

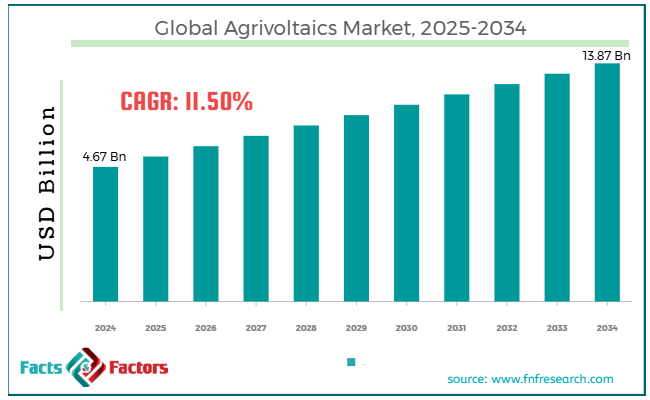

[221+ Pages Report] According to Facts & Factors, the global agrivoltaics market size was worth around USD 4.67 billion in 2024 and is predicted to grow to around USD 13.87 billion by 2034 with a compound annual growth rate (CAGR) of roughly 11.5% between 2025 and 2034.

Market Overview

Market Overview

Combining photovoltaics (PVs) and agriculture is known as agrivoltaics. Power is produced by utilizing solar PVs and agriculture at the same time. Agrivoltaics is also known by various synonyms, including dual-use solar, agripv, agrisolar, and agriphotovoltaics. Agrivoltaics systems are made so that solar panels can be installed and the land can be utilized for farming, cattle grazing, and other purposes. As a result, players in solar energy and agriculture have less rivalry for land. Agrivoltaics allows both the agricultural and solar farm/garden sectors to coexist on terrain that was previously only suitable for one or the other. Agrivoltaics provide a way to use both at the same time, which has substantial mutual benefits.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global agrivoltaics market is estimated to grow annually at a CAGR of around 11.5% over the forecast period (2025-2034).

- In terms of revenue, the global agrivoltaics market size was valued at around USD 4.67 billion in 2024 and is projected to reach USD 13.87 billion, by 2034.

- The rising government initiatives is expected to drive market growth over the forecast period.

- Based on the system design, the dynamic segment is expected to dominate the market during the forecast period.

- Based on the cell type, the monocrystalline segment is expected to capture the largest market share over the forecast period.

- Based on the crop, the crops segment is expected to hold a prominent market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Growth Drivers

Growth Drivers

- Growing investment from public and private players drives market growth

The government has boosted the solar industry with massive investments and incentives. All governments are converting their fossil fuel-based economies to renewable fuel-based economies to meet net zero carbon emission targets. Numerous initiatives are being implemented to raise knowledge about solar energy generation, particularly among the household and commercial sectors. The government provides large subsidies to people who use solar energy models for their energy production.

Utilizing solar PV in agriculture is a novel idea, and there is a dearth of evidence to support it, which raises worries among farmers. Therefore, more research and development efforts to collect useful data and a rise in farmer awareness of the advantages of agrivoltaics contribute to market expansion.

Restraints

Restraints

- High installation cost hinders market growth

Due to the high cost of solar PV modules, installation is expensive overall. Due to worldwide energy transitions aimed at lowering carbon emissions, the solar PV business is expanding. This change is anticipated to eventually result in lower prices for solar photovoltaics (PVs), as increased demand will drive mass manufacturing and the entry of new companies into the market. Nevertheless, even with the help of government subsidies and potential revenue from solar electricity, the farmer will initially have to bear a larger installation cost.

Opportunities

Opportunities

- The rising launch of several projects by major firms offers a lucrative opportunity for market growth

The rising launches of several projects by major firms are expected to offer a lucrative opportunity for market growth during the forecast period. For instance, in July 2024, to finance the building of the La Manganizza agrivoltaic plant, Renantis announced the opening of its third lending crowdfunding campaign. Situated in Manzano, in the province of Udine (in the Friuli Venezia Giulia region), the initiative provides the local community with an opportunity to engage in energy. The project will be created on a 15-hectare site, with work starting in the fall of 2024. It will have an installed capacity of 8.16 MW, and the total expected investment is approximately EUR 8 million.

After it starts up, the plant should be able to produce about 12 GWh of electricity annually, which is enough to power over 4,000 households. More than 14,000 double-sided solar PV modules on single-axis trackers make up the energy production technology. This technology will allow for higher output and less visual impact than regular modules.

Challenges

Challenges

- Technology integration poses a major challenge to market expansion

Integrating solar panels with agricultural infrastructure and practices requires careful planning and engineering. Ensuring compatibility between solar arrays and existing agricultural operations, such as irrigation systems and crop management practices, can pose technical challenges.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 4.67 Billion |

Projected Market Size in 2034 |

USD 13.87 Billion |

CAGR Growth Rate |

11.5% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Mirai Solar, Namaste Solar, SunAgri, Insolight SA, Next2Sun Technology GmbH, JA Solar Holdings Co. Ltd., BayWa AG, SunSeed APV Private Limited, Enel Green Power Spa, Ombrea, and others. |

Key Segment |

By System Design, By Cell Type, By Crop, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global agrivoltaics industry is segmented based on system design, cell type, crop and region.

Based on the system design, the global agrivoltaics market is bifurcated into dynamic and fixed solar panels. The dynamic segment is expected to dominate the market during the forecast period because they are specifically made for the type of crop, the terrain, the weather, and other considerations. They must be installed according to specifications and moved or changed as needed. Since they are a costly solution, installing them will cost a lot of funds. Since fixed solar panels are best suited for permanent installations, they are anticipated to expand at a quicker rate during the projection period. Because there is an air gap between the cells and the surface, they are resistant to weather and will usually produce less heat. Fixed solar panels are incredibly durable, require no maintenance, and don't have any moving parts. Financial incentives are available for fixed solar systems.

Based on the cell type, the global agrivoltaics industry is segmented into polycrystalline and monocrystalline. The monocrystalline segment is expected to capture the largest market share over the forecast period. The initial kind of solar panels designed to capture solar energy are monocrystalline ones. Single crystal silicon solar cells are used to construct them. Smooth and round-edged wafers are created by shaping pure silicon into a bar. Due to their increased efficiency, monocrystalline solar panels are more costly. Their ability to form a single cell gives them durability and excellent power output. Considering their high efficiency, they are most appropriate for modest roofs.

Based on the crop, the global agrivoltaics market is segmented into fruits, vegetables, crops and others. The crops segment is expected to hold a prominent market share over the forecast period. With conditions sometimes too hot and dry or other times marked by unexpected hailstorms, the rise in increasingly extreme weather has a considerably more profound effect on agriculture than on practically any other economic sector. Photovoltaic systems can be useful here. By preventing crops from falling, they protect them from excessive sun exposure, dryness, and hailstorms. As a result, this fuels the expansion of the agrivoltaics industry.

Regional Analysis

Regional Analysis

- North America is expected to dominate the market during the forecast period

North America is expected to dominate the market over the forecast period as the energy demand grows, and so does the appeal of agrivoltaics as a sustainable energy source. The demand for renewable energy is expected to rise, and government support and the benefits that agrivoltaics offers to farmers will all contribute to the U.S. agrivoltaics market's predicted faster growth in the future years. Marking a significant turning point in the nation's agrivoltaics environment, the U.S. Department of Energy's Agrivoltaics Partnership was founded in 2020 to accelerate the research and deployment of agrivoltaics technology.

The Foundational Agrivoltaics Research for Megawatt Scale (FARMS) program, which was unveiled by the U.S. Department of Energy in December 2022, would provide $8 million to six solar energy research projects spread across six states and the District of Columbia. The government's dedication to fostering the expansion and advancement of the agrivoltaics industry is demonstrated by this financial effort.

Competitive Analysis

Competitive Analysis

The global agrivoltaics market is dominated by players like:

- Mirai Solar

- Namaste Solar

- SunAgri

- Insolight SA

- Next2Sun Technology GmbH

- JA Solar Holdings Co. Ltd.

- BayWa AG

- SunSeed APV Private Limited

- Enel Green Power Spa

- Ombrea

The global agrivoltaics market is segmented as follows:

By System Design

By System Design

- Dynamic

- Fixed Solar Panles

By Cell Type

By Cell Type

- Polycrystalline

- Monocrystalline

By Crop

By Crop

- Fruits

- Vegetables

- Crops

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Mirai Solar

- Namaste Solar

- SunAgri

- Insolight SA

- Next2Sun Technology GmbH

- JA Solar Holdings Co. Ltd.

- BayWa AG

- SunSeed APV Private Limited

- Enel Green Power Spa

- Ombrea

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors