Search Market Research Report

Aerospace Galley Trolley And Containers Market Size, Share Global Analysis Report, 2021 – 2026

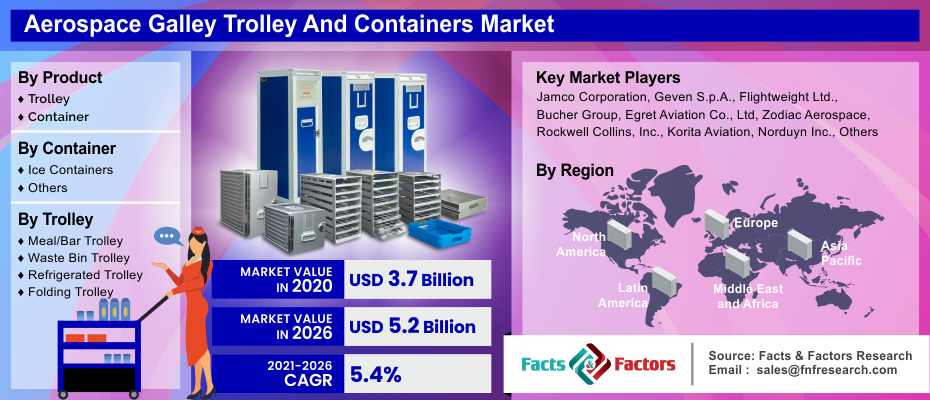

Aerospace Galley Trolley And Containers Market By Product Type (Trolley and Container), By Trolley (Meal/Bar Trolley, Waste Bin Trolley, Refrigerated Trolley, and Folding Trolley), and By Container (Ice Containers and Others): Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

[179+ Pages Report] The global aerospace galley trolley and containers market is set for rapid growth over the forecast period. In terms of revenue, the global aerospace galley trolley and containers market accounted for USD 3.7 Billion in 2020 and is anticipated to reach around USD 5.2 Billion by 2026 end, growing at a CAGR of nearly 5.4%.

Market Overview

Market Overview

An aircraft cabin's galley trolley and container are important equipment. Manufacturers of galley trolleys and containers, as well as airlines, believe that the galley trolley and galley may have an indirect or direct impact on a passenger's flight experience. A traveler's trip can be ruined by a technically unhygienic and inadequate trolley and container. The indirect passenger experience, on the other hand, is measured by the degree of satisfaction of the flight crew as a result of their experience with their facilities, such as the galley trolley and container.

Industry Growth Factors

Industry Growth Factors

The growing air traffic is expected to drive the global aerospace galley trolley and containers market. Due to advancements in airport facilities as well as growing consumer demand, there has been a rise in air traffic passengers globally in the last few years. The increase in disposable income coupled with the increasing middle class has also contributed significantly to the growing demand. Globally, the commercial aircraft fleet is constantly expanding, particularly in the Asia-Pacific region, to meet rising demand. Furthermore, airlines are renewing their older aircraft fleets and replacing them with new facilities and technology, as the refreshed fleet would operate for almost the next 30 years. Also, the market is anticipated to propel in the upcoming years due to the growing demand for lightweight aerospace galley trolleys and containers attributed to the increasing emphasis on the reduction of aircraft weight. In the aerospace industry, one of the most important considerations of structural design is weight reduction. With a substantial boost in fuel efficiency, lightweight materials provide a strong effect on airline profitability. As a result, lightweight galley trolleys and containers are becoming increasingly popular in the aerospace industry to help with weight reduction. Furthermore, the flammability of these materials is low, ensuring passenger protection in the event of a fire or emergency. Hence the use of lightweight materials in the galley trolley and containers of aircraft is anticipated to persist in the future years. In the coming years, this trend is likely to boost the demand.

Global Aerospace Galley Trolley And Containers Market: Segmentation

Global Aerospace Galley Trolley And Containers Market: Segmentation

The global aerospace galley trolley and containers market is bifurcated into its product type, trolley, container, and regions. Based on the product type, the global market is divided into containers and trolleys. Based on the trolley, the global market is divided into waste bin trolley, folding trolley, meal/bar trolley, and refrigerated trolley. Based on the container, the market is bifurcated into ice containers and others. Geographically, the global aerospace galley trolley and containers market is divided into North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

Global Aerospace Galley Trolley And Containers Market: Regional Analysis

Global Aerospace Galley Trolley And Containers Market: Regional Analysis

North America region dominated the global aerospace galley trolley and containers market in 2019 and is anticipated to continue its dominance in the upcoming years. This is due to the region's rising business and commercial aviation sector, which has the world's highest demand for aerospace and defense aircraft. In addition, industry growth is projected to be fueled by the rapid introduction of new manufacturing technology and substantial investment in research and development activities. The participation of many major industry players such as Rockwell Collins, Inc. and Norduyn Inc. among others, will help the market expand even further. Furthermore, over the last few years, North America has seen an increase in aircraft deliveries in both commercial and defense applications, which is projected to fuel the region's industry.

The Asia Pacific market is anticipated to grow at a significant rate in the forecast period. The growth of the Asia Pacific region can be attributed to the region's increased emphasis on the construction of aircraft manufacturing facilities. The market's growth is being fueled by encouraging government policies and a growing defense budget. The region's increased commercial and military aircraft production and procurement programmes are expected to fuel the market's growth. For example, in December 2018, the Boeing Company and the Commercial Aircraft Corporation of China formed a joint venture to build the first 737 aircraft in China. The Boeing Company spent about USD 33 million in the joint venture and now owns a significant portion of it.

Europe market followed North America market in 2019 and is expected to grow at a healthy growth rate in the upcoming years. This is due to increased demand for aerospace galley trolleys and containers from main Airbus SE and ATR aircraft manufacturing facilities in Germany, U.K., France, and Italy. Furthermore, leading manufacturers such as Zodiac Aerospace and Geven S.p.A. among others, are present in the region, fueling the market growth over the projected period. Furthermore, the UK authorities' assurances that the UK will remain a member of the European Aviation Safety Agency will not affect the BREXIT agreement also brought relief to UK-based manufacturers. The aerospace galley trolley and containers industry in Latin America is dominated by Brazil and Mexico, with Brazil being the largest consumer. Despite its limited scale, the Middle East and Africa aerospace market is projected to expand rapidly due to the optimistic outlook of airplane manufacturers to open new bases in the area and its strategic location.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD USD 3.7 Billion |

Projected Market Size in 2026 |

USD 5.2 Billion |

CAGR Growth Rate |

5.4% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Jamco Corporation, Geven S.p.A., Flightweight Ltd., Bucher Group, Egret Aviation Co., Ltd, Zodiac Aerospace, Rockwell Collins, Inc., Korita Aviation, Norduyn Inc., Trenchard Aviation Group Ltd, and Diethelm Keller Aviation Pte. Ltd. among others. |

Key Segment |

By Raw Material, By Aircraft Type, By End-Use, By Distribution Channel, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Global Aerospace Galley Trolley And Containers Market: Competitive Players

Global Aerospace Galley Trolley And Containers Market: Competitive Players

Some of the key players in the aerospace galley trolley and containers market are :

- Jamco Corporation

- Geven S.p.A.

- Flightweight Ltd.

- Bucher Group

- Egret Aviation Co. Ltd

- Zodiac Aerospace

- Rockwell Collins Inc.

- Korita Aviation

- Norduyn Inc.

- Trenchard Aviation Group Ltd

- Diethelm Keller Aviation Pte. Ltd.

Global Aerospace Galley Trolley And Containers Market: By Product Type

Global Aerospace Galley Trolley And Containers Market: By Product Type

- Trolley

- Container

Global Aerospace Galley Trolley And Containers Market: By Trolley

Global Aerospace Galley Trolley And Containers Market: By Trolley

- Meal/Bar Trolley

- Waste Bin Trolley

- Refrigerated Trolley

- Folding Trolley

Global Aerospace Galley Trolley And Containers Market: By Container

Global Aerospace Galley Trolley And Containers Market: By Container

- Ice Containers

- Others

Global Aerospace Galley Trolley And Containers Market: Regional Segment Analysis

Global Aerospace Galley Trolley And Containers Market: Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle-East Africa

Industry Major Market Players

- Jamco Corporation

- Geven S.p.A.

- Flightweight Ltd.

- Bucher Group

- Egret Aviation Co. Ltd

- Zodiac Aerospace

- Rockwell Collins Inc.

- Korita Aviation

- Norduyn Inc.

- Trenchard Aviation Group Ltd

- Diethelm Keller Aviation Pte. Ltd.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors