Search Market Research Report

Media Monitoring Software Market Size, Share Global Analysis Report, 2022 – 2028

Media Monitoring Software Market Size, Share, Growth Analysis Report By Offering (Integrated Platform and Standalone Software), By Deployment Mode (Cloud-Based, and On-Premise), By Application (Broadcast Monitoring, Print Monitoring, Social Media Monitoring, and Online Monitoring), By End User (Large Enterprises, Small and Medium-Sized Enterprises), By Verticals (IT & Telecommunications, Travel & Hospitality, Retail & Consumer Goods, Media & Entertainment, Banking, Financial Services and Insurance, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

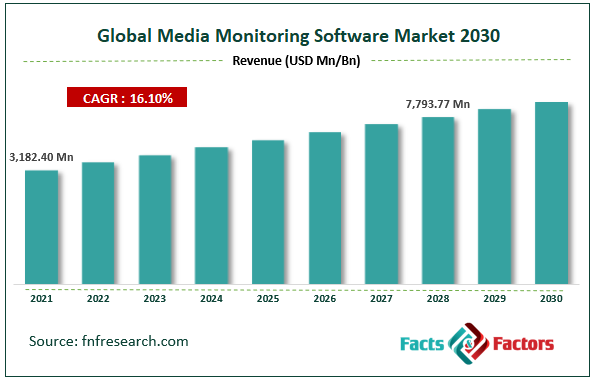

[229+ Pages Report] According to Facts and Factors, the global media monitoring software market was worth USD 3,182.40 million in 2021 and is estimated to grow to USD 7793.77 million by 2028, with a compound annual growth rate (CAGR) of approximately 16.10% over the forecast period. The report analyzes the media monitoring software market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the media monitoring software market.

Media Monitoring Software Market- Overview

Media Monitoring Software Market- Overview

Media monitoring software market generally helps users know about consumer requirements, product feedback, brand loyalty, and competitors' marketing plans. Apart from this, it also helps the firms measure communication material's impact. The media monitoring software market increases the focus on customer needs and satisfaction. The rising number of technological advancements is increasing the adoption of artificial intelligence-based monitoring tools, which are more likely to accelerate global demand. Furthermore, the increasing digitization and growth of social platforms are also propelling the industry's demand in the global media monitoring software market.

The market growth during the forecast period is an increase in the development and adoption of monitoring platforms. Software monitoring is expected to have the largest market share, while the growth is attributed to the rising demand for software solutions such as Google alert and others. The monitoring tools integration cost is expensive for medium and small-scale organizations. The number of potential losses in the system integration process will likely hamper market expansion.

COVID-19 Impact:

COVID-19 Impact:

The covid-19 pandemic affected the positive impact of marketing size during the forecast period, and it also outbreaks the increasing demand backed by the rising use the social media platforms. The adoption of online digital media platforms supports by rising internet penetration. Additionally, covid-19 has changed the working culture across the business verticals. They stayed at home work opportunities for media monitoring software providers. Furthermore, several leaders in the market are developing many tools for the media monitoring software market.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the media monitoring software market value is expected to grow at a CAGR of 16.10 percent over the forecast period.

- In terms of revenue, the global media monitoring software market size was valued at around USD 3,182.40 million in 2021 and is projected to reach USD 7,792.77 million by 2028.

- The market growth during the forecast period is an increase in the development and adoption of monitoring platforms.

- By deployment mode, the cloud segment dominated the market in 2021.

- By application, the social media monitoring segment dominated the market in 2021.

- North America dominated the media monitoring software market in 2021.

Growth Drivers

Growth Drivers

- Increase in adoption of social media and digital platforms

The increasing adoption of social media and digital platforms by individuals globally is expected to drive market growth during the forecast period. In the current scenario, government organizations and officials are also using social media platforms for many activities such as promotion, spreading information, and others which also require media monitoring software. In addition, the rising demand for software solutions such as Google alert and others is expected to aid the market growth during the forecast period. Also, the prominent player in the market is developed advanced social listening platforms.

Restraints

Restraints

- High deployment and service costs are expected to restraints the growth

The monitoring tools integration cost is expensive for medium and small-scale organizations. The number of potential losses in the system integration process will likely be market expansion. Furthermore, increased data security and information privacy attack issues are some factors limiting the market growth.

Opportunity

Opportunity

- Increasing penetration of the internet drive the media monitoring software market

The increasing internet penetration across emerging countries and growing investment in digital infrastructure are expected to support the media monitoring software market growth during the forecast period. The rising demand for digital data collection through the different channels promoting the business to use monitoring tools to strengthen their brand also offers various opportunities for the market players.

Segmentation Analysis

Segmentation Analysis

The global media monitoring software market has been segmented into the offering, deployment mode, application, end users, and verticals.

Based on the offering, the media monitoring software market is categorized into integrated platforms and standalone software. In these two segments, the standalone segment dominated the market in 2021 as standalone software is referred to as offline computer work and does not necessarily require a network connection to functions and programs that run as a separate computer process.

Based on deployment mode, the media monitoring software market is bifurcated into cloud-based and on-premise. Among these, the cloud-based is expected to grow with the highest CAGR during the forecast period. The rising adoption of cloud-based monitoring platforms in several end-use industries such as media and entertainment is expected to drive cloud segment growth.

Based on application, the media monitoring software market is classified into broadcast, print, social media, and online monitoring. Among these, the social media monitoring segment captured the highest market share in 2021 and is expected to continue its dominance during the forecast period. The increasing penetration of the internet globally supports the high use of social media platforms worldwide and helps connect people in real time.

Based on by end user, the media monitoring software market is classified into large enterprises and small and medium enterprises. The large enterprise segment dominated the market in 2021 with the highest market share and is anticipated to continue its dominance in the forecast period.

Recent Developments

Recent Developments

- In January 2020, Talkwalker launched an advanced augmented and data visualization analytics tool.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 3,182.40 Million |

Projected Market Size in 2028 |

USD 7,793.77 Million |

CAGR Growth Rate |

16.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Meltwater, Salesforce.com, Zoho Corporation Pvt. Ltd., SPRINKLR INC., ISENTIA, Kantar Media UK Ltd., Socialbakers, Linkfluence, Digimind, CARMA International Inc., Circus Social Pte. Ltd, Media Track Pte Ltd., Brandwatch, Bangkok Digital Services Co. Ltd., Brand 24 SA, PT. SONAR ANALITIKA INDONESIA, GALASEO, and Others |

Key Segment |

By Type, Application, Process, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- The North American region is dominating the media monitoring software market

North America has the highest market share in the media monitoring software market in 2021. The adoption of advanced technologies-based software and service. Also, the region comprises several key players, such as Hootsuite and Salesforce.com, and others are expected to boost demand for media tracking tools. Furthermore, North America is developing advanced social monitoring tools. Thus, such factors are expected to support market growth in the North American region during the forecast period.

Competitive Landscape

Competitive Landscape

Key players within the Global Media Monitoring Software Market include

- Meltwater

- Salesforce.com

- Zoho Corporation Pvt. Ltd.

- SPRINKLR INC.

- ISENTIA

- Kantar Media UK Ltd.

- Socialbakers

- Linkfluence

- Digimind

- CARMA International Inc.

- Circus Social Pte. Ltd

- Media Track Pte Ltd.

- Brandwatch

- Bangkok Digital Services Co. Ltd.

- Brand 24 SA

- PT. SONAR ANALITIKA INDONESIA

- GALASEO

Global Media Monitoring Software Market is segmented as follows:

By Offering

By Offering

- Integrated platform

- Standalone software

By Deployment Type

By Deployment Type

- Cloud-based

- On-premise

By Application

By Application

- Broadcast Monitoring

- Print Monitoring

- Social Media Monitoring

- Online Monitoring

By End User

By End User

- Large Enterprises

- Small & Medium-Sized Enterprises

By Verticals

By Verticals

- IT & Telecommunications

- Travel & Hospitality

- Retail & Consumer Goods

- Media & Entertainment

- Banking

- Financial Services and Insurance

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Meltwater

- Salesforce.com

- Zoho Corporation Pvt. Ltd.

- SPRINKLR INC.

- ISENTIA

- Kantar Media UK Ltd.

- Socialbakers

- Linkfluence

- Digimind

- CARMA International Inc.

- Circus Social Pte. Ltd

- Media Track Pte Ltd.

- Brandwatch

- Bangkok Digital Services Co. Ltd.

- Brand 24 SA

- PT. SONAR ANALITIKA INDONESIA

- GALASEO

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors