Search Market Research Report

1,3-Dihydroxyacetone Market Size, Share Global Analysis Report, 2020–2026

1,3-Dihydroxyacetone Market By Application (Cosmetic, Pharmaceutical, and Others): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecast 2020–2026

Industry Insights

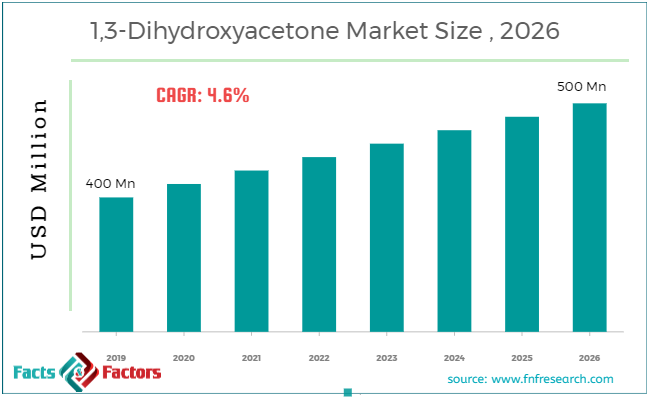

[185+ Pages PDF Report] Global 1,3-Dihydroxyacetone market in 2019 was above USD 400 million. The market is expected to grow above a CAGR of 4.6% and is anticipated to reach over USD 500 million by 2026.

This specialized and expertise oriented industry research report scrutinizes the technical and commercial business outlook of the 1, 3-Dihydroxyacetone industry. The report analyzes and declares the historical and current trends analysis of the 1, 3-Dihydroxyacetone industry and subsequently recommends the projected trends anticipated to be observed in the 1, 3-Dihydroxyacetone market during the upcoming years.

Key Insights from Primary Research

Key Insights from Primary Research

- According to the primary researcher operating in the global 1, 3-Dihydroxyacetone market, the market was valued at USD 400 million and is expected to be valued over USD 500 million.

- The 1, 3-Dihydroxyacetone market is predicted to witness a significant growth of nearly 4.6% during 2020-2026 owing to increasing demands for 1, 3-Dihydroxyacetone in the chemical industry.

- Based on various applications, the global 1,3dihydroxyacetone market was led by cosmetics. It accounted for more than 40% share of the market in 2019.

- Europe market accounted for more than 35% of the total revenue of global 1,3dihydroxyacetone in 2019.

- The Asia-Pacific is expected to be the fastest-growing market for 1,3dihydroxyacetone during the years to come.

Key Recommendations from Analysts

Key Recommendations from Analysts

- Our analysts recommend that the Pharmaceuticalsegment is anticipated to boost the 1, 3-Dihydroxyacetone market owing to the use of DHA in the healthcare and pharmaceutical industry.

- DHA is widely used in the chemical industry, such as the synthesis of fine chemicals. The biotechnological process of DHA production is distinguished by low cost and environmental friendliness compared to chemical synthesis is expected to grow the DHA market in the future years.

- Due to an increasing number of 1, 3-Dihydroxyacetone industries in developing countries such as China, Japan, India, etc.

- DHA market is anticipated to grow in the European region attributed to the increasing number of chemical and cosmetic industries in this region.

- Increased awareness of the health hazard presented by sunburned skin and the cultural urge for tan were key drivers of growth for self-tanning agents. Dihydroxyacetone (DHA) provides a safe natural tanning effect for the skin without sun exposure, with a key focus on prevention and safety. Due to these properties,1, 3-Dihydroxyacetone market is anticipated to share the highest growth in the future years.

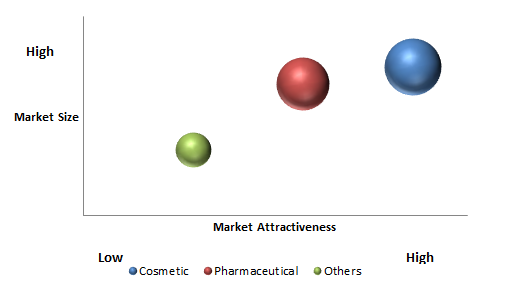

Market Attractiveness By Application Analysis

Market Attractiveness By Application Analysis

The 1, 3-Dihydroxyacetone market report analyzes and notifies the industry statistics at the global as well as regional and country levels in order to acquire a thorough perspective of the entire 1, 3-Dihydroxyacetone market. The historical and past insights are provided for FY 2016 to FY 2019 whereas projected trends are delivered for FY 2020 to FY 2026. The quantitative and numerical data is represented in terms of both volume (Kilo Tons) and value (USD Million) from FY 2016 – 2026.

The quantitative data is further underlined and reinforced by comprehensive qualitative data which comprises various across-the-board market dynamics. The rationales which directly or indirectly impact the 1, 3-Dihydroxyacetone industry are exemplified through parameters such as growth drivers, restraints, challenges, and opportunities among other impacting factors.

Throughout our research report, we have encompassed all the proven models and tools of industry analysis and extensively illustrated all the key business strategies and business models adopted in the 1, 3-Dihydroxyacetone industry. The report provides an all-inclusive and detailed competitive landscape prevalent in the 1, 3-Dihydroxyacetone market.

The report utilizes established industry analysis tools and models such as Porter’s Five Forces framework to analyze and recognize critical business strategies adopted by various stakeholders involved in the entire value chain of the 1, 3-Dihydroxyacetone industry. The 1, 3-Dihydroxyacetone market report additionally employs SWOT analysis and PESTLE analysis models for further in-depth analysis.

The report study further includes an in-depth analysis of industry players' market shares and provides an overview of leading players' market position in the 1, 3-Dihydroxyacetonesector. Key strategic developments in the 1, 3-Dihydroxyacetone market competitive landscape such as acquisitions & mergers, inaugurations of different products and services, partnerships & joint ventures, MoU agreements, VC & funding activities, R&D activities, and geographic expansion among other noteworthy activities by key players of the 1, 3-Dihydroxyacetone market are appropriately highlighted in the report.

DHA is a crystalline, and hygroscopic white powder with a sweet taste for cooling and a characteristic odor. The solitary of the sugars identified in carbonaceous chon rites is 1, 3 dihydroxyacetone (DHA), or CO (CH2OH) 2. Dihydroxyacetone is a commonly used monosaccharide as a complex component in sunless tanning products. Dihydroxyacetone is synthesized via glycolysis and it is used in the production of ATP, and 1, 3 dihydroxyacetone is also involved in antioxidant activity, weight increase, and fat loss, and increasing stamina capacity. Moreover, DHA functions as a flexible building block for the natural synthesis of a number of fine chemicals. DHA is derived from plant sources such as sugar cane, sugar beets, and glycerin fermentation.

DHA is a skin coloring agent. In the chemical industry, 3-Dihydroxyacetone (DHA) is used as a pioneer. For the synthesis of many fine chemicals, DHA is an active browning ingredient in the cosmetic industry. It is also used in winemaking. The growing demand for DHA in the cosmetic and pharmaceutical industries are driving the 1, 3-Dihydroxyacetone market. Dihydroxyacetone however has an unsatisfactorily short shelf life. Dihydroxyacetone has properties that impose significant inherent limitations on its use. Dihydroxyacetone is soluble in water when it is in the form of a monomer. While this is a desirable property for preparing formulations of dihydroxyacetone, it also creates a problem as it exposes dihydroxyacetone to the action and effects of different agents, moves it into many unintended conditions, and makes it difficult to isolate. These parameters may restraints market growth. On the other hand, an increasing number of 1, 3-Dihydroxyacetone industries in developing countries are giving more opportunities for export to the big as well as small chemical businesses.

The 1, 3-Dihydroxyacetone market research report delivers an acute valuation and taxonomy of the 1, 3-Dihydroxyacetone industry by practically splitting the market on the basis of different types, applications, and regions. Through the analysis of the historical and projected trends, all the segments and sub-segments were evaluated through the bottom-up approach, and different market sizes have been projected for FY 2020 to FY 2026. The regional segmentation of the 1, 3-Dihydroxyacetone industry includes the complete classification of all the major continents including North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. Further, country-wise data for the 1, 3-Dihydroxyacetone industry is provided for the leading economies of the world.

The 1, 3-Dihydroxyacetonemarket is segmented based on type and application. In terms of Application segmentation, the market is bifurcated into cosmetic, pharmaceutical, others.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 400 Million |

Projected Market Size in 2026 |

USD 500 Million |

CAGR Growth Rate |

4.6% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

MerkKGaA, Zhejiang Changxing Pharmaceutical Co. Ltd., Hisun Pharmaceuticals USA, Wuxi Jingyao Bio-Technology Co., Ltd., Alpha Chemika, Penta Manufacturing Company, and others. |

Key Segment |

By Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Landscape

Competitive Landscape

Some of the essential players operating in the 1, 3-Dihydroxyacetone market, but not restricted to include:

- Hisun Pharmaceuticals USA

- Penta Manufacturing Company

- Zhejiang Changxing Pharmaceutical Co. Ltd.

- Wuxi Jingyao Bio-Technology Co.Ltd.

- MerkKGaA

- Alpha Chemika

- and others.

The taxonomy of the 1, 3-Dihydroxyacetone market by its scope and segmentation is as follows:

By Application Segmentation Analysis

By Application Segmentation Analysis

- Cosmetic

- Pharmaceutical

- Others

Global 1, 3-Dihydroxyacetone Market: Regional Segmentation Analysis

Global 1, 3-Dihydroxyacetone Market: Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Industry Major Market Players

- MerkKGaA

- Zhejiang Changxing Pharmaceutical Co. Ltd.

- Hisun Pharmaceuticals USA

- Wuxi Jingyao Bio-Technology Co. Ltd.

- Alpha Chemika

- Penta Manufacturing Company

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors