Search Market Research Report

Acetic Acid Market Size, Share Global Analysis Report, 2022 – 2028

Acetic Acid Market Size, Share, Growth Analysis Report By Application (VAM, PTA, Anhydride, Ethyl Acetate, Butyl Acetate, Others), By End-Use (Plastics & Polymers, Food & Beverage, Inks, Paints & Coatings, Chemicals, Pharmaceuticals, Others), and By Region - Global Industry Insights, Comparative Analysis, Trends, Statistical Research, Market Intelligence, and Forecast 2022 – 2028

Industry Insights

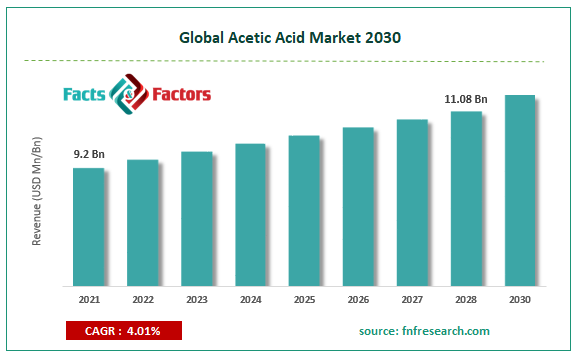

[205+ Pages Report] According to Facts and Factors, The global acetic acid market size was valued at USD 9.2 billion in 2021 and is predicted to increase at a CAGR of 4.01% to USD 11.08 billion by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries. The report analyses the global acetic acid market’s drivers and restraints, as well as the impact they have on demand throughout the projection period. In addition, the report examines global opportunities in the acetic acid market.

Market Overview

Market Overview

Acetic acid, also known as ethanoic acid, is a colorless organic compound that falls under the category of carboxylic acids. Global market growth will be aided by developing and expanding applications in various industries such as paints and coatings, adhesives and sealants, and textiles. The growing demand for paints and coatings around the world drives the consumption of Vinyl Acetate Monomer (VAM), which fuels the market's growth.

Growth Drivers

Growth Drivers

The growing use of solvents such as VAM in the chemical industry for paints, coatings, adhesives, and sealants is driving the market growth. Furthermore, PTA is used in the production of polyester, and the growing demand for polyester in the textile and packaging industries contributes to the high consumption of PTA. Mature market conditions for acetic anhydride and volatile methanol prices, which produce acetic acid, are expected to stymie the acetic acid market's growth during the forecast period.

Since acetic acid is a major contributor to the production of VAM, it is expected to drive the overall acetic acid market. The demand for vinyl alcohols and polyvinyl acetates is also increasing, which is propelling the acetic acid market forward. VAM is also used to make polymer for coatings and adhesives, which increases acetic acid consumption. As the world's population grows, so does the demand for clothes and other packaged goods, which drives the growth of the packaging and textile industries that use PTA, thereby contributing to the growth of the overall acetic acid market during the forecast period. Acetic acid is also used as an industrial chemical and chemical reagent in the production of cellulose acetate for photographic films, as well as polyvinyl acetate in the production of synthetic fabrics and fibers, which will increase acetic acid consumption during the forecast period.

COVID – 19 Impact

COVID – 19 Impact

The COVID-19 pandemic in 2020 had a negative impact on the market. The declining automotive industry, as well as the temporary shutdown of automotive manufacturing units and various construction projects due to the ongoing uncertainty of pandemic regulations, reduced the use of adhesives, paints, and coatings, negatively impacting acetic acid demand. Work stoppages caused by measures imposed by various government authorities around the world in an attempt to slow the spread of the virus, as well as workforce shortages caused by illness and preventative quarantines, impacted most end-user industries, including textiles, food and beverage, automotive, and construction, affecting the acetic acid market's growth.

The complete research study looks at both the qualitative and quantitative aspects of the Acetic Acid market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global Acetic Acid market is segregated based on Application and End Use.

Based on Application, vinyl acetate monomer dominates the market. This is due to the product's widespread demand from the world's rapidly growing industrial and cosmetics manufacturing sectors. VAM is a colorless liquid with a strong odor that is typically stored in reconditioned steel drums and transported in tank trucks and bulk vessels. Vinyl acetate monomer should be stored in cool, dry places away from fire hazards. VAM's primary function is to produce polyvinyl alcohol and polyvinyl acetate. Polyvinyl alcohol is commonly found in water-soluble packaging, coatings, adhesives, and textile warp sizing, among other applications. Furthermore, polyvinyl acetate is widely used in textile treatment, adhesives, paints, and paper coatings around the world.

Based on End-user, the global acetic acid market was dominated by the paints and coatings category, which held the biggest market share. The increase is due to increased demand for acetic acid in the production of paints and coatings. Acetic acid, also known as ethanoic acid, is used to make vinyl acetate, which is then converted to ethyl acetate and utilized as a solvent in paints.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 9.2 Billion |

Projected Market Size in 2028 |

USD 11.08 Billion |

CAGR Growth Rate |

4.01% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

British Petroleum Plc, Celanese Corporation, Daicel Corporation, Eastman Chemical Company, GNFC Limited, HELM AG, LyondellBasell Industries N.V., Mitsubishi Chemical Corporation, PetroChina, SABIC, Showa Denko K.K., Sinopec, Svensk Etanolkemi AB (SEKAB), Wacker Chemie AG, and Others |

Key Segment |

By Application, End-Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

The Asia Pacific dominated the market and will account for the majority of the market in 2021. This is due to the region's increasing penetration of polymer formulators. Acetic acid is a critical substance used in various industries in China, Japan, and India. Due to increased mergers and acquisitions, the region is seeing a surge in construction activity. Over the last decade, the region has attracted a slew of multinational corporations from a variety of industries, as well as a slew of manufacturing expansion projects. Despite slight trade tensions between China and the United States, prices for plastics and polymers remained stable in the Asia Pacific region. With more developing industries in countries such as China, Japan, and India, the demand for plastics and plastic products has grown.

Competitive Landscape

Competitive Landscape

The report contains qualitative and quantitative research on the global Acetic Acid Market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts. The study examines, among other things, each company's global presence, competitors, service offers, and standards.

List of Key Players in the Global Acetic Acid Market:

- British Petroleum Plc

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- GNFC Limited

- HELM AG

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- PetroChina

- SABIC

- Showa Denko K.K.

- Sinopec

- Svensk Etanolkemi AB (SEKAB)

- Wacker Chemie AG

The global acetic acid market is segmented as follows:

By Application Segment Analysis

By Application Segment Analysis

- VAM

- PTA

- Anhydride

- Ethyl Acetate

- Butyl Acetate

- Others

By End-Use Segment Analysis

By End-Use Segment Analysis

- Plastics & Polymers

- Food & Beverage

- Inks, Paints & Coatings

- Chemicals

- Pharmaceuticals

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- British Petroleum Plc

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- GNFC Limited

- HELM AG

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- PetroChina

- SABIC

- Showa Denko K.K.

- Sinopec

- Svensk Etanolkemi AB (SEKAB)

- Wacker Chemie AG

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors