17-Aug-2022 | Facts and Factors

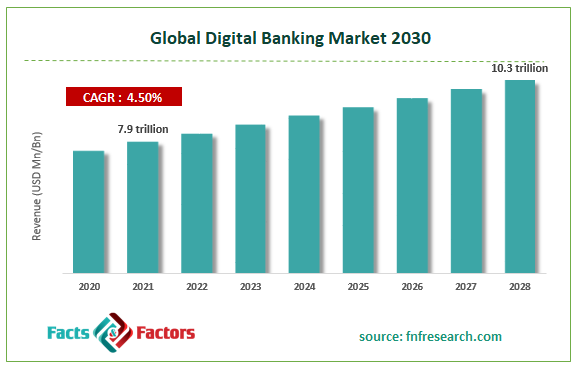

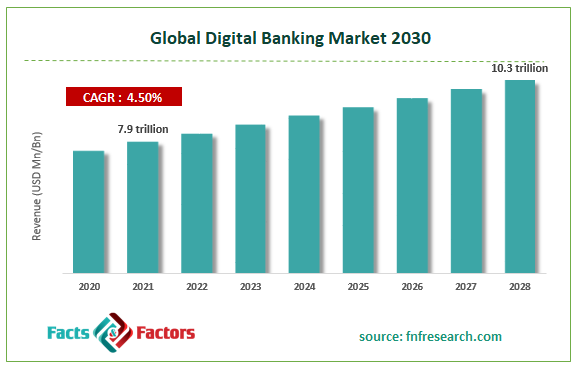

According to Facts and Factors, the global digital banking market was worth USD 7.9 trillion in 2021 and is estimated to grow to USD 10.3 trillion by 2028, with a compound annual growth rate (CAGR) of approximately 4.50% over the forecast period. The report analyzes the digital banking market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the digital banking market.

Digital banking platforms enable the automated provision of new and existing banking services and products to end users using informal communication channels. In addition, many banks and financial institutions are providing their clients with easy-to-use digital banking systems to broaden their clientele globally. To meet the needs of banks and customers, vendors of digital banking platforms are currently developing smarter and smarter banking systems.

Browse the full “Digital Banking Market Size, Share, Growth Analysis Report By Type (Credit Unions, Co-operative Banks and Consumer Bank), By Services (Digital payments and Digital sales), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028" report at https://www.fnfresearch.com/digital-banking-market

This includes the necessity of channel integration support, a dynamic customer experience, easily implementable core banking, and the requirement for user-friendly and appealing devices. Digital banking allows banks and their clients to seamlessly handle completed transactions, daily operations, and other responsibilities. Modernized smart gadgets have enabled state bankers to adapt their old banking system into a modern one by incorporating the latest and most advanced technology into many parts of daily banking operations. Most banks adapt to client demands by establishing services such as ATMs, mobile banking, internet banking, SMS banking, and others.

The main factors driving the market's expansion are the rising number of internet users and a shift from conventional banking toward online banking. The market is expanding due to increased cloud platform adoption, which allows for more scalability. The market for digital banking is expanding, yet there are security and compliance difficulties with digital lending platforms. Furthermore, it is anticipated that increased use of artificial intelligence and machine learning in digital banking, as well as an increase in advanced banking services and corporate investors, will create good market potential. Several banks and financial institutions use banking systems based on artificial intelligence to offer customers faster and more effective customer services. Additionally, many banks are implementing machine learning to predict fraud even before it occurs to enhance the security measures in the banking platform. These developments, which are always being made, present the industry with various opportunities. The market for digital banking is anticipated to benefit significantly from the increased incorporation of innovative technologies in the next years.

The global digital banking market is segregated based on type, services, and region. The market is segmented based on type: credit unions, cooperative banks and consumer banks. In 2021, the consumer bank segment dominated the market over the forecast period. The market is segmented based on services: digital payments and digital sales. In 2021, digital payments' largest service sector in the digital banking market was anticipated to dominate during the forecast period.

The global digital banking market is divided into geographic regions: North America, Latin America, Europe, Asia Pacific, Middle East, and Africa. North America dominated the global digital banking market in 2021. Keeping a customer for life is one of the primary goals of most financial organizations. Due to this, major American banks like Bank of America and others are employing key development techniques like product releases and others to protect client and customer data so they may connect with their current clients and boost sales. The key elements fostering the market's expansion in this area are sizable rivals and the rapid adoption of cutting-edge technology. Due to significant players, this region competes with other regions of Canada and the US.

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 7.9 Trillion |

Projected Market Size in 2028 |

USD 10.3 Trillion |

CAGR Growth Rate |

4.50% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Industrial and Commercial Bank of China Limited, Bank of China Limited, Bank of America, Citigroup, China Construction Bank, Agricultural Bank of China, Wells Fargo, JPMorgan Chase, HSBC Group, China Merchants Bank., and Others |

Key Segment |

By Type, Services, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Key players in the global digital banking market include Industrial and Commercial Bank of China Limited, Bank of China Limited, Bank of America, Citigroup, China Construction Bank, Agricultural Bank of China, Wells Fargo, JPMorgan Chase, HSBC Group, and China Merchants Bank.

Recent Development:

- In April 2021: NCR expanded the cloud availability of the digital banking software where the NCR channels for banking and payment processing were through cooperation with Google Cloud.

- In July 2020: Microsoft and Finastra joined together to hasten the transformation of bank services to the digital age. They provide businesses with integrated solutions that consider their client's needs and way of life.

Global Digital Banking Market is segmented as follows:

By Type

- Credit unions

- Cooperative Banks

- Consumer Bank

By Services

- Digital payments

- Digital sales

By Regional Segment Analysis

-

North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com