Search Market Research Report

Aeroplane Engines Market Size, Share Global Analysis Report, 2022 – 2028

Aeroplane Engines Market Size, Share, Growth Analysis Report By Component (Combustor, Mixer, Fan, Turbine, Compressor, and Nozzle), By Engine Type (Turbojet, Turbofan, Piston & Turboprop, and Turboshaft), By End-User (Commercial, and Military), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

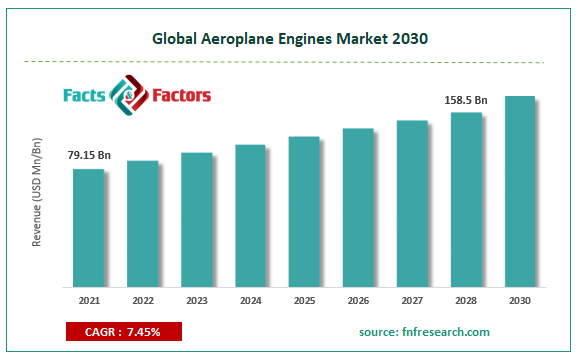

[203+ Pages Report] According to the report published by Facts Factors, the global aeroplane engines market size was worth around USD 79.15 billion in 2021 and is predicted to grow to around USD 158.5 billion by 2028 with a compound annual growth rate (CAGR) of roughly 7.45% between 2022 and 2028. The report analyzes the global aeroplane engines market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the aeroplane engines market.

Market Overview

Market Overview

An aeroplane engine, also called an aero engine, is the power-providing part of the aircraft propulsion system, which is the process of pulling or pushing to drive a given system or an object. In most cases, an aeroplane is installed with gas engines or piston engines, but some aircraft are powered by rocket engines and some unmanned aerial vehicles (UAVs) use electric motors. Piston engines, also known as aircraft reciprocating engines are manufactured to run on aviation gasoline (Avgas) that has a higher octane rating as compared to the gasoline used for automotive purposes. This is to allow an increased power output, better compression ratios, and excellent efficiency at higher altitudes. As of 2022, the most commonly used Avgas is 100 LL, referencing the octane rating where the number implies 100 octanes and LL stands for low lead content. Aircraft diesel engines and turbine engines run on different grades of jet fuel which is a lesser volatile petroleum derivative but can only be used under stringent aviation laws along with external additives.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global aeroplane engines market is estimated to grow annually at a CAGR of around 7.45% over the forecast period (2022-2028).

- In terms of revenue, the global aeroplane engines market size was valued at around USD 79.15 billion in 2021 and is projected to reach USD 158.5 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on component segmentation, the turbine was predicted to show maximum market share in the year 2021

- Based on end-user segmentation, the military was the leading end consumer in 2021.

- On the basis of region, North America was the leading revenue generator in 2021

Covid-19 Impact

Covid-19 Impact

Covid-19 had serious repercussions on the aviation industry in general owing to the ban on commercial flights across regions. The global market cap witnessed a sharp decline in revenue during 2020 since most of the aeroplanes for the general population were parked idle and did not take flight until the end of the 3rd quarter of 2020. However, the demand for the products for military and non-commercial purposes remained high during the phase.

Growth Drivers

Growth Drivers

- Innovation is the key to future market growth

The global aeroplane engines market is expected to be driven by the constant innovation in the aerospace industry owing to the growing demand from the end consumers segment. The world is moving toward advanced technology at an extremely rapid pace with ongoing research & development activities along with the need to develop systems and resources that not only provide efficient output but also encourage sustainable growth. Since airplanes are known to consume a high amount of fuel in various forms, the aviation sector is working toward developing systems through which fuel dependency can be regulated. For instance, Otto Celera 500L is claimed as the most fuel-efficient commercial & utility aircraft as of 2022. Other milestones like the GE9X, the world’s largest aero engine ever created, completed flight tests on a modified Boeing 747 and was being geared up for another flight test on Boeing 777-9.

Restraints

Restraints

- Rising political turmoil to restrict the market growth

Aerospace is an extremely important segment of any economy either for commercial purposes or for national security reasons. The current political turmoil between Russia and Ukraine along with the backlogs created by Covid-19 can result in reduced global market size since world leaders are now changing dynamics in terms of raw material and fuel procurement depending on their alliances.

Opportunities

Opportunities

- Growing number of inflight passengers to provide excellent expansion opportunities

The global aeroplane engines market is projected to benefit from the increasing number of people preferring airways as a mode of transport. The growing population along with globalization, resulting in the relocation of people from one region to another driven by professional or personal reasons is anticipated to generate a high demand for smooth airway travel which in turn is expected to benefit the global market cap in the coming years. For instance, in 2021, there was an increase of 18% in the global air traffic passenger rate as a result of the reopening of the commercial travel sector.

Challenges

Challenges

- Increasing safety standards to impede the addition of new consumers

Aeroplane engines play a significant role in determining the safety index of airway travel. There has been a growing incidence of aircraft failure owing to issues with substandard engines or poor maintenance. This has further propelled regulatory authorities to upgrade aeroplane engine standards and authorization protocols which could cause challenges during the global market growth trend.

Segmentation Analysis

Segmentation Analysis

- The global aeroplane engines market is segmented based on component, engine type, platform, end-user, and region.

Based on component, the global market segments are combustor, mixer, fan, turbine, compressor, and nozzle. The global market cap is dominated by the turbine segment. The engine of an aircraft in itself is the most expensive part of the flying object, in which turbine blades and the control system contribute heavily to the overall cost. Jet engines are known to cost between USD 10 million to USD 40 million.

Based on engine type, the global market is divided into turbojet, turbofan, piston & turboprop, and turboshaft. The global market generated the highest revenue from the turbofan segment. The Rolls-Royce Trent is one of the most expensive high-bypass turbofans. In 2015, Emirates Airlines signed a deal for 200 units of Trent 900 for a total investment of USD 46 million per engine.

Based on end-user, the global market is segmented into commercial and military. Even though the number of commercial flights is more compared to military airplanes, the latter is much more expensive than the former owing to the various specifications and requirements for high-powered engines. As per Statista, in 2019, the cost of operating the aircraft fleet in the US is about USD 49 billion.

Recent Developments:

Recent Developments:

- In June 2022, Boeing Co, an American multinational manufacturer of aircraft and other aviation devices, announced that it is open to trying the new engine concept of Safran. The latest innovation involves an open fan design or an open rotor design and is a concept driven by a futuristics growth approach.

- In June 2021, the world witnessed the announcement of a new-age technology development program in a joint venture by Safran and GE Aviation. The program called CFM RISE aims to target a 20% reduction in CO2 emissions and lower fuel consumption as compared to the engines used currently.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 79.15 Billion |

Projected Market Size in 2028 |

USD 158.5 Billion |

CAGR Growth Rate |

7.45% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

General Electric, Textron Inc., IHI Corporation, CFM International, Lycoming Engines, and others. |

Key Segment |

By Component, Engine Type, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead market growth during the forecast period

The global aeroplane engines market is projected to be dominated by North America, with the US contributing the highest regional market revenue. As per official reports, the US was the top exporter of spark-ignition engines with a total value of USD 6.05 billion. The country's government spends a hefty amount on its aviation systems which were further propelled by the distressing situation that arose after 9/11, with the government becoming more stringent with aircraft-related protocols. The regulatory bodies created stricter standards for aircraft to fly in the region’s zone. The revenue of Boeing Company, a world leader in the aircraft space, generated a revenue of USD 63 billion in sales in 2021. Such factors are projected to further aid the regional market expansion.

Competitive Analysis

Competitive Analysis

- General Electric

- Textron Inc.

- IHI Corporation

- CFM International

- Lycoming Engines

The global aeroplane engines market is segmented as follows:

By Component

By Component

- Combustor

- Mixer

- Fan

- Turbine

- Compressor

- Nozzle

By Engine Type

By Engine Type

- Turbojet

- Turbofan

- Piston & Turboprop

- Turboshaft

By End-User

By End-User

- Commercial

- Military

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- General Electric

- Textron Inc.

- IHI Corporation

- CFM International

- Lycoming Engines

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors