Search Market Research Report

Smartwatch Market Size, Share Global Analysis Report, 2024 – 2032

Smartwatch Market Size, Share, Growth Analysis Report By Operating System (iOS, Android, and Others), By Application (Running, Checking Notifications, Swimming, Cycling, and Others), By End-User (Male, Female), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

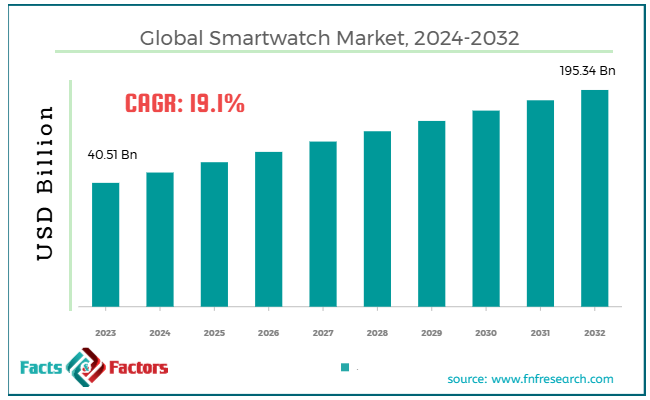

[221+ Pages Report] According to Facts & Factors, the global smartwatch market size was worth around USD 40.51 billion in 2023 and is predicted to grow to around USD 195.34 billion by 2032, with a compound annual growth rate (CAGR) of roughly 19.1% between 2024 and 2032.

Market Overview

Market Overview

A smartwatch is a wearable tool that links users’ smartphones to offer characteristics like fitness tracking, notifications, sometimes making calls or sending texts, and health monitoring. The device usually comprises sensors, a touchscreen, and applications to track sleep patterns, heart rate, and steps. The global smartwatch industry has witnessed substantial growth over the past few years owing to the rising consumer interest in fitness & health and technological improvements.

Since more individuals on a global scale are becoming health-conscious, the demand for smartwatches embedded is also increasing. The key attractive features include heart rate monitoring and step tracking, sleep analysis, and ECG. These features are a key attraction among fitness enthusiasts and health-conscious groups.

Furthermore, the new smartphones are being specially designed to appeal a broader consumer groups by integrating fashionable designs, interchangeable bands, and luxury options. This inclination has increased the prominence of smartwatches beyond just tech devices.

However, a few factors restraining the growth of the global smartwatch market include high price points and security & privacy concerns. Despite the availability of several affordable options, most hi-technology smartwatches, especially premium brands like Garmin, Apple, and Samsung restrict their attraction to a wider audience.

Also, since smartwatches gather ample personal data like location tracking and health metrics, privacy and security become key concerns. This may create hesitation among most consumers to purchase, mainly because they are clueless about how their data will be protected or used.

Yet, personalization, customization, and wellness integration are some opportunities witnessed in the global market for further progress. With the rising emphasis on preventive care, smartwatches might integrate medical apps and devices to monitor chronic conditions.

In addition, the growing number of customizable design features dedicated to specific activities like yoga, running, and cycling and watch faces are some of the leading opportunities for companies to attract niche markets.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global Smartwatch market is estimated to grow annually at a CAGR of around 19.1% over the forecast period (2024-2032)

- In terms of revenue, the global smartwatch market size was valued at around USD 40.51 billion in 2023 and is projected to reach USD 195.34 billion by 2032.

- The smartwatch market is projected to grow significantly owing to growing health consciousness among a large population, increasing technological improvements, and rising integration with IoT devices and smartphones.

- Based on operating system, the iOS segment is the dominating segment, while the Android segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the running segment is expected to lead the market as compared to the cycling segment.

- Based on end-user, the male segment is expected to lead the global market, while the female segment is expected to register considerable growth in the coming years.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Growing health consciousness among a large population propels the Smartwatch market growth

Fitness and health are today the primary drivers in the smartwatch industry, mainly since consumers are becoming health-conscious and seeking ways to monitor their health and wellness in real time.

With the rising popularity of technology products, especially wearables, a majority of people are shifting their interests towards smartwatches since they help track several metrics.

In 2022, a Deloitte survey says that nearly 50% of people with smartwatches use them for fitness and health tracking. This indicates that health-associated features are the key reasons for buying smartwatches.

Recently, Apple introduced novel features with the Apple Watch Series 8, comprising temperature sensors for tracking cycles and an improved ECG application. These characteristics belong to Apple's current efforts to transform its smartwatch into a personal health device, mainly emphasizing on health of women.

Fitbit by Google also launched novel health-based updates in its smartwatches, comprising a daily readiness score and skin temperature sensor to assist consumers measure their physical state.

- Growing demand for convenience to fuel the industry growth

Smartwatches offer optimal convenience, permitting consumers to manage their regular tasks, communications, and notifications right from their wrists. Since people are looking to reduce dependency on smartphones, this is one key attraction.

Apple has recently taken steps to enhance user experience with the Apple Watch 9 series, comprising a modernized Always-On display for better gesture control for free-hand operating. This is highly convenient for consumers to easily manage their tasks without requiring them to touch their smartphones.

Adding to the convenience section, Google recently launched a WearOS update that improves the incorporation between Android smartwatches and smartphones. This permits users to respond to text messages, manage apps straight from the smartwatch, and access notifications, thus enhancing user experience.

Restraints

Restraints

- Battery life limitations hamper the Smartwatch market growth

Battery life is an obstinate restriction for several smartwatches. Although multiple enhancements in technology, most smartwatches still need bi-daily or daily charging, which is inconvenient in comparison with the conventional watches that last many years.

In 2023, International Data Corporation reported that nearly 50% of consumers complained of irritation with the need to frequently change their smartwatches. These are mainly the high-power-consuming features like health sensors and GPS, which are largely used.

In 2023, Apple introduced the Apple Watch Series 9, offering just 18 hours of battery, which was disapproved by many users, mainly looking for multi-day performance in such wearables.

Garmin also lately offered long batteries in its smartwatches with almost 28 days of battery, gaining significant attention in the industry. Nonetheless, despite these enhancements, the niche market and several mainstream smartwatches still fight for battery durability.

Opportunities

Opportunities

- Corporate and enterprise solutions boost the smartwatch industry growth

One of the key opportunities for smartwatches is to capture the industrial and corporate sectors. Wearable devices like smartwatches help businesses in domains like manufacturing, logistics, and healthcare to monitor and track the productivity and health of their employees. This ultimately enhances workplace safety.

In manufacturing and logistics, giants like UPS are starting to discover smartwatches as their safety programs for employees. These wearable devices efficiently track the physical status of workers, ensuring they are not experiencing exertion and more stress, which could otherwise lead to fatal incidents.

Furthermore, Apple has been working with many hospitals and healthcare providers to integrate with Apple Watch. They have been aiming to work with remote patient monitoring and telemedicine programs. Apple Watch was used in numerous clinical trials to monitor several vital signs of patients like heart rate with medical conditions like atrial fibrillation.

Challenges

Challenges

- Restricted use cases and consumer perception act as key barriers to the Smartwatch market

While smartwatches have gained huge traction for health and fitness tracking, their wider appeal is still restricted. Most individuals see them as luxury items and as just fitness devices, thus limiting the overall demand and underutilization of devices.

Since brands like Samsung and Apple have incorporated improved features in smartwatches, like fall detection, ECG monitors, and sleep tracking, most users primarily use their wearables for simple functions like notifications and time. This restricted use majorly hinders the wide adoption, mainly among the middle-class groups, who may not see the added value of these tools.

Also, Apple's efforts to rank the Apple Watch as an exhaustive health device have not completely tapped all demographics, since most people still see smartwatches as just fashion items instead of medical tools.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 40.51 Billion |

Projected Market Size in 2032 |

USD 195.34 Billion |

CAGR Growth Rate |

19.1% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Apple, Samsung, Garmin, Fitbit, Huawei, Amazfit, Fossil, Xiaomi, Suunto, Withings, Oppo, Google (Wear OS), Huawei Honor, Asus, Lenovo., and Others. |

Key Segment |

By Operating System, By Application, By End-User, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global smartwatch market is segmented based on operating system, application, end-user, and region.

Based on operating system, the global smartwatch market is divided into iOS, Android, and others. The iOS segment held the maximum share of the market owing to smooth integration with the Apple network, strong customer base and brand loyalty, and innovative features. Apple Watch, operating on watch OS, incorporates several Apple tools like iPads, MacBooks, and iPhones. This creates an enhanced user experience, as apps, notifications, and data synchronize efficiently in all Apple devices. This increases the convenience for users to remain connected.

Furthermore, the strong customer base of the said brand majorly contributed to the segment's prominence. iPhone users are likely to buy Apple Watch due to its familiarity and convenience. Also, innovative health features are another reason for the segmental growth. It comprises improved features like fall detection, blood oxygen monitoring, ECG, and sleep tracking.

Based on application, the global smartwatch market is segmented as running, checking notifications, swimming, cycling, and others. The running segment registered a notable share of the market owing to the number of advancements in technology and high running popularity. Another reason for the growth of the segment comprises a higher emphasis on wellness and health. The new smartwatches provide accurate GPS, VO2 max data, and sleep tracking, which attract athletes and casual runners.

Moreover, with the growing number of individuals opting for stress relief and fitness, the demand for modernized smartwatches has elevated. They are embedded with running characteristics like route mapping, interval training, and real-time coaching.

Based on end-user, the global smartwatch industry is segmented as male and female. The male segment recorded for higher market share owing to the preference for hi-tech features, technology adoption, and product design and marketing. Most men prefer enhanced features like battery longevity, GPS navigation, and advanced sports in smartwatches. The leading brands comprise Suunto, Garmin, and more emphasizing these key functionalities. They also are attracted to novel technologies at a faster pace than females, mainly in devices like smartwatches.

Also, several brands have designed their devices and marketing plans to appeal to the male segment, essentially. These factors are the key reasons for the segmental growth.

Regional Analysis

Regional Analysis

- North America to hold a remarkable growth over the forecast period

North America held a notable share of the global smartwatch market in 2023 and is anticipated to lead over the forecast period owing to early adoption of technology, high consumer purchasing power, and emphasis on fitness & health. Consumers in North America, mainly Canada and the United States have comparatively high spending power, leading them to purchase premium wearable devices like Garmin, Apple Watch, and Fitbit. The region accounted for nearly 35% of the global smartwatch shipping in 2023, with the United States being the highest.

Moreover, the rising emphasis on fitness, health, and wellness has majorly fueled the need for smartwatches. The key attractions comprise sleep tracking, heart rate monitoring, and ECG. The rising number of tech-savvy consumers is also propelling the regional market growth.

Europe accounts for the second-leading region in the global smartwatch industry. This growth is attributed to the rising emphasis on wellness and health, high preference for premium brands, and strong demand for technology-based devices like wearables. Prominent brands like Garmin, Apple, and Samsung are famous in the region, with the rising demand for premium and affordable smartwatches. Apple brand remains the leading Smartwatch in Europe, with the brand capturing above 40% of the European market in 2023.

Since Europe witnessed growth in the elderly population and a higher focus on preventive healthcare, wearable watches are seen as devices for promoting healthy lifestyles and accurately managing chronic illnesses. In 2023, many European health insurance workers started associating with wearable technology firms, distributing smartwatches, thus increasing the demand for smartwatches.

Competitive Analysis

Competitive Analysis

The global smartwatch market is led by players like:

- Apple

- Samsung

- Garmin

- Fitbit

- Huawei

- Amazfit

- Fossil

- Xiaomi

- Suunto

- Withings

- Oppo

- Google (Wear OS)

- Huawei Honor

- Asus

- Lenovo

Key Market Trends

Key Market Trends

- Enhanced battery life:

Individuals are increasingly preferring devices with longer battery life to prevent daily charging. Most fresh models are launching long-lasting power and battery-saving modes. For instance, Garmin Fenix 7X provides 28 days of battery life, thus satisfying the needs of consumers who adore endurance.

- Fashion and customization:

There is a growing personalization trend, with smartwatches providing customized straps, skins, and faces to attract diverse tastes and preferences of people. Samsung and Apple offer a broader range of customized faces and bands, permitting them to match their styles with smartwatches.

The global Smartwatch market is segmented as follows:

By Operating System Segment Analysis

By Operating System Segment Analysis

- iOS

- Android

- Others

By Application Segment Analysis

By Application Segment Analysis

- Running

- Checking Notifications

- Swimming

- Cycling

- Others

By End-User Segment Analysis

By End-User Segment Analysis

- Male

- Female

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Apple

- Samsung

- Garmin

- Fitbit

- Huawei

- Amazfit

- Fossil

- Xiaomi

- Suunto

- Withings

- Oppo

- Google (Wear OS)

- Huawei Honor

- Asus

- Lenovo

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors